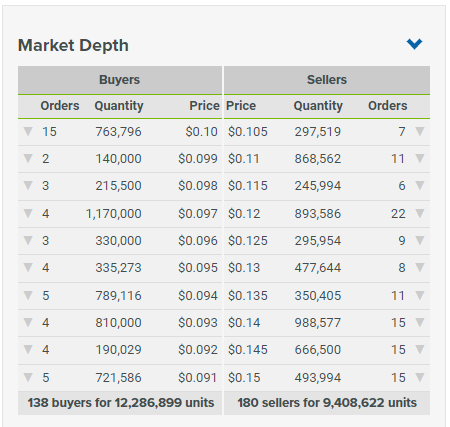

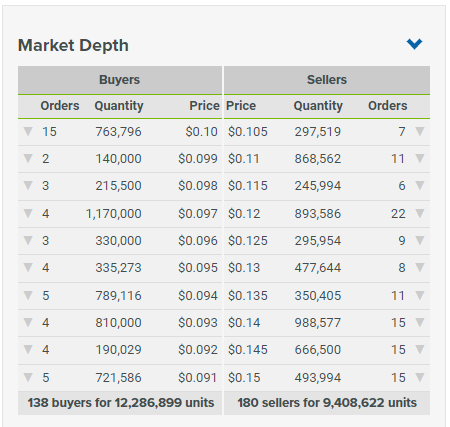

I reckon what you are missing there is that the 0.1c increments ($0.001) only goes up to 10 cents, and after 10c the increments are half a cent ($0.005) not one tenth of a cent - see the right side of your Market Depth table.

And you're trying to place an order at $0.101, which is above 10c where the one tenths of a cent increments are not allowed by the ASX.

You will occasionally see stocks rise or fall by strange amounts, like 7 tenths of a cent, but my understanding is that is either due to Chi-X allowing smaller increment trades than the ASX does, and/or volume matching where a mid-point is used between a buy and a sell price for certain trades where such mid-points can be used - this only applies to institutional trades as I understand it (the volume matching using mid-points) where the relevant permissions are in place for the modifications of those trades by the system. For ordinary retail investors trading on the ASX, it's 0.001 increments up to 10c, then half cent increments from 10 cents up.

Additional: I was too late! I see this question has already been answered. Regarding where the half cent increments end, I thought they did end somewhere, but I've just checked the trade history for CSL today, and there has been the occasional trade gone through this morning at half a cent increments - not many at all - but they do exist. Not sure if there is a limit imposed on placing trades at half cent limits above a certain dollar value though. I don't think I've ever tried to place a trade at a price like $20.005 or $101.015. Perhaps someone else knows about the upper dollar value limit for half cent increments - if there is one.