Some small excerpts from Marcus Padley's lengthy Saturday morning email:

Saturday 25th March 2023:

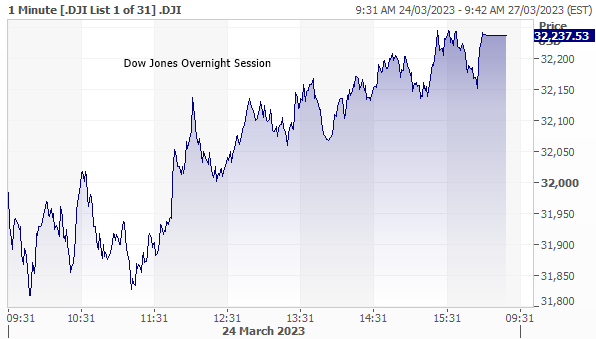

US stocks closed higher overnight marking the end of a volatile week as US Fed officials calmed markets over a potential liquidity crisis in the banking sector. European stock markets fell on fears that regulators and central banks have yet to contain the worst shock in the banking sector since 2008. Market sentiment was hurt by a sell-off of Deutsche Bank, which fell by as much as 15%, closing down 8.53%. Dow Jones up 132 points (+0.41%). At best Dow up 152, and at worst, down 300. S&P 500 up 0.56%. NASDAQ up 0.31%. VIX Volatility Index down 3.2%. In Europe, STOXX 600 -1.37% FTSE -1.26% CAC -1.74% DAX -1.66%. SPI Futures are down 3 points (-0.04%).

After sliding over 1% in the first hour of trade, the S&P 500 snapped back recording its second straight week of gains. Recovery in regional lenders helped drive the push, with the KBW Regional Bank Index rising sharply up 2.92%. First Republic Bank slipped again, down 1.36%, extending this year’s losses to 90%. Confidence remains fragile, and volatility is likely to remain high as conditions continue to tighten, increasing the risk of a hard landing.

Banks remain in the headlines, as wider indicators of financial market stress were flashing in Europe, with the Euro falling significantly against the USD, euro zone government bond yields sinking, and the costs of insuring against bank defaults surging despite assurances from policymakers. Following Credit Suisse’s rescue by UBS, all eyes turned to Germany’s Deutsche Bank, slumping 8.53% overnight, as the cost of insuring its bonds against default rose sharply. Deutsche Bank has now lost a fifth of its value so far this month, as short sellers’ cash in profits of over $100m betting against the bank over the last two weeks. The Index of top European Banks stocks fell 3.8%.

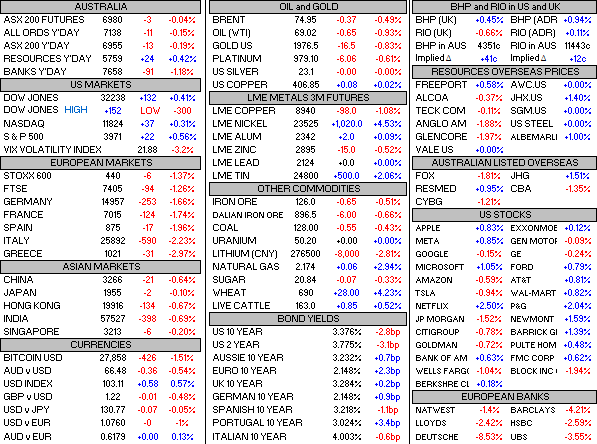

OVERNIGHT TABLE ON FRIDAY

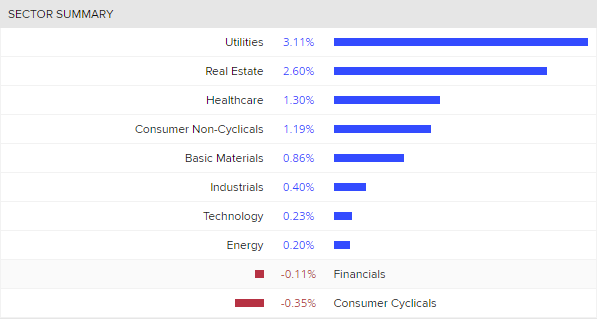

US SECTORS

- A stronger USD dragged gold prices. Gold down 0.83%.

- Large US Bank stocks slipped JPMorgan -1.52%, Citigroup -0.78%, Goldman – 0.72%, and Wells Fargo -1.04%.

- US Financial Stability Oversight Council agreed the US banking system remains “sound and resilient”, soothing markets.

- Durable goods orders in the US fell 1% MoM in February significantly below expectations of a 0.6% rise.

- Aussie dollar takes a hit down 0.54% to 66.48c. Bitcoin down 1.51%.

HEADLINES OVERNIGHT

- World stocks gyrate as bank contagion fears bite

- Wall Street ends green as Fed officials sooth bank jitters

- Deutsche Bank tumbles as nervous investors seek safer shores

- Coinbase, SEC on collision course for 'existential' clash over crypto industry

- Block shares extend losses as Hindenburg report weighs

- US business investment appears weak in first quarter as orders rise moderately

- Venture capitalists race to land next AI deal on Big Tech's turf

- Gold set for fourth weekly rise as bank worries spark rush to safety

- Nickel surges as inventories slide and speculators wade in

- Iron ore rebounds as further fall in port inventories lifts sentiment

- Russia presses along Ukraine front after reports of Bakhmut slowdown

- U.S. and China wage war beneath the waves - over internet cables

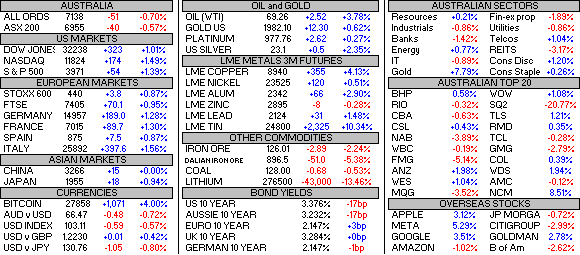

LAST WEEK TABLE

US markets close this week off higher despite bouts of high volatility amid the FOMC meeting and the ongoing banking turmoil. NASDAQ up 1.49%, and S&P 500 up 1.39% for a second straight week. The Dow up 1.01%. Short-dated Treasurys have been behaving like meme stocks this week, the US 2-year yield fell as low as 3.44% overnight and reached a high of 4.26% on Wednesday, wild stuff. Tech rallied this week on safe-haven buying, while banks took a hit as jitters surrounding contagion remain even after countless policymakers everywhere tried to reassure markets. The KBW Bank Index fell for a third straight week and is nearly down 29% for the month.

On the domestic front, the ASX 200 slipped 0.57% and the All Ords fell 0.70% for the week. Defensive sectors the best performers, Gold [sector] up a staggering 7.79%, Telcos up 1.04%, and Consumer Discretionary up 1.20%. The Aussie dollar has taken a hit down 0.72% to 66.47c as the greenback strengthens.

--- end of excerpt ---

Source: Saturday morning email from MarcusToday.

So, swings and roundabouts. Gold up. Banks down. US market was up for the week, ASX was down, but not by much. Plenty to worry about, as always. SNAFU!