I'm going to create a forum post for this rather than a straw, as hope this will become a discussion, rather than an opinion.

@Strawman posted the following 3/12 ago:

yeah I used to hold, but sold down earlier in the year purely because I thought there were better risk/reward opportunities. I still think it's a solid company, but growth options are largely predicated on acquisitions, with minimal organic growth potential (something management acknowledged at the latest results), and I'm not sure shares represent great value (not that they are expensive, just not as cheap as I'd like for me to switch out capital from other places).

There's nothing wrong with this picture. The business has very reliable cash flows and has been diligently reducing leverage while continuing to pay dividends.

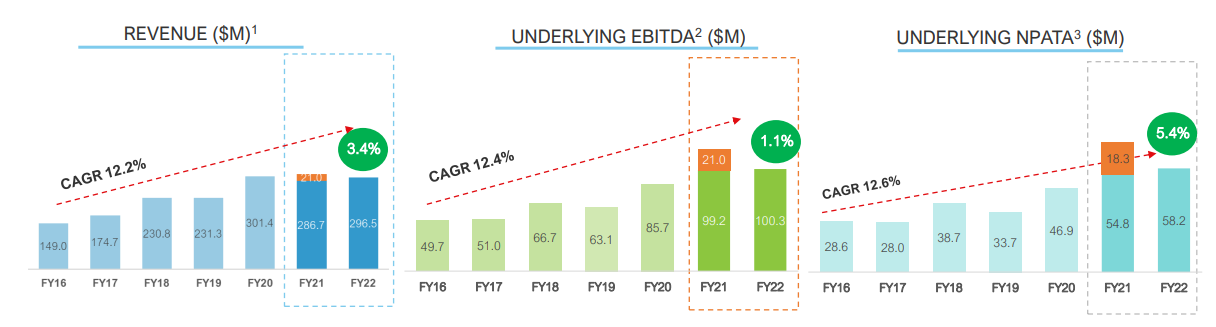

But while 5.4% average profit growth is perfectly decent, it's not spectacular. And a PE of 18 or a yield of 2.4% isnt enough to tempt me back right now.

That being said, it's a very low risk company, and a good 'under the mattress' holding for dividend focused investors.

Now, I am a bit of a fan of HSN. It is one of those quiet achievers (like IFT - other key holding in my Super) that I think that if you want some certainty in your portfolio - this could be a sensible addition.

For disclosure - I am very poor at creating spreadsheets and DCFs. I am also guilty of being a sucker for a good narrative and have along track record of investing good companies at the wrong time/valuation. HSN, for me, is one of those great low-risk compounders that I don't have to worry about, is not unreasonably valued and I believe in today's market is going to be re-rated or taken over because it is such a stable performer.

The reason it is mis-understood is because of the variability in EBITDA and NPAT. It is a serial take-over merchant. I feel it's important to point out that is NOT a roll-up, whereby a company leverages the multiple of their listed company to acquire a similar but smaller (usually un-listed) company by issuing more shares. HSN acquires super-sticky utility billing companies that are deeply unsexy (think: me in a pair of gold lamé skin-tight jocks) and have been ticking along on low multiples, with legacy software - often for decades. It takes over with debt. This is important as shareholders never get diluted. It introduces improvements/efficiencies to the legacy software, charges a small - moderate increase to the user, and sits back and takes in the rent - for years and years and years. Debt is then paid down, in preference to paying out shareholders with a high dividend. Then several years later...it does it all over again.

Over the years it has been moving up in scale: the acquisitions are getting larger, the hits to NPAT and EBITDA as demonstrated in the graphs above, and the swings in valuation (based on these metrics) get larger. So, HSN has periods where it is valued as a high growth, high PE tech company. Then a few years later it is a debt-laden, low growth utility. But wait, then a few laters we are back to square one again! If you wish to buy into HSN it is worth getting your timing right!

But, much like any quality company, one needs to look at the long term SP chart to get a feeling as to how successful they are at this process:

the next chapter pertains to it's debt level:

HSN has paid off the majority of their debt, and history would suggest that they are on the prowl again.

I would hazard a guess that one of three things are about to happen:

- they will shortly announce another take over, increase debt, repeat the whole cycle over again and therefore increase EPS - albeit in a lumpy fashion. This assumes careful assessment of ROIC and debt servicing. HSN is owner-run and has previously demonstrated excellent risk management. I am confident that if this path is taken, it will be as successful as all the other previous take-overs.

- they will increase returns to shareholders significantly either via increased dividends or a share buy-back (with a significant re-rate). This is what I consider to be most likely, until debt costs (interest levels) come down.

- they get swallowed by PE

best wishes

C