Never seen anything like that @OxyBBear - and have a look at this: https://www.marketindex.com.au/asx/klr/announcements/change-of-directors-interest-notice-2A1612313

One director spent a single US$ (yep, $1) to purchase 75,734,441 KLR shares on August 5th via the acquisition (for US$1) of another company called Treasure Unicorn Limited who had a debt relationship with KLR underpinned by shares. It's not too clear, but the notice says that the director purchased Loans totalling $4,599,506.43 owing by Kaili Resources Limited and that he has only paid $1 (US) at this stage to do so, although there is mention of an undisclosed further amount that may be payable, and that apparently entitles him to those 75,734,441 KLR shares, possibly if the loans are not repaid within the agreed timeframe, but the amounts are very strange.

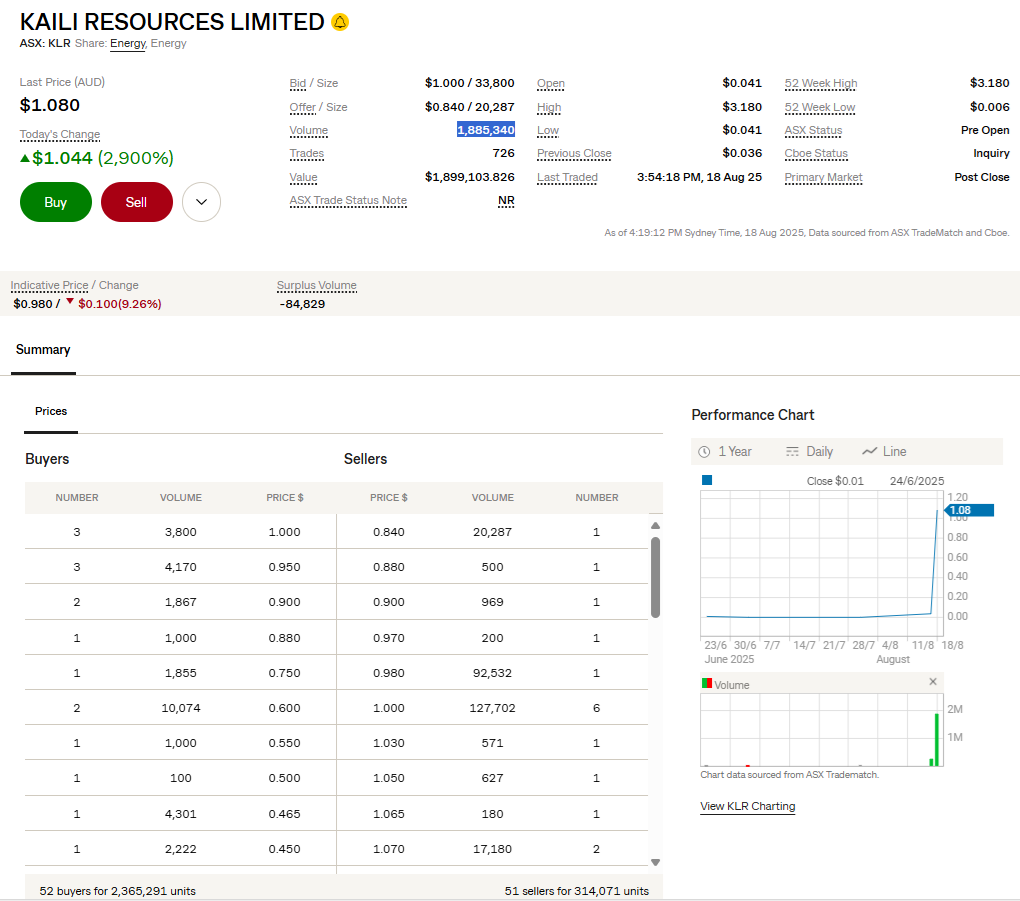

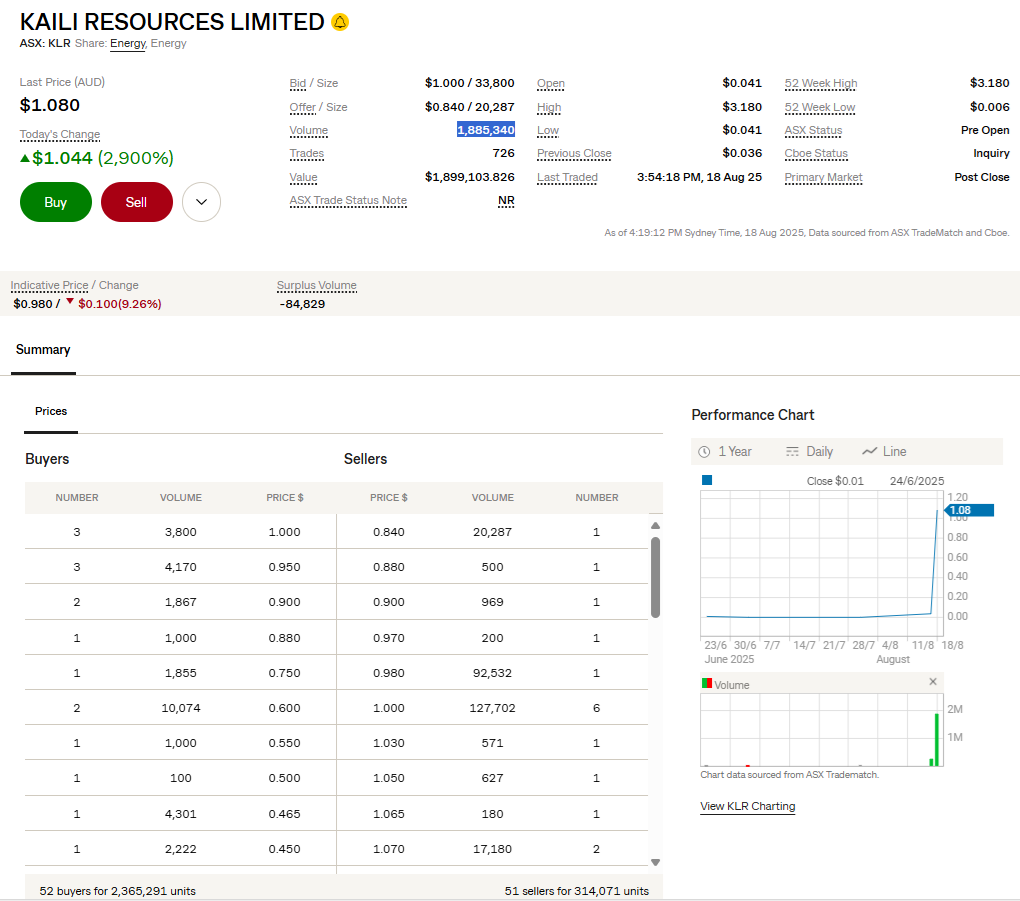

Today's volume traded in KLR, being 726 trades totalling 1,885,340 KLR shares at prices ranging from as low as 4.1 cps ($0.041) up to $3.18/share is mind-blowing considering they closed at $1.08, some +2,900% above Friday's close of $0.036 (3.6 cps). The day high today ($3.18) was 7,656% above the day low (of $0.041), and they did NOT do a share consolidation today, which was my initial guess.

Also, the last trade was @ 3:54:18 PM, so 6 minutes BEFORE the pre-CSPA - and KLR did not participate in the CSPA suggesting that the ASX suspended them from trading at 3:54pm this arvo, and, yes, there was a Pause-in-Trading.PDF announcement at 3:54pm from the ASX for KLR after the ASX had done the same thing earlier today at 12:37pm - after which KLR provided a "nothing to see here" Response-to-ASX-Price-Query.PDF @ 2:06pm.

Some Weird stuff going on over at KLR for sure!!

Disc: Not holding.