Pinned straw:

28th November 2025:

https://www.youtube.com/watch?v=i3LvvWqLMdY

CHAPTER TIMESTAMPS

- 0:00 – Intro & Guest Welcome

- 4:10 – The HAV Story Begins

- 6:50 – Early Impressions & First Encounters

- 10:00 – The Oz Minerals Deal

- 13:00 – BHP Takeover & Asset Uncertainty

- 16:30 – Investment Approaches & Management

- 20:00 – The Sandfire Deal Explained

- 24:00 – Share Registry & Bob Johnson

- 27:00 – South Australia Copper Potential

- 30:00 – Deal Valuation & Market Reaction

- 34:00 – Risks & Technical Challenges

- 37:00 – Sizing the Investment

- 40:10 – Final Thoughts

- 43:14 - What's the next HAV?

DISCLAIMER

All information in this podcast is for education and entertainment purposes only and is of general nature only. The hosts of Money of Mine are not financial professionals. Money of Mine and our contributors are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional. Money of Mine doesn’t operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. MoM strive to ensure the accuracy of the information contained in this podcast but we don’t make any representation or warranty that it’s accurate or up to date. Any views expressed by the hosts of Money of Mine are their opinions only and may contain forward-looking statements that may not eventuate. Please read the full Disclaimer here: https://www.moneyofmine.com/privacy-p...

---

Disc: Trav, JD and Kav all hold. Bear77 does not hold HAV. My copper developer play is FFM (held in my SMSF, 2.5%).

https://www.havilah-resources.com.au/

That pod above is all about HAV, not at all about FFM, but FFM is my personal preference, however FFM is developing a copper-gold project in Canada; HAV are trying to develop - now with the help of SFR - a copper project in South Australia, much closer to home.

thetjs

Had a listen to the pod while whipping up the Sunday dinner.

It came off as complaints by the guest as to why the offer was not at a higher level and how the founder was still too involved.

I’m a regular listener of the MoM team, and enjoy their stuff but this seemed to be riding that line of sponsored content tbh.

Bear77

Yeah @thetjs they did mention multiple times that they were all shareholders in HAV so they were clearly biased and admitted that, but it certainly didn't convince me to buy HAV any time soon.

My thoughts - FWTW - are:

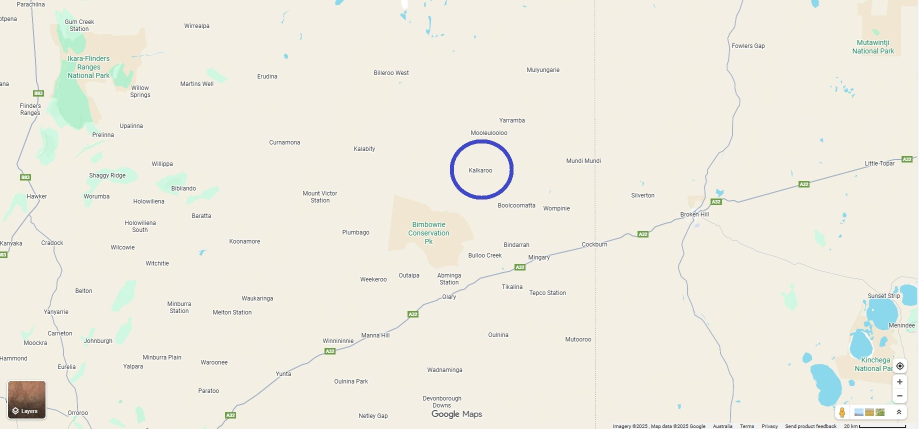

I did invest in HAV quite a few years back when I was still working at Coca-Cola, after a workmate said they were a sure thing - he had a family connection to one of the Kalkaroo deposit's founders - a geo I think it was who claimed Kalkaroo was going to be a massive copper mine one day. And he could still be right, eventually, but it's taken a long time so far, and they're not much closer now than they were then to be honest.

I lost money on it because they were regularly raising more money and the share price dropped with every CR they did, and there was talk that the basic chemistry / basic mill wouldn't work due to the nature of the ore.

Google tells me today that: The majority of the copper at Kalkaroo is in a sulphide form, with 12.529 million tonnes of sulphide ore. There is also an oxide component, with a much smaller oxide copper mineral resource of 598,000 tonnes. The sulphide resource is a mix of chalcopyrite and other sulphides, while the oxide resource is a gold-rich saprolite layer with some oxidised copper.

That was the talk back then also, that the copper was in sulphide ore, and that takes extra chemistry and processes (i.e. engineering and significant extra cost) to extract copper and/or gold from.

Google says: A mill needs to add chemistry and engineering processes beyond crushing and grinding to extract copper from sulfide ore, specifically froth flotation to concentrate the copper and pyrometallurgy (smelting and refining) to purify it. The chemical processes involve using reagents like xanthate collectors in flotation to make sulfide particles float, and high-temperature smelting to separate copper from other elements, followed by electrolytic refining to achieve high purity.

Source: I asked Google: What extra chemistry or engineering does a mill need to viably extract the copper from sulphide ore?

So, that's not to say it can't be done, just to say it's going to take more than just a basic mill to do it, and the mill is going to cost a lot to build because of those extra processes and also cost more to operate because of the extra chemicals involved in the process. And it's not high grade copper. It's OK, but it's primarily sulphide ore and primarily low grade copper. The big advantage is that there's so much of it. So it has significant scale.

On the pod yesterday, Kav hesitated when asked about this aspect saying he's no chemical engineer etc., but that the people he had talked to, and I think he said they were all family members but I might have misheard that, said that it should be doable. I agree that it's doable - it's just the cost-benefit analysis and whether the economics stack up to build such a large and expensive plant - you would need the copper price to stay high because it's going to take years to get into production.

That said, Sandfire (SFR) have experience with this sort of ore: Sandfire's DeGrussa and Monty deposits were/are primarily sulphide ores, classified as volcanic-hosted massive sulphide (VHMS) deposits. However, near the surface, weathering created an oxidised zone with oxide/carbonate copper minerals, which overlies the primary sulphide body.

- DeGrussa: The deposit is made of massive sulphide lenses containing minerals like pyrite, chalcopyrite, and pyrrhotite. The near-surface zone was oxidized, producing a surface cap of native copper, gold, and other oxide minerals before the deeper sulphide ore was reached.

- Monty: This deposit is also classified as a VHMS deposit and contains multiple sulphide lenses.

- Overall: Both are examples of VHMS deposits, which are characterized by the formation of massive sulfide deposits in a volcanic setting, with the original mineralisation being in sulphide form.

Source: Google: Was Sandfire's DeGrussa and Monty copper-gold deposits in sulphide ore or oxidised ore?

BTW Firefly Metals' Green Bay Copper project is also a volcanogenic massive sulphide (VMS) deposit with footwall zone sulphide mineralization so they are also going to need a larger and more expensive plant at Green Bay - more on them in a moment.

HAV's current mkt cap is about $154m. They're getting $105m for SFR to have the RIGHT to acquire 80% of the HAV's flagship Kalkaroo project, if they elect to do so after spending $30m on further drilling and evaluation. So it's conditional on seeing results from that extra drilling - and if that goes well Sandfire can pay another $105m to farm-in and own 80% of Kalkaroo which leaves HAV with a lot of cash, 20% of Kalkaroo and their other projects.

So my thoughts are that HAV is now in play and likely to go higher because the SFR deal has some material upside. SFR have only bought an option right at this point, but HAV now has a large spotlight on them from a major global copper company in Sandfire that could result in third party interest - Kav said more than once that he's had other parties approach him and his fund with questions concerning Kalkaroo and HAV. So they had eyes on them already and now they will have more.

So there's likely significant upside, however I already have a position in Firefly Metals (FFM) who are developing their Green Bay copper-gold project in Canada (in Newfoundland) and FFM's SP has been rising strongly over the past 6 months - from 80 cps in May to $1.87 on Friday - because of how much copper they are finding and the high grades. They also have a hydro power station right next door to the project - on the edge of their tenement boundary - so they will have access to cheap power.

High grades and cheap energy costs is a potent combination. And Canada is really becoming a much easier place to get permitting through these days, for a number of reasons however the idea of becoming less dependent on the USA and other countries is a big motivator for them and for their politicians who are using this new "Canada First" sentiment to push through developments that might previously have had a lot more pushback from their constituents. I don't know if I'll hold them through to production - probably not - depends on what other ideas come my way between now and then - but they're in that first rising phase of the Lassonde curve at the moment, so their share price is on a nice north easterly trajectory.

HAV on the other hand may get the same trend happening if SFR start reporting solid hits with the drilling that they are intending to spend that $30 million on, but it seems to me that the HAV share price has become more event-driven, and by "event" I mean the announcement of the SFR deal (27 cps to 45 cps), and looking to the future, events such as announcing third party interest or that SFR will exercise that option to aquire 80% of Kalkaroo for another $105 million. The downside is that if SFR elect NOT to exercise that option and there is no other interest from other large players, the HAV SP could retrace somewhat - almost certainly they'll drop from wherever they happen to be at that time if SFR say "no thanks".

This $30m on drilling and evaluation is not massive expenditure for a company the size of SFR ($7.16 Billion m/cap currently), so is unlikely to move the dial too much for them either way, but the outcome will make a massive difference to HAV and their own TSRs over the next little while.

HAV have been trying to get Kalkaroo developed for over a decade and you will remember Kav saying that he struggles to understand why they were trading at a discount to their net asset value, before this SFR deal, and also now after the SFR deal. It could be the deposit - the ore types - they have two ore types, oxidised and suphide ores and there were talks of possibly running those different ores through two different plants or through different circuits within a larger split plant designed to run two different types of ore simultaneously, and it could also be about having to build their own power station because of the location of Kalkaroo.

Source: ABC News: https://www.abc.net.au/news/rural/2014-09-23/nrn-havilah-resources-buy-pastoral-land/5763076

On slide 8 of one of their capital raising pressos 5 years ago (November 2020, see here: https://announcements.asx.com.au/asxpdf/20201119/pdf/44q1j44w1gydrr.pdf), they said that Kalkaroo is 30km away from Grid Power with excess wind turbine and solar [renewable] power being generated at Broken Hill, so they may opt to go with grid power and build a 30km power line across to existing grid power instead of a standalone power station at Kalkaroo, but regardless they will have high power costs because of the nature of their ore and the processing it will require.

Critics will say that if this project had the compelling economics that HAV claim it has, why has it taken them this long to get somebody interested in funding further development with them? HAV have after all (as the three guys confirmed in the podcast) had their data room open for over a year now. Probably a number of years.

As Kav said, the lack of any deal being made prior to this may well have to do with Bob Johnson and his associates who together control a bit more of HAV than it might appear at first glance. And that might not be a bad thing if that has been all about hanging out for a decent deal that properly values the asset(s). The flip side is that sometimes people with some power or influence tend to resist giving up that power or influence, despite the economic value (dollars) on offer.

Today Commsec shows Johnson's company Maptek Pty Ltd owning 9.93% of HAV, but as long as Bob has at least one other holder with at least 0.1% of HAV willing to vote alongside him, Bob Johnson (full name: Keith Robert Johnson) would have the 10% necessary to block any full takeover of HAV if he wanted to.

Bob was HAV's founder and their Executive Chairman up until 2 years ago (resigned in November 2023) so it's probably all about legacy with Bob - check out the list of associates that he admits to in this notice: Becoming-a-substantial-holder-Bob-Johnson's-MapTek.PDF.

He won't let HAV go for less than he thinks it's worth and he likely has a high valuation in mind. That could be good if a deal gets done at a decent price, but bad if he holds out for a better price and no deal gets done.

There is probably some decent money to be made with HAV, especially if copper runs further and projects like this become even more attractive, but I'm thinking there's even more upside in a well-managed company like Firefly (FFM) who have loads of cash and they're actively drilling and providing positive results newsflow. And they have that cheap hydro power when they're ready to build. HAV's Kalkaroo may well become a copper mine, but I reckon FFM's Green Bay gets there first, with plenty of share price upside between now and then.

So that's my thoughts. HAV is interesting but my personal preference is to play FFM - I don't particularly want exposure to two copper developers. One will do.

I'm personally not as bullish on HAV as Kav, Trav and JD, which is probably due to personal biases relating to having previously lost money when holding them and having a few reservations about the quality of the deposit, the metallurgy (in relation to appropriate viable extraction techniques) and the people involved. I was also a bit negative on SFR for a few years back when Karl Simich was their CEO and MD, but Karl left SFR 2 years ago, so that's really not a factor any more - he did have a reputation for both empire building (global ambitions which to his credit the company managed to achieve) and being very impatient with and sometimes rude to analysts and sometimes also shareholders. He was the sort of manager that obviously felt that talking to shareholders and analysts should be somebody else's job, not his, as he was the big picture guy, the man with the big vision, and he shouldn't be questioned about that vision or have to defend it to plebs like us.

I haven't really followed SFR closely since Karl left 2 years ago, but I did make some money on them in prior years. Anyway, maybe if I was coming across HAV as a fresh idea I would be more bullish but because it is a company I have previously invested in, so had high hopes for in prior years, and lost money on, I am likely biased against them. Hope that makes sense.

tomsmithidg

@Bear77 , what are your thoughts on FFM doing the institutional only capital raise via share issue?

Bear77

Well @tomsmithidg - I'd say firstly that they're raising capital at a good time - when they've just made a new all time high share price of just short of $2/share, secondly that you have to accept CRs when you invest in explorers and project developers - and I do expect them - and thirdly, it's not institutional only - the document says:

"FireFly will also separately undertake a retail share purchase plan (‘SPP’) under which it will offer shareholders who were registered as a holder of ordinary shares in the Company as at 4:00pm (AWST) on December 1, 2025 (‘Record Date’) and whose registered address is in Australia or New Zealand the opportunity to subscribe for a maximum of A$30,000 worth of fully paid ordinary shares in the Company, to raise up to A$5 million (with the ability to accept oversubscriptions, at the discretion of the Company). The Flow-Through and Placement are expected to close on or about December 12, 2025, with the SPP to be completed subsequently."

Source: FFM-Canadian-bought-deal-financing-and-Australian-equity-raise.PDF [02-Dec-2025]

I assume that SPP will also be at A$1.70, and I won't be participating because my FFM shares are held in my SMSF which is in an industry super fund and they don't allow their members to participate in SPPs. Tradeable rights issues, yes, but share purchase plans, no. But that's OK, because I was in FFM to make money, and I've already locked in substantial profits by selling half my position when they went over 30% gain in a few short weeks. Their SP has almost doubled since early August.

FFM is currently now a 2.6% position for me based on their last traded price ($1.945) - I expect their share price to drop towards the $1.70 CR price when they resume trading.

I'm not worried about maintaining my proportional shareholding, I'm just trying to make money, and it's working so far with Firefly Metals.

Raising more money is exactly what companies in this position do as their project gets bigger and bigger, and they often don't bother with the SPP aspect because it costs them more than doing straight placements - so it's a positive tick in my book that Firefly are allowing their retail shareholders to buy up to $30K worth of shares at the same price as the insto's.

It also wouldn't bother me too much personally if they didn't, because I expect CRs from developers and I don't expect all of those CRs to be extended to all shareholders, but good on them for looking after their ordinary retail shareholders on this occasion. It's probably because they are now a $1.3 Billion company and they can afford to.

tomsmithidg

Thanks @Bear77 , must have missed that when I was reading blurry eyed last night. Was it my question 7 months or so ago that got you looking at FFM again? If so I'm glad it's paid off. I've been doing some profit taking too with it up over 213% for me. I have been (trying to) re-evaluate all my holdings utilising Perplexity to give me a different perspective. It predicted a price range for FFM of between $1.45 and $2.30 based on current reported drilling results. Basically reckoned that the price at the moment is very speculative and hype driven, with resources to production already factored in. Highly negative operating margins and very high cash burn. Obviously FFM has been valued over $3 per share in the past and there is room for further profit if the SP drops back to $1.70 and then progresses to above $2 again. Perplexity indicates that FFM would either need a 'significant resource upscale' or a 'transformational discovery' to validate higher valuations than $2.

What's your thoughts on the hype vs substance of the drilling results? Do you have a target valuation for FFM? What sort of horizon are you looking towards for production? Or is this purely speccy from your perspective.

Bear77

Your mention could have been one factor @tomsmithidg but another was looking at all of the ASX300 new inclusions in September this year and seeing what I could add to my SMSF in terms of gold and copper plays and then watching FFM's D&D Presso that was uploaded to Youtube in August - I watched that in September and again in October before buying into FFM. I also added CSC at the same time as FFM and then sold out of CSC when a better opportunity presented itself a few weeks later. I stuck with FFM for obvious reasons - mostly the sharp price rise - but then halved the position after the position crossed over a 30% gain - again in only a few weeks.

In terms of valuation, it's much more of an art than science when they're at this early stage - Firefly is still finding more gold and copper in most of their drillholes so their resource will keep growing - and I don't know by how much, and yes, granted there is already upside priced in, but there may continue to be upside priced in with a further rising share price as they report more and more drill hits until they don't find any more at significant grades. I'm riding the wave at this point, or I am with half of what I first put into FFM anyway.

So I'm not doing valuations - just price targets - and in the case of FFM I don't even have a solid price target because what they could get to is determined by (a) what they find going forwards added to what they've already found there at Green Bay, (b) the copper price, and (c) sentiment towards copper/gold explorers and developers.

I rarely hold these sort of companies through to production because I try to avoid that downward sloping leg of the Lassonde Curve - usually when they're at the FS and/or FEED stage when they're no longer finding significantly more metal. Not every company follows the Lassonde Curve with their journey from Discovery through to Production, but absent external stimuli such as a rising commodity price and/or further drill hits during those phases, we can expect that they won't just keep going north east in a straight line during those phases where there is reduced newsflow from the company.

In terms of hype vs substance, I think the hits are real, and the resource keeps growing, and it's one of the more exciting copper/gold plays currently in development. I also love the location, right next to existing hydro power generation assets, and I know Canada has shifted more towards pro-mining now that they have developed their Canada First mantra in response to Trump's bullying and threats. The Canada First stuff means they want to become much more self-sufficient and import less, but it also means they want to exploit their natural resources where it makes sense to do so - i.e. balanced against environmental concerns in particularly sensitive areas - so they want to have even higher employment, higher GDP, higher tax receipts, you name it, projects are getting streamlined approvals is what I'm hearing.

Now things may pan out very differently with FFM to what I expect, and that's also OK, because I intend to lock in profits as they rise by reducing the position at regular intervals - more as they reach different levels such as when I'm 50% up, 80% up, 100% up, etc., so if and when their share price crashes, I've already locked in profits on the way up. As I said, I've already sold half at a 30%+ profit - and that's the sort of thing I intend to continue doing. I'm in them to make money, not to bet the farm on them.

Hope that helps explain my thinking on this company - I have a similar approach to all of my higher risk speccy stock, even the two I hold in my SMSF being FFM & SX2, who are both project developers.

I don't think the same way about profitable companies who are much higher quality, however I still lock profits in at times with those as well.

Companies that are pre-profits should be managed differently in my personal opinion. I lost money on Audinate (AD8) in my SMSF when I sold out this year, but I had held them in my SMSF right up to over $23/share in March 2024, and I hadn't sold much on the way up from my original $8.99 buy price (14-Jul-2023) because they rose so quickly and I had a full time job back then and wasn't as active with my trading as I am now. After they got over $23/share and fell all the way back down again I sold out at $8.90 (22-Oct-2024), so a small loss, but it could have been over +100% profit, or at least it wouldn't have been a loss if I'd trimmed on the way up. I bought back in at $9.78 in Feb this year and averaged down until I finally sold out completely (again), this time at $5 on 18-Aug-2025. I wrote about why I sold over under AD8, but my investment thesis was busted in my view is the short version. That is just my AD8 trading history in my SMSF I'm talking about, not here, but the lesson I learned from that is that those sort of companies are not "set and forget" companies or bottom drawer stocks, even though they might seem like it because of their huge TAM (potential). Those positions need to be actively managed. That was what I took from examining my trading or lack of trading in AD8 during their magnificent rise and fall over the period from early August 2023 to mid-August 2024.

What derailed AD8 IMO was their management's focus on Video and Control instead of just sticking to their market leading position in Audio, and over time their decisions may yet prove to be strategically brilliant, but so far all they have done is push out the inflection point at which they become profitable - which should have occurred either last year or early this year if they had stuck to Audio only, and their decision to focus on Video and Control as well as Audio also pitted them against much stronger competitors than they had been facing in digital audio where they virtually had that market to themselves.

So my mistake was probably not paying enough attention to what management were saying in their presentations and reports and instead I was just focussed on what I thought was their eventual inevitable position as a highly profitable company that dominated digital audio for large buildings, arenas, stadiums, etc. within a couple of years, five at the most. In other words, Audinate's management had a completely different vision for the company than I did, and I wasn't quick enough to pick up on that, so enirely my fault, and lessons learned (two lessons: pay more attention to management communications, and take profits on the way up).

And resources companies are a whole different kettle of sardines, but the basic principal of locking in some profit as they rise still applies in my opinion. And to be very flexible with expectations because things rarely pan out how you think they will.

tomsmithidg

Thanks @Bear77 , I've been looking at the Lassonde curve and trying to get my head around where FFM is on it. I am figuring that it is near the top of feasibility with a capital raising and I believe a feasibility study scheduled to be completed in 2026. Is that how you see it?

Bear77

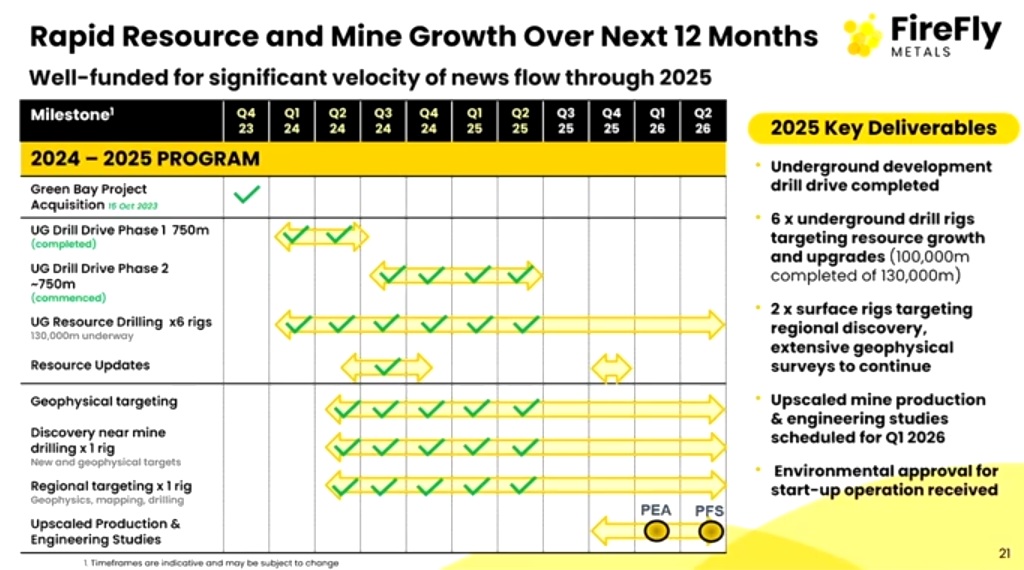

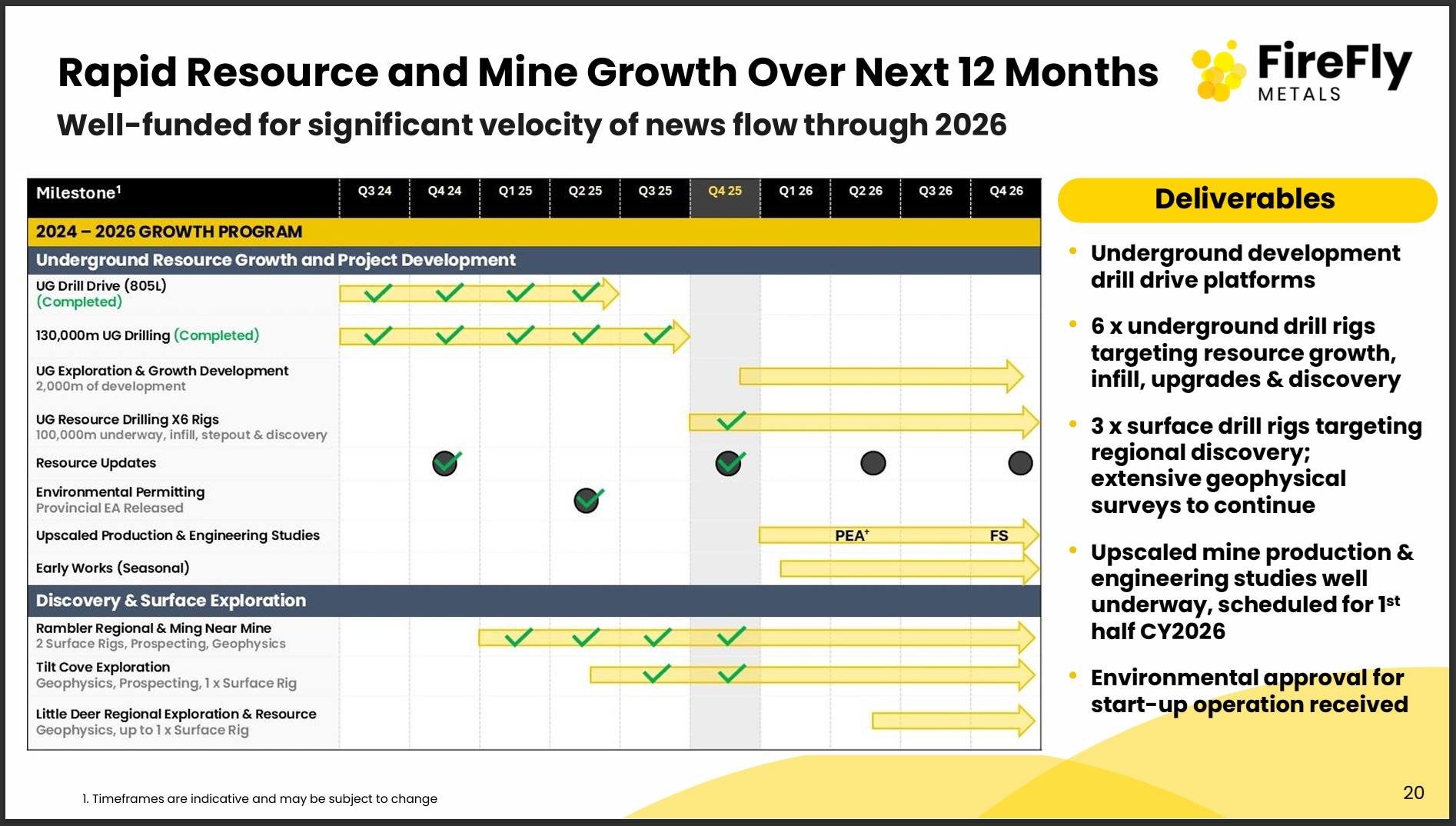

No @tomsmithidg - they're still in that first leg up, they are not going to be in the FS stage until next year. Below is the relevant timeline slide from their D&D presso in August, and below that is their CR presso slide from yesterday (02-Dec-2025), so the second slide below is the most current one.

Their latest update (the last slide that is immediately above this line of text) shows their PEA (preliminary economic assessment) phase as starting in Q1 and/or Q2 of 2026 running into their FS later in 2026 (see PEA / FS yellow arrow in the middle) - we're currently in Q4 of 2025 which is shaded grey. They are working with calendar years here, not the traditional Australian financial years, so their Q4 of 2025 finishes on December 31.

If they keep drilling through that period, which I think they will - they have said they will and they currently have 6 drilling rigs operating there - then they might not even have a significant drop as the Lassonde curve suggests during that study phase - because their positive newsflow may override it - the second leg (the first leg down) in the Lassonde Curve usually coincides with a lack of positive newsflow that is consistent with a company that has mostly stopped exploring and drilling out their deposit and are studying the best way to commercialise it, hence not much newsflow often during that study phase, but these days I have seen a number of companies have much shorter downlegs or no downleg at all if they can keep the positive drilling results (newsflow) coming through that period and their commodity price holds up as well.

So a downleg is not guaranteed, but should reasonably be factored in or expected.

The lassonde curve is only a guide but how closely any individual company's share price adheres to it can be very different from company to company - Pierre Lassonde created the Lassonde Curve methodology to help explain why projects go through different phases and tend to attract different types of investors as they get closer to production and then into production. As the speculators and trend riders move out, often during the study phase or whenever the newsflow stops for a period, there can be a lack of buyers until the instos start buying after the FID stage, when the project has been fully permitted, fully financed, and construction contracts have all been awarded and the project is actually in the build phase.

Since Pierre created the Lassonde Curve methodology, we have seen a number of fundies like LSX and Regal Funds Management (who own 7.42% of FFM and are the second largest shareholder behind BlackRock) specialise in investing in companies in the project development stage rather than the build phase, so a lot of stuff is changing and has already changed making the Lassonde Curve even less reliable these days.

Companies like Lion Selection Group (LSX) and Regal may or may not hold companies through to production - depending on whether they still see value at any given time and price. LSX own shares in a number of gold project developers.

Correction: I had previously said here (and have now removed it) that LSX also have a decent position in Ramelius (RMS), an ASX100 (large) established gold producer. This is NOT correct. Sorry, but I remembered the podcast incorrectly (this podcast) - Hedley did mention Ramelius (RMS) and their Edna May mill which is currently on C&M, however he was only pointing out that there are no mid-tier or larger goldies currently operating in that area, and he was discussing that in relation to the potential of Brightstar Resources (BTR) at that point, a company that LSX does hold. However Lion Selection Group (LSX) does not hold shares in RMS or any of the other larger producers. --- End of correction ---

But in terms of where Firefly are in the curve - they're still in the first leg up by Pierre Lassonde's definition of the various stages @tomsmithidg as are HAV also, but HAV have been in that discovery phase for over a decade already and Firefly have only been in it for just over 2 years - because they only acquired the Green Bay copper/gold project in October 2023 so their rise has been much more pronounced and over a much shorter time frame whereas HAV really haven't progressed their Kalkaroo project much in the past 5 years or so until the news that Sandfire might be farming in. The amount of copper and gold that Firefly is finding is truly impressive and that is reflected in their share price. And their grades are higher than HAV have at Kalkaroo.

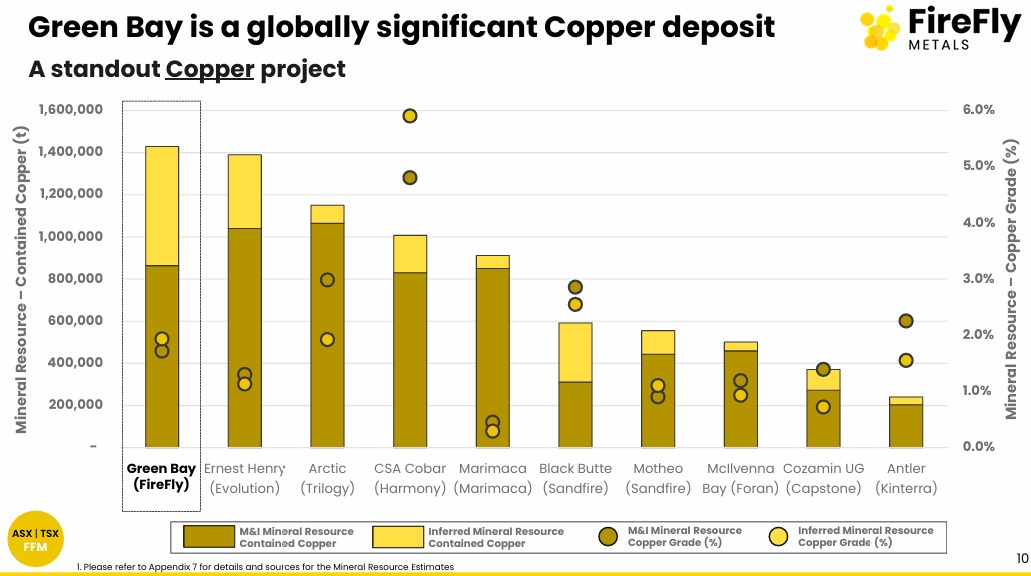

Here's another slide from yesterday's presentation by Firefly:

Green Bay has decent grade copper starting reasonably close to surface, they already have a decline and a heap of infrastructure in place, and their met work shows around 98% recovery with what they are calling a simple mill, and they clearly have a LOT of metal there - 1.4 million tonnes of contained copper so far, so more copper than EVN's Ernest Henry copper/gold mine and better grades than EH as well.

There's a lot to like. I wouldn't expect the FFM SP to retrace much unless they stop providing positive drilling results and/or the copper price falls significantly.

My thoughts, FWIW.

Disc: Holding FFM, not HAV.