Hi - I’m not sure that’s what they mean - I read that as 35% of EBITDA. On that basis it’s 35% of the 35% if you know what I mean - ie on $100m revenue - $35m EBITDA - 35% of that as a dividend - c. $12m dividend would be my view,

Should say "if" of course, EBITDA margin is 35%. Obviously if it's 10% - dividend pool would be less c. $3.5m.

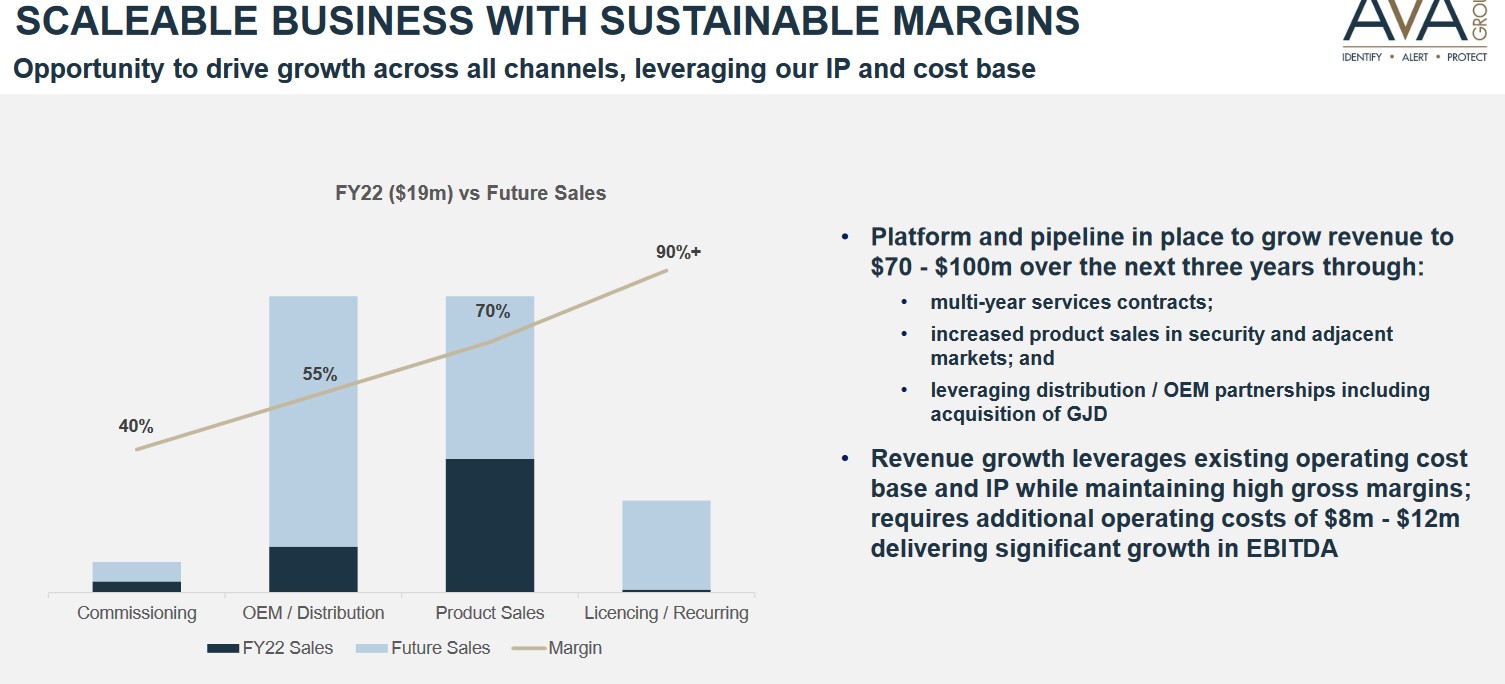

I have just been looking closely at AVA and thinking about what they are going to do over the next few years. AVA have guided to increase revenue to $70-100M over the next 3 years, which is a 2-300% increase with only a corresponding 50-70% increase in operating costs to do it. Their commentary at the AGM seems like they think this is a very achievable target.

The gross profit margin should be maintained around the 65-75%, but what I am struggling to identify is what their EBITDA margin is likely to be going forward, does anyone have a good number to estimate this at. In FY21 it was 36% (5% ex IMOD revenue), in FY22 it was 4%, but this was a messy year and I think this is artificially low and was tangled up with the divestment of their old buisness unit. The buisness is also a bit different now than it previously was, so I am not sure if these old numbers are much of a guide. Base operating costs seem to be around the 10M mark, but this does not include depreciation and amortisation expenses. I am guessing that the EBITDA margin will be somewhere around 15-30% but this is still a wide range.

The part that I am confused about is that they have announced their Dividend policy going forward to be "not less than 35% of Earnings Before Interest Taxation Depreciation and Amortisation (EBITDA) annually (commencing based upon FY2023 results)".

From this I am assuming that their EBITDA margin must be considerably higher than 35%, as otherwise they will be depleting their cash reserves to maintain the dividend. Does anyone have a good estimate of how much of their EBITDA drops through to become NPAT?