22-Mar-2022: @Stuey727 Hamish has said that his resignation from the MFG Board "is due solely to his medical leave of absence." That was the exact wording in today's announcement. I take that to mean that Hamish wants a total break from Magellan for a while, and that includes not having to attend board meetings. That makes sense to me. I think he'll be back at some point, but while he's taking this leave it makes sense for him to not have to think about Magellan at all - if that is indeed possible for him, or at least not to have any responsibilities or duties with respect to MFG during this period.

With regard to BlackRock Group lodging a Substantial Holder notice, they are the largest funds management group in the world, with over 10 Trillion Dollars of assets under management - note that's with a T, not a B (or an M) - see here: BlackRock surges past $10tn in assets under management | Financial Times (ft.com)

...and they do run a huge number of ETFs - they manage 395 ETFs on the US market alone - see here: 395 Blackrock ETF Reports: Ratings, Holdings, Analysis | ETF.com

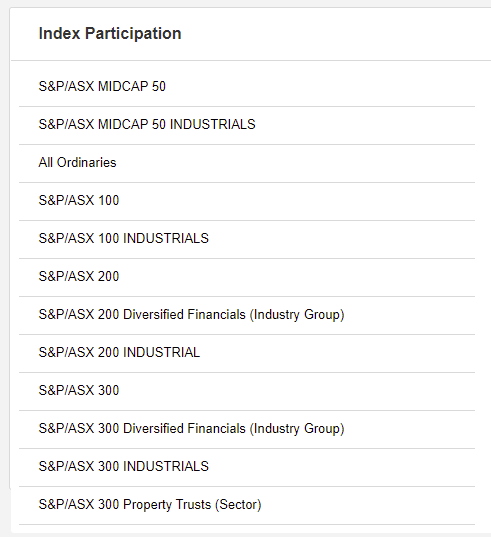

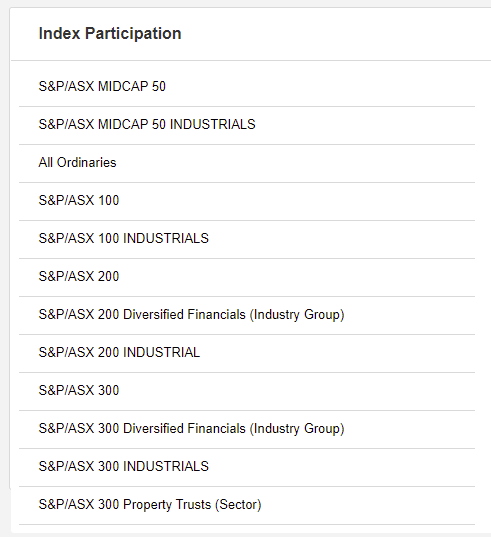

And MFG are currently in the following indices:

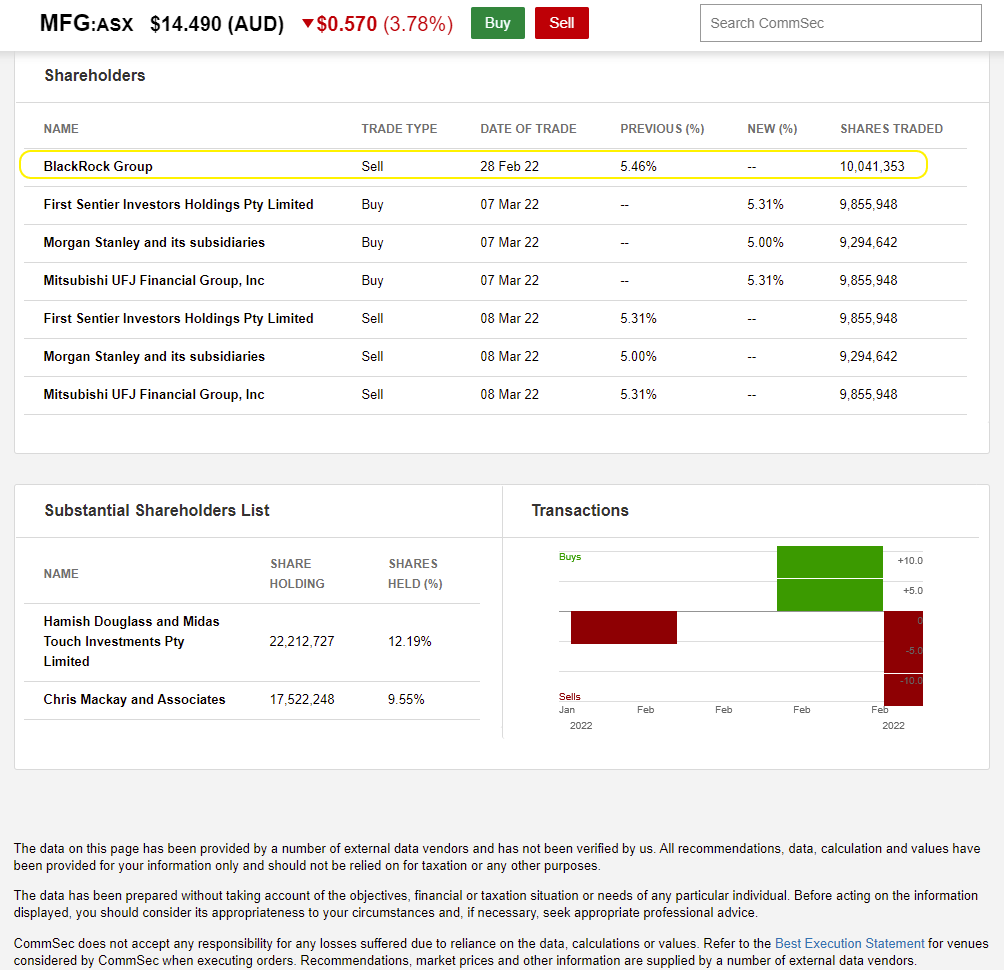

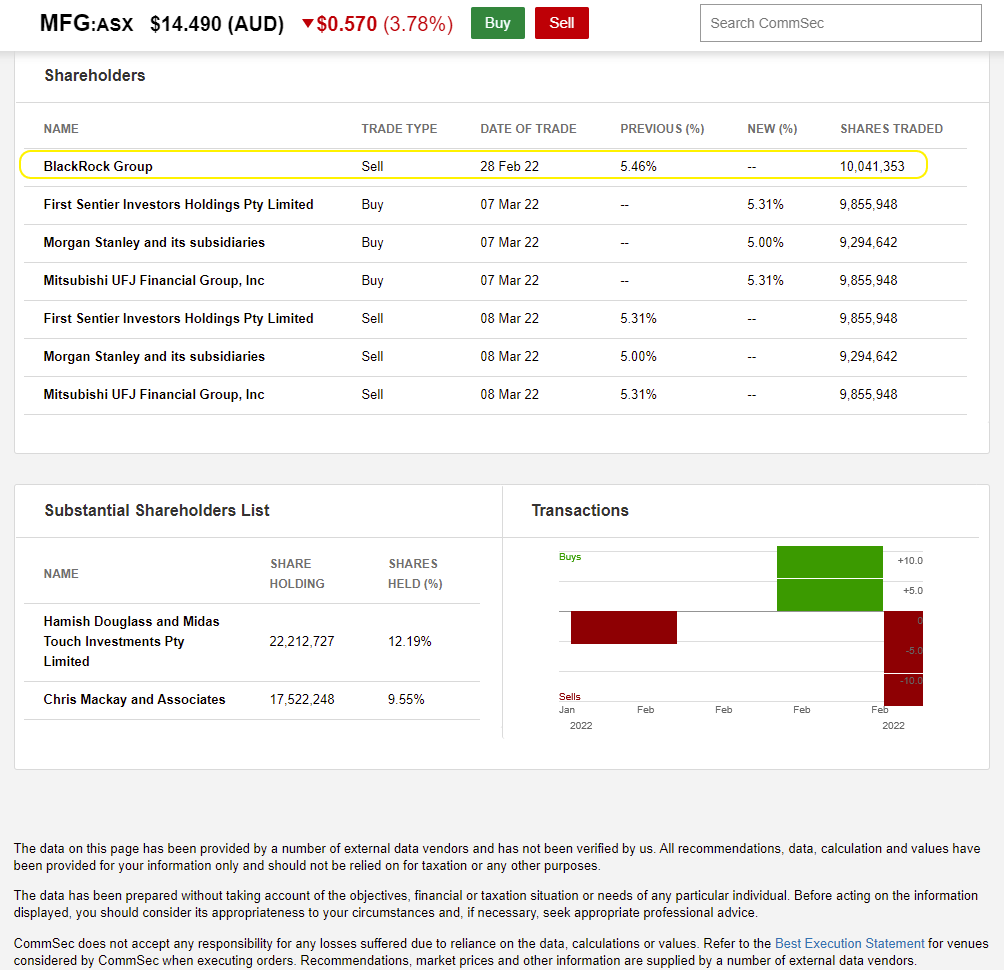

And they would therefore be included in ETFs that cover any of those indices. Additionally, the threshold for "substantial holders" is 5%, so every time a company or individual (or any other entity) ends up holding 5% or more of an ASX-listed company, they have to lodge a "Becoming a substantial holder" notice/notification. And every time they drop below 5%, so 4.99% and below, they have to lodge a "Ceasing to be a substantial holder" notice/notification. They also have to lodge a "Notice of change of interests of substantial holder" every time their ownership moves by 1% or more for any reason (including because of dilution through no action on their part, such as when the company they hold shares in does a capital raising or issues more shares to other shareholders for any other reason) while they remain over that 5% threshold. So when they buy more, or sell, or their percentage ownership moves by 1% or more for any other reason. Here's the list of recent substantial shareholder notices for MFG:

From that you can see that BlackRock were substantial shareholders previously and lodged a "Ceasing" notice with 28th Feb this year being the effective date (just over 3 weeks ago, so quite recently). You can also see there that First Sentier, Morgan Stanley and Mitsubishi UFJ FG were all subs for one day in March, in on the 7th and out on the 8th. Not sure what that was about, however it could well have been related to shorting. MFG's SP dropped every trading day from March 1st to March 8th, and the worst day of that period was Monday 7th March with a -7.3% fall for that day (closing at $14.35, being $1.13 below the $15.48 they closed at on Friday 4th March).

First Sentier Investors are owned by Mitsubishi UFG FG (see here), so those two lots of 5.31% is actually a single 5.31% holding held by First Sentier, but because First Sentier is itself owned and controlled by Mitsubishi UFJ FG, they both have to lodge notices because they are both considered to be in control of that position. This happens EVERY time First Sentier lodge a notice. Mitsubishi UFJ Financial Group will lodge one also, because they are required to. This happens when one company is considered to be a subsidiary or a controlled entity of another company and the position is held by the smaller one (the controlled entity). You'll see the same thing whenever Brickworks (BKW) lodge notices. There will always be a similar notice also lodged by SOL (WH Soul Pattinson and Co) at the same time - because Brickworks is considered to be a controlled entity of SOL. Again, they are both referring to the same holding, not two different holdings. If BKW and SOL both lodge identical notices, the position is held by BKW. If only SOL lodge a notice, and BKW do not, then the position is held directly by SOL and BKW is not involved (other than as a part owner of SOL). Likewise, if First Sentier and Mitsubishi UFJ both lodge notices, then the position is held by First Sentier. If however only Mitsubishi UFJ lodged a subs notice and First Sentier did not, then the position would be held directly by Mitsubishi UFJ and First Sentier would not be involved.

The other thing that can happen, and I've seen this with SOL and BKW, is when they both lodge notices but there are different ownership percentages on them. You'll find that every time that does occur it will be the parent company (the larger one) that will have the larger percentage ownership, not the "subsidiary" or controlled entity (the smaller company). In the case of SOL and BKW, it will always be SOL who will hold the larger stake. If for instance BKW lodged a notice for 12% ownership of XYZ and SOL lodged a similar notice but their notice was for 15% of XYZ, then BKW would own 12% of XYZ and SOL (who also have direct investments themselves) would own an additional 3% of XYZ but because SOL control BKW they (SOL) would speak for 15% of XYZ, being their own 3% plus the 12% that BKW hold.

But anyway, back to MFG. Whenever a company lodges a "Ceasing..." notice, they are NOT required to disclose their new ownership percentage, so they could then own anywhere from zero (nothing) up to 4.99% and we would not know. The only people who are required to declare their ownership of companies when they own less than 5% are the directors of that company. They have to always update the market with their exact number of shares and options. I think there also might be a provision in the rules for companies or individuals (or entities) who are involved in takeover attempts, so I think, from memory, that when a company is bidding to takeover (acquire) another listed company, the bidder company has to state their ownership at the time of the bid and then update the market as that changes (by 1% or more). Other than in those cases, there are no rules that I am aware of about disclosure of positions that constitute less than 5% of a company. There is of course the requirement for companies to include their top 20 shareholders (or more) in their annual reports, however that info is only current at the time it is published and is not required to be regularly updated (other than annually). In those Annual Reports they are also only required to name the registered holder of the shares, and not the ultimate owner (the person or entity that controls those shares), so a number of different positions on those lists could be controlled by the same individual or entity and we would not necessarily know. However with the substantial holder notices, they refer to the actual ultimate owners of the shares - the people or companies who actually control those shares, regardless of how many holding companies or other companies or trusts they choose to use to hold the shares.

So all that is to say that BlackRock could well own just under 5% of MFG a lot of the time and occasionally a little more than 5%, which is when you'll see these substantial shareholder notices lodged, OR they could be taking large positions and selling out completely in between. Because BlackRock operate so many ETFs including some ETFs based on some of the Australian market indices that MFG are included in, I would imagine that BlackRock actually ALWAYS hold MFG but that a lot of the time it is less than 5% of MFG. When they go above 5% that is probably BlackRock's active funds management (i.e. their discretionary managed funds, NOT the ETF side of their business) buying more because they think they are cheap and should rise over time, but that's just my own assumptions, and I can't prove it one way or the other.

It is also probably worth remembering that ETFs are open-ended, so they can create more units when there is demand or cancel them when they have redemptions, and as such an ETF will grow and shrink in line with demand for units in that ETF, as well as the dollar value moving around due to the changing value of the underlying holdings in the ETF. So when people are worried and selling out of ETFs, those ETFs that track particular indices closely are selling down their positions in line with (and to fund) those redemptions. And they are buying more shares in the same companies when their ETF is being bought (more purchases than redemptions). That alone can explain why ETF managers like BlackRock will have changing ownership of companies that are included in their ETFs.

That's my 2c anyway, FWIW.