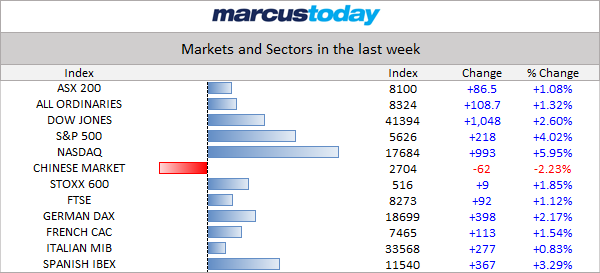

Saturday 14th September 2024: The past week:

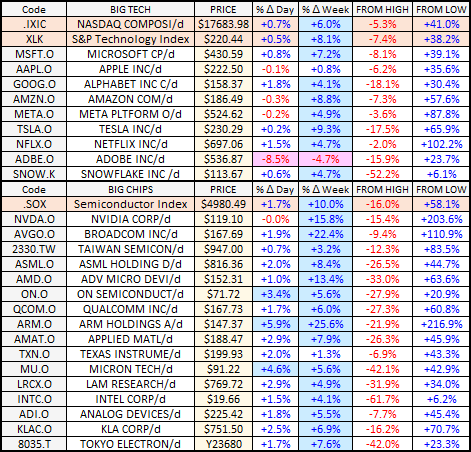

NASDAQ outperforms again. Risk on. Tech carrying the US market ever higher.

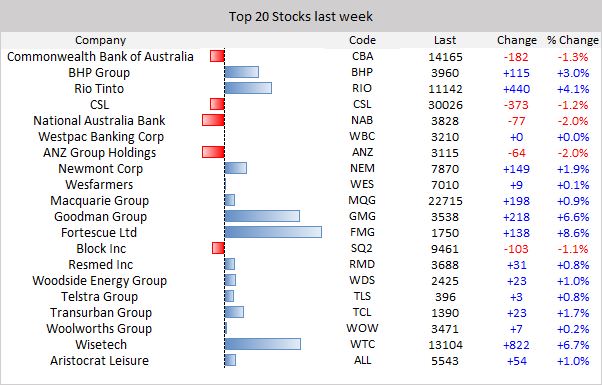

Back on the ASX, we had tech (or Wisetech) and Resources (Mining) carrying us higher over the past 5 trading days:

Outside of those ASX20 companies, we had some other decent rebounds, like MIN +25% and PLS +20%, albeit off very low bases due to recent falls.

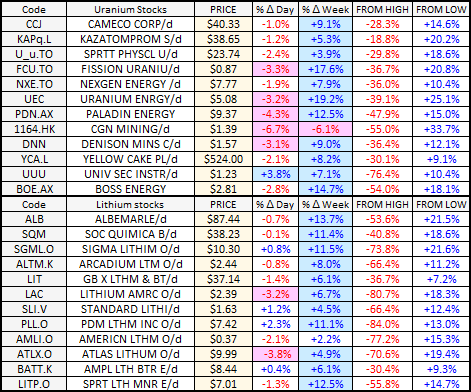

Uranium and lithium popped during the week on Chinese lithium (lepidolite) operation closure rumours and the threat of Russian export restrictions on uranium. The obvious question is whether this was a material pivot point in the sector.

The uranium price hardly moved, and by Friday, the rally was fading. Similar sort of response for lithium companies, some of which had a fabulous week (MinRes +25.1%, Pilbara Minerals +20.3%, LTR +12.6%).

On the uranium front Paladin (PDN) was up +12.5% with NexGen (NXG) up +9.3% and Deep Yellow (DYL) up +20% despite the uranium price not ending the week materially higher than where it was the previous week.

The table below shows the International uranium and lithium stocks overnight on Friday and their weekly SP movement.

Most were down for the day (Friday) but up for the week.

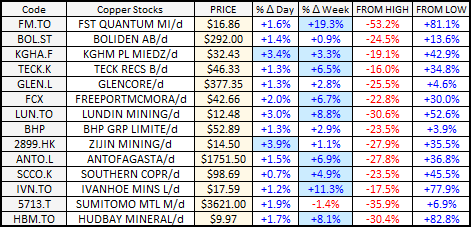

Copper companies (below) were up for the day and the week:

Source: Tables and data above plus the one table below have been sourced from today's Saturday email from MarcusToday.com.au

They left out Sandfire (SFR), Australia's main pure-play copper company, which was up +0.6% on Friday and up +7.7% for the week (it's a sign!!)...

Another way people play copper on the ASX is through the dual listed MAC the SPAC (MAC.asx, Metals Acquisitions Corporation) - which was up +2.92% on Friday and up +9.4% for the week. MAC may not always be a pure-play copper producer however, because we don't know what they will acquire next, or in what commodity.

However, that table (plus the SFR & MAC moves over the past week) shows that there's some positive movement in copper.

I'm not directly exposed to lithium, iron ore or copper at this point. Still trying to understand more about the supply dynamics, such as with copper I would like to get my head around how much more supply can be wrung out of existing large copper mines with the newer technology we now have for both the processing of lower grade ore and for finding more copper around existing processing facilities. Getting new copper processing operations of any decent size up and running from scratch is a lengthy and costly process, and so involves the company and its backers having a bullish outlook on where copper will be in 5 and 10 years from now, something you don't need to worry about so much when you are simply expanding or extending the life of an existing operation.

Metals and minerals can be interesting - for instance Gallium is now being classed as a critical mineral because of Chinese export bans, and most Gallium today is produced as a minor by-product of alumina production (alumina is smelted into aluminium) from bauxite ore, however most Alumina refineries haven't bothered to build Gallium circuits into their plants because at the time of design and construction of those plants - and for almost all of the time since - gallium was not considered to be in short supply or something worth producing for a large Alumina producer. As a result, it's been left in the tailings and there's tonnes of it in the bauxite residue dams (a.k.a. tailings ponds, a.k.a. TSFs or tailings storage facilities, a.k.a. red mud lakes) that surround most Alumina refineries, including Worsley Alumina (where I used to work) in SW WA, and the Alcoa Alumina refineries a bit closer to Perth (also in the SW of WA) - and if the gallium price keeps rising, we may see that residue (tailings) being reprocessed just to extract the gallium.

A similar scenario is occurring with Antimony, again due to Chinese export bans, which is part of the trade wars between China and the USA due to both countries trying to be more self-sufficient (less reliant on the other for inputs to manufacturing) while at the same time trying to slow down technological progress of their opposition by restricting exports of materials that are hard to source elsewhere - at this point in time. This is also playing out through the use of tariffs on imports from each other as well, but what I'm seeing is possible opportunities for Australia in terms of providing much needed supply to the USA for stuff like gallium and antimony that they need but can't source from China any longer in the quantities they require (if at all). The US is also passing legislation that is designed to future-proof their own industries in terms of diversification of supply chains away from China, which may well help Australia.

Antimony is occasionally found with gold, but not often in sufficient quantities to make it worthwhile to extract as a viable byproduct of gold production, however we do have 2 or 3 companies on the ASX who are putting it out there right now that they do have significant quantities of antimony - and they have been getting some attention from the market.

So, I think we have a good setup forming for a nice rebound in base metals - except for nickel - and rising prices for some lesser-known critical minerals, along with a continued rise in precious metals, however bulks like iron ore and oversupplied metals like lithium remain a little bit more uncertain in the near-term, IMO. Nickel also has some unique supply side factors at play, mostly the rise of Indonesia as the world's largest nickel supplier - see here: https://www.mining-technology.com/data-insights/nickel-in-indonesia/

Indonesia was the world's largest producer of nickel in 2023, with their output up by +21% on 2022, despite various environmental concerns about the way it is being mined there and the mess they are leaving behind in terms of environmental devastation, however they are finding sellers, and their costs are lower than most if not all other countries that produce nickel, hence the nickel price staying low now for a while due to oversupply, resulting in nickel operations in Australia and elsewhere either going broke or being put on care and maintenance (C&M) until the nickel price rises above their cost of production again. The cure for low prices is usually sustained low prices, i.e. as more and more mines shut down due to being loss-making, further supply is being removed from the market, and then prices naturally rise in line with reduced supply, however that has not been happening so far with either lithium or nickel, and the main reasons for that is that we have China and Indonesia not playing by the old rule-book.

There have been Lithium operations in China (mostly higher cost lepidolite operations) that the Chinese Central Government has been prepared to continue to run at a loss for their own reasons, likely to ensure they maintain their own internal supply chain, so reasons connected to national security, or security of supply. And in Indonesia, the usual environmental guidelines for their nickel operations appear to have been largely ignored, which can subtantially reduce a nickel producer's costs - not having to do things cleanly or worry about the mess you leave behind. Alledgedly. Additionally, the Indonesians have spent money and time to perfect processing laterites ores using High Pressure Acid Leaching (HPAL) which involves processing ore in a sulfuric acid leach at temperatures up to 270 degrees C and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves. There are plenty of people not happy with the Indonesians' environmental record with nickel mining and processing in particular, however they have certainly got very good at HPAL, which means they can produce high grade nickel suitable for batteries with what was previously considered to be lower-grade or Class 2 material that had previously only been used to make stainless steel (nickel is an essential component of stainless steel but battery grade nickel sells for a higher price). Anyway, credit where credit is due - they have perfected HPAL nickel production at scale apparently in Indonesia - according to Australians and Americans who have visited some of their processing facilities.

So, nickel has undergone a change that is more structural than temporary - and nickel producers are coming to terms with that structural change now, such as BHP announcing they are shutting down their Nickel West operations in WA. Further Reading: https://www.mining.com/web/indonesia-and-china-killed-the-nickel-market/ [04-March-2024]

Lithium doesn't have the same issues - it's just a case of oversupply which has been exacerbated by some producers (mainly Chinese producers) prepared to run operations at a loss for much longer than people expected they would. And the bounce we saw during the past week with Lithium names on the ASX was on the basis of unconfirmed reports that some of the Chinese loss-making lithium producers may finally be reducing or ceasing production, or are at least prepared to discuss that possibility. Nothing confirmed yet other than reports of things that have been said. What would be more important would be action in that regard rather than just words. Trouble is, it's hard to get good reliable data out of China - many people are relying on talking to locals in nearby towns about activity levels at the mines and/or using satellite images. But the market likes rumours it seems.

But outside of iron ore, lithium and nickel, which all could remain challenged for a bit longer, we appear to have some base and precious metals, and some minerals, all moving in the right direction again, and the market may be getting interested in some resources stocks once again.

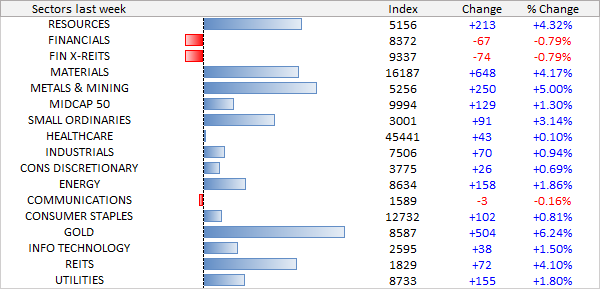

Here are the ASX sector movements over the past week:

Banks underperformed for a change.

Interesting.

Only cross promoting my tweet because I'm too dumb to take a video from my phone into strawman but here is an aircore rig in motion drilling for mineral sands

https://twitter.com/DznBkr/status/1638859543013920771