LGI last month announced a capital raise of $51.2 million to fund an accelerated and expanded pipeline of 'high conviction' projects.

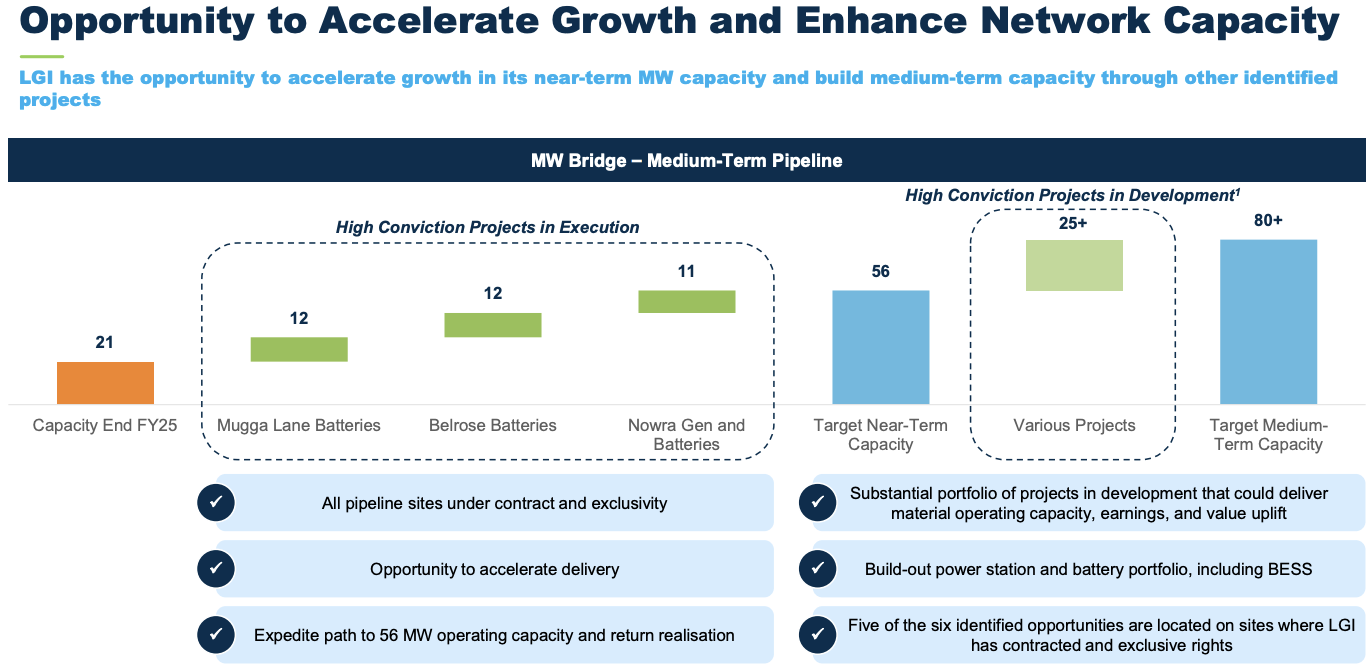

From what I've seen over the last 2 years, the share price has moved higher when ever the pipeline for MW is expanded. So currently they have 21 MW of generation and the next target, which was fully funded, was 56MW. Now, with this raise, the target is 80+ MW and the share price quickly moved from around the offer price in the high 3's to 4.40 now. They want to keep rolling out more batteries at power generation sites and they see volatility in the electricity market continuing.

SPP closed this afternoon and was in the money by 14%. Liquidity has increased noticeably in the last few weeks. The company is now ~$450 million market cap. I think the company is increasingly in a better position to win new contracts, but I do wonder about where growth comes from 3-5 years from now unless the company can win cornerstone landfill sites to then anchor regional expansions. This came up on the meeting the other month, they kind of run a hub and spoke approach, where its just uneconomical to tender for some contracts unless they have a closer presence.

Held in RL.