mikebrisy

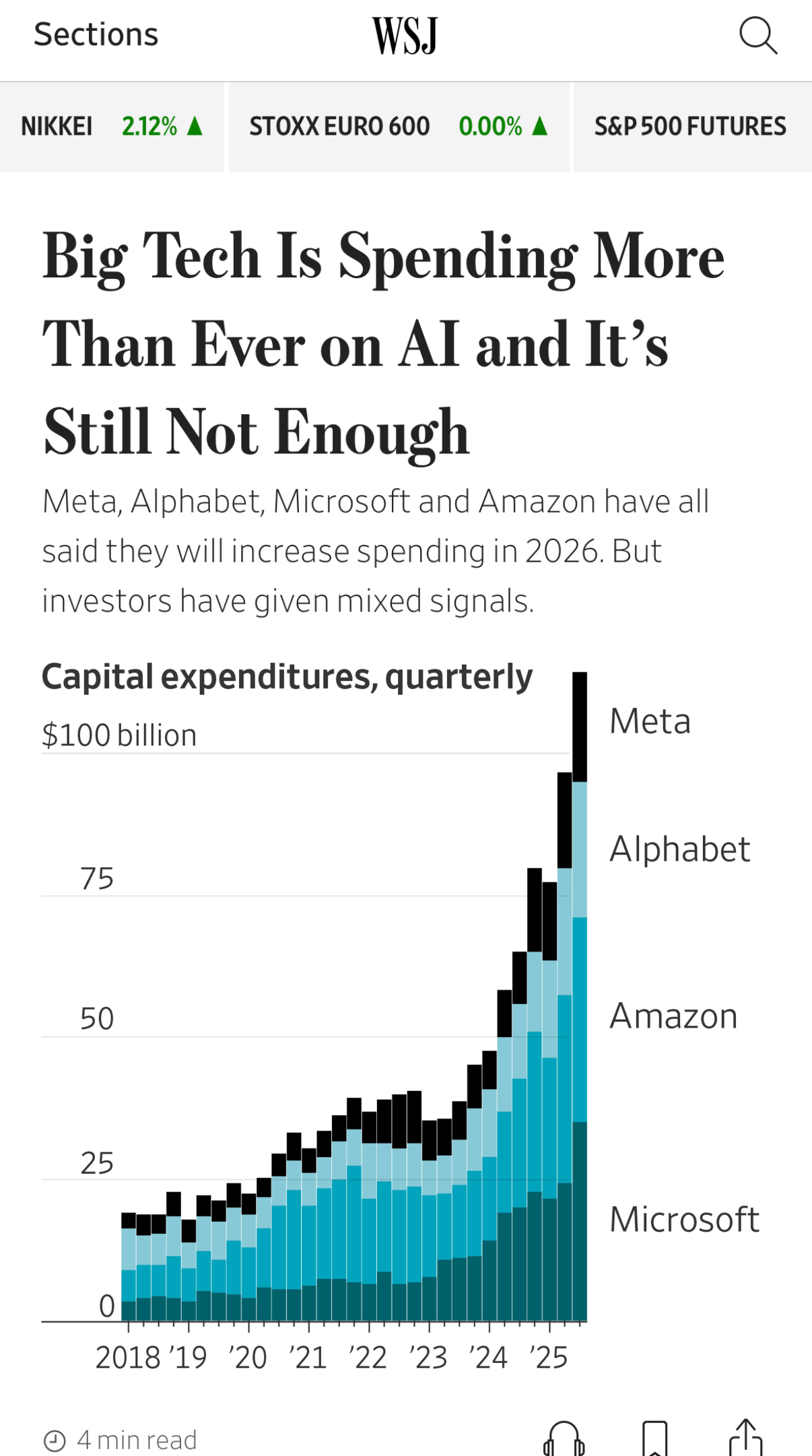

Quite the trend!

These were all once capital light businesses, or at least of moderate capital intensity. No more.

I wonder what trends we will see along the value chain as they work to capture the returns? (We can’t even see the beginning of the full cycle economics, yet.)

My (passive) non-ASX portfolio is very exposed to this. And I’m wondering if that’s a wise thing?

edgescape

AMZN also posted a beat on all analysts expectations and is up about 13% pre-market with 20% growth in AWS sales.

Just amazing what can be done when you have scale.

I hold AMZN and IVV wish I bought more of these instead of WTC :(

edgescape

AMZN rally fizzing out back to 9 percent

My guess is people don't like the exposure to tariffs

Still at a PE of 30x which is much cheaper than some of the ASX listed companies here like WES. It doesn't pay a dividend but I prefer it that way.

Bushmanpat

@mikebrisy I was speaking this week with a bloke who has done very well for himself fitting out data centres. Been doing it for over 16 years in multiple countries and he mentioned that it's really ramped up in the last 3-6 months!

Solvetheriddle

@mikebrisy since these are all holdings (and some big ones), i just wrote a large explanation considering demand and the value stack, that has disappeared on entry!. im not going to do it again. The summary, the demand is insatiable atm, compute is short driven by real client demand, driven by use case wins, but expect demand volatility given the numbers involved and usual bottlenecks/execution etc. i think the full stack guys will win over time, which explains some of the cross investing. not chasing but any pullback i will concentrate and increase positions, is my feeling at this stage. probably worth pointing out that although ROIC are under pressure the above companies say the older vintages of investments are every profitable so they are extrapolating that experience.

huge question short (inadequate) answer

edgescape

On subject of WES I noticed that they did a capital return AND special dividend

If only they put some capex into AI like AMZN instead of appeasing the baby boomer dividend holders.

Maybe even start their own version of AWS...

That would be something but also would be out of their comfort zone.

Also probably everyone knows the history already but AWS was initially part of Amazon marketplace when the company decided to spin it out as a hosting service.

pubenvelope

I personally would hate to see WES jump on the AI bandwagon - sounds more like diworsification if you ask me. They're better off sticking to what they do well, which is retail.

WES is an amazing company without the AI hype.

edgescape

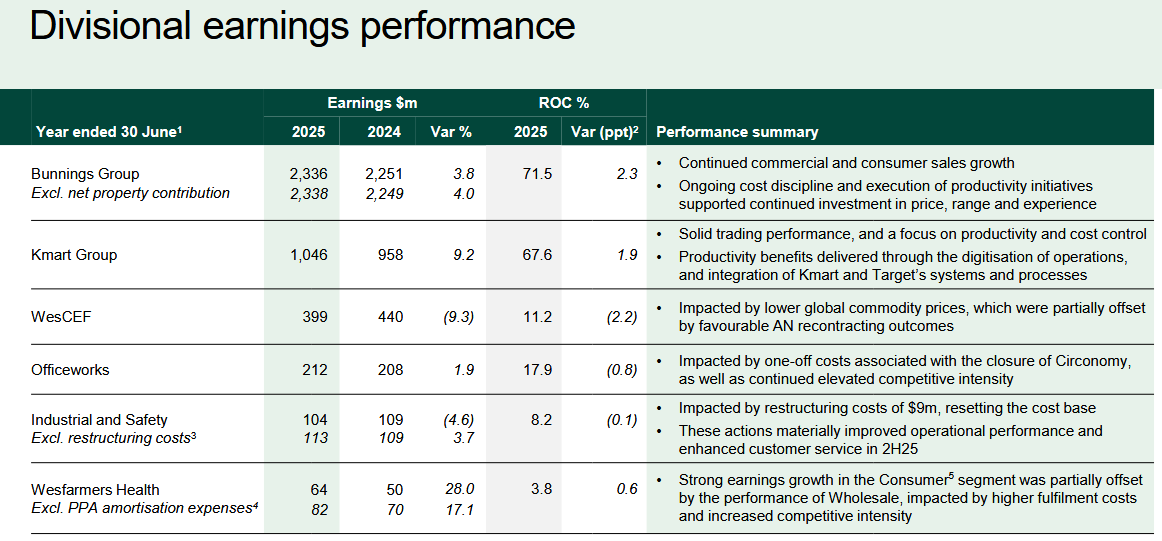

I partially agree @pubenvelope. I'm a bit concerned Wesfarmer's strategy of getting into health maybe stalling when you compare the performance against Bunnings, Kmart and Officeworks if you see the last line.

Even Bunnings I have doubts. I tried to buy a Ozito jumpstarter from Bunnings, the website said the item was in stock at the local store but in actual fact wasn't. I had to go to another store to and even then the stock management incorrectly said the item was on the shelf when in fact it was an empty box! Did someone help themselves? Anyway they luckily found one box at the back of the store although the system said there were five. Definitely a reconciliation problem right there!

I think they need to look within and see what they can do with cost and inventory pressures in the business as a whole. And then turn these risks into opportunities. Maybe AI can assist!

On the other hand I think the big US tech companies see there is demand in AI and are spending big to get that return on capital.

Bear77

I think the WES foray into health is still in its early days @edgescape - and it will likely pay off for them over time. Remember how people thought that them (Wesfarmers) buying Coles, KMart, Target etc. was a big mistake, especially early on when Coles appeared to be struggling against Woolworths, but Wesfarmers turned Coles around and then spun it out as a separate company (COL) along with the associated liquor businesses, keeping Officeworks, which is a lot like Bunnings in terms of both having the lion's share of their respective TAMs. WES also kept Target and KMart. I think WES have always had longer investment timeframes than a lot of investors tend to have these days, and while I don't currently hold WES (too expensive) - I would expect them to make good money out of that new Health Care division given a few years. It won't happen overnight, but I reckon it will happen.

Clio

I hold WES and imagine I will continue holding it for a good long while. Like @Bear77 I think their foray into the Health sector will pay handsomely in time given teh similarities with the retail models that work in health compared to hardware and office supplies. I do expect them to try this and that on the way to finding the system that works best. But long term? I'd be surprised if they don't nail it.

edgescape

Think it will be tough when CWH constantly bombards the TV and Morning Show airwaves and prescriptions are cheaper than the competition. I'm not saying WES won't succeed but you have to account for the possibility they will take the bat and head home.

AMZN failed in their attempt to get into sports analytics and health. So that's a bit of perspective. AI for AMZN could be different because AWS already have a large footprint and branding they can work with.

Bear77

I think retail pharmacy is a minor part of the API Business that formed the cornerstone of WES Health Care, API makes far more money as a pharmacy wholesaler and distributor, providing a one stop shop wholesaler and delivery service for both pharmacies they own and others that they don't own. I know that CWH have their own pharmacy wholesaler, Sigma, and the two have now merged so API now competes directly with Sigma/CWH as both a wholesaler and retailer, and Sigma/CWH is as dominant in that space as Bunnings is in Hardware, so I do NOT believe that API is going to win that war, however WES Health also includes other brands and they have been looking at moving into radiology (I-MED, Qscan) and even hospitals - see here: https://ajp.com.au/news/wesfarmers-loses-interest-in-ramsay/

The three dominant pharmacy wholesalers in Australia are EBOS Group, Sigma Healthcare, and Australian Pharmaceutical Industries (API). Apparently EBOS (EBO.asx) is the most dominant of the three and is NZ-based and dual listed (NZX and ASX).

Wesfarmers was reportedly interested in buying Ramsay Health Care and conducted due diligence, but they eventually "lost interest" and walked away because the asking price was too high. Wesfarmers was particularly interested in acquiring Ramsay's Australian hospital business.

They have reportedly run the ruler over a heap of these types of companies but ultimately decided not to go ahead with most of those acquisitions which in the majority of cases (particularly in RHC's case) was based on the price being too high in WES' opinion, so they remain disciplined in that respect.

So when I say that it's still early days for WES Health, I'm not just talking about their API business, I'm talking about a new division of Wesfarmers that they've only just begun building, with API being their first major purchase (in 2022). It won't be their last.

edgescape

@Bear77 The health expansion is all good but I think my point is WES may have bitten more then they can chew when their flagship businesses suffer.

That's especially when 2 local Bunnings stores has trouble finding what I am looking for in the store which includes one box that happens to be empty and 4 others in the system that are MIA.

I can't believe I witness something like that first hand but credit to WES for disclosing this in their results call.

I still think AMZN is cheaper than WES and I'm looking at a 5 year horizon when the world can hopefully get on without Trump and trade wars will be over.

Having said that I found an article in X about AI spend on data centers which is interesting reading and puts everything in perspective