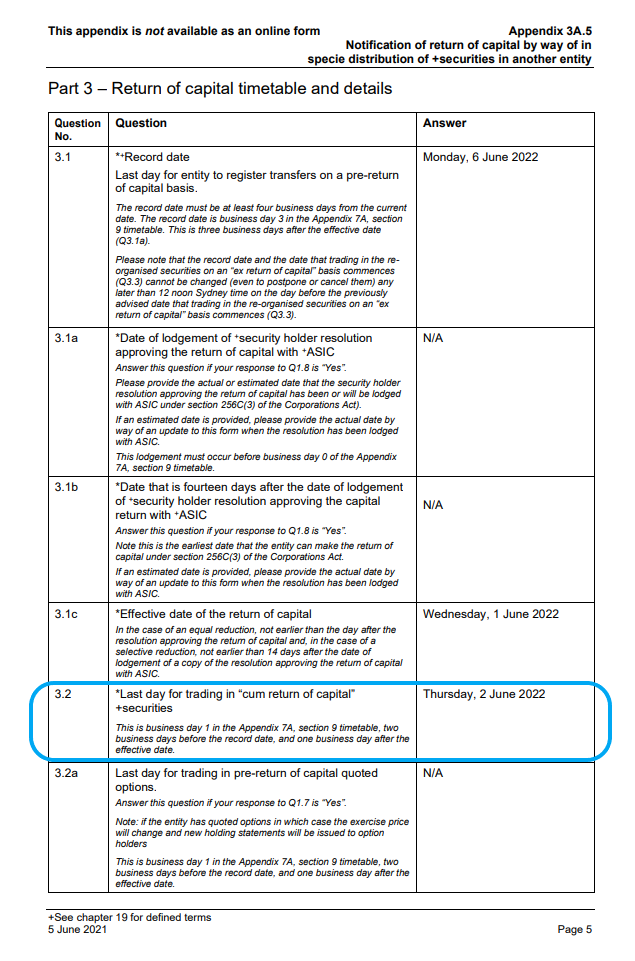

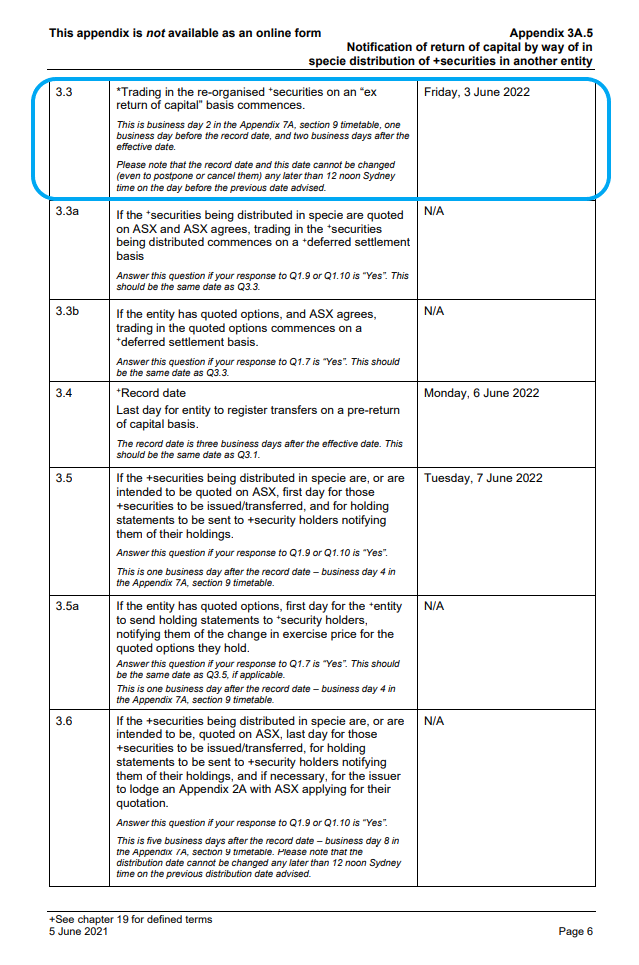

FFX trades ex-distribution today (Friday 3rd June 2022) for the Leo Lithium shares. Effectively, while the record date for the demerger is Monday, any shares bought today are bought ex-distribution - as explained here: FFX-Updated-Appendix-3A5---Notification-of-Return-of-Capital.PDF

So from today, those people buying FFX shares are buying a pure gold play, with zero exposure to lithium. The last cum-distribution date was yesterday, Thursday 2nd June:

They are referring to the event as a return of capital, but what they are actually doing is giving all FFX shareholders shares in Leo Lithium, so are demerging their substantial lithium assets. Because of the 2-day settlement - i.e. you are recorded as owning shares 2 trading days after you buy them, those shares bought yesterday (Thursday) will be recorded on Monday (the "record day") as being held by those new owners, but shares bought today (Friday) will not be recorded until Tuesday, i.e. the day AFTER the record day, so people buying FFX shares today will NOT receive any Leo Lithium shares, hence the circa 60+% fall in the FFX SP today.

You can click on those images to make them larger.

Hope that helps @Hands