Now here's the much-celebrated Berkshire Hathaway. 8/8/23 1:18am

Berkshire Hathaway stock sets record high as rising rates, Apple boost profit (yahoo.com)

(Reuters) -Berkshire Hathaway's stock price set a record high on Monday, rising 3.4% after the conglomerate run by billionaire investor Warren Buffett said quarterly operating profit topped $10 billion for the first time.

Class A Stock up 77% in the last 5 years.

Dig Deeper.........

Plus more

Reports:

BERKSHIRE HATHAWAY ANNUAL & INTERIM REPORTS

2023 Report: 1stqtr23.pdf (berkshirehathaway.com)

mmm.. some natural gas pipelines over there. In Victoria, they are outlawing the natural gas.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations BHE (Continued) Our U.S. utilities operate in several states, including Utah, Oregon and Wyoming (PacifiCorp), Iowa and Illinois (MEC) and Nevada (NV Energy). After-tax earnings decreased $237 million in the first quarter of 2023 compared to 2022. The earnings decrease reflected higher operating expenses, partially offset by higher electric utility margin (operating revenue less cost of sales), higher other income and lower state income taxes. Operating expenses increased primarily due to a pre-tax increase of $359 million in loss accruals (net of expected insurance recoveries) associated with the 2020 wildfires, as well as from increases in general and plant maintenance costs.

The U.S. utilities’ electric utility margin was $1.7 billion in the first quarter of 2023, an increase of $62 million (3.8%) compared to the first quarter of 2022. The increase reflected higher operating revenue from favorable retail and wholesale pricing and increases in retail customer volumes, partially offset by increases in thermal generation and purchased power costs and lower wholesale volumes. Retail customer volumes increased 2.6% (3.3% at PacifiCorp, 1.0% at MEC and 2.9% at NV Energy) in the first quarter of 2023 compared to the first quarter of 2022, primarily due to increases in customer usage and in the average number of customers. After-tax earnings of natural gas pipelines increased $47 million in the first quarter of 2023 compared to the first quarter of 2022. The increase was primarily due to higher regulated transportation and storage services revenues from certain general rate cases.

After-tax earnings of other energy businesses decreased $156 million in the first quarter of 2023 compared to the first quarter of 2022. The decrease was primarily due to a deferred income tax charge of $82 million recognized in March 2023 related to the enactment of a new Energy Profits Levy income tax in the United Kingdom, lower earnings from changes in unrealized positions on derivative contracts and unfavorable results from natural gas, solar and geothermal generating facilities due to increased maintenance costs and lower solar generation due to weather events in California. Partially offsetting these earnings decreases were increased wind tax equity investment earnings of $36 million

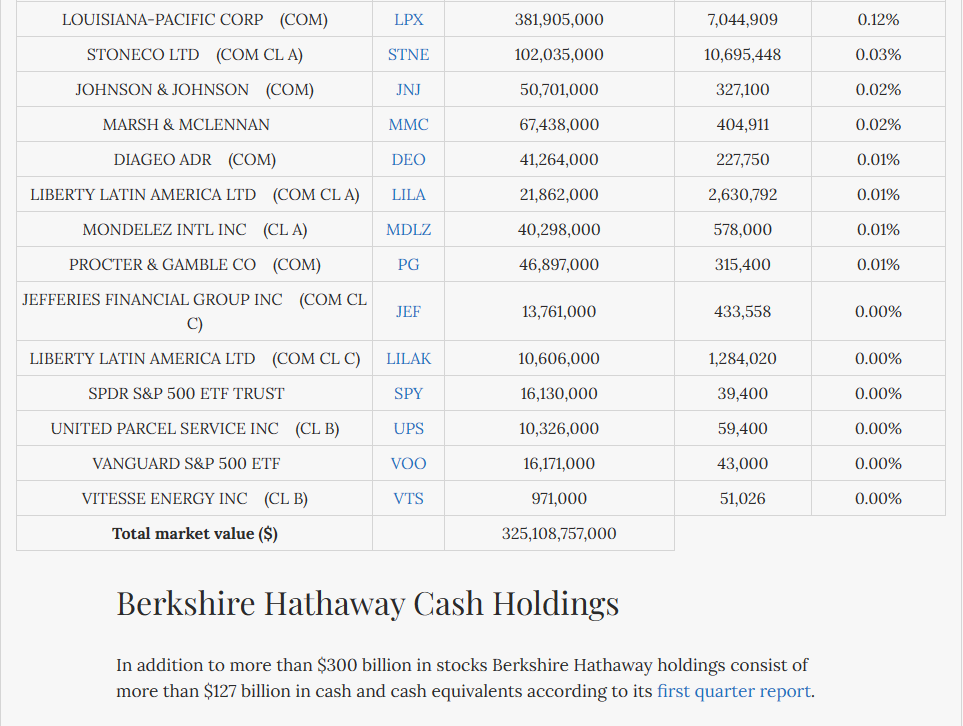

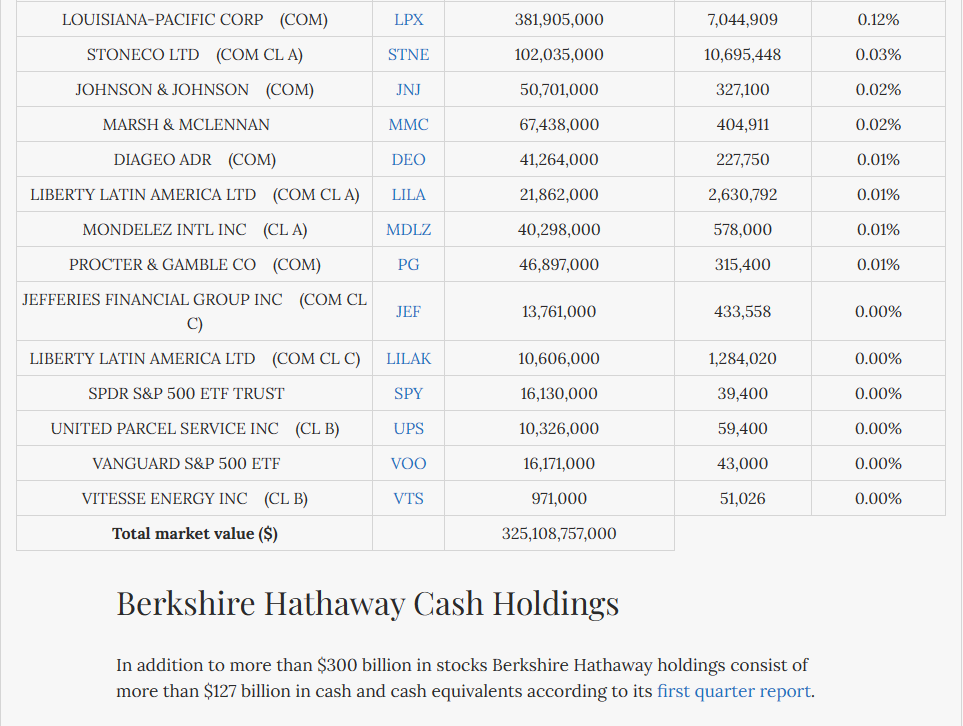

At 31st March 2023

Warren Buffett Portfolio 2023 | Berkshire Hathaway Holdings | Buffett.Online

Warren Buffet’s Foreign Investments

Warren Buffet’s Foreign Investments

On 31 August, 2020 it became known that Berkshire Hathaway made 6 billion dollars investment in the stocks of 5 biggest Japanese corporations: Mitsubishi Corp., Mitsui & Co., Sumitomo Corp., Itochu Corp. and Marubeni Corp.

On 21 November, 2022 it became known that Berkshire Hathaway increased its investments in each five Japanese trading houses: Berkshire now owns 6.59% of Mitsubishi Corp, 6.62% of Mitsui & Co Ltd, 6.21% of Itochu Corp, 6.75% of Marubeni Corp, 6.57% of Sumitomo Corp.

Latest Warren Buffett’s Stock Buys

Warren Buffett continues increasing stake in oil-producer Occidental Petroleum. Currently Buffett’s company holds 24.9% stake in Occidental Petroleum.

EOM.

Hello fellow strawman members. I am looking at going to the Berkshire Hathaway AGM next year. Will any of you be going? To those who have made the Journey before, please provide me with tips on where to stay.

Warren Buffet’s Foreign Investments

Warren Buffet’s Foreign Investments