TSK

TSK

FY23 Results

Pinned straw:

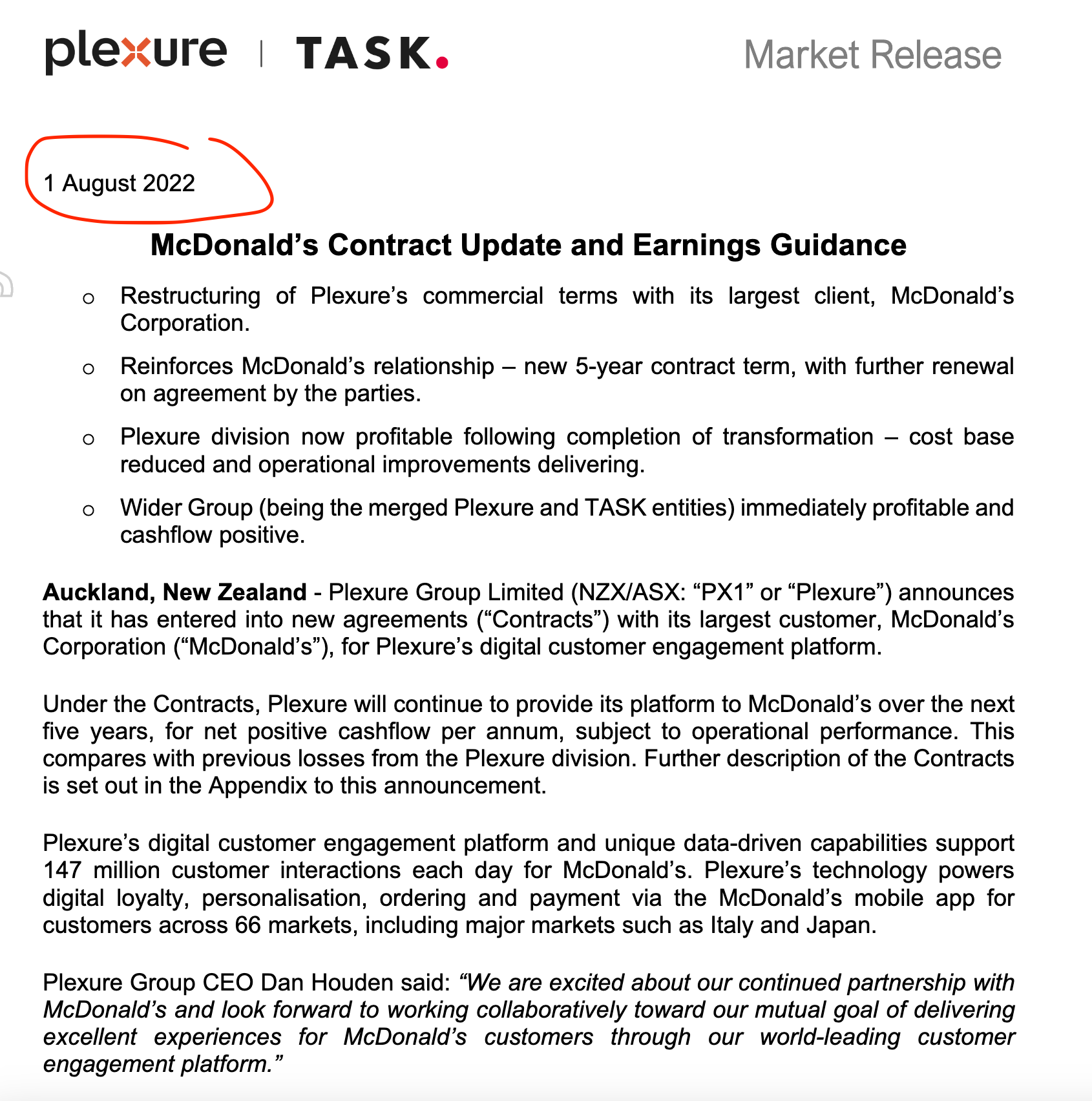

It's a weird one @mushroompanda! As you pointed out on Twitter the original McDonald's restructured contract was extremely light on details. Almost suspiciously so...

https://announcements.asx.com.au/asxpdf/20220801/pdf/45cf1wwx32053h.pdf

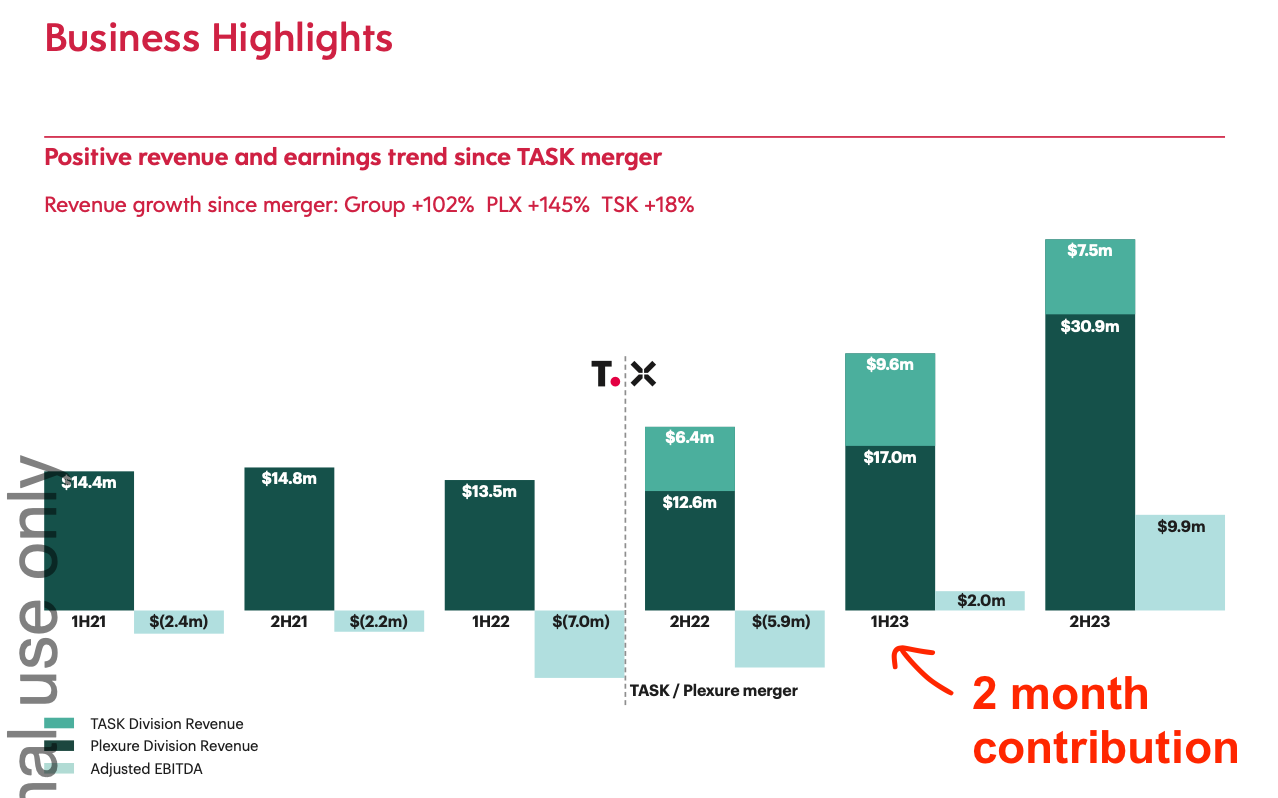

It looks reasonable value on the current numbers but without another Macca's restructure growth appears very muted with Task going backwards half on half.

21