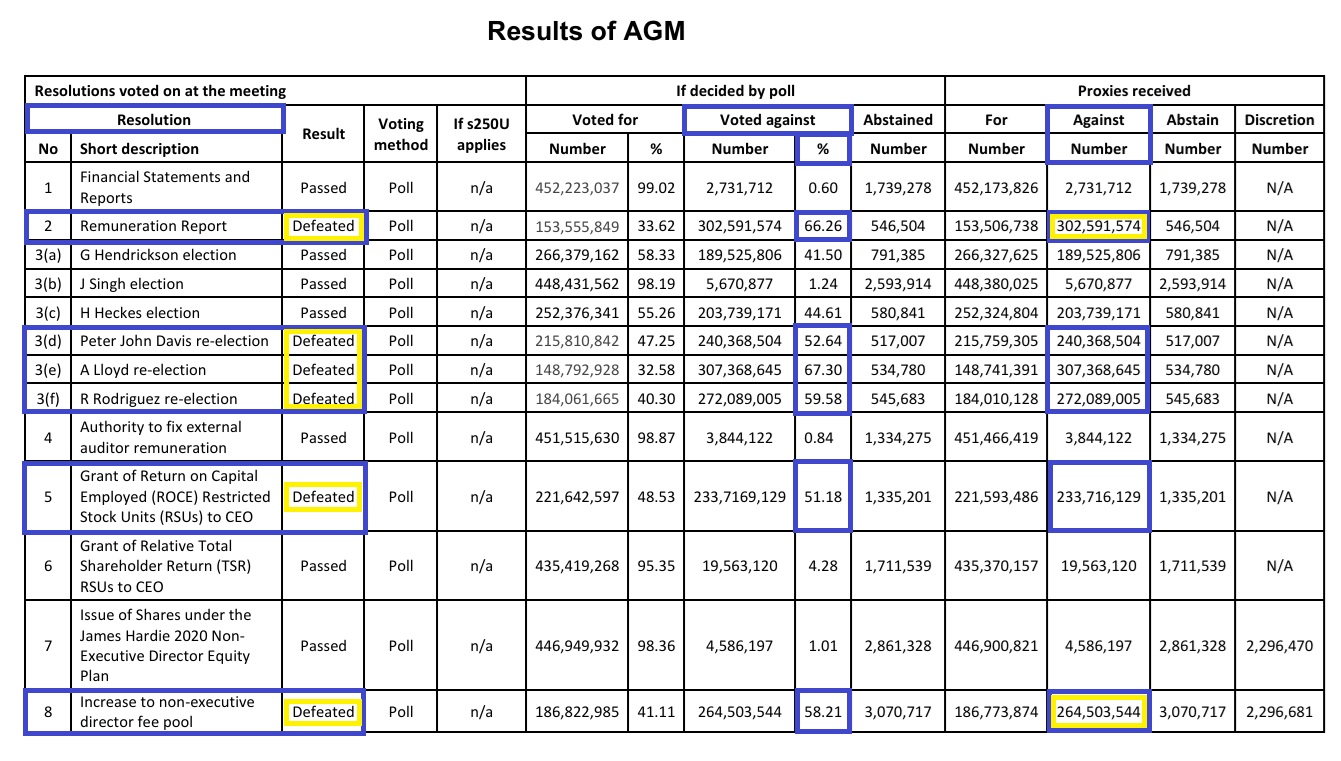

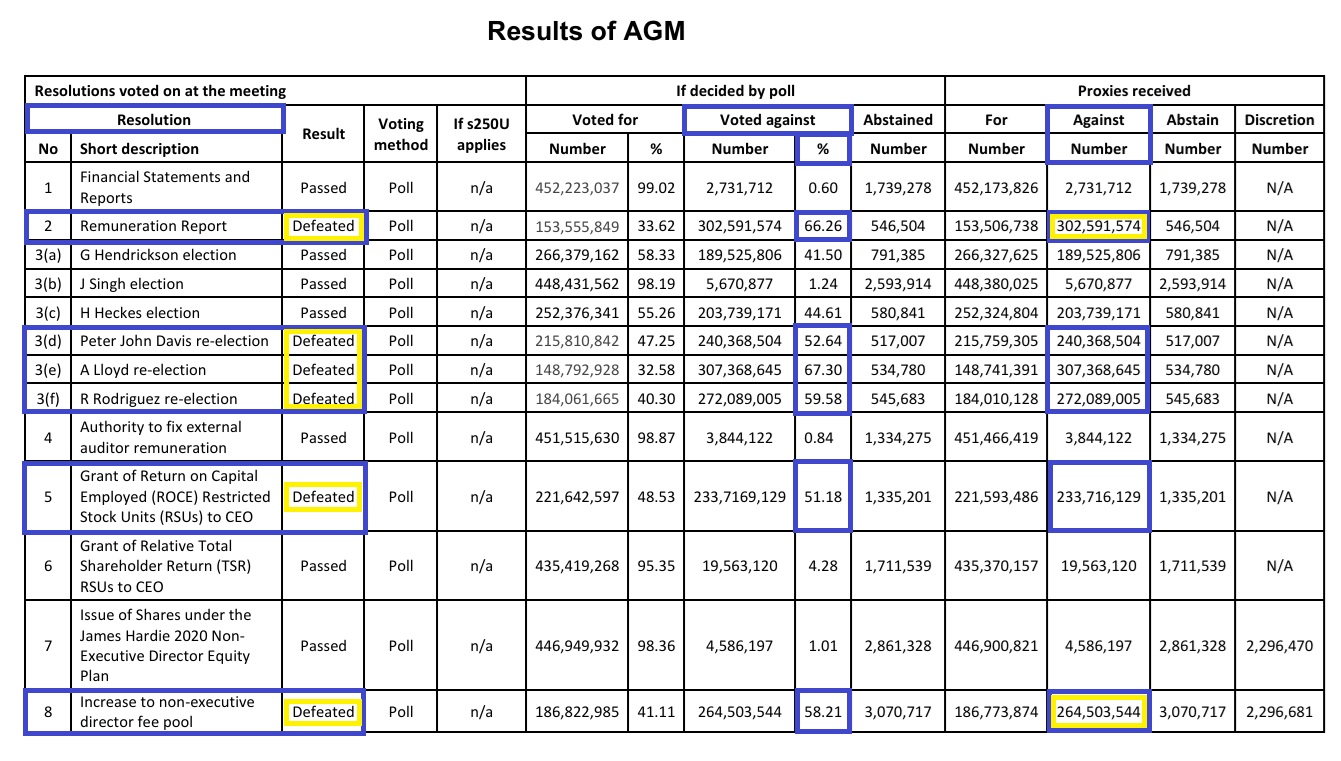

That SMH article was behind a paywall when I tried to access it @NewbieHK however I've got access to the AFR article which I'll reproduce a portion of below, plus the ABC News take on it, but first, here's how the votes landed today:

Source: Results-of-2025-Annual-General-Meeting-JamesHardie-30-Oct-2025.PDF

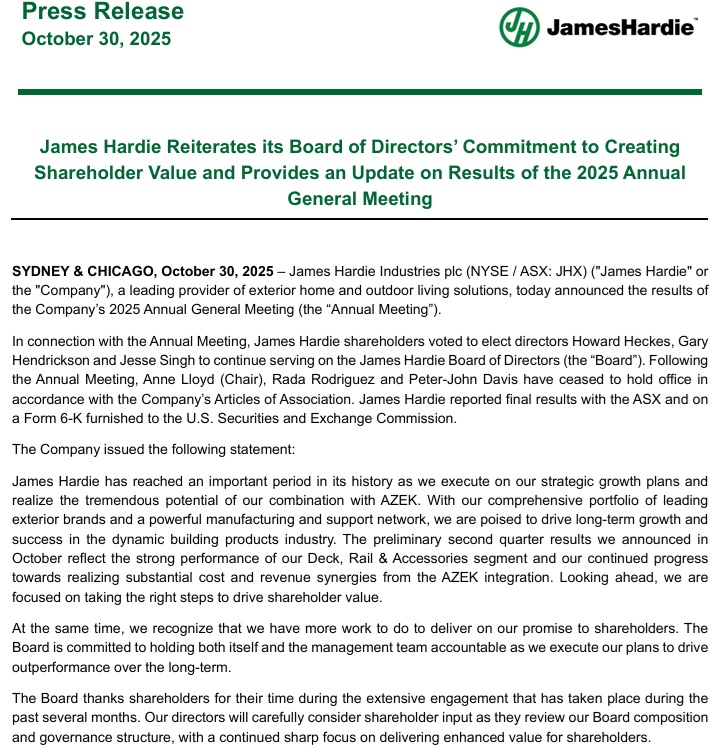

Here's what the company had to say this morning in relation to the meeting and the resolutions being defeated:

Source: 2025-AGM-Press-Release-JHX-30-Oct-2025.PDF

Here's ABC News take on it:

By chief business correspondent Ian Verrender

James Hardie chair have faced fury from shareholders twice in 20 years. (Getty Images: Thomas Fuller/SOPA Images/LightRocket)

Disappointed. That's how Anne Lloyd described events overnight after she and two other directors were summarily dismissed by James Hardie shareholders.

Incredibly, the chair remained not just unrepentant for her recent actions but seemingly oblivious to the unbridled anger roiling through the company's ranks.

"We have always acted in the long-term interest of all James Hardie stakeholders," she told stunned shareholders at the company's annual general meeting in Dublin.

Unfortunately for Lloyd, 67.3 per cent of shareholders disagreed, opting instead to unceremoniously dump her and two other directors. A further two directors only narrowly survived the vote.

It's difficult to recall another time when the chair of a top 200 company was publicly booted from the position.

Normally, in the genteel world of corporate politics, company directors facing a shareholder revolt are either quietly told to move on, given the opportunity to resign, or at least signal an intention to quit in the near future.

Richard Goyder, the former Qantas chair, did exactly that as the company was facing down attacks from the courts, shareholders, employees and customers in the dying days of Alan Joyce's tenure as chief executive.

Even Meredith Hellicar, another former James Hardie chair, vacated the position before being removed back in 2007 after the company thumbed its nose at a government-enforced promise to compensate victims from its asbestos-driven past.

Lloyd, for whatever reason, hung on to the bitter end.

Loopholes and arrogance

James Hardie has a long history of attempting to avoid its responsibilities.

It shifted its home base from Australia to The Netherlands in 2001, before relocating again to Ireland in 2010, countries that have, at times, been considered tax havens.

James Hardie has a long history of attempting to avoid its responsibilities. (Reuters: Tim Wimborne)

While listed on the Australian Securities Exchange, it is domiciled in Dublin, with most of its business in the USA.

And it was that blurring of boundaries and the use of legal loopholes that have enraged investors.

The drama began on March 24 when the company, led by its US based chief executive Aaron Erter, announced a $14 billion purchase of a rival firm, decking company Azek.

The deal was to be paid for with a combination of shares and debt.

"They were issuing shares in their own company," Dean Paatsch, head of shareholder advisory group Ownership Matters told the ABC's Sally Sara on Radio National Breakfast.

"The best house on the best street for what could only be described as a much inferior product. Plus, they paid too much."

The purchase has been a disaster, with Azek underperforming and facing the prospect of a long turnaround.

The biggest insult to shareholders, however, was that they were denied any say in the matter.

"It was, more than anything else, the use of loopholes in the Australian listing rules to facilitate that transaction," Paatsch explained.

Had the deal ever been put to a vote, there was no chance it would ever have been approved, particularly given that it would saddle the company with an extra $4 billion in debt.

"Plus, no-one was being held to account."

Hardie's special place in history

Even before the meeting began, the result was obvious.

Proxy results from the votes made it clear the board would be gutted, that director pay would be curtailed and that the chief executive's $25 million pay packet would be reduced.

"So, there was blood all over the floor this morning in Ireland," Paatsch said.

Despite this, the messaging and statements from the podium bore no resemblance to a company under siege from its owners.

There was no acknowledgement of the collapse in the share price, no remorse for the way investors had been treated, no apologies for ignoring shareholder complaints and, most importantly, for refusing to give them a vote on the deal.

The meeting, held via video link in the early hours of the morning Australian time, lasted just 17 minutes. No-one even bothered to ask a question.

Astoundingly, an unemotional Lloyd said: "The board acknowledges the significance of these outcomes and will engage with shareholders to understand the feedback received."

There's been high volume feedback since March, but Lloyd won't be around to deal with the fallout.

It's the second time in 16 years a Hardie chairwoman has been humiliated in public.

At least Lloyd was spared the dressing down meted out to her predecessor Hellicar.

In his judgement against James Hardie back in 2009, Justice Gzell found Hardie directors had breached their duties and misled the public on their commitment to compensate asbestos victims.

But he singled out Hellicar for special mention.

"I have grave doubts about her evidence. There was a dogmatism in her testimony that I do not accept," he said.

"She was proved to be inaccurate on a number of occasions. I found Ms Hellicar to be a most unsatisfactory witness".

--- ends ---

Posted 5h ago, updated 4h ago (@ 11pm on 30-Oct-2025)

Source: https://www.abc.net.au/news/2025-10-30/why-the-james-hardie-board-was-gutted/105954054

More:

Source: https://www.youtube.com/watch?v=CXnQLo0ge8M

The above is an ABC Business interview with Suhas Nayak of Allan Gray Australia about the JHX deciding to merge with AZEK without a shareholder vote.

Show Notes:

The ASX has responded to growing anger among Australia's biggest institutional investors, over its decision to allow James Hardie, a global building materials company listed on the S&P/ASX 200, to proceed with a merger with American outdoor living company AZEK, without first consulting Australian shareholders. Portfolio manager at Allan Gray Australia, Suhas Nayak, says the decision is another example of the "big hole" in ASX listing rules, which allow shareholder interests to be diluted without their approval.

Mr Nayak explained the impact of the ASX decision in this way: "imagine if you were a owner of an investment property and you had a real estate agent looking after your investment property. One day, the real estate agent said to you, 'I've done a deal, a great deal, with a neighboring property, and you end up with 75% of that combined property, and you don't get a vote'."

Allan Gray Australia is not a shareholder of James Hardie, but is one of many signatories to an open letter to the ASX, demanding change.

While announcing a review of the current rules, the ASX said it was mindful that by giving shareholders a say on mergers and acquisitions, listed companies are at risk of competitive disadvantage to unlisted ones.

--- end of show notes ---

Here's what the AFR had to say about the JHX AGM:

by Simon Evans, AFR Senior reporter, Updated Oct 30, 2025 – 6.00pm, first published at 8.30am.

James Hardie Industries investors say the company should appoint a chairman untarnished by its ill-fated decision to buy American decking giant Azek in a $14 billion deal, after they took less than 20 minutes to sweep the incumbent Anne Lloyd and two other directors off the board.

In an unprecedented show of shareholder anger after months of growing disquiet, fewer than one in three votes were cast in favour of retaining Lloyd as James Hardie chairman at the annual meeting in Dublin on Thursday morning. Investors had fumed for much of the year that they had not been given a say on one of the company’s largest-ever takeovers.

Anne Lloyd (left) has been dumped as the chairwoman of James Hardie, but remains defiant over the Azek buyout and the long-term value creation she says is ahead. Aaron Erter (right) has been chief executive since 2022.

The Azek deal was followed closely by an earnings downgrade, and investors have been smarting over the decision by Lloyd, an American, not to bother visiting Australia to meet with shareholders. Lloyd was ousted alongside two others: Rada Rodriguez and Peter-John Davis.

Investors and influential governance advisory firms – all of whom had recommended their institutional clients vote against Lloyd – are urging James Hardie’s board to look for a fresh face, although they are split on who that could be. Some pushed for Jesse Singh, Azek’s chief executive, who was elected to the board with 98.2 per cent of votes cast in his favour, to be given the chairmanship, given the importance of integrating the business.

Wilson Asset Management portfolio manager John Ayoub said that although James Hardie would ideally find an external chairman, the practicalities suggested that the best pick for the job would be Singh.

“He has the ear of the US shareholder base. He has built a successful business in Azek,” Ayoub said. “That’s not to say that Australian shareholders would support such a move.”

Preston Hamersley, the founder of Indian Pacific Funds Management, said it would be difficult for a chairman to come from outside the company, but the work of repairing relations with investors could not be started by a current director. “Everyone internal is tarnished. It will be a hard one to take on, given the damage is now done and can’t really be unwound,” he said.

Lloyd unrepentant about Azek acquisition

Despite the outsized vote against her – an unprecedented rejection of a board of a company on the S&P/ASX 200 – Lloyd was unrepentant about the Azek acquisition. She had been chairwoman for three years and a director since 2018, having previously been an executive at Martin Marietta.

“The board acknowledges the significance of these outcomes and will engage with shareholders to understand the feedback received,” she said, insisting that the deal to buy Azek was the right thing to do.

“We are poised to drive long-term growth and success. We have always acted in the long-term interest of all James Hardie stakeholders.”

The annual shareholder meeting lasted all of 17 minutes, with no questions from investors, given that it was held in Dublin. ASX-listed James Hardie moved to the Netherlands in 2001, which it said was to position it for international growth. Critics accused the company of making the move to minimise how much it had to pay to victims of the cancer caused by its asbestos products. It moved to Ireland in 2010 in the hope of lowering its tax bill.

Lloyd had expected a significant backlash, given advisory firms from CGI Glass Lewis to Ownership Matters had recommended voting against her.

Ownership Matters’ Dean Paatsch said the vote was a damning result for a company that had lost the trust of its shareholder base.

“The board has been deemed not worthy of investor trust. I’d interpret this as confirming a diagnosis of an ailing patient. They have gone out of their way to get every type of shareholder offside,” he said, adding that James Hardie needed to conduct a comprehensive overhaul of the board.

“The worst of all outcomes after the defenestration of the three directors, and the emasculation of two other directors [Howard Heckes and Gary Hendrickson] would be that the board tries to dig in,” he said.

Heckes and Hendrickson were narrowly re-elected, with 44.6 per cent and 41.5 per cent of votes cast against the two men, respectively.

The Australian Council of Superannuation Investors, which represents some of the biggest retirement savings managers in the industry, said the result was a sign that significant change was needed at James Hardie.

Ed John, executive manager of stewardship at ACSI, said an external appointment as chairman would be crucial. “It’s really up to shareholders to now find a cleanskin to come from outside,” he said, adding that the required board renewal could not come from within the company.

Australian investors still account for more than 60 per cent of James Hardie’s share register, even though it moved to having full ordinary shares trading on the New York Stock Exchange after the Azek deal. James Hardie now generates about 80 per cent of its revenues from the United States.

‘Anne is a courageous woman’

The company’s shares finished 3.07 per cent lower on Thursday at $32.83. The stock is down 36 per cent since the Azek buyout was first announced in March.

In an interview with The Australian Financial Review earlier this week, James Hardie chief executive Aaron Erter had urged investors not to take their anger out on directors because it would create instability. “Anne is a courageous woman because this deal, you know, took some courage to be able to go out and believe in the prospects for the future,” he said.

James Hardie’s executive remuneration report also received a 66 per cent protest vote. While this amounts to a second strike against the company, it did not have to put a vote to spill the entire board to shareholders, like other ASX-listed groups, because it is domiciled in Ireland.

Citi analyst Samuel Seow said he was “cautiously optimistic that we may have seen the low point in terms of governance concerns” and investors had made their views known “without damaging board experience too much”.

Seow said either Heckes or Hendrickson could be the company’s next chairman, “albeit an external candidate may have better optics given a near majority voted against both directors, and all major proxy advisers recommended against them over perceived conflicts”.

--- ends ---

Source: https://www.afr.com/companies/manufacturing/dumped-james-hardie-chair-defiant-over-azek-deal-20251030-p5n6e6

Related (sort-of):

by Michael Smith, AFR Health editor, Oct 27, 2025 – 5.08pm

David Williams, the outspoken investment banker and chairman of PolyNovo, has abruptly resigned from the burns treatment biotech a day before he was due to seek re-election at the company’s annual meeting.

Williams fell on his sword on Monday after a tally of proxy votes over the weekend showed he did not have enough shareholder support to stay in the job.

David Williams said he “picked up a few enemies along the way” but was proud of his achievements. Eamon Gallagher

“There is no use turning up at the AGM when you know you are going to be voted out. You might as well pull the vote, resign and move on,” Williams said.

PolyNovo’s largest shareholder, Fidelity International, and several of the company’s past chief executives who were sacked by Williams but still owned shares in the biotech, were among the investors who wanted Williams out, sources familiar with the situation but not authorised to comment publicly said.

Some shareholders and proxy advisers raised concerns about media reports of Williams’ aggressive style.

In October last year, the company launched an independent investigation into complaints about Williams’ conduct made by former chief executive Swami Raote and chief executive Jan Gielen. Although the report recommended Williams step down as chairman, the board decided he should stay.

Raote stepped down as chief executive in March. His predecessor, Paul Brennan, also resigned in 2021, which Williams at the time attributed to Brennan’s management style and board differences.

“These incidents, together with the independent findings, have undermined shareholder confidence in the board’s ability to uphold sound governance and a respectful workplace culture,” influential governance advisory firm CGI Glass Lewis said in a report.

Investors also pointed to Williams’ sale of $1500 of PolyNovo shares during a blackout period in January, which he said was a wedding gift to a US doctor affiliated with Vanderbilt University Medical Centre, a hospital that uses PolyNovo’s product.

Williams maintains that giving the shares as a gift was not trading under ASX rules, and it was disclosed to the market.

Institutional Shareholder Services, another widely used proxy advisory firm, also recommended against his re-election.

It also highlighted failings of the board’s process and procedures, and a lack of transparency regarding independent investigations into Williams’ conduct.

The Australian Council of Superannuation Investors and Ownership Matters voted in favour of his re-election.

Williams admitted he had “picked up a few enemies along the way”, but said he was proud of what he achieved since joining the company in 2014.

David Williams helped bring Vegemite back into Australian ownership and he was behind a string of sharemarket floats in the agriculture and healthcare sectors. Arsineh Houspian

He will be replaced by non-executive director Leon Hoare.

“They came to me to fix the company,” Williams said. “The price is not down because of performance but because 10 per cent of the stock is short sold. It is a very proud moment to take something from $20 million to $1 billion, and save lives in 46 countries.”

He said he supported the appointment of the new chief executive Bruce Peatey, who starts in December, and a new director, Rob Douglas.

PolyNovo shares rose 3.1 per cent to $1.34 on Monday, valuing the company at $900 million. The stock has fallen 35 per cent since the start of the year.

Williams is a high-profile corporate adviser in Melbourne and has worked on some of the country’s biggest agribusiness deals.

He is also a major investor in PolyNovo with a stake worth about $30 million at Monday’s trading price. He acquired an additional 55,000 shares on September 16, bringing his total shareholding to 21.7 million shares.

Williams, in an interview with The Australian Financial Review in March said he was “known for being very aggressive and taking no prisoners” and “sometimes that might challenge some people with various woke views, but I’m determined to grow businesses.”

PolyNovo is the producer of NovoSorb, a foam-like sheet used to treat severe wounds and burns where the dermal layer of skin has been lost.

Williams has been behind a string of sharemarket floats in the agriculture and healthcare sectors.

He led a syndicate to buy salmon producer Tassal, after it went into receivership in 2003, and floated it on the ASX.

Williams also helped bring Vegemite back into Australian ownership when he advised Bega Cheese on the purchase of the brand from its international owner, Mondelez, in 2017.

His firm, Kidder Williams, was also involved in the sale of another ASX-listed salmon producer, Huon, to Canada’s Cooke Aquaculture.

--- ends ---

Source: https://www.afr.com/companies/healthcare-and-fitness/david-williams-exits-polynovo-after-investors-vote-against-re-election-20251027-p5n5jl

Related: March 11th, 2025: https://www.afr.com/companies/healthcare-and-fitness/david-williams-unapologetic-of-aggressive-style-in-a-woke-world-20250310-p5licf

Discl: Not held by me (JHX or PNV).

These stories are only related because both companies' Chairpersons got ousted as a result of proxy adviser organisations like Ownership Matters, Institutional Shareholder Services and CGI Glass Lewis advising institutional investors to vote against their re-election at their respective AGMs. Sometimes it's as basic as the Board overpaying themselves or their executives, but in James Hardie's case, it clearly goes well beyond that.