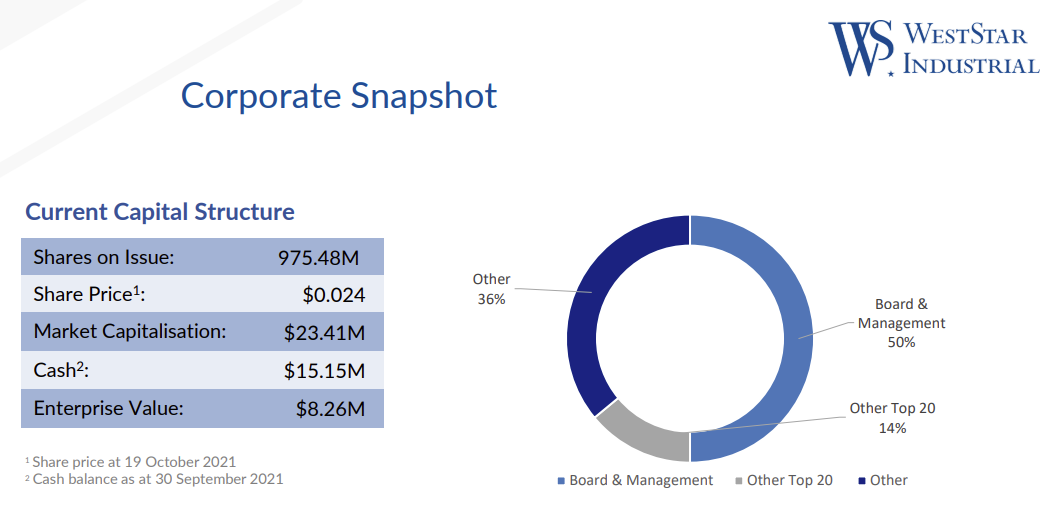

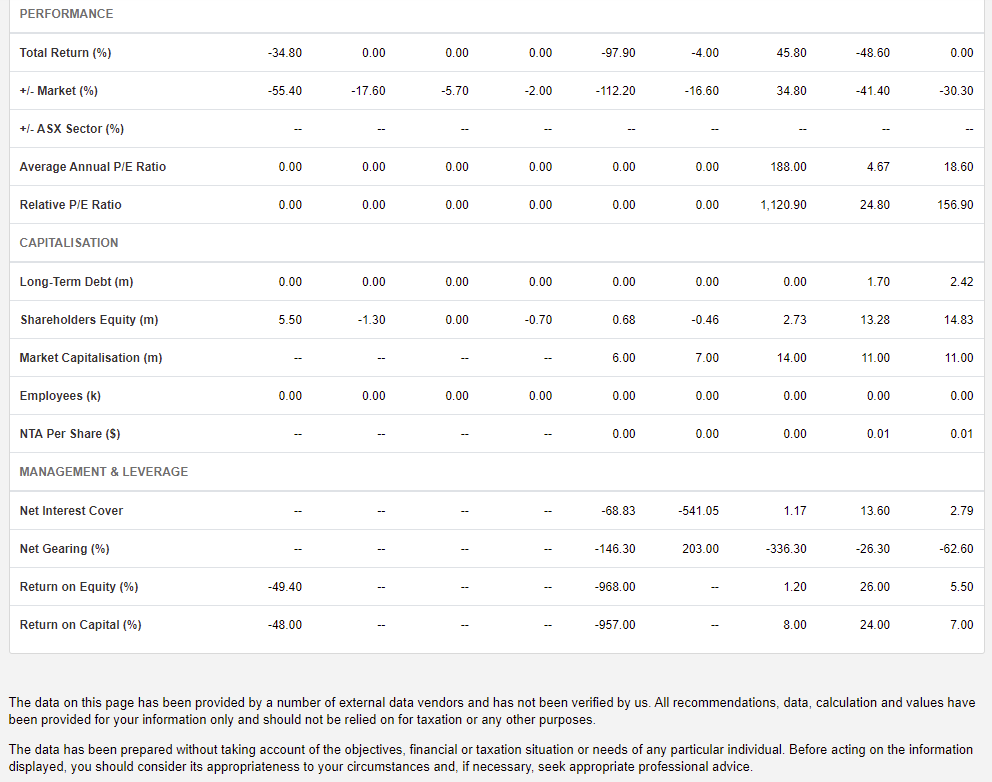

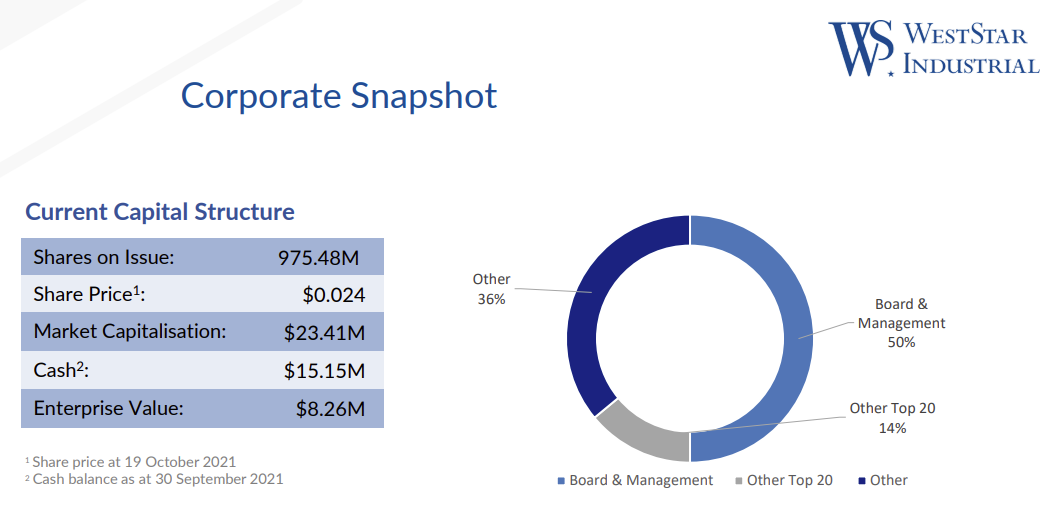

No worries @Vandelay. You are right of course in that they are issuing shares on a regular basis, and that could ordinarily be a red flag, or at least an orange one. However, they appear to be growing quite rapidly at this point - for an industrial engineering company, and with negligible debt - i.e. their FY21 ND/E ratio was negative, i.e. -62.6% according to Commsec, meaning they had much more cash than they had debt. They ended the September 2021 quarter (i.e. Q1 of FY22) with a $24m m/cap and $15m in cash and only $300K ($0.3m) of debt. They have had an interesting history, with things heading in a positive direction recently.

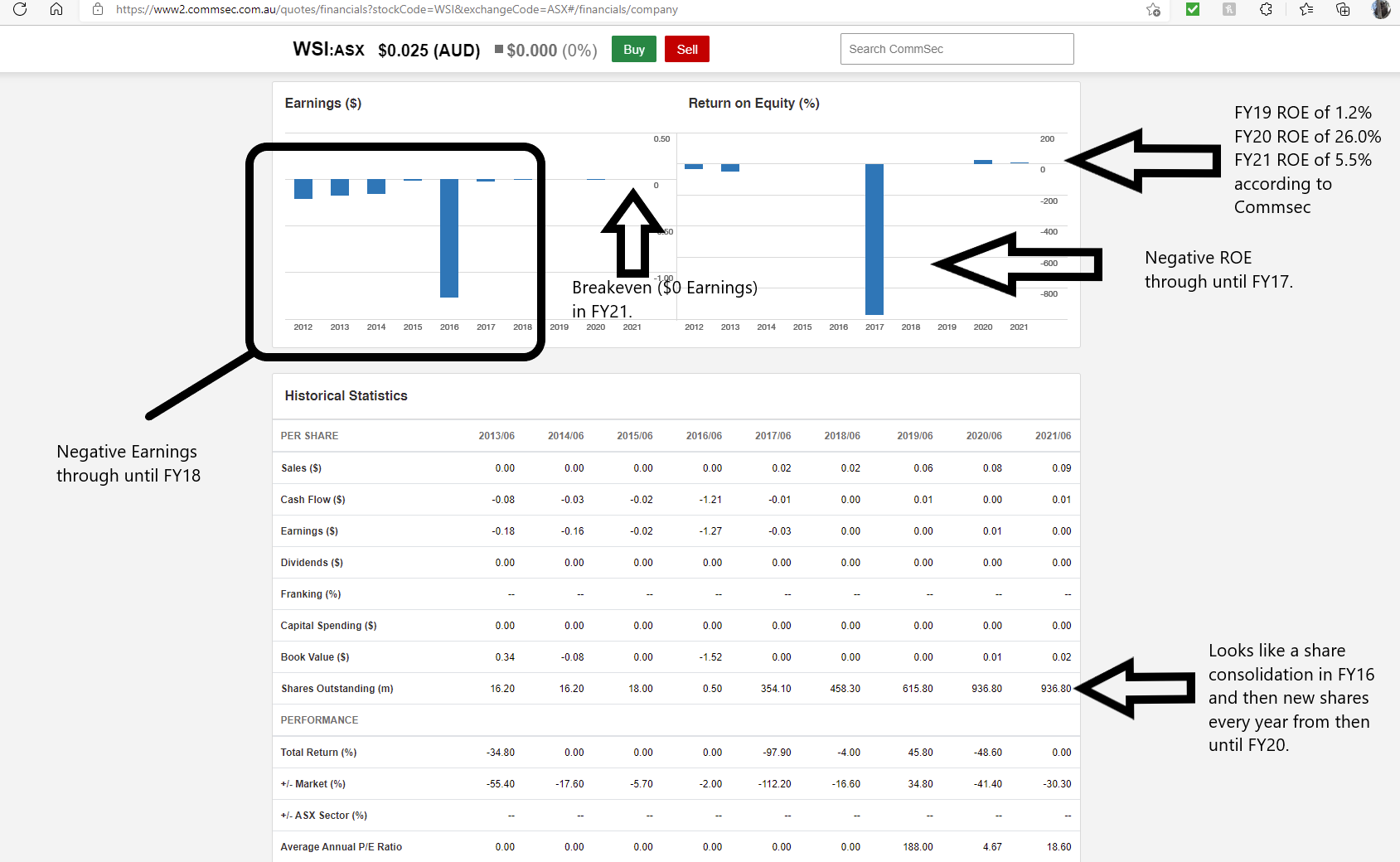

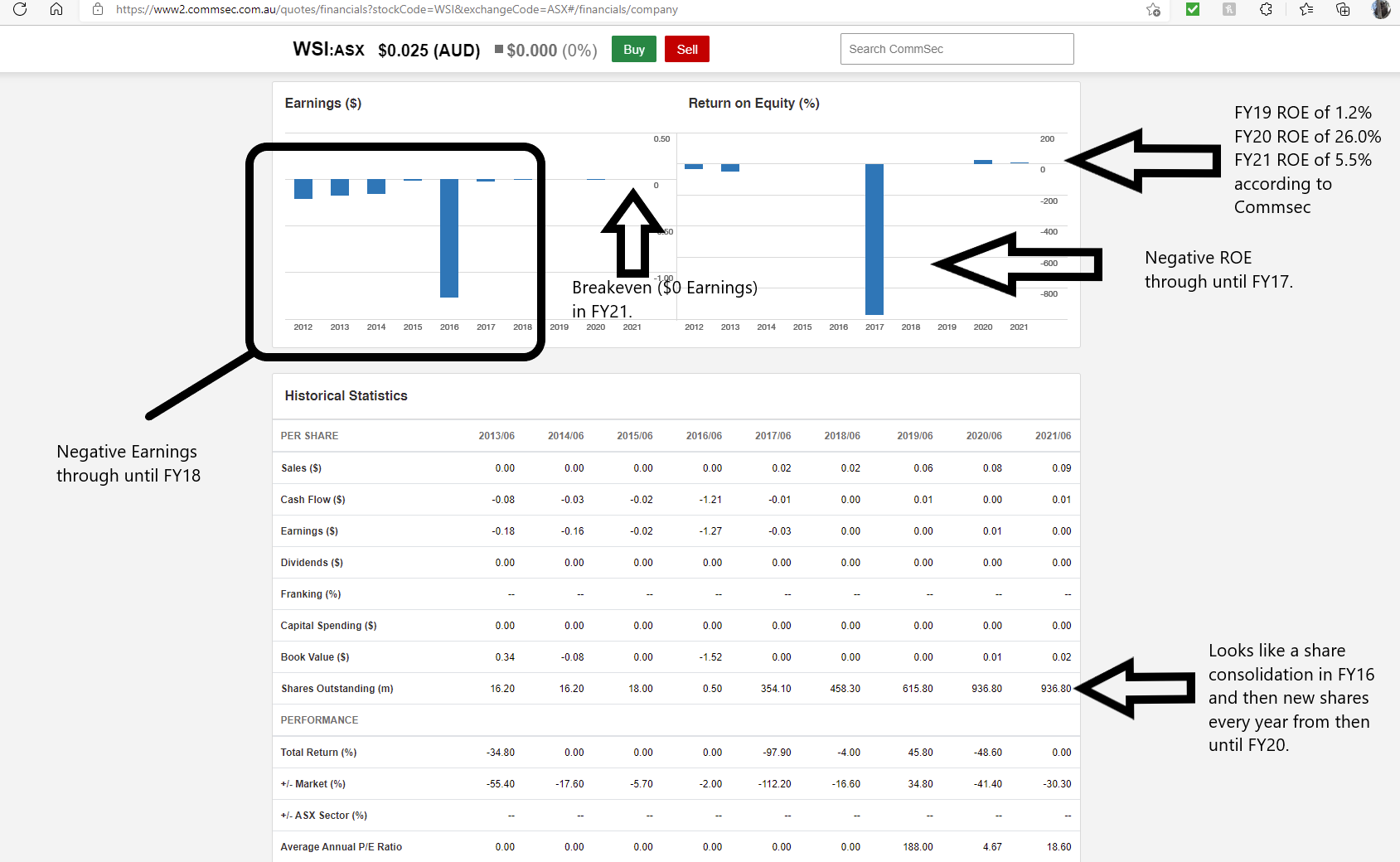

Here are the rest of those historical financials for WSI from Commsec:

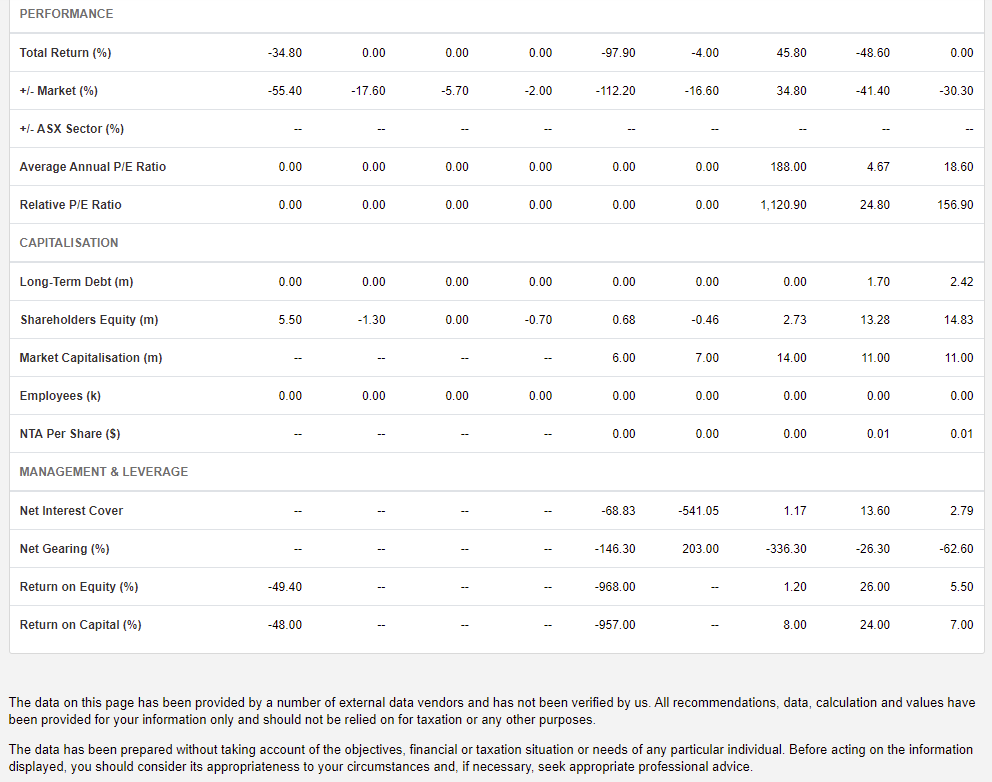

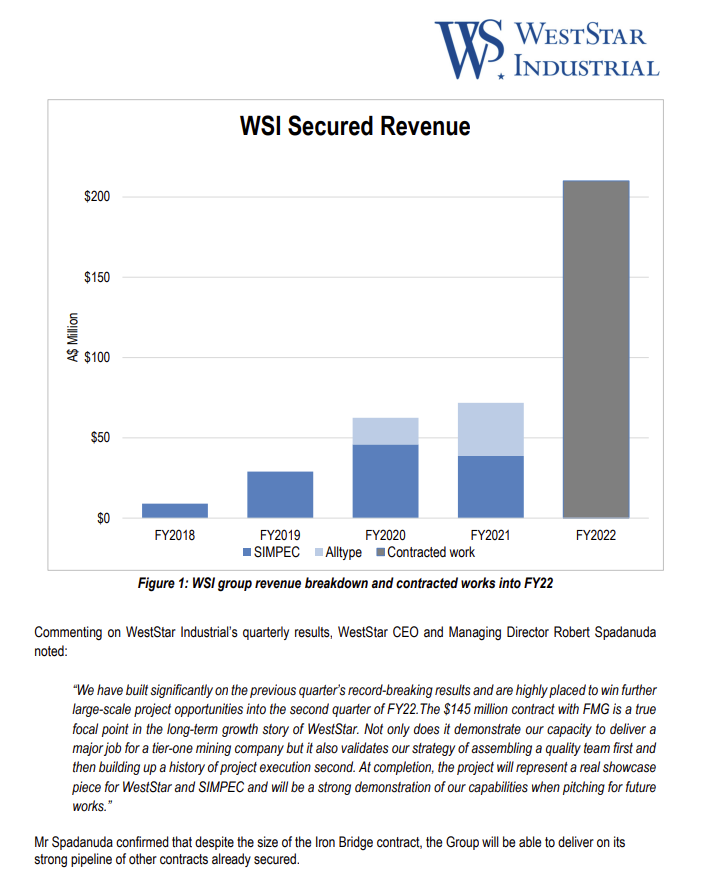

Their September 2021 (Q1 of FY22) Quarterly Report paints an interesting picture:

Their main website home page (Weststar Industrial: www.weststarindustrial.com.au) suggests they are targeting mining and earthmoving work:

However, they have two divisions, SIMPEC and Alltype Engineering, and each of those divisions has its own website:

Here's the SIMPEC website home page (SIMPEC - your reliable partner):

And the Alltype Engineering website home page (Home » Alltype Engineering):

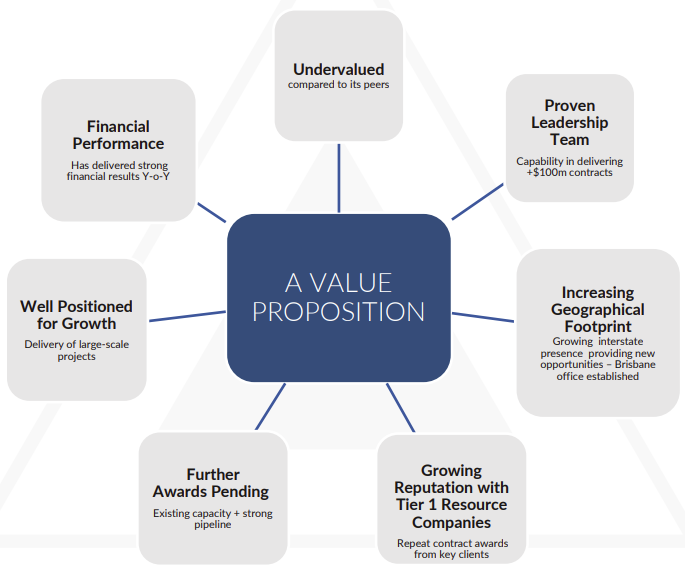

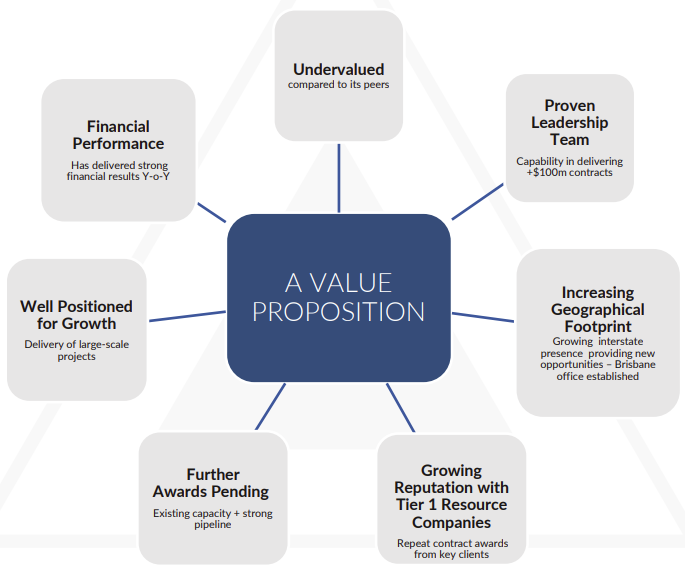

Their October 2021 ASX release titled "FY22 Growth Plan Investor Presentation" gives a reasonably good investment case for the company. I don't mind them issuing more shares reasonably often as long as they are avoiding debt (which they are) and they are growing their EPS. Which they should. But they haven't. Not consistently. They were barely profitable in FY20, and achieved breakeven ($0 earnings) in FY21. However they were unprofitable prior to FY18, so in that respect they are moving in the right direction, just not in a straight line.

Some positives:

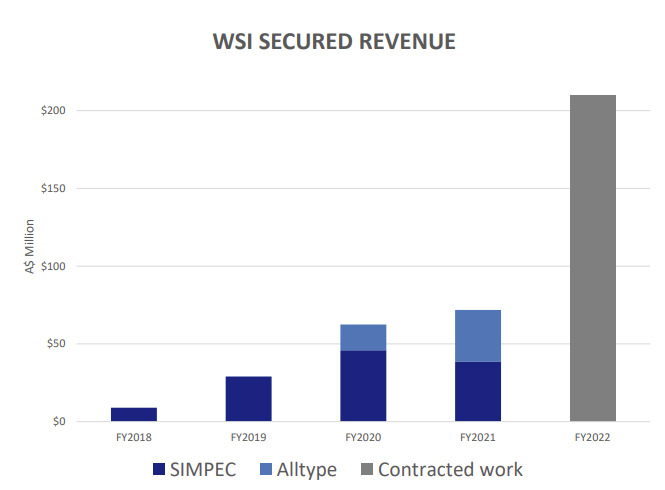

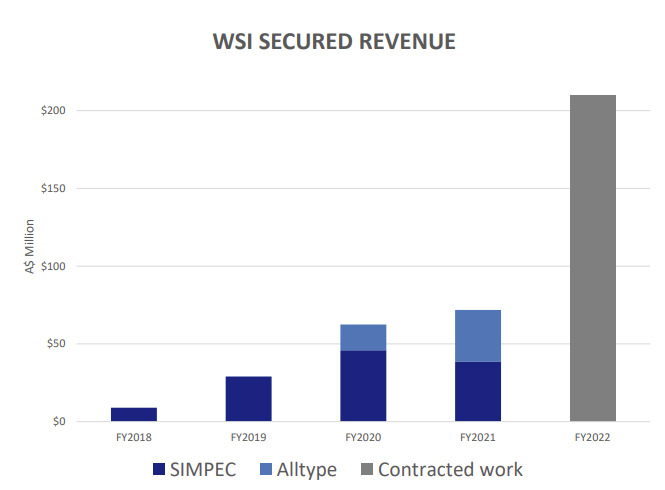

They are growing their WIH (Work In Hand, a.k.a. Order Book):

They have experienced management with plenty of skin in the game:

They look reasonable cheap for what they are, where they are positioned, and the tailwinds that they have at this point.

And they have some quality Tier 1 clients, both current and past clients:

So, in summary, small but heading in the right direction, negligible debt, good cash balance for a company their size (i.e. very small), experienced management with plenty of skin in the game (50% of the company is owned by the Board and Management), appear to be making the right moves, they have tailwinds at this point rather than headwinds, and they have very good quality (tier 1) clients (both past and present).

Because of the nature of their work, they tend to have to pay a lot of upfront costs (including labour and materials) and then they receive progress payments and completion payments, so they tend to need to hold more cash as they grow, hence the regular cap raisings (share issues).

Things to be aware of:

They are in a very competitive industry/sector, which at this point (unlike during the last big mining boom) has medium to low margins. High margins attract new competition, while low to medium margins can result in a more stable sector, but this means that for WSI to grow their earnings and market cap they are going to probably have to chase larger and larger contracts, which means that they face larger and more experienced and resourced competitors as they move up the food chain. If one of those larger competitors decides to acquire (takeover) WSI, that could be a positive outcome for WSI shareholders, but if instead one or more of those larger competitors decides to undercut WSI (price them out of the market) and send them broke (or cause their contract win-rate to slow dramatically) that would obviously be a real negative. That said, the larger players that I follow don't tend to exhibit that sort of behavior. For instance NRW Holdings (NWH) and Monadelphous Group (MND) are both trying to make money on every contract they win, and they pride themselves on their profitability (I hold both).

While the fact that WSI have a good cash balance (for their very small size) and almost no debt is a great thing, it pays to be aware of the industry practices of completion bonds and agreeing to include financial penalties in many contracts that trigger when companies fail to deliver key project milestones on time. Such details are rarely public knowledge, they tend to be commercial in confidence (confidential) and they only usually become public when things go wrong and they are called upon by the client. I have no idea if WSI are exposed to these risks or not, but they have been commonplace within the engineering and construction sectors, and many mining companies (particularly the larger ones) have demanded those contract inclusions in the past. In my experience these only become a serious issue when (a) a company does fixed price contracts and doesn't allow enough for cost blowouts (due to labour cost and/or equipment or materials cost increases, or material/equipment or labour availability issues, for example), or (b) a company decides to move into a new ("growth") area in which they have limited or no prior experience and they try to carve out some market share by undercutting the incumbent service providers in that sector - and then they lose money due to bad risk management and lack of experience in that sector. There are going to be other scenarios where that happens also, but the main two causes in my experience are fixed price contracts that have major cost blowouts or a company moving into a new area and not getting their pricing right.

Two quick examples of where that sent companies to the wall in recent years are RCR Tomlinson (was ASX: RCR) and Forge Group (was ASX: FGE). RCR had some very solid business units that are still going today, but they were picked up at fire-sale prices from the administrators when the company went bust and shareholders lost all of their investment in RCR (those that held on to the end). For instance, RCR's old Tomlinson Energy Services business (which is Australia's leading industrial boiler and pressure vessel servicing company) is now owned by The Environmental Group (EGL, who I also have shares in) and the RCR Mining Technologies business (including the Heat Treatment business) is now part of NRW (NWH, who I hold). NRW even kept the old RCR logo for RCRMT. The only part of RCR that wasn't viable and is therefore no longer in existence was their doomed move into Solar Farm construction where they undercut everybody else, carved out a nice market share, and then couldn't deliver on any of their many solar farm construction contracts at a profit. They were forced to cut corners, including allegedly using unqualified electricians to wire up hundreds of panels, they didn't allow for ground conditions at two north Queensland sites that required a heck of a lot more in terms of foundations for the panels (they had to stay in place during cyclonic conditions but the ground was very soft), and they failed to alert the market to the extent of the issues they were facing until they were in a precarious financial position where clients were calling on completion guarantee bonds. That division took the entire company down. They rapidly went from being a fast growing company with negligible debt to a heavily indebted company that couldn't meet their financial obligations. The debt was hidden, off-balance sheet debt, because it wasn't regarded as debt until it was called on by the clients. Similar story with Forge Group (FGE) who moved into Power Plant construction, won some very large contracts, including one for RIO, and then went broke due to massive cost blowouts that in hindsight were as a direct result of them underquoting and signing fixed price contracts with very little wriggle room in the event of costs being substantially higher than what they had anticipated. Lack of experience basically.

The good news is that most contractors these days are wary of these sorts of contracts and are loathe to sign fixed price contracts unless there are a lot of contingencies priced in to cover stuff like that. Most contracts are also now structured so that the client has to foot the bill for increased costs that are outside of the contractor's control. They don't cover stupidity or lack of experience however, which is what often occurs when a company decides to move fast into a completely new area and win market share by undercutting the incumbents.

As long as WSI stick to their knitting, i.e. continue to provide the types of services they already provide to the industries they already service, I don't see a great deal of that sort of risk with WSI, due to the experience of their board and management, and the fact that 50% of the company is owned by the board and management, but it is something to be aware of.

Another thing to be aware of is the lumpy nature of earnings for engineering and construction companies. They tend to have very little in the way of recurring revenue. Most of them will tell you they have a growing maintenance and operations division that boasts recurring revenue, but at this point the vast majority of WSI's revenue comes from shorter-fixed-term contracts. They build something, it gets commissioned and that's it, contract completed. They therefore need to keep winning more work, and to grow they either have to win more and more work (increasing quantities of contracts) or larger contracts (increased quality of contracts hopefully). Such companies can still be profitable and can still grow, but it is rarely in a straight line. Their revenue and earnings tend to be lumpy.

Another thing to keep in mind is the sector exposures that WSI have and where in the cycle each of those sectors is. You even need to think about that in terms of individual commodity cycles, such as the iron ore cycle and the lithium cycle. Hopefully when one is falling (less demand, prices dropping, less new work), another is rising (increased demand, prices rising, more new work). Sometimes, like in a mining bust (which inevitably follows every mining boom) you will get most commodities falling at the same time, which can be a rough time for companies like this. At this point, based on the small amount of research I've done on them, WSI's main exposures appear to be to iron ore, lithium, gas (LNG) and mineral sands. They are the sectors that WSI's Tier one (so called "blue chip") clients are in anyway.

I'm going to have to move on now, I have some stuff to do before I head off for work. I lost a HEAP of stuff that I wrote using bullet points and numbered lists - which all disappeared when I saved the post - everything in dot points and bullet points was gone - and I had not saved a back-up, so I've tried to remember most of what I had typed, and included most of the links and pictures that I did the first time around, so lesson learned - always save to Word before hitting the "save" or "update post" buttons here.

Andrew - PLEASE fix up the numbered list and bullet point list function in the text editor - I just lost over an hour's work because it stuffed up again!

Obviously I've avoided using numbered lists or bullet point lists (dot point lists) the second time around.

Hope that helps. I'll add WSI to one of my watchlists, but I won't be buying any at this stage. I'd like to watch them for a while and see what sort of profits they can make in FY22 and FY23 after their breakeven result in FY21.