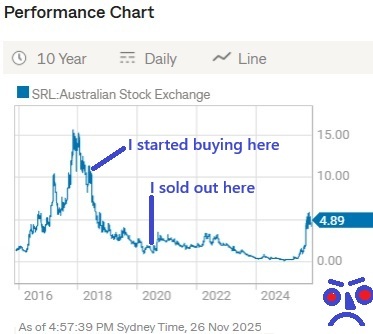

Yeah, it was Robert Friedland's involvement that made me research and then buy shares in SRL @Chagsy back when it was called Clean TeQ in May and June 2018 at prices ranging from $1.20 down to $1.04, topping up again in 2019 at prices ranging from 65 cps down to 28 cps, however I sold out completely in April 2020 (for between 13 and 19 cps across three sells). The share price just kept going down the whole time I held them.

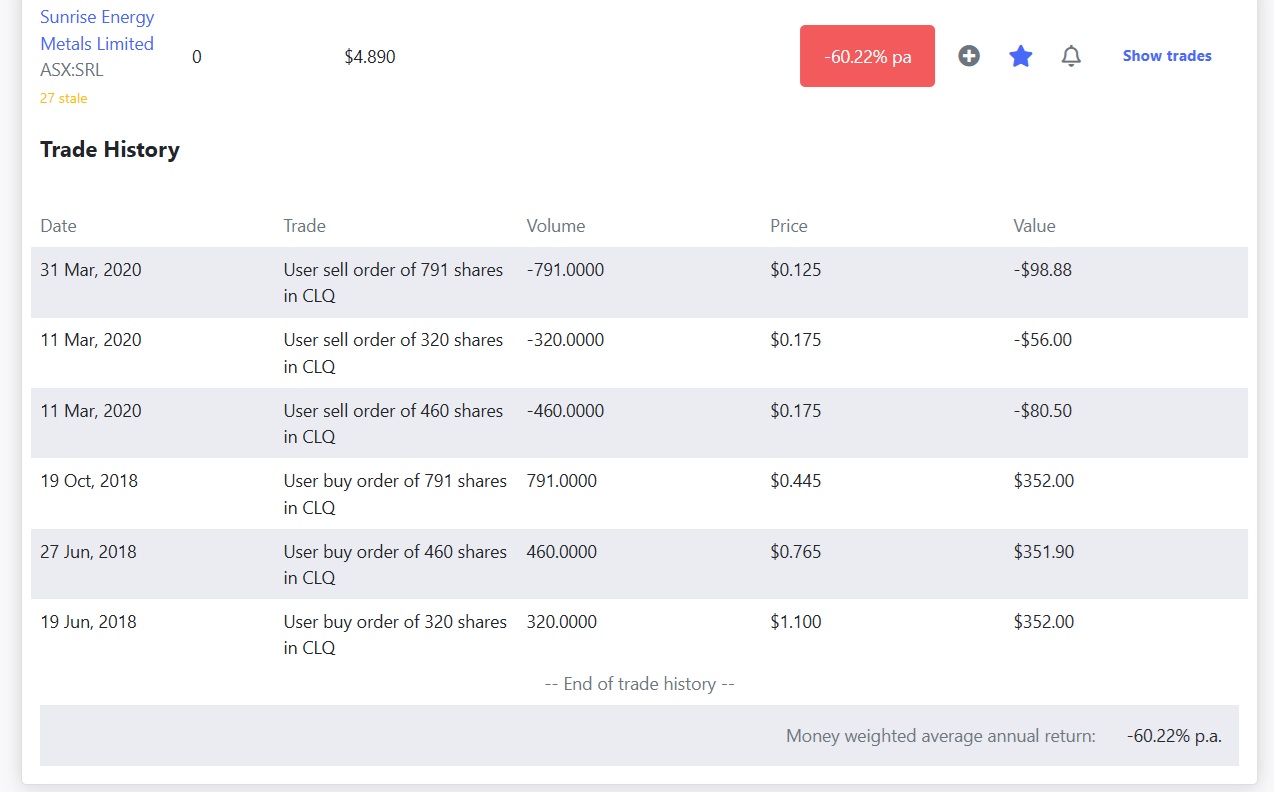

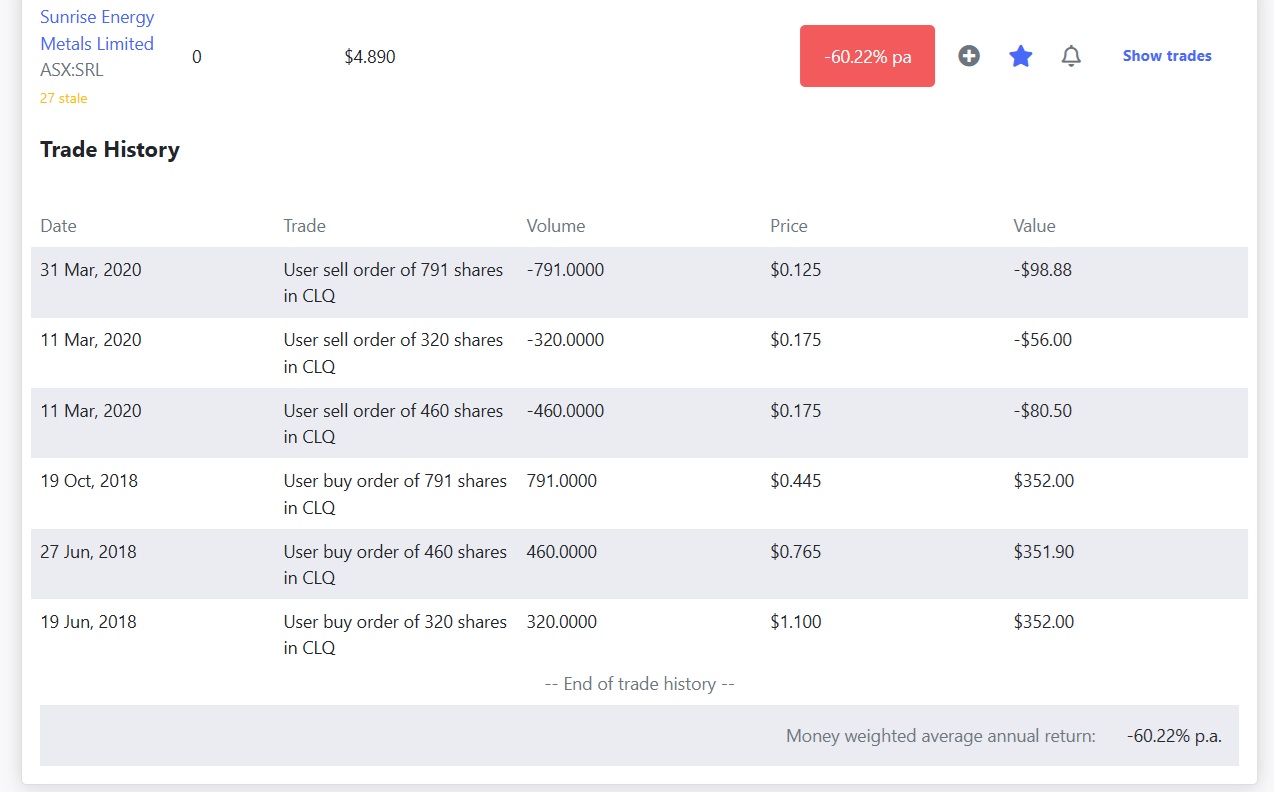

Edit: Additional: I just checked and I also held a small Clean TeQ position here on SM - and the buy/sell dates and amounts were similar to my RL position, just less dollars involved here:

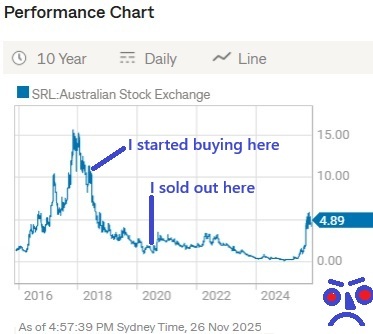

SRL did a 1 for 10 share consolidation (sometimes called a reverse split) on March 29, 2021, so you can move the decimal point one place to the right on those prices I've used above when comparing them to current prices; Their share price chart now (shown below) shows SRL as having traded (as CLQ) back in May 2018 through to April 2020 at $12 down to $1.30, but pre-one-for-10-share-consolidation those prices were actually $1.20 down to 13 cents, which is the highest price I paid ($1.20) and the lowest price I sold at ($0.13).

When they consolidated their share structure in March 2021 (at the same time that they changed their name to Sunrise Energy Metals), their chart was adjusted so that all share prices pre-consolidation were multiplied by 10 to reflect the post-consolidation share prices that we've had since March 2021.

They changed their name to Sunrise Energy Metals in March 2021 to reflect their greater focus on the Sunrise Scandium project in NSW and less on their water purifcation tech. I liked both sides of the business back then, but I was more interested in the water purification than the scandium because my research indicated that scandium was a tiny market and the price of scandium made it difficult to make money from a mine focused directly on scandium production rather than scandium as a byproduct of other production. The theory was that once there was a lot more supply, the use cases would expand and the global demand would increase, which struck me as a backwards way of framing the usual supply/demand dynamics of those types of rare metals - or rarely mined metals.

Usually the price had to rise as a direct result of limited supply and increased demand, which incentivises further production and new mine development, however the argument with scandium was that there was little chance of the price rising WITHOUT new supply being there to supply increased demand. Scandium was discussed here on the MoM pod last week (posted on 21st Nov) - full plain text link = https://www.youtube.com/watch?v=qnzAkbX8o-c&t=1891s

Clean TeQ Water was spun out of (a.k.a. demerged from) Sunrise Energy Metals (formerly Clean TeQ Holdings) on July 1, 2021, with eligible Sunrise shareholders receiving one Clean TeQ Water (CNQ) share for every two Sunrise Energy Metals (SRL) shares they held. I wasn't holding any of their shares at that stage. CNQ has traded as high as $1.20/share back in July 2021, and as low as 15 cps (cents/share) in June this year. They closed at 36.5 cps today. They're another company that has had their share price more than double during this calendar year but are still well below their previous highs (from prior years).

Robert Friedland is probably the best mine financier in the world, or has been over the past 20 years or more, getting mines built in dangerous places around the world, and many of them being very profitable operations once they were operating, and he had one of his right hand men running Clean TeQ (now SRL) as CEO & MD, Sam Riggall - he's still SRL's MD & CEO - Sam commenced his career in the mining industry working as mining executive for RIO's portfolio of industrial minerals businesses, then worked in exploration, evaluation, development and operations, having served as a director on several public and private boards in Australia and overseas. Directly prior to Clean TeQ/Sunrise Energy Metals, Sam was head of strategy and planning at Ivanhoe Mines (Friedland's flagship mining company), where he worked actively in Central Asia, Africa and Australia.

So from a management POV, and also in terms of skin in the game, it ticked the boxes I wanted it to, but like many of Friedland's projects it was going to make a motser if the scandium price rose as they were arguing it should and stayed there or higher until they were in full production, but might never get built if the stars did not align for them.

I was aware that Fiedland had his fingers in many pies and so he certainly wasn't "all in" on CLQ/SRL, it was a tiny part of his overall empire of companies, mines and mining projects.

Once they made it clear that they weren't going to keep tipping significant money into further developing and refining the water purification side of the business and that Clean TeQ was going to become SRL and be predominantly focused on the Sunrise Scandium project, it became less attractive in my view as a place to park money, because of both the risks of the project never getting through to production, and also the extended timeline even if it was to get built and they do eventually get into production.

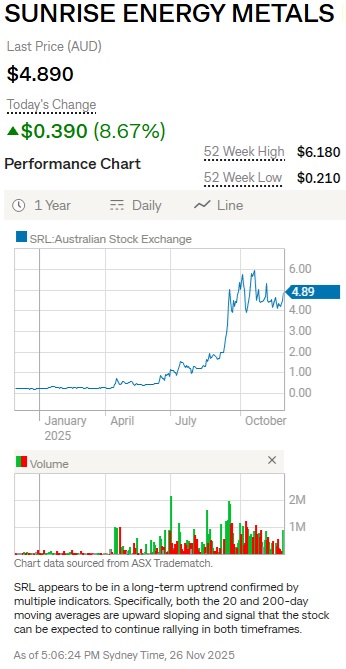

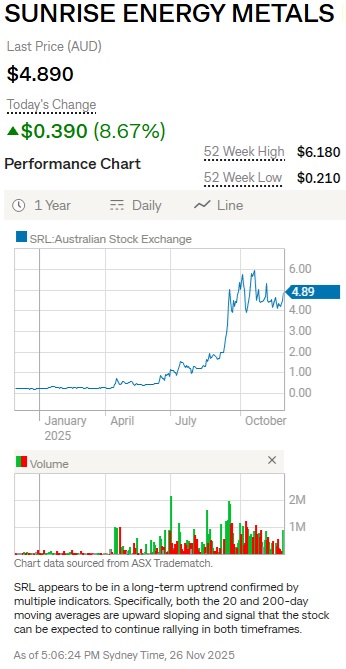

So I sold out 5.5 years ago and while with the benefit of hindsight I could have held them for 7 years through until today and sold at close to $5/share (they got up to an intraday high of $5.05 today before closing at $4.89), my average buy price when adjusted for their subsequent 1 for 10 share consolidation (in March 2021) was $7 (or 70 cents/share pre-consolidation), so today they're 29% lower than my average buy price through 2018 and 2019 and they're only one third of their all-time high of over $15 in late 2016 ($1.50 pre-share-consolidation). So the one year graph below doesn't tell the whole story:

I wasn't too interested in scandium back then, and I'm even less bullish on scandium now - because of the tiny market for it - and because it can be easily produced as a byproduct of existing production (from existing producing mines) if demand increases - example: RIO have recently agreed to supply the US Government with something like $40m worth of scandium for defence applications and my understanding is that this will all come from RIO's existing operations.

And many punters who bought Clean TeQ (now SRL) when they last had this sort of move (spike up) back in 2016 and 2017 would still be underwater on them today, particularly if they bought in during 2017 and/or 2018 - as shown on the 10 year graph further up this post - and I would be one of those people if I'd held on instead of selling out and crystalising that loss back then.

Despite booking a sizable loss at the time, I ended up making more money by redeploying that capital back in April 2020 into better ideas - than I would have made by leaving that money in CLQ (now SRL+CNQ) through until today.