SayWhatAgain

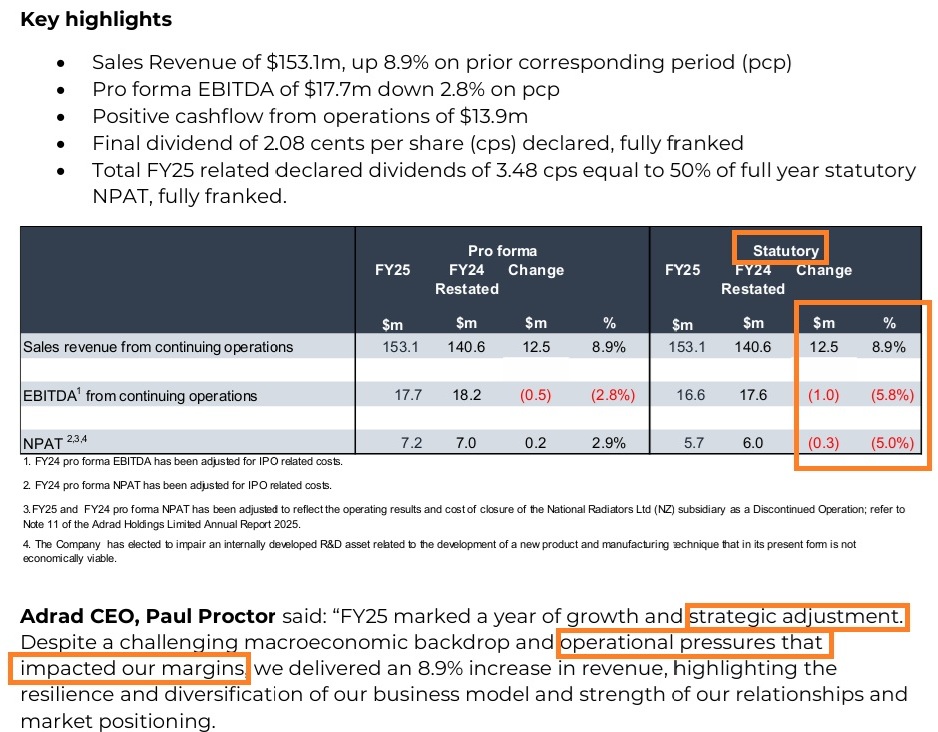

AHL reported an 8.9% revenue increase to $153.1 million and positive operational cashflow of $13.9 million, but a 2.8% drop in pro forma EBITDA to $17.7 million and a 5% decline in statutory NPAT to $5.7 million, due to macroeconomic pressures and an R&D asset impairment.

Despite fairly solid revenue growth, the share price fell around 12% today. Were investors disappointed with profitability? Were there unmet market expectations?

Bear77

Most of the time @SayWhatAgain the reason why the market sells down a company on their results even when the results look good is either because they were expecting even more, or else they feel underwhelmed by the forward guidance, in other words they are not as excited about the next set of results.

In this case, it's likely a bit of both:

We have margin slippage in FY25, so even though their revenue was up +8.9% higher, their profits (EBITDA and NPAT) were both down in statutory terms (the bottom line). Even if you look at the Pro Forma numbers, EBITDA was lower and NPAT only rose +2.9% on a +8.9% increase in revenue, so they are earning less profit on every dollar of revenue.

It's not going backwards by much, it's bugger-all really, but it's red, not black.

They also called out in their commentary that it was a year of strategy adjustment (or "strategic adjustment") and that operational pressures impacted margins, so they drew attention to (pointed directly to) that margin compression as being a feature of FY25.

Next, their outlook:

The two things that I think the market didn't like there were that the current financial year (FY26) is only "expected to" provide substantial completion of the on-highway alu-fin prototypes with commercialising (commercialisation) to follow in subsequent financial years, so no money from those before FY27, and the second thing is the statements in the final paragraph are too general in nature, as in: It's a beautiful day out there, we could go for a walk (we've got legs), we could have a picnic (we have rugs and baskets), we could go to the beach, or we could start planning to.

- "The data centre market Remains Robust..."

- "We will continue to push into service work in rail and remote power generation"

- "Expansion of our Distribution footprint is planned for FY26."

What the market would likely have prefered to see would have been something like, "Our order book is at record levels, and it's been particularly pleasing to see additional work flowing in from data centre operators and builders where our power generation cooling product is a critical component, we are seeing increased tender wins in both rail and remote power generation, and we are well into our planned distribution footprint expansion. We expect good growth in both revenue and profit in FY26 and we are confident that we can also expand our margins."

But they didn't get that, and when the market is after growth and they see a company that looks to be either ex-growth or treading water rather than powering ahead, they often move their capital into something they see as being more exciting and may provide more bang for their bucks.

Bear77

I should have added some more context to that post about the market perhaps moving on to the next shiny new thing @SayWhatAgain - When Uncle Warren said "the market is there to serve you and not to instruct you" - he meant that investors should not follow market price movements as if they were instructions, but rather should use the market as a tool to achieve their investment goals, so with that in mind, I'll add this:

I have had similar things happen to companies I hold as high conviction buys - such as Lycopodium (LYL) and GR Engineering Services (GNG) - at different times - and those two have always come back - as GNG is right now - recently powering through $4/share and their report yesterday didn't do that uptrend much harm, but it hasn't always been like that.

GNG cut their dividend entirely in August 2017 (so no full year div for FY17) mostly because of two doubtful debts they had at that time. The first bunch of oxygen thieves was Eastern Goldfields, which is now known as Ora Banda Mining - OBM; back then, as Eastern Goldfields, they had dodgy management who wouldn't pay their bills - not just what they owed to GNG but to a bunch of their other creditors also at that time - and they (Eastern Goldfields) had so many financial issues and owed so much money to so many people that just one day after announcing a $75 million recapitalisation in November 2018, they were placed into Administration. The company was then properly recapitalised in 2019 and rebranded to Ora Banda Mining (OBM) which is what they're known as today. It's that unsavoury history that probably psychologically predisposes me to have a negative bias against OBM despite their recent success - and may explain why I never seriously consider investing in OBM.

The second bunch of space-wasters was whoever was running Wolf Minerals, owners of the Hemerdon Tungsten and Tin Project in the UK which faced multiple "teething problems" primarily due to the underperformance of its processing plant, which was not equipped to handle the ore's fine nature, plus lower-than-expected global tungsten prices, which ultimately resulted in Wolf Minerals later being placed in receivership. Because GNG never did the studies (scoping, PFS or DFS) for the plant, the main claims that Wolf were making against GNG - to substantiate them (Wolf) not paying GNG what they owed them - was that the plant was too noisy and they were getting noise pollution complaints from neighbours and the local council. GNG tried to fix those issues but ultimately stated that they had built the plant exactly to the specifications that they had been given by Wolf, and that the issues were not that the plant hadn't been constructed properly, but rather that the plant's design was based on incorrect assumptions in the Feasibility Study (FS), so they took Wolf to court and Wolf counter-sued GNG (or it might have happened the other way around) and I'm not sure how that all ended but I'm glad GNG mostly stick to Australian gold miners and copper miners for their clients these days.

For some historical context, a company called AMAX Exploration UK conducted the initial/pre-feasibility study (PFS) on Hemerdon in 1982 and then Wolf Minerals decided to do their own Definitive Feasibility Study (DFS) in 2011 resulting in their own report finding that the project had potential to deliver a strong boost to the Devon (UK) economy and strong returns to shareholders, so they gave Hemerdon a positive FID (final investment decision) and awarded GR Engineering Services (GRES) the EPC contract in 2013 to build the processing plant. These plants always end up running better when the FS is done properly, and preferably by the same mob who go on to design and build the plant, but that wasn't the case with Hemerdon.

Geez, this takes me back; in that same year that GNG declined to declare a final dividend (FY17), they completed the Nova Nickel Project for IGO, commissioned works on the Hellas Gold Project in Greece, ramped up Dacian Gold's Mt Morgans Gold Project (now known as Genesis Minerals' Laverton gold mill) and began early works on the Dalgaranga Gold Project for Gascoyne Resources (who then became Spartan Resources and are now part of Ramelius Resources). They had also just began constructing the non-process infrastructure for the Gruyere Gold Project that is 50/50 owned by Gold Road (GOR) and Gold Fields Ltd (who are currently acquiring GOR to get 100% control of Gruyere and the surrounding tenements).

It was a very busy period for GNG, yet on the back of that no-final-dividend decision on 24th August 2017, their SP dropped from $1.40 to $1.15 (around -18% down) during the following month, before recovering and going back up to a year high of $1.58 shortly after their next half year report (5 months later) in February 2018. And they're now $4.24 - and they closed yesterday (Monday) at $4.48.

Similarly, Lycopodium (LYL) reduced both their half year dividend and their full year dividend for FY25, to use that cash to fund a strategic acquisition (60% of SAXON) so they wouldn't have to borrow money OR issue any new shares, and despite making it crystal clear (last week when they reported) that they are returning to their previous higher dividend payout ratio now (in FY26), they're still bouncing around $12/share after bouncing off $10/share a number of times in the past 9 months. They were trading above $14/share in August last year, and they're an even better company today (with majority ownership of SAXON) than they were then, so I was loading up in that $10 to $11 share range and they've become my largest real money position by a decent margin.

There are others factors involved obviously - it's not ALL about their dividends, but I'm just giving an example because I feel that had a fair bit to do with why people moved on from LYL in the first 9 months of the past year. My thesis was that their issues were temporary, not structural so it was an opportunity rather than a reason to get spooked by all the sheep running away from perceived danger, i.e. there was no need to panic.

Which is all to say that IF you are bullish on AHL @SayWhatAgain and you have the conviction to hold them through turbulent times, then this sort of market reaction - possibly an overreaction, depending on your viewpoint and opinions - may be a similar opportunity.

The market is there to serve you, not to instruct you.

SayWhatAgain

Hi @Bear77 thank you for the explanation, it really helps me. It's dropped further today. Seems like an overreaction....Do you think the market is being too impatient, or is this margin trend likely to persist and justify the selloff...?

Bear77

I don't follow AHL at all @SayWhatAgain - I was only giving you some feedback (and hopefully help with your questions) based on a quick look at their report, so I am not the person to give any advice on whether the market has overreacted or not. I can't give advice anyway, none of us here can, just opinion, but I can't offer an opinion either because I just haven't done the work to form any solid opinions on this company.

However... From the report we do know that they have a negative NTA, so they owe more than they own, so there's that. When you've got a company in debt that has shrinking margins and a pipeline of new products that might take a couple of years to see any payback, as I pointed out from their report, plus their management are not trying to hype up their chances of releasing a better set of numbers this time next year... so they might be thinking it's going to take longer than this next year to get to the growth the market wants to see... you need reasons to form the basis for a conviction that they're worth investing in, and I don't have those reasons - hopefully someone else here can help with that.

They are trying to paint a rosy picture in terms of their TAM (total addressable market) and saying there are opportunities out there for them to capitalise on, but not giving any indication in terms of timelines to strong revenue growth. Sure they beat last year's (FY24's) NPAT on a "Pro Forma" basis, but only by 200K ($7.2m vs. 7m last year, +2.9%) but their statutory numbers say they made $300K less than FY24 ($5.7m vs $6.0m, -5% down) and they've called out that they've experienced "operation pressures" that have resulted in lower margins, so there's plenty to get concerned about in terms of them possible coming off the boil in terms of growth. Which could become a problem when they have so much debt that they have a negative NTA.

I don't know what the investment thesis is for this company but there obviously is one because although the share price has dropped, some people are still buying, albeit at lower prices, so those buyers think they're getting a good deal. I don't know what their investment thesis is, but there must be one.

I wouldn't personally hold a company in this position just based on their balance sheet and lack of tangible assets, unless they are about to experience explosive growth, and I don't see anything in this report to suggest that they are, so that's why I'm not digging any deeper than that.

Also, the thing about the market being too impatient, possibly, or a possible market overreaction in terms of a company being possibly oversold is the old saying, "the market can stay irrational longer than you can stay solvent", which suggests that even when you're right and the market is wrong, the market can often stay "wrong" longer than you can last in a position that keeps heading south. Or it might turn out in the fullness of time that the market was right all along. I have found that out the hard way with about a dozen companies over the years that I lost far more money on than I should have, by being stubborn and thinking I knew better than the market and they were overreacting, and it turned out that they weren't.

So, if I was thinking about buying a company like this, unless I had really strong conviction and was willing to hold them through a major further sell-down from here, I would usually wait until the selling had stopped and they were back in a share price uptrend on the back of more positive news before buying in. But that's just me.

Everyone has to make their own decisions and do what works for them.

Sorry I can't help any further than that. They're just not the sort of company that interests me, so I don't follow them. I do hold one company that sells automotive parts, and that's ARB, but ARB have a very solid balance sheet, very strong management, and have provided some really good TSRs (total shareholder returns) over the years, and I wouldn't even be buying more ARB up here at around $40 - I was buying them down around $30 because I do have high conviction on ARB - having followed them for over 20 years. I also like that ARB sell a wide variety of products, so they don't just specialise in cooling systems for instance, but I think they're back to being close to fully priced again up here, so even ARB aren't a buy now in my opinion.

It's a tough industry and there's always going to be competitors trying to do things cheaper and eat away at your margins, so that's why I like ARB, they don't compete on price, they compete on quality, they're global, and expanding, and they have the balance sheet strength to ensure they survive industry downturns, plus they are very diversified in what they sell (different products and types of products). So that's the sort of company that interests me - industry leaders with strong track records and great management who are growing. Beyond ARB, I don't have any other direct exposure to the automotive industry, or much interest in it - in terms of prospective investments.

Anyone else have a view on AHL?

rh8178

Had a small shareholding while I explored taking a bigger position recently - I decided against going for a larger shareholding - one thing that really put me off was the contingent note where they vaguely talk about an historical workplace fatality - not only do I just not want to invest in companies that don’t provide safe workplaces - it says something about management competence - it was a while ago to be fair but still having an impact.

lowway

There's quite a few SM investors holding $AHL including me @SayWhatAgain & @Bear77. There's plenty of info an opinion on the SM company straws, etc.

I have a personal view that they have good management with a new CEO only appointed a month ago, so he'll still need time to get his position settled down.

As for share volatility, the volumes traded on a daily basis are very small (30k yesterday and 60k today), and it doesn't take much to move the SP up or down with these types of daily volumes.

I think they have a longer term potential, as I've outlined in previous posts and will be holding, but not increasing my current holdings IRL & SM portfolios unless the price gets very silly. The annual range has been between 56 and 83 cents, so below 56 cents would be interesting.

Disc: holding ~20k shareson $AHL IRL and what you can see in my SM portfolio.

SayWhatAgain

Thanks @Bear77, wasn't looking for advice, just chatting and some thoughts, but appreciate the discussion :) I hold a small position in my SM portfolio and will continue to monitor it closely. Cheers!

Bear77

I miss-read that first line in your post @lowway and thought you said that I was holding AHL, but then I realised you were just tagging me in to the sentence, coz, no, I don't hold, but you're right - there are a lot of holders - see here: https://strawman.com/reports/AHL/investors

Including our #1 Investor (and site founder). Currently Andrew's 5th largest position at this particular point in time. So it's far from universally hated - it does have its fans for sure. Probably proves that I can't make good judgements on a company's potential or the quality of a company by ONLY looking at their latest report.

lowway

All good @Bear77, we can't chase everything!!

As you mentioned it in the thread, I (that's me) also own $ARB in IRL and even though they both play in automotive ($AHL has significantly wider applications for heat exchanges, etc outside of automotive) I hold them for completely different reasons.

I purchased $ARB after they were harshly treated by investors for Trump tariff potential affects and the supposed risk of trying to breakout in US market. Great Aussie company with a long, long history of success and shareholder returns. This investment is almost a set and forget in my SMSF portfolio.

$AHL is more niche in their area of expertise and a midget compared to $ARB and their SP will likely be based on small volume, somewhat volatile movements which probably don't truly recognise their value. This investment is hoping for some large upside opportunity over the next 2-3 years if all goes to plan, more of an asymmetrical investment.

Either way, I like both at the moment, but if a thesis breaks....