Great conversation here.

I lean to the view that we are not in a broad bubble. There are legitimate concerns on all the AI spending, but as noted, this is, in the main, from the most profitable companies in the world that are still growing at double-digit rates. There is uncertainty which seems to have shaken the markets, but I am just not convinced (not yet anyhow) it is a systemic issue for the whole economy.

For me, I like to keep things pretty simple and look at the bigger picture, which at the moment is all about the macro environment. The American government shutdown is now over, so the funds in the Treasury General Account will start flowing. On top of that, interest rates are trending down, unemployment is stable, and there are trillions of dollars to refinance in the coming months (aka money printers go crazy). How can that all be bad for asset prices? Although, longer-term all of this can create another set of issues for the economy but that is a separate topic. It just seems to me that with so much money floating around, it is all going to push up asset prices.

I am not going to put the house on it, but I am very comfortable bringing forward as much of my DCA'ing funds to continue buying what I see as sale price assets. It could all come crashing down one day, for sure, but I just do not see how that can happen in the short/medium term.....again, there is/will be way to much new money and stimulus (lower interest rates) in the broader system.

What could go wrong lol :)

BUBBLE, BUBBLE, TOIL and TROUBLE

One of my beliefs is that market timing is hard, harder than stock selection, for instance. It is a widow maker, and takes two correct decisions to get out near a peak and back in, hopefully lower than you got out. However, that doesn’t stop people from trying, especially less experienced investors, which I find amusing. I wish you luck with that.

What follows is how I look at the market valuation, but to be clear, I rarely act to any significant degree. It just gives me a perspective of the broader risks, like my ability to find value in the market or not. Finding great stock stories at the right valuation, regardless of the market, is the main game, for me anyway.

The first place I look for market froth is the good old CNN Fear and Greed Index. Although it is apt to move around a bit, especially lately, there is little to warrant being overly cautious. A reading of extreme greed is a sign of potential overexuberance. So this one looks fine.

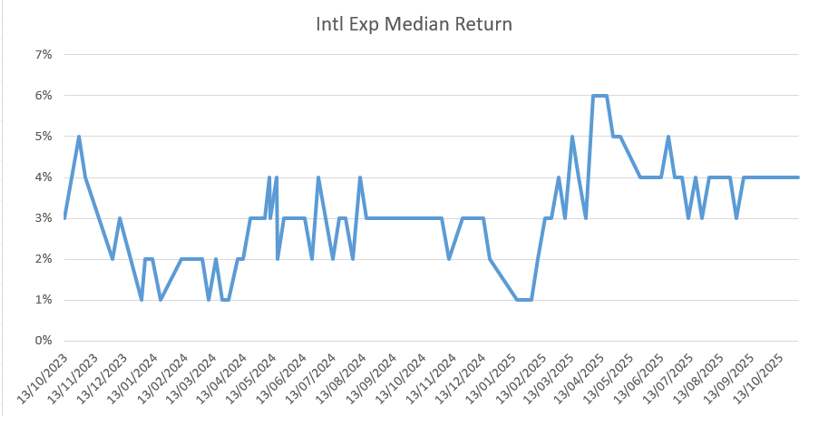

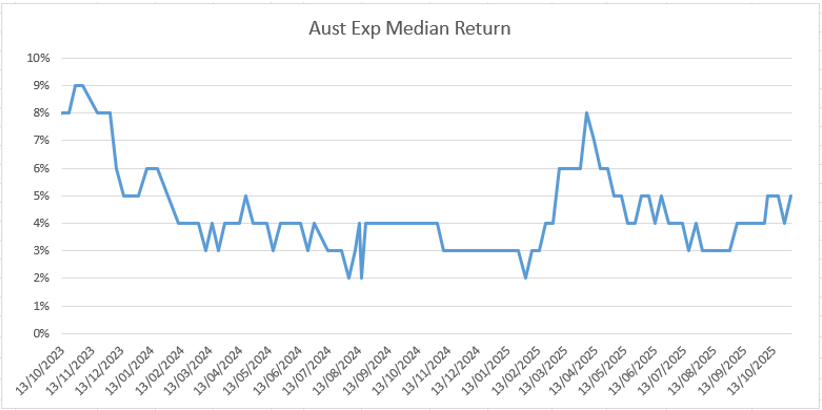

Secondly, my own valuations. I do back-of-the-envelope valuations on 45 Australian and 131 International companies, which I consider the best examples of quality growth businesses in the respective markets. The universe is reasonably stable. I also use a median, equally weighted approach. So every stock in the index gets the same weight. That is, it is not market weighted. That means two things: larger market cap stocks do not influence the results, and the median return is not influenced by extreme outliers. So this is the “average” stock results.

Remembering a lower reading is expensive (lower returns), and a higher reading is cheap. What we can see below is both markets moving generally in tandem, probably to be expected. We can see the broad rally after Trump was elected, the sell-off in the April “Trump Dump” and the normalisation since then. All makes sense. In my view, the average stock is around fair value using these measures.

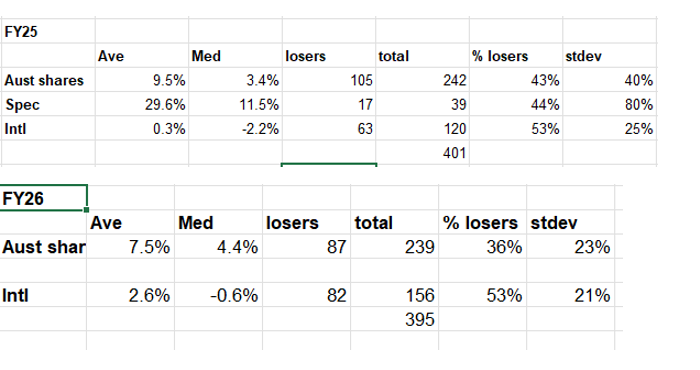

The next measure looks at past performance, but through the lens of equal weighting of stocks, again, so the bigger stocks do not overly influence the outcome. I also use median and average to take into account the skewing you get with equity markets. Again, this list is curated to include profitable companies. The International is quality growth biased. They do not include dividends, so add back about 2% for Australia and 1% for International.

These figures show close to market average returns for Australia and poor returns for international. The International is so poor that I have checked it many times. The outcome is that most stocks in the US have lagged in the last 18 months. Try telling a healthcare investor we are in a bubble! There is some suggestion of bubble-like behaviour in the speculative sector, but the sample is small.

Overall, these measures of past performance show little in the way of bubble-like overexuberance, imo.

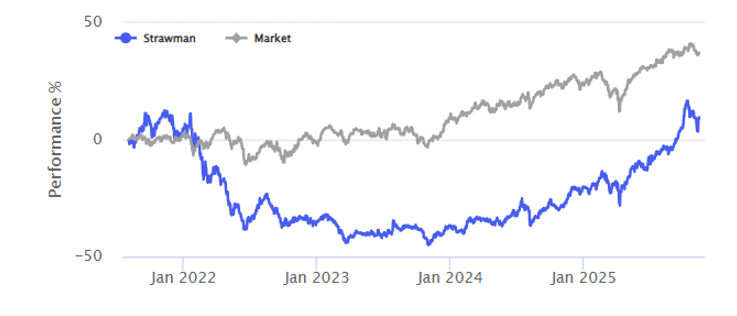

Another area I look at for overreach is liquidity flowing into the more speculative end of the market. Hard to get a definitive answer here, so I look at the good old Strawman Index and ARKK fund. When the market is exuberant, it will look at stocks with a wide dispersion of likely outcomes, more than a tight conservative one, and push towards the bigger but riskier payoffs, displaying higher risk tolerance. This is a common occurrence. Here we do see some strong returns, especially since the April 25 lows. The movements, although strong, are off very low levels, so some caution is warranted, but not crazy like.

NUMBER AND TYPE OF HIGH-PRICED STOCKS

Another area is to look at absolute stock valuations to see what the market is pricing up, for some clues on where excess is occurring. Since the current market has a low 20s PE, as far as I can tell, I looked at stocks with PEs above 50X, so at least double the market. So, where growth expectations are well above the market. I also separated these into Australia and International, and for International into AI and non-AI; some subjectivity is required here.

Australian companies' PE using the last reporting year's earnings

PME 318X, XRO 128X, TNE 99X, HUB 96X, PWH 85X, SIG 69X, PXA 66X, NWL 62X, REA 60X, WTC 59X, CDA 59X, OCL 55X, FPH 54X. =average 93X Median 66X

International (last reporting year), note I have used GAAP but added back a/t amortisation.

Non AI

ISRG 83X, FICO 81X, LLY 77X, HEI 72X, IDXX 66X, MELI 57X, NFLX 55X, ROL 54X, COST 51X.=average 66X Median 66X

AI related

PLTR 825X, NOW 118X, AMD 109X, AVGO 98X, MPWR 97X, CDNA 82X, APH 67X, VEEV 65X, NVDA 63X, ANET 59X, ASML 51X.=average 148X median 82x

Now we are getting somewhere. Note the median Australian and US non-Al stocks have a median PE of 66X, yes, very high, but these are the best growers in the market. While the AI grouping has a median PE of 82X. large expectations built in here.

POTENTIAL HOT SPOTS

So far, we have seen that most of the market does not exhibit bubble-like features. By bubble like I mean a potential pricing cataclysm if anything goes wrong. But AI-influenced stocks look high; the rest are stock-specific, so choose your own adventure. There is also potentially some heat in the speculative market; again, choose your own adventure.

Lastly, I can see two pockets of potential trouble. These are my own opinions, no real data.

PRIVATE CREDIT

I firmly believe we are in the innovator/imitator/idiot cycle here. There is a long history of people lending outside where the banks will go, and we usually find out why the banks didn’t go there in the first place. The theory here is that the banks are restricted, which is true, so PC is filling a genuine need. The question is how overboard and systemic the lending can be. We need more information on this, but it is financed by equity funds for the most part, so it doesn’t have the bank liquidity cycle risk. My belief is that PC is diversified, so it needs a widespread economic problem to trigger major disasters. IMO, PC will be a problem for specific managers/investors; they could lose a lot and maybe frighten investors across the food chain here. However, it does not look systemic and bubble-like to me. The proof of the pudding will be who the better managers are. I have exposure here through MQG, which has a reasonably large PC book and PNI, where one of their managers, a larger one, Metrics, is very active in this area. Clearly, as investors, you are backing that they are innovators, not idiots.

AI

The success of the AI ecosystem depends on the usefulness of the products and continual funding. Most of the funding so far has come from the hyperscalers, being AMZN, GOOG, META, MSFT, plus a few others. These are amongst the most profitable firms in the world and have funded capex so far from cash flows. A mighty effort. The other big spender is OpenAI, which is funding their portion from equity raises, so much more risky. OpenAI is also important as it is a bit of an innovation pace setter in the AI market. To a man, all these participants have said that demand, so far, is insatiable and diffusing. Both great signs at the moment. The huge capex has, of course, provided rivers of gold for the extended ecosystem, with NVDA being the biggest beneficiary. NVDA is also ploughing money into various parts of the chain as it is in its interest to keep participants liquid and able to meet demand.

As far as I can see, there are two big risks. Firstly, for any number of reasons, the hyperscalers slow or pause spending. The most devastating would be if the AI products fail expectations. That would send a shudder across the whole chain. The size of the AI infrastructure built is so huge that there is a risk that deployment cannot be carried out smoothly. There are chances of a hiccup at some stage. The second is the funding. The large hyperscalers can afford to go for some more time, and as I said, OpenAI is depending on the goodwill of the equity funders.

We can speculate endlessly here. The conclusion for me is that there are risky and safer ways to play this theme. Those with existing businesses and cash flows are much safer than those leveraged, financially or operationally, needing ongoing spending and funding to grow. I can see potentially bubble-like falls for those types of operators, for example, those that are swing suppliers of capacity or supply second-rate product. Although if funding or product fails, the whole ecosystem will encounter large pullbacks, but not all with bubble-like pops.

My exposure is, from least to most risky, imo, and sizing to match, as follows: MSFT, GOOG, AMZN, TSMC, ASML, META, and NVDA. These have been set for a while, I'm not chasing.

CONCLUSION

Most of the market doesn’t exhibit overexuberance IMO. It may be hit with any shocks, but it is not overextended and should come back. There are some signs of excess in the speculative end of the market, usual with a bull market mentality, and it is a case-by-case decision. The AI market is being fuelled by extraordinary spending, and those that are priced to benefit continually from this and priced for such carry risk. Not to say a break is coming or of a size to decimate the market, but that is what risk is all about. We see conditions and position accordingly, so if the worst comes about, we can survive. I would be particularly careful of those more vulnerable to a slowdown and watch overallocation to the ecosystem.