Yes @secondtake88 - I figured they were going to come back on the boards at a significantly lower price than where they were when they last traded (@ 20c/share in June) - and 6c/share is definitely lower. I note they also announced a new MD (Scott Lowe) a couple of days ago - FFX-Appointment-of-Managing-Director.PDF

Firefinch appoints experienced mining executive Scott Lowe as managing director By Proactive Investors (investing.com)

Scott Lowe to take over the helm at Firefinch (miningreview.com)

Scott Lowe (businessnews.com.au)

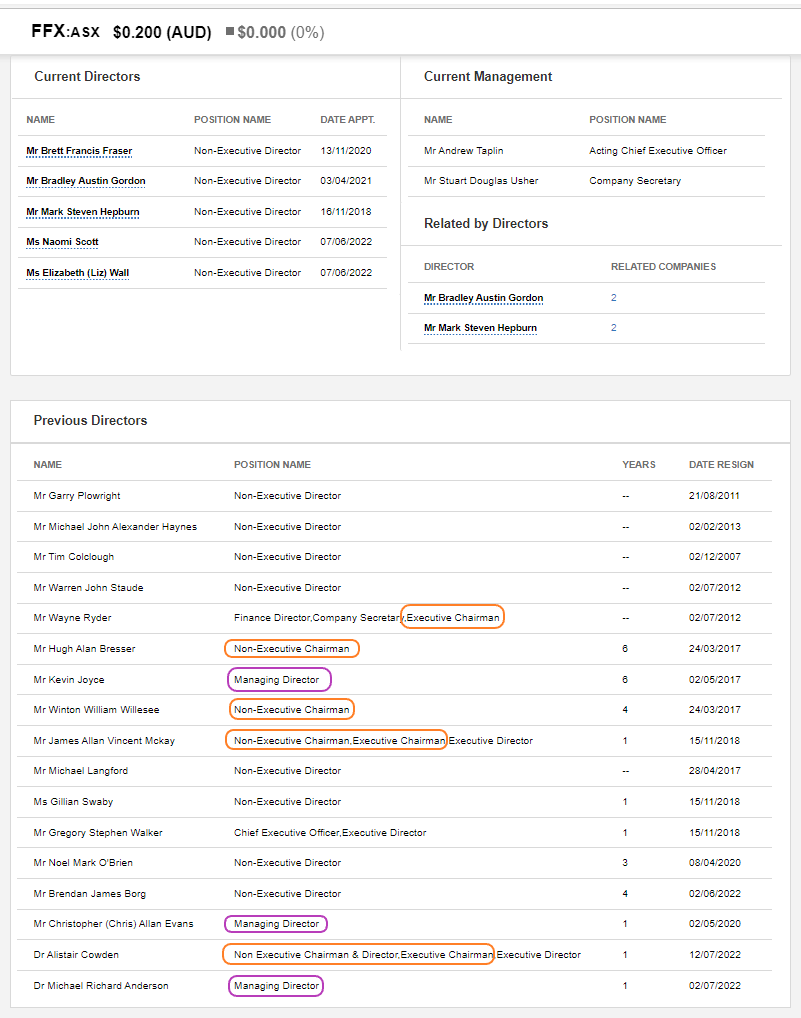

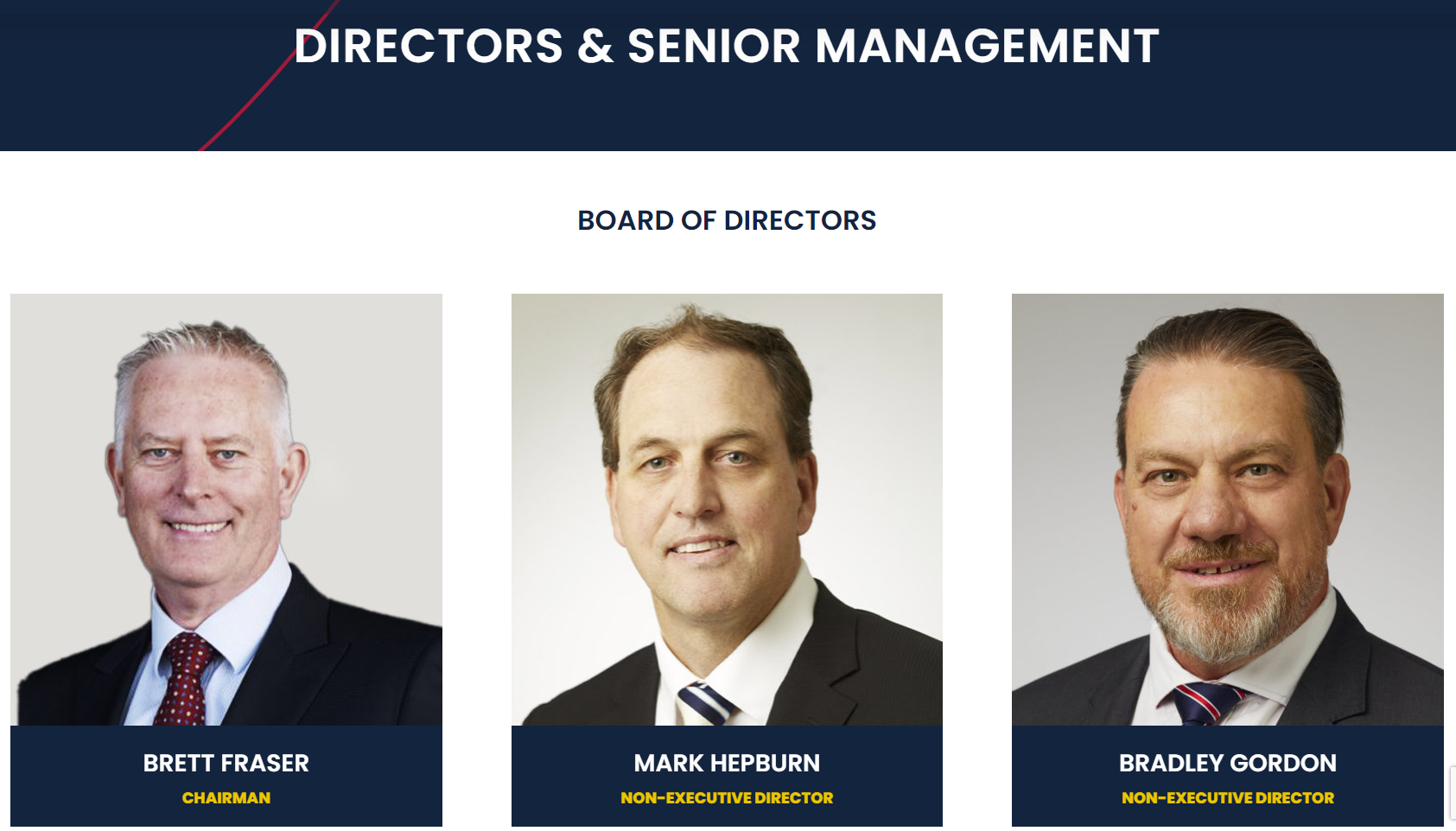

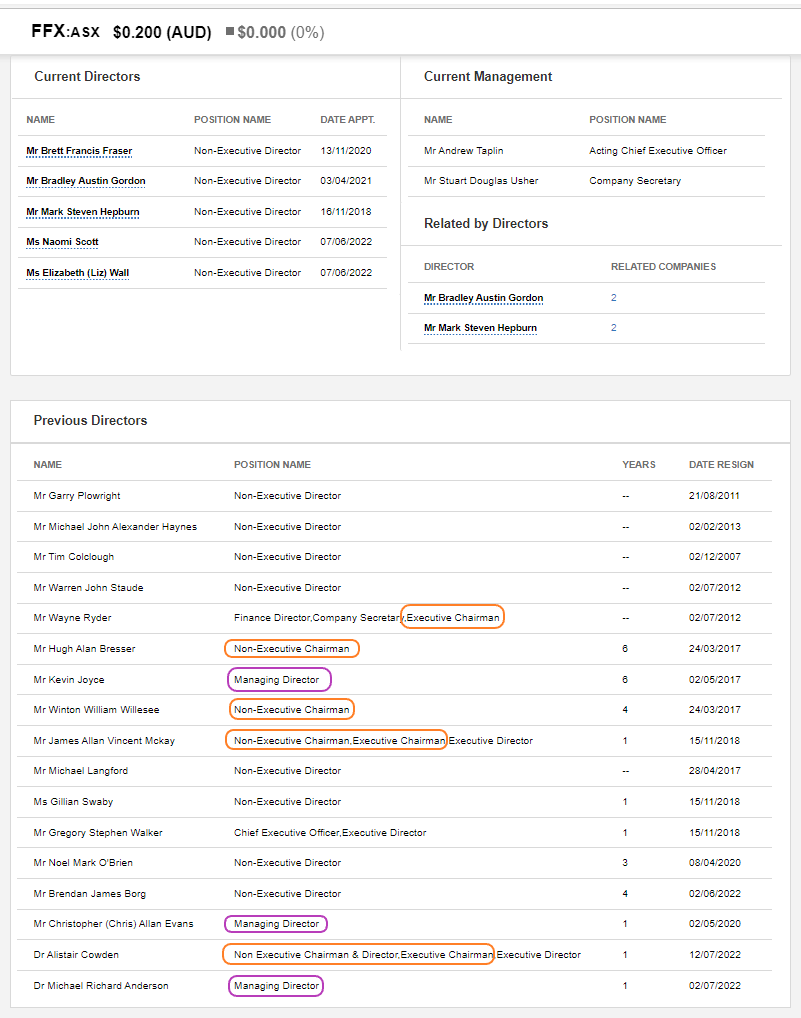

Commsec still has them listed as not having an MD or a Chairman, but Scott Lowe is their new MD and apparently Brett Fraser is their Chairman, although it's hard to keep track, as they lost a few Chairmen over the years.

Six in 10 years, and five of those in the past 5 and a half years (since March 2017). Brett Fraser is apparently their current Chairman, and there are another 5 ex-Chairmen listed there along with their resignation dates on the right. They've also had four MDs in 5 and a half years, including their new one, Scott Lowe. They could certainly do with some stability at Board level.

Interesting that their recapitalisation includes a fair amount of debt converted to equity. From their Recapitalisation package announcement today:

"In addition to the equity raise, the Company’s current mining services contractor, MEIM Morila SARL, to convert approximately US$23.4 million of outstanding debt and future liabilities to equity, subject to shareholder approval. Additional trade creditors to convert at least US$4.89 million of outstanding debt to equity, subject to shareholder approval."

That gives a bit of an insight into why this recapitalisation has taken a while to get sorted out, they couldn't even pay their mining contractor what they owed them.

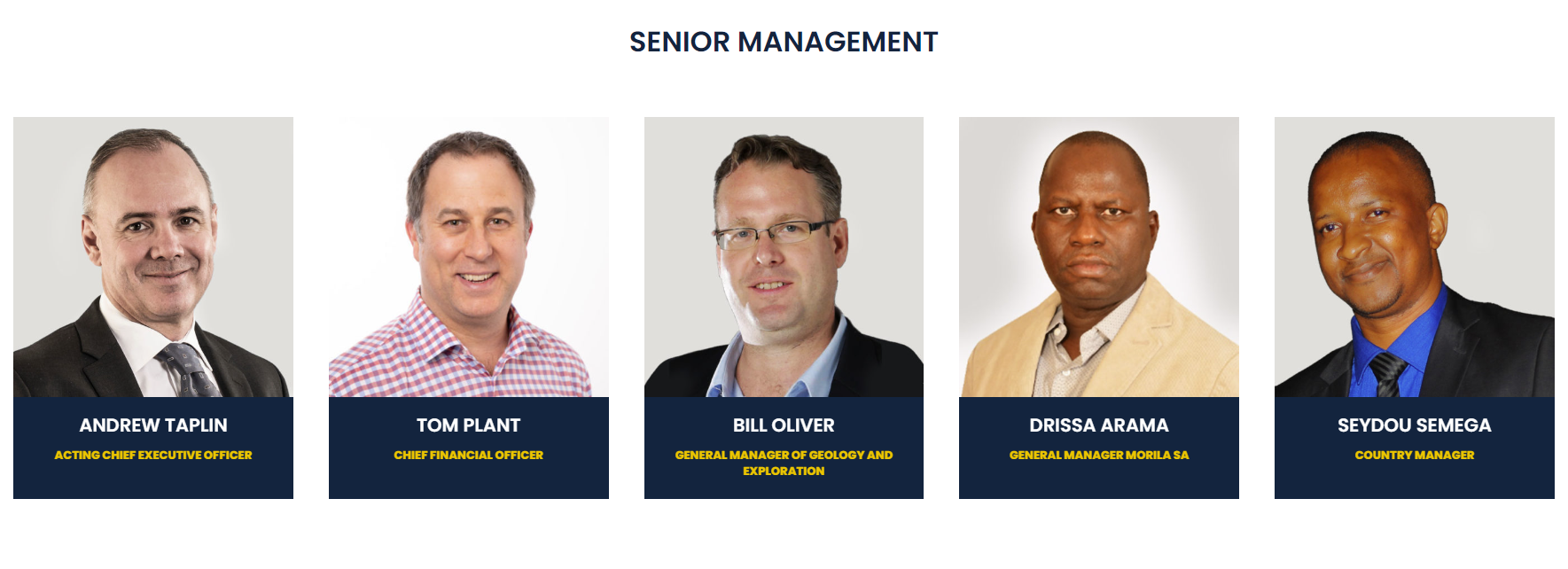

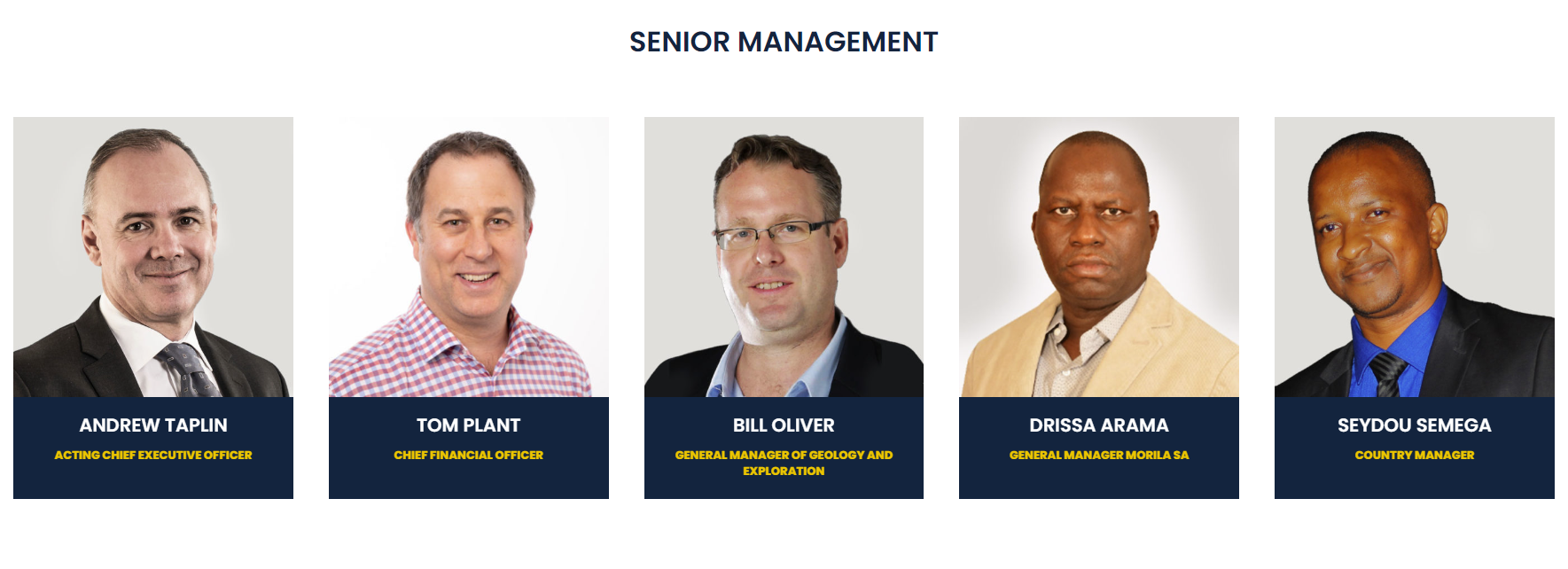

Have a look at their current General Manager at Morila (Drissa Arama, pictured below)- he's not the happiest looking bloke - and that's the photo that Firefinch have chosen to use of him on their website:

Hope they get this capital raising done and raise the full $90m that they are targeting. He needs some cheering up by the looks of it, and if Firefinch can get back on the boards of the ASX then perhaps those shareholders who want to get the heck out can do so. FFX will have to pay their annual ASX listing fees first though - as they were one of the companies who would have been suspended from trading - if they weren't already suspended - which they were - for not paying their listing fees on time (by August 19th) - see here: Suspension-from-Official-Quotation---Annual-Listing-Fees.PDF

Let's hope there's life in Morila the Gorilla yet...

Disclosure: Not an FFX shareholder.