HUB FY25 RESULT

Strong result with revenue up 24% and NPAT up 44%, ahead of my numbers 5% on revenues and 10% on NPAT. The reason was strong markets from the start of the year, but more importantly, strong net flows, records and also revenue margins doing a bit better, not declining as expected. Class the tech solutions business also had its best year in a long while-SMSF administration. EBITDA margin from 32% to 36% (on my measure), all indicators pointing up.

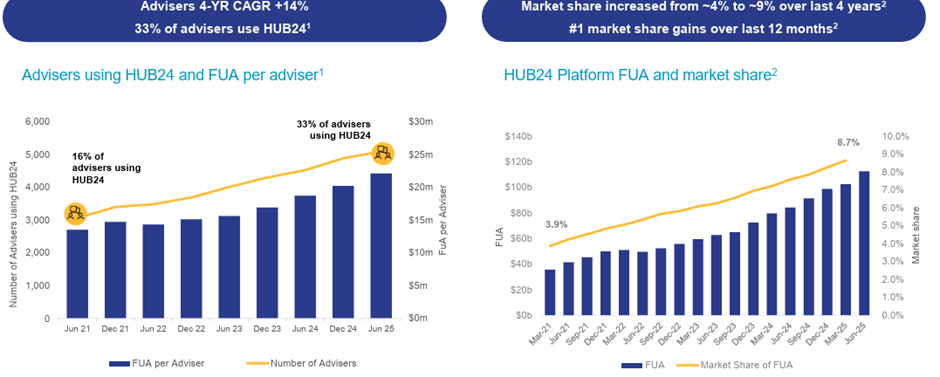

As per below, HUB is now at 8.7% market share, about the same as NWL, with both of these gathering 98% of net flows in the industry. Market share will go much higher, imo.

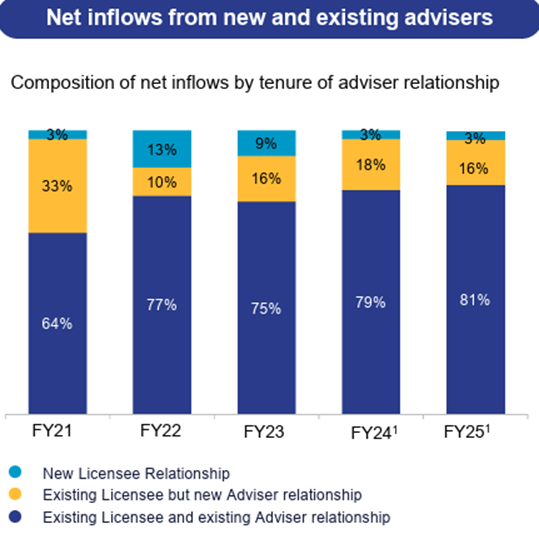

The industry is growing, HUB is adding advisors (+572 to 5072), and those advisors are adding FUM. Some comments to add colour here. About 33% of advisors use HUB but at lowish FUM at this stage. The industry average advisor manages $76m in FUM, the average HUB advisor manages $22m on the platform, but 11% are above $50m. The implication here is that it takes time for advisors to move clients onto the platform; 6-7 years was mentioned, so there is built-in growth. See the chart below. Most of the growth is coming from existing advisors moving FUM across.

Profit growth rates can be lumpy because of the fast growth, but also investment can come in fits and starts, so margin grows through operating leverage but can be muted by further investment. HUB continue to launch new features to improve the efficiency and compliance of advisors. The investment spend is aggressive, and HUB does not want to lose the lead here. HUB strategy is to ingrain itself into the advisor businesses, much like REA with real estate agents. Adding more services and more fees, Hub is building an advice ecosystem through several aligned initiatives. They held an investor day earlier in the year, which showed they have their eye on a much larger slice of advisor activity. However, HUB are not in a position to increase fees like REA, not yet anyway.

HUB guided to platform FUA of between $148-162B for 2027, currently $113B (+34% FY25). Needs good markets and good flows to hit that. Im a buyer around $60.

ok, i know i have been bleating on about this one for a long while. i thought i might put down a few words on investing in market-facing growth businesses. i own HUB, PNI and MQG all at size. these are market sensitive, which means if the market tanks, these go with it. i expect that, and that must be kept in mind, but that also brings about opportunity.

after the interims, i suggested HUB was a buy in the mid $50s, it was trading around $80 at the time. i know it seemed like a nonsense valuation, yeah i got the message. but guess what, 6 weeks later, Trump waves around a chart and HUB is at mid $50s, and i added. Added PNI and MQG as well. use cash, use your defensive investments, whatever. That is my simple strategy for these types of stocks: assess your total exposure, pick the best (that's up to you), and wait for a market break. then rebalance when the market recovers, sounds simple but needs the conviction in the stories, i guess.

all the best, good luck