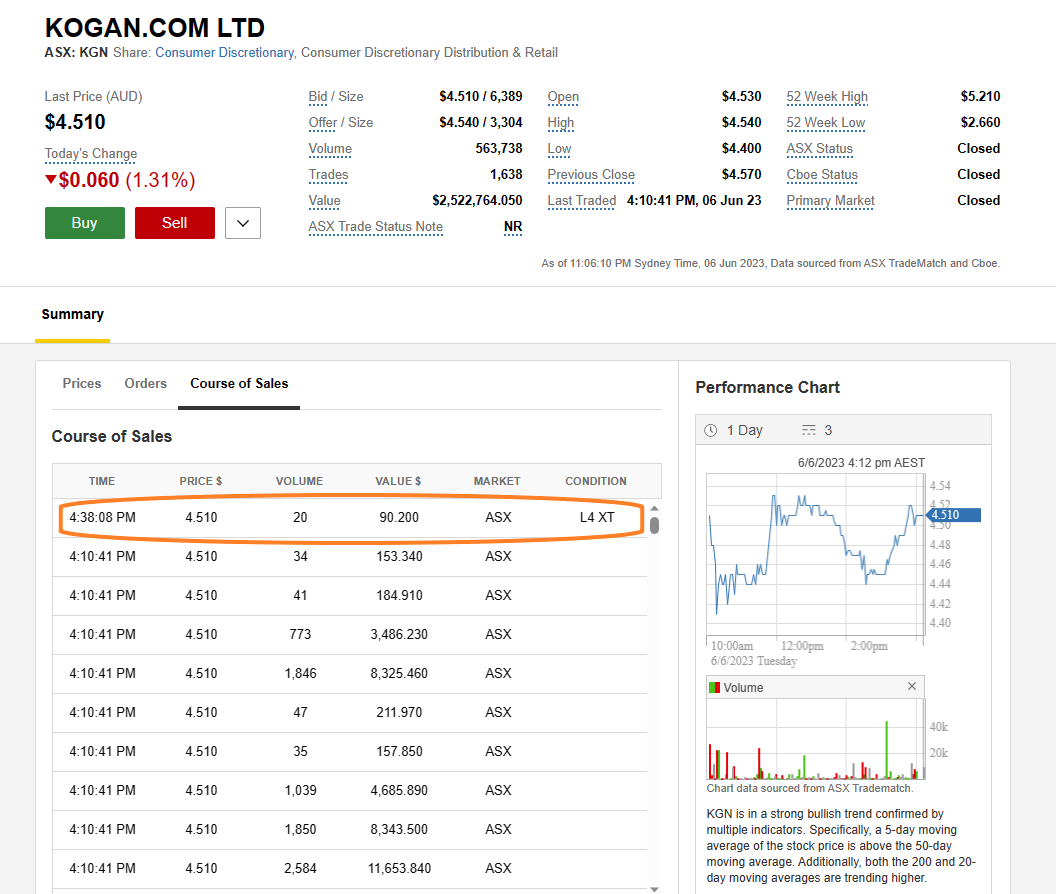

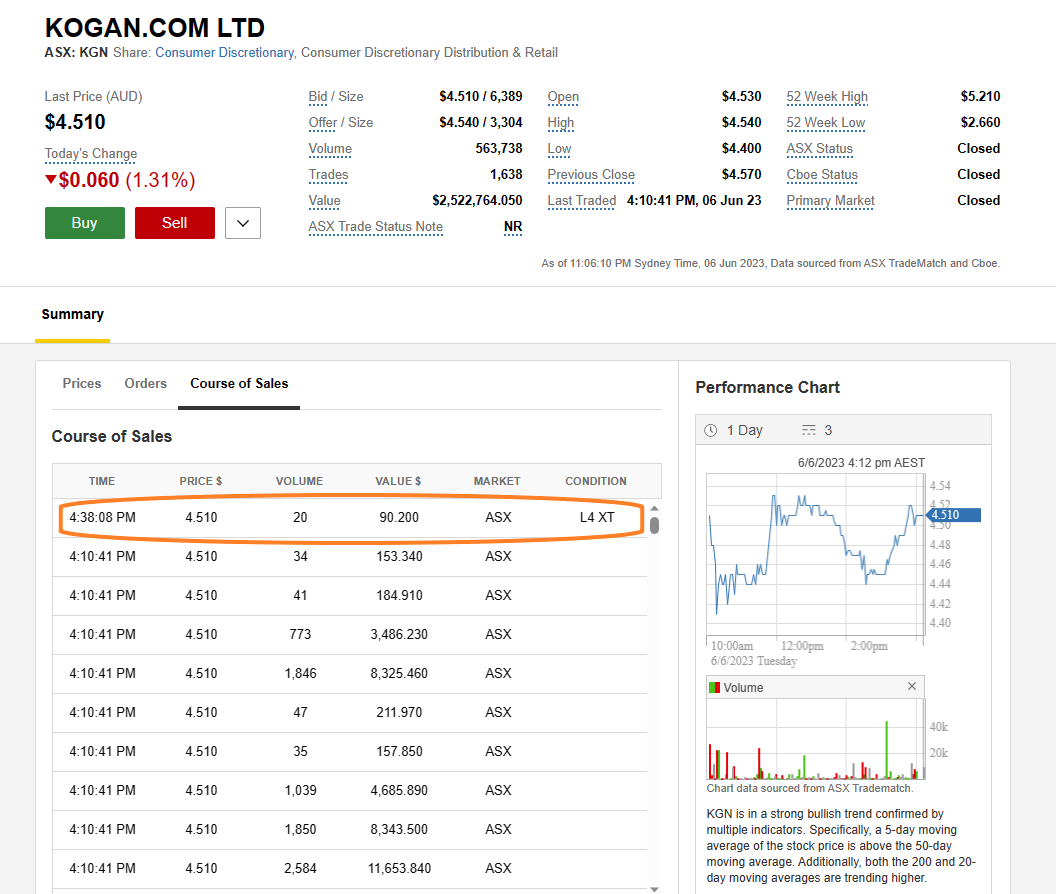

Not sure what you're refering to there @Saiton - here's how they ended the day:

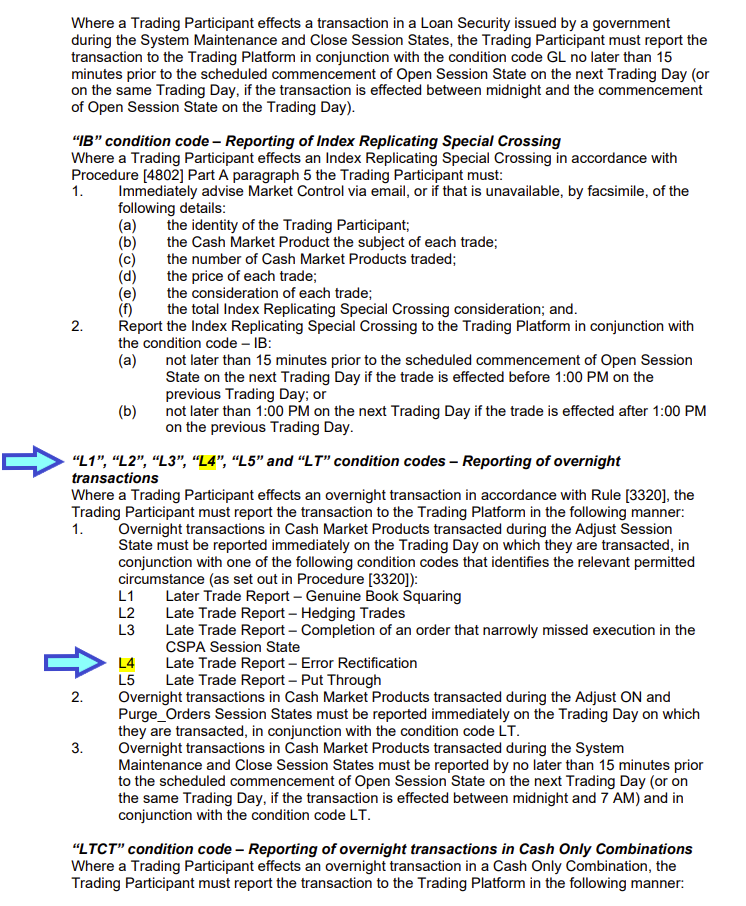

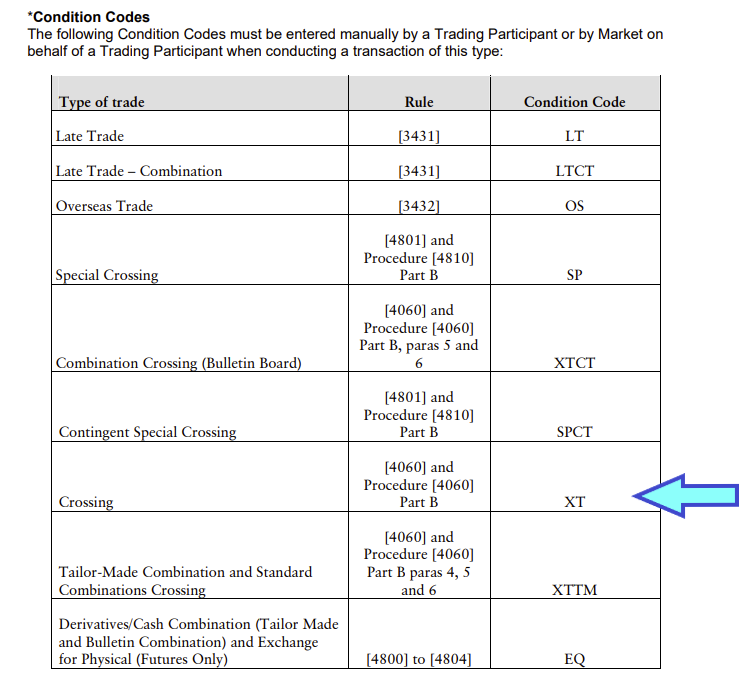

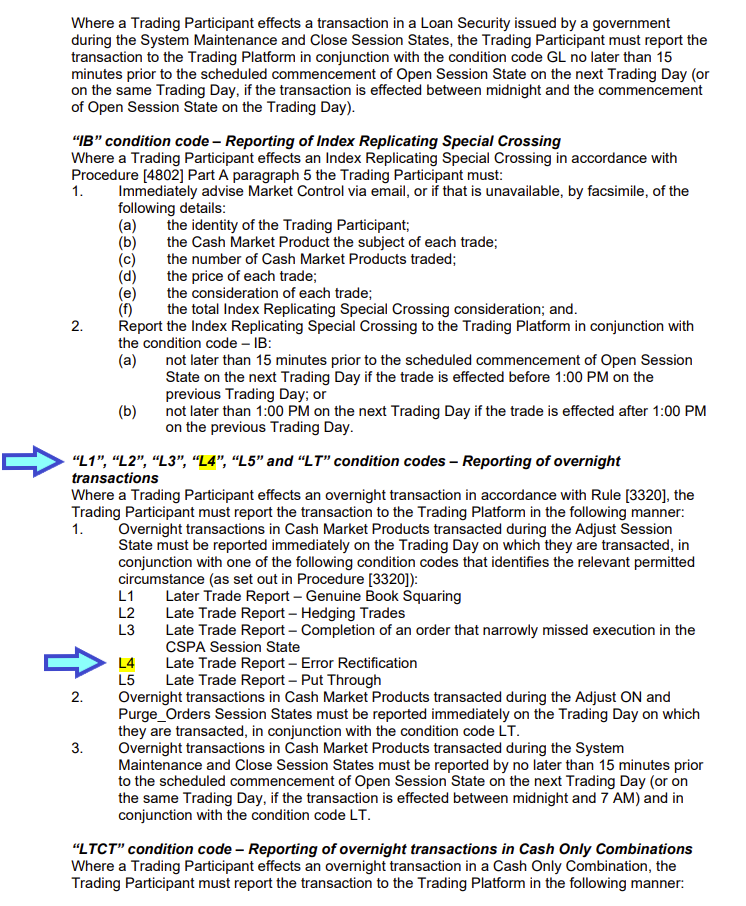

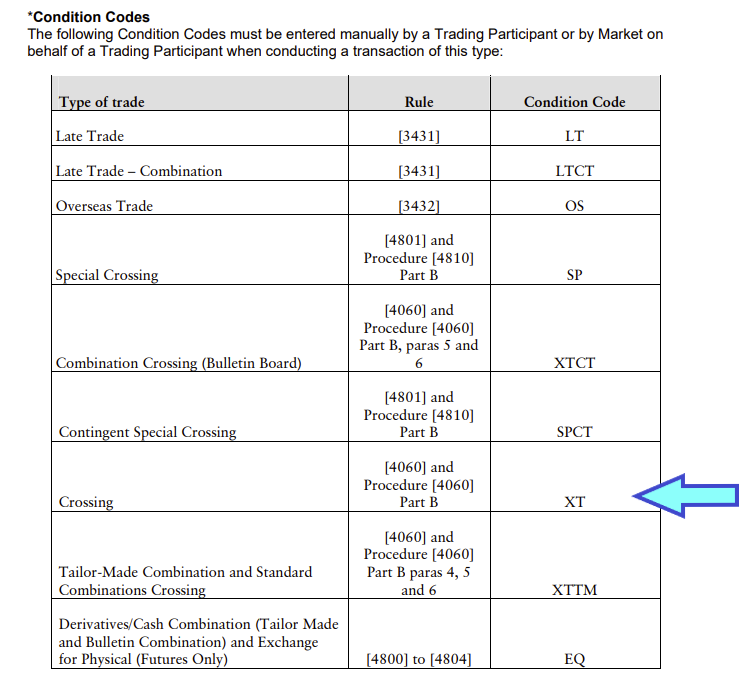

All of the 4:10pm trades (and there were more than those displayed there) were the ones that settled at the end of the ASX's Closing Single Price Auction (CSPA) (see here for details of how that works) and that's why they all settled at the same price, which was the closing price for the day ($4.51). There was also another small trade (worth just $90 and 20 cents) put through at 4:38pm (which I've highlighted in orange above), which was an L4 (error fix) and a crossing trade (or cross trade) as indicated by the "XT". A cross trade occurs when a broker executes an order to buy and sell the same security at the same time, in which the buyer and seller are both clients of the same broker. This can happen to any of us at any time. A cross trade is represented by XT in the course of sales. If your order has been cross traded, your contract note will state this. The L4 code is explained here:

Source: https://www.asx.com.au/documents/rules/Draft_ASX_Operating_Rules_procedures.pdf [the above can be found on page 20]

Those "L" codes apply to overnight or "Late" trades, i.e. trades processed outside of the normal ASX market operating hours.

There's also this:

[Page 28 of the above "ASX Operating Rules and Procedures" document]

See also: https://www.commsec.com.au/support/help-centre/placing-a-trade/what-do-cx-cxxt-and-nxxt-mean.html

Otherwise, Kogan didn't do anything special today that I could see - from a share price perspective - they traded in a range between $4.40 and $4.54/share with an open of $4.53 and a close of $4.51, being 6 cents lower than the $4.57 they closed at yesterday.

In terms of how they've been trading this year...

That looks OK, as in some form of pennant forming I suppose, with a possible breakout to the upside well overdue, however it seems to me that every time they get up to this $4.50 level, they fall away again (resistance?), but I guess it's making higher lows each time - which is positive.

However, the three year chart tells a different story:

Can't say that looks very bullish to me... They look like a dog that has already had its day. And the trade volume has been declining as well, so less people are interested.

My own opinion is that Kogan was a pioneer of 100% online retailing here in Australia, and they had first mover advantage, and they did well for a time, but I don't see that they've got any significant competitive advantages any more. No moat now. Way too much competition - from Australian companies and US companies and Chinese companies and - from everywhere! Most of them will give you free shipping too. And having been a past customer of Kogan - I ended up hating them due to the amount of spam they were sending to me trying to sell more and more stuff to me - so I blocked them and won't buy anything from them again. I also found their "100% online instruction manuals" policy was problematic - on more than one occasion, but that's getting into the weeds now. They may rise again, but then again, they may also fall again.