Pinned straw:

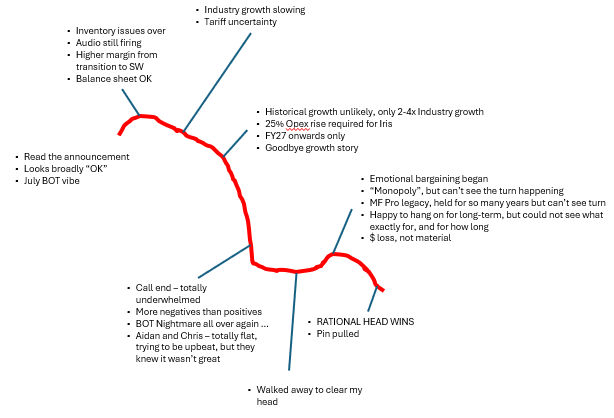

Pulled the pin as well. This was a more difficult one as it was a MF Pro rocket that once soared to the heavens and was going to orbit nicely. But have to acknowledge that the rocket is much closer to earth having lost a lot of engines, than is comfortable and I can't see how the engines will be re-ignited in the short/medium term. Aidan's body language was reminisicent of BOT's Howie in July and tried as I did, could not shake off the lack of management confidence in FY26, depsite attempts to put on a brave front.

Instead of the usual formal thesis exit notes, doodled instead, the "AD8 Exit Worm" to capture my emotions and thought process since the results announcement.

Disc: Exited IRL

I'll leave this brief, as there are many others more qualified on AD8 than me. One of the disciplines I employ is not to look at the Sp of a company during the results call. i do not want to be biased by the market reaction, i don't know anyone who can not be biased once having looked at the SP. As mgt went on, I thought this was mixed, ie good and bad, then the GM was promising (+13-15%), then the opex was a huge blow (+25%). all the upside is drained in more costs.

Positives--GM better than expected for me, the forecast for GM to hold in 2026 is good, but there is a sting in the tail. GM holds due to either operating leverage, more s/w (good) or poor growth in the lower margin CCM disappoints (I'll get back to this). the usage of Dante continues to climb, which is positive and has been an ongoing trait of results. better usage is good. lead over the competitor is increasing is good.

negatives-- "Show me the money" continues to be an issue, and the opex guide pushes this out again. The talk about LT revenue growth being a multiple of a much lower industry growth, i did not like. Talked down a big rebound in sales, i think the story needs this. the video story is up for grabs, mgt talked up the Iris acquisition, and the increase in costs is much to do with attempting to win here. The video looks a bit like the Vietnam War, long and possible success is unknown and over the horizon.

i think AD8 stays in the unloved camp imo, until we see a stronger rebound in sales for the core or some positive headway on video, both sound like they are being pushed out. i had 2026 as a profitable year, now in losses.

held spec

Have had a brief look, some additional high level reporting (in $US) below for awareness:

- FY revenue of just over 40m – H2 (21.2m) was a slight improvement over H1 (18.9m)

- Gross profit saw an improvement to 17.4m in H2 (vs 15.5m H1)

- Gross margin steady at 82%, consistent with H1

- Net cash from operating activities 7.4m, an improvement on the 1.1m recorded in H1

@mikebrisy, you weren’t too far off – just outside your revenue range – market consensus was almost spot on. Still though, the result is largely consistent with management’s commentary and indicative of a recovery, with revenue and gross profit up on H1 figures.

Slightly different take from me than others, noting I didn’t see the call, but my thesis is well and truly intact.

- 490 OEM brands with products in market vs 476 in H1

- This FY alone, almost 500 Dante-enabled products entered the ecosystem – imagine increasing the total from 4.1k to 4.6k in a ‘year of transition’?

- Nearest audio competitor? Well, that gap has grown AGAIN – 14x number of products, up from 12x in FY24

- Video is ticking along; Dante video products increased to 122 in H2 (116 in H1). YoY, this has grown from 84.

I will have a better look at the results this evening and report back. But from a high-level view, a market cap of 440m remains attractive to me – for that you are getting a growing market leader trading at a revenue of multiple of 7x, but also more than 100m sitting in their armoury.

Short term noise will cloud market judgement and result in volatility from month to month, but I am not interested. Take a step back and consider what this business continues to achieve year on year – continued, growing dominance in audio and ongoing traction in video. The latter will be a slow burn, but importantly video isn’t (at least I don’t think) a winner takes all market.

I remain a bull.

Ditto

Just off the call, my touchy feely impression was both looked worried/concerned/unhappy, particularly Aidan

And I’m guessing Aidan was checking the stock price on his phone!!!

Correct guess or not, it is poor form checking your phone on a call.