TECHONE FY25 RESULT

FY25 results were solid, with 18% revenue growth to $599 million, and NPAT growth of 17%, which was 3% better at the revenue line and 1% lower at the NPAT line than my estimates. Remember, the FH result was a blockbuster.

The FH/SH splits were interesting, with revenues slowing slightly from 19% to 18%, but NPAT growth significantly slowed from 31% in the FH to 7% in the SH, together with no numeric guidance given for FY26, which brought some uncertainty. Management mentioned that the costs of SaaS+ impacted PBT margins by 2.7%, the bulk of which may have been in the 2H. An inflection point is expected, but management was reticent to state a timeframe. The tax rate was slightly higher, as well, which didn’t help. A special dividend was declared, perhaps to help the story. Management reiterated the LT guidance to double revenues over the next five years and to improve margins. Specifically stated, FY26 will be strong.

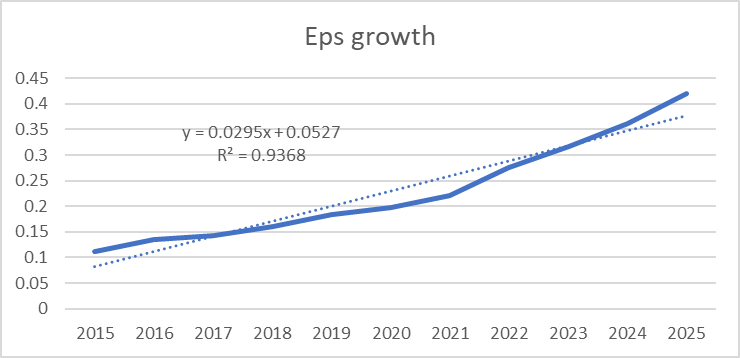

Overall, the numbers remain enviable. The EPS growth trajectory is almost a straight line, there is net cash on the balance sheet, and LT growth remains on target. Cash reconciliation remains good.

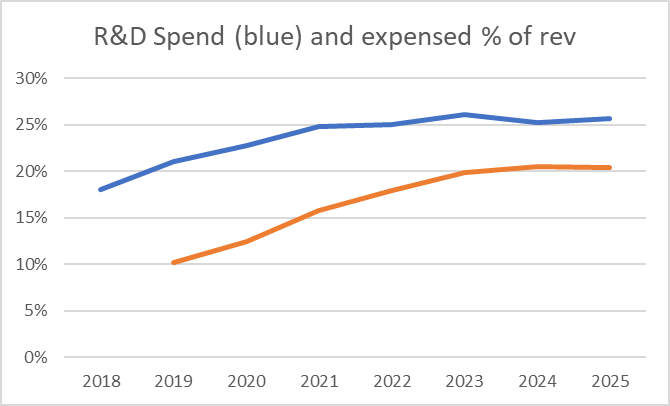

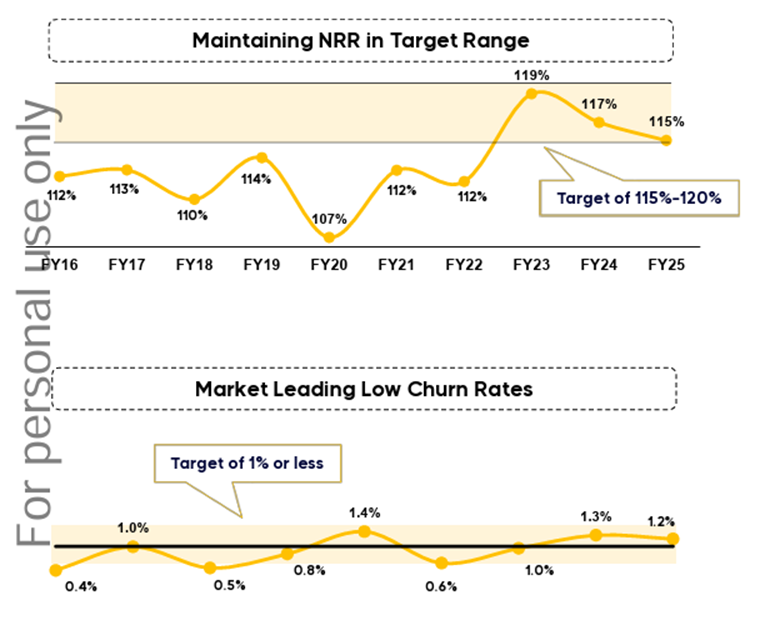

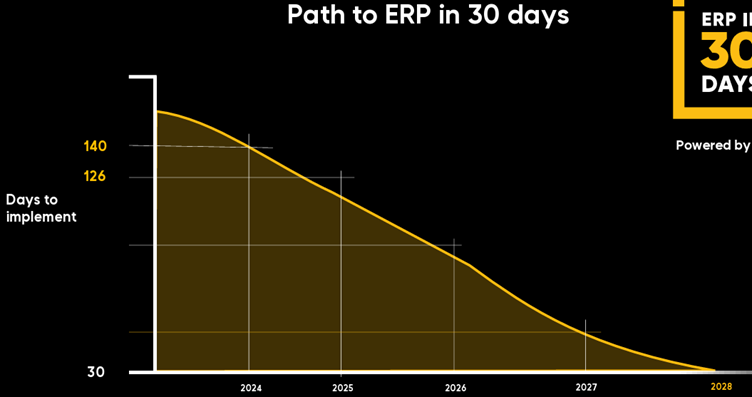

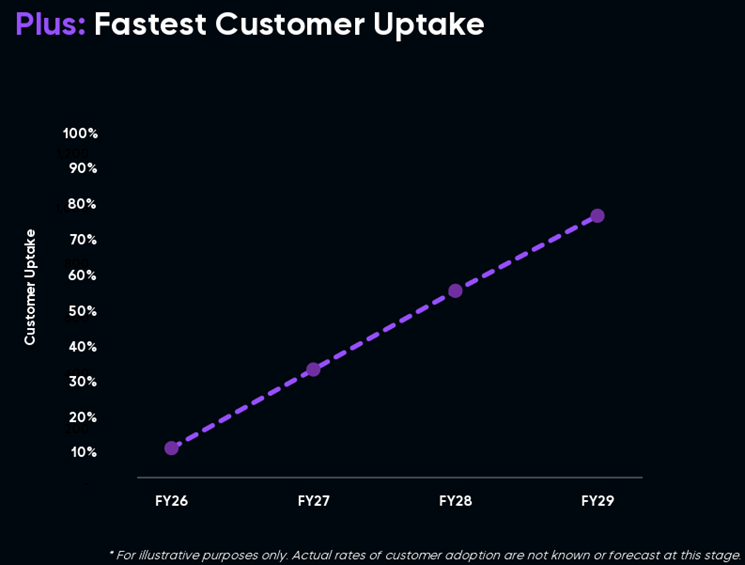

TNE is building on several fronts with the core SaaS+ package, the path to ERP in 30 days and the AI-driven helper, Plus. (see growth targets below). All are expected to greatly improve sales over time, but some bumpiness can probably be expected. Plus was specifically promoted by management with much interest from clients. It will take some time to hit the ARR growth rates. R&D remains within the broad guidance, and capitalisation and write-off are steady. NRR and churn were within range, but NRR slowed, blamed on cycling the C19 inflation comps.

The pricing of the AI product was interesting, with TNE choosing a simple, licence fee plus a charge per conversation instead of the price per token we usually see in place. The aim is to encourage usage from the client base. Pricing will be adjusted to hit profit targets, I suspect. Plus is regarded as another “game changer” for TNE. There have been a few.

VALUATION and SUMMARY

TNE remains a premium growth stock, but valuation has been an issue, with the pricing of the stock prohibitive. The recent result has enough niggling issues to cause some doubt on a very high valuation. Offshore software stocks are also much lower this year on AI fears. On the valuation, I think the exit PE is most difficult; the earnings growth rate is probably easier to estimate.

Targeting a 10% return and an 18% 5-year eps growth, with an exit multiple of 40X, gives an entry price of $25. Having said that, you very rarely get any attractive entry points into TNE.

Held, but room to add.