BigStrawbs70

First, and at the risk of over-explaining, let me say that I consider myself a sound money person. While I lean towards Bitcoin, I am not against gold. I just have not been able to make the leap of faith at this stage, which is why I am writing this post. For me, it is about making money (or even protecting money), not about being a purist, and I am looking for some education. Although to clarify, I do say protecting 'money' deliberately as opposed to protecting 'currency' as the later is just totally stuffed.

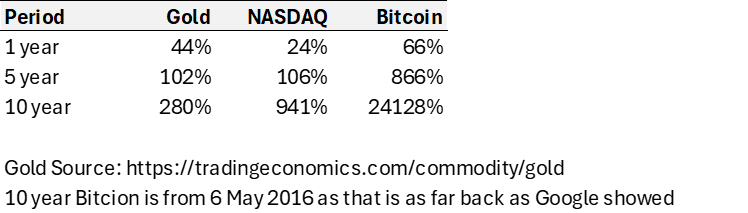

I have only done a little research, like a few quick Google searches, and looked at some graphs comparing the NASDAQ, Bitcoin, and a gold reference source I have listed below. From this, I have pulled together a rough summary chart, see below. Gold has certainly done well recently, very well in fact, with countries buying it in bulk. However, over longer timeframes, it has not outperformed the NASDAQ, and it is nowhere near Bitcoin.

That said, I can still see a case for gold continuing to perform strongly for a while, particularly as money printing accelerates. Of course, those same conditions are also likely to drive both the broader stock markets and Bitcoin as well.

So my questions are this: Why would I buy into gold? For diversification? As a hedge? I certainly would not sell my Bitcoin to buy anything else, so does investing in gold effectively mean betting that it will outperform the NASDAQ? Or have I totally stuffed up the data collection?

Any thoughts or perspectives are greatly appreciated.

Bear77

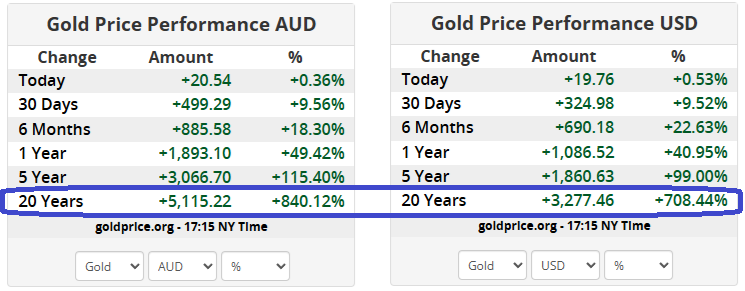

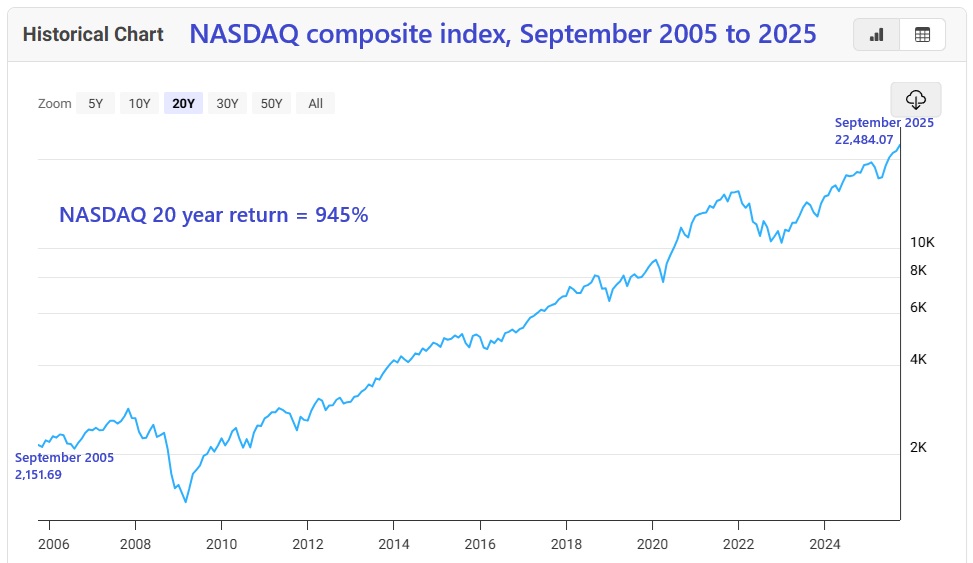

OK, I'll bite @BigStrawbs70 - yes, it looks like the NASDAQ has outperformed gold bullion over 10 years, although I get +387%, not +941% for the NASDAQ, which rose from 4,620.16 in September 2015 to 22,484.07 now (September 2025), and I also get a lower return (262%) than your +280% for gold over 10 years, as shown below. The NASDAQ beat gold over 20 years also (see below) although more recently gold has outperformed the NASDAQ.

Over 10 years, it's +262% in A$ ($1,589.09 to $5,744.62) and +237% in US$ (from US$1,115.20 to US$3,759.86) for gold (See 10 year gold charts 2 images below). The NASDAQ composite index was up +387% (4,620.16 to 22,484.07).

Over 20 years gold is up +840.12% in A$ and +708.44% in US$. NASDAQ index is up +945%, as shown below. Bitcoin did not exist 20 years ago, so I'll leave that to the Bitcoin fans.

So based on 10 year and 20 year returns, gold has underperformed the NASDAQ, but gold has outperformed the NASDAQ over the past 3 years, 2 years and 1 year mostly on the back of the momentum in the past 18 months as shown on the charts above.

So - as we all know, historical performance is not a reliable indicator of future performance, but momentum is worth considering, especially when that momentum is underpinned by increased central bank buying of gold, especially China, and that move from the US$ (US treasuries) into gold by central banks globally will only accelerate as holding US Dollars and US Treasuries becomes even less popular.

Gold has strong tailwinds right now, and you could also say the same about the NASDAQ particularly in relation to AI, however I believe that we are seeing a bit of an "AI Bubble" forming and we know what happens eventually with bubbles.

It all gets back to what you think is most likely to happen from here, and when it comes to Bitcoin I have zero confidence in where that will be in 20 years - one way or the other - I'm just leaving that alone, and I don't want to get into a debate about cryptocurrencies with anybody, good luck to you, it just isn't for me. I'm happy to talk about shares and gold, but that's where my wheelhouse ends.

BigStrawbs70

Thanks for the reply @Bear77, and apologies, as I was trying to be careful in my wording to not sound like I was stirring the pot, but your intro of “I will bite” suggests my wording could have been better. Yes, I currently don’t hold gold, but there was a day when I also didn’t hold Catapult, and the wisdom in the group got me to look at that as well. Hence my question on gold, as I am tempted to buy, but just can’t bring myself to click buy at the moment.

You are also 100% correct to call out my error on the NASDAQ calculations, as I agree with the numbers you have listed. I somehow stuffed up the Excel calculation.

Re Bitcoin: I also have no idea what this will be in 1, 3, 5 or 12 months, not to mention years. All I do know for certain, and I do mean certain, is that the global financial system faces real stresses and is being disrupted. How much stablecoins, Bitcoin and even gold play in that (I do think gold has a role, hence why I’m thinking of buying some), we will have to wait and see I guess.

Re Shares: This is where we have an overlap. I can certainly get on the same page that we will see some companies found to be over-investing in AI, but that doesn’t automatically equal a bubble, any more than saying there was “over-investment in steam engines” during the Industrial Revolution. In particular, those who can translate, or be a major part of the supply chain, to put an IQ of 200+ into an autonomous vehicle (car, robot or other form) will be the biggest companies in the world as we step into the next technological era. As a thought exercise, when driving or walking around, ask yourself what jobs you see that couldn’t be replaced by an autonomous system with superhuman intelligence, not to mention the same entity having the capability writing code, doing medical research, etc, etc? Anyhow, this is getting off topic.

Anyhow, again, thanks for the reply, and apologies if I sounded like I was only looking for a reaction.

Clio

@BigStrawbs70 - it’s a question worth asking. Until recently - after I joined Strawman and started listening to many investing podcasts of all types - prior to that, I couldn’t get interested in gold either. Mostly following the argument that it doesn’t produce anything, so how can it ‘grow’?

Then after an intensive year of serious portfolio restructuring, I was looking for a place to put a percentage of the portfolio with a very long-term, stable, not necessarily growing in value to any great extent but, most importantly, not losing value (to any great extent over a very long 10+ year horizon).

Gold got the nod. Over long periods, it might not increase much - it could go sideways for years - but it rarely decreases significantly, and if it does dip, it doesn’t stay down forever. AND then there are the capital flows out of the US that I can’t see slowing anytime soon, also looking for safe haven. AND then there’s the on-going demand from Asian countries/cultures, who have always used gold as a store of wealth. The expansion in the Indian middle class is going to be adding to the demand.

So now my major growth portfolio has 3% gold (PMGOLD), and 2% gold miners (GDX). Of course, that portfolio still has 29% NASDAQ (in various ETFs; that’s the overall US exposure, which is almost all NASDAQ-listed companies).

Long story short, I’ve come around to the notion that there’s a place for gold in even a very high-growth portfolio, essentially as a long-term store of wealth. In my eyes, Bitcoin could serve the same purpose, but it’s a much more volatile asset, at least at present.

My two cents, anyway, but thanks to you and @Bear77 for the discussion.

stevegreenycom

Hi @BigStrawbs70 , as Bear77 points out I think some longer timeframes are also worth investigating.

I note you mentioned this in your post, "That said, I can still see a case for gold continuing to perform strongly for a while, particularly as money printing accelerates. Of course, those same conditions are also likely to drive both the broader stock markets and Bitcoin as well."

Given that your original post seemed more focused on the last decade, I wonder if it is a case of more recency bias when contemplating the likelihood of strong performance in the gold price also occurring when broader stock markets are doing well.

It is worth noting the experience of the 1970s how gold played a useful role in a balanced portfolio when inflation was high. This was a poor decade for broader equity markets.

So your questions near the end of the post such as "Why would I buy into gold? For diversification? As a hedge? " - Maybe they are the potential answers, and it is largely as simple as that?

Bear77

I didn't have any problem at all with your post or its wording @BigStrawbs70 - I just said, "I'll bite" because it's a big topic. As @stevegreenycom mentioned, gold often performs in a completely uncorrelated way to equities, particularly when inflation is high, based on the past, however I believe the basic drivers of gold demand is a little different now than it was back then. That said, I do agree that if the market has a meltdown, AFTER the initial panic selling when everything that is liquid is sold, including gold, I'll bet gold does well coming out of that, and also if we have a sustained equities bear market based on global growth concerns / recession. But that is based on past experience, and the future may be different.

As @Clio points out, gold can go sideways every now and then, but it returns to growth after a bit, and when it does rarely drop, it bounces back and goes above its former highs soon enough, much like the US share market and ours to a lesser extent - we do the same thing down here but it takes us longer because we are not a technology heavy market like the US - we are overweight resources and banks. The US seems to return to growth much quicker than the Australian market does, because of that, and because it's the world's premier stock market and holds the world's biggest companies, many of which are growing at a good clip.

In relation to AI @BigStrawbs70 I agree that many companies are going to benefit from heavy investment into AI, however not all, and those that do will benefit to different extents - there are going to be some very big winners for sure, but not all companies that have an "AI premium" in their share price will benefit to the full extent that the market is currently pricing in, in my humble opinion. I don't claim to know which ones, just that it seems to me that there's a bubble forming in relation to the perceived upside of all tech companies that have embraced AI and/or told us about their AI aspirations, so a bubble in the price of tech in general. Not quite at "Dot Com Bubble" levels yet, but it's early days. As I said, it's likely warranted in SOME cases - there will be big winners, but not in ALL cases. So I reckon there's going to be a "correction" of sorts with the NASDAQ at some stage, but probably not a crash, but a number of company valuations could easily go higher and then more than halve.

I saw it in mining and even in mining services back during the last big mining boom. Everyone in the sector gets priced for perfection, but not all of them achieve perfection, so the prices correct to reflect reality at some point. In terms of AI at this point we're in the "market is a voting machine" stage, because it too early for the "weighing machine" stage - we need to see how AI plays out and who really benefits from it the most before we can attribute accurate intrinsic valuations to those companies.

And that's the rub - by the time we know who the real big winners from AI are we will probably have missed most of their run up, and so from that perspective I can see why people prefer to invest in the NASDAQ composite index than try to pick their own winners directly from within it.

I'm just of the opinion that not every company will be big winners; Just like your example of jobs getting replaced, there will be losers. Just my opinion, FWIW.

Bear77

This might be of interest in relation to AI and how a very large US fund and asset manager, Blackstone, is investing to capitalise on the AI megatrend.

Blackstone's Jon Gray on the Economy, AI as “The Main Thing,” and Where to Invest Now | Sept. '25

Plain text link: https://www.youtube.com/watch?v=lUXy6Xp2j_I

That was posted on September 24th, 4 days ago. If you watch it from the beginning you'll hear Jon discuss the tragic death of Wesley LePatner who headed up their Real Estate division - she was chief executive of the Blackstone Real Estate Income Trust - and she was one of 4 people killed in July in an office shooting (source) - yet another senseless death due at least in part by the US Government's total lack of proper gun control and their reluctance or inability to fix that issue.

If you want to skip the intro and the company details and go straight to Jon discussing how Blackstone, the world's largest Alternative Asset Manager with US$1.2 trillion of AUM, is tackling their exposure to AI, you can click here: https://youtu.be/lUXy6Xp2j_I?t=700

Note: This isn't BlackRock, the world's largest asset manager, who have US$12.5 trillion of AUM. Blackstone are instead the world's largest alternative asset manager, with one tenth of BlackRock's AUM, however Blackstone are still worth listening to - their market cap is currently US$225 billion, bigger than BHP. Blackstone as a company is actually bigger than every single company listed on the ASX except for CBA, and Blackstone have a history of providing double digit annual returns across their various strategies, as shown below, so they have a track record to suggest they are worth listening to.

A perspective from the big end of town.

While Blackstone are excited about the opportunities that AI provides, Jon also talks about AI valuations being one of the big risks that they're keeping an eye on: https://youtu.be/lUXy6Xp2j_I?t=1795

There are other risks, but AI valuations is certainly one of them.

BigStrawbs70

Thanks @Bear77

I may have taken your earlier comments about an AI bubble a bit too literally. That is, I interpreted a ‘bubble’ to mean the entire AI trend does not have any substance behind it and will fall away just like the dot.com bubble. While I 100% agree there are a number of companies being priced for perfection and then some, I see that as different to saying we are in a situation comparable to a bubble.

Using the Industrial Revolution analogy I touched on before: no doubt there were steam engine and locomotive makers and all sorts of other companies that had valuations lifted far too high during the transition, with money lost as a result. Although in saying that, the broader transition of the economy into this new technology was profound, with a number of companies winning, others going broke, most becoming more productive and a number of industries rendered obsolete. This is totally different to the dot.com world, where the hype did not match the underlying technology.

In terms of AI, there certainly are many companies that are overpriced, and the benefits of this transition in the economy will not be equally shared. Entire industries will again be made effectively obsolete, and even those that win in this transition will look totally different to how they do today. Just as loom makers back in the day still did their work, they simply did it in a way that could not have been imagined beforehand. I find it fascinating to think about how much miners could be valued at when production costs, which are already amazingly low, fall close to zero due to super-intelligent autonomous vehicles doing the work. What about medical research? What about software companies that do not have ownership of their data and/or strong networks? These are not science fiction examples, and they are not some far-off future years away.

So what I am trying to say is this: Similar to the Industrial Revolution, there will be massive changes to how we work and the work we actually do. Many companies are certainly overvalued, and I would suggest we will even see some pretty confronting social issues, with the gains not shared equally. But again, I see this as different to a broader AI bubble, as the technology has already proven itself, and autonomous robots (autonomous cars are already on the roads) in all shapes with these AI ‘brains’ are rapidly coming.

These impacts are only made more profound as we move into a new financial system.

Anyhow, to tie this back to my original question, the above is why I am looking more and more at other scarce assets (I say other given I already have Bitcoin) for my portfolio, hence my growing interest in taking a position in gold.

Bear77

Understood @BigStrawbs70 - so I'm talking about a valuation bubble around tech companies who are talking the AI talk but are yet to walk the AI walk, and I'm not suggesting that AI itself is a bubble - it's just that many company valuations have gotten ahead of themselves and there could be a broad correction at some point.

In terms of gold, AI will also impact how gold explorers find gold, because of the massive amount of data that is out there including millions of drill core assays and all of the various types of land surveys identifying mineralisation and other anomalies, and the ability to study patterns across vast data sets and identify similar patterns with data being collected in real time. All the stuff that geo's do now in terms of data evaluation, but much faster and more thoroughly using much more data.

It is going to get interesting. I personally don't think that AI impact on gold discovery is going to have a major negative impact on the gold price due to more supply vs demand, simply because there is only so much gold out there to be found anyway, and it takes time to take a discovery through to actual gold production, so discoveries themselves don't move the needle much in terms of supply dynamics, it's actual gold production that matters most, and demand continues to exceed supply, hence the gold price rising.

Clio

Cross-posting from another forum thread - thought this would be of interest here.

Livewire interiew with Viktor Shvets (Macquarie's Head of Global Strategy)- very wide-ranging, the investing world as it is today. When Viktor was asked how he viewed gold, his immediate reply was: "Insurance."

actionman

I hold up to 10% of my portfolio in physical gold (ETF) purely for diversification purposes. Markets have been going well for 17 years, but there will be a major downturn again one day. If my shares halved in value, gold would then be about 20% of the portfolio which would be awesome to be able to buy more shares at beaten down pricies.

IMHO it makes no sense to compare gold to the NADAQ. They are completely different asset classes for different purposes at the portfolio level and that is the reason to hold both. It's not about which will have the higher return, but how they can be blended to help you sleep at night and give you more options in various trading environments. Perhaps the same goes for bitcoin but I'm less familiar with that.

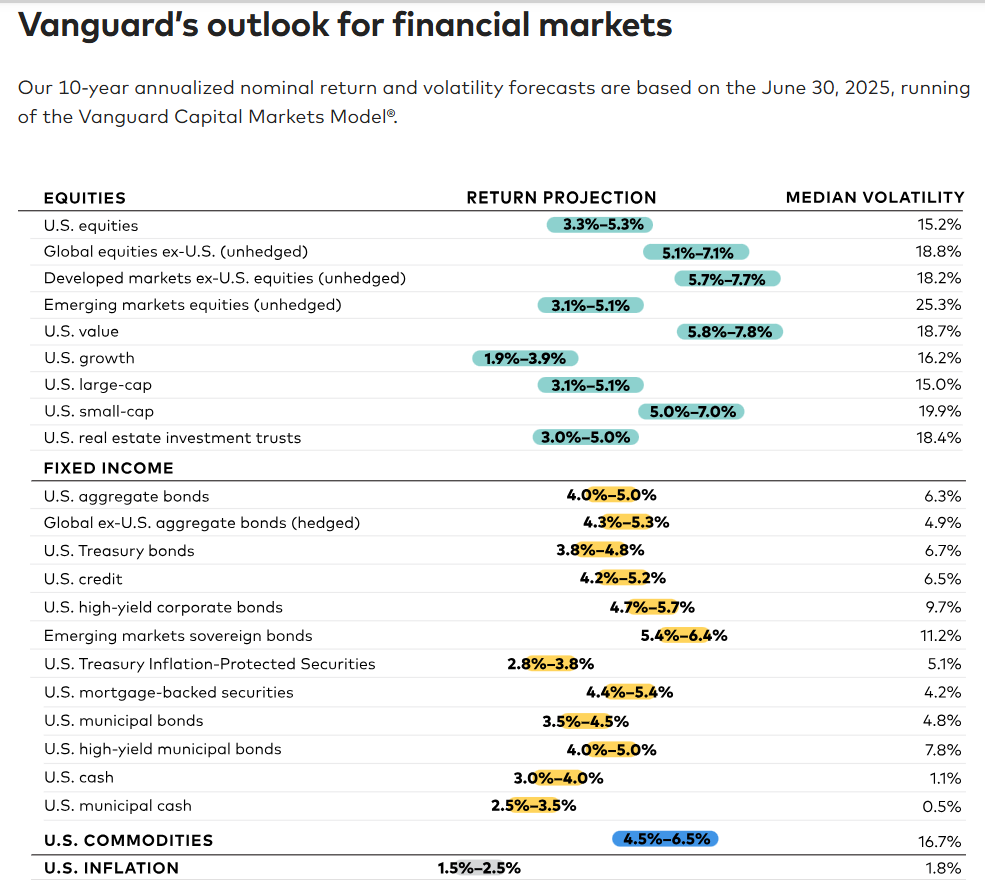

However, in terms of returns, gold may do OK given that the stock markets are on such high valuations the predicted returns on US growth equities could be as low as 1.9% according to Vanguard, about the same as inflation.

BigStrawbs70

Can you please send through the link to the chart? I’m keen to read the full context and the Vanguard article, as I personally don’t see how the US markets are set for such a massive downturn in the near term. With interest rates heading lower, unemployment steady, and money printers about to go into overdrive as large portions of debt need refinancing, I struggle to see the case for a sharp drop. Let’s not forget the egomaniacs in the White House who will do whatever it takes to keep markets humming. Yes, that ends in tears in the medium to long term, but for now it looks like I am missing something and I welcome the chance to see where I might be wrong and hear the counter-argument.

Also, at the risk of taking your words a little too literally, I do believe we need to compare gold and the Nasdaq (and any other asset we’re considering) to some degree. Returns are a key factor in deciding where to allocate capital, otherwise, we could just hold non-returning assets indefinitely. That said, I 100% agree that portfolio construction is ultimately a personal choice, and this is where the ‘sleep at night’ test matters. Personally, I’m comfortable with one position being over 50% of my portfolio (and I expect it to increase much higher in the coming years), while others impose a 10% cap, and everything in between. It’s the Strawman quote of “do you”.

actionman

@BigStrawbs70 link to the chart here https://corporate.vanguard.com/content/corporatesite/us/en/corp/vemo/vemo-return-forecasts.html

I'm not saying Vanguard are correct, I'm just pointing out that there is a chance that markets are highly valued and that they may struggle in the short to medium term. I have struggled during big drawdowns and have found that diversification has helped me focus on the part of my portfolio doing well and hold on to my growth stocks during such times. Psychology is a huge part of investing IMHO and maybe the hardest part. I find gold has been a non correlated asset class, but I guess others may use bitcoin or property or art etc.