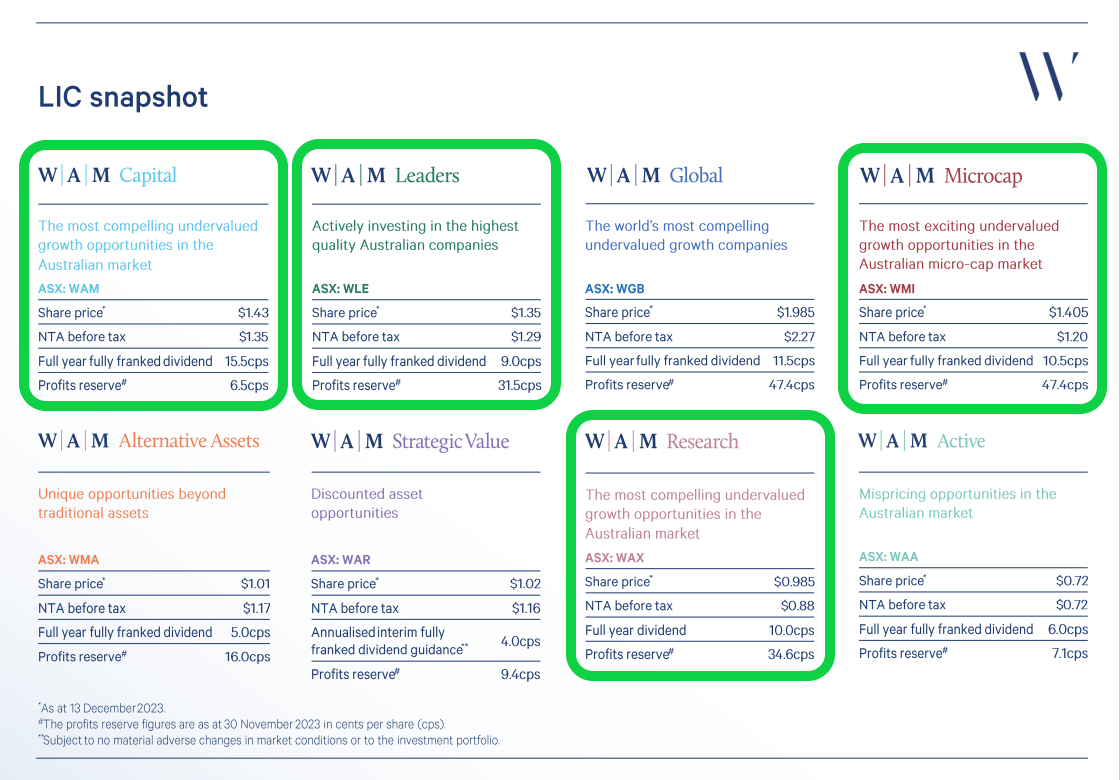

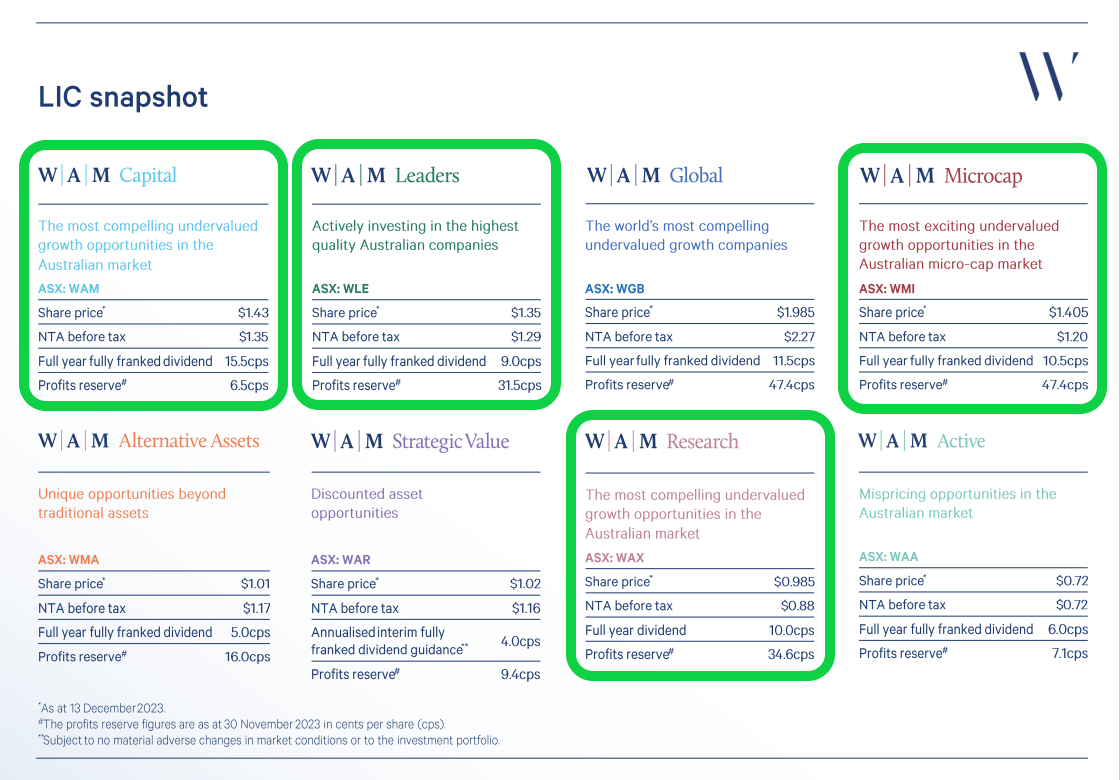

Half of them do trade at a premium @TycoonTerry - which I've highlighted below in green:

Source: WAM-Funds-November-2023-Investment-Update.PDF

So the premiums in the share price of WAX and WMI continue to remain stubbornly high, although they have reduced somewhat from the 30%+ levels they were at earlier in the year and in previous years, however over recent years WAX and WMI have also been among the best performing LICs of the eight, as evidenced by their high profit reserves which have 3 years and 4 years (respectively) of dividends covered (as do Leaders [WLE] and Global [WGB] who also have 3 & 4 years of divs covered), even if the dividends continue to be slowly increased as they almost always are with those two (Research and Microcap - WAX and WMI). WMI's divs have increased in 4 out of the past 5 years, and WAX's divs have increased every year for the past 15 years - so since 2008, see here: WAM Research Limited (ASX:WAX) - Dividends - Intelligent Investor and here: WAX-2023-Annual-General-Meeting-Chairman's-Address.PDF [see graph of divs on page 3]. In that respect WAM Research has been outstanding - pity they've run out of franking credits now... And that they're still trading at a premium to NTA...

Interestingly, in that WAX AGM Chairman's Address they said the following:

Outlook

The last two years have been difficult for investors in small-cap companies with the S&P/ASX Small Ordinaries Accumulation Index underperforming the S&P/ASX All Ordinaries Accumulation Index by 20.7%. Interestingly, in the United States, valuations of small-cap companies versus large-cap companies are also trading at multi-decade lows, highlighting that this phenomenon is not limited to Australia.

Over the last 25 years we have seen many periods where small-cap companies have underperformed the broader equity market. Examples of this include the dot com era from 2000 to 2002 and the global financial crisis from 2008 to 2009. These cycles are common, and while it has been a tough period for investing in small-cap companies, we believe the current cycle is coming to an end and the headwinds that we have witnessed can turn into tailwinds over the coming years.

Pleasingly, there are signs that this period of underperformance is coming to an end and we are seeing many buying opportunities from companies across an array of sectors that have been significantly impacted by the prevailing uncertain macroeconomic environment. The June 2023 quarter represented the first quarter since September 2021 where the S&P/ASX Small Industrials Accumulation Index outperformed the S&P/ASX All Ordinaries Accumulation Index. We believe we are approaching the end of the tightening cycle by global central banks and will soon enter an earnings downgrade cycle as we enter a recession. While this may seem contrary to earlier comments, we note that equity markets traditionally move 12 to 18 months in advance of earnings rebounding. After a challenging two years, we see a brighter period ahead for undervalued growth companies with a catalyst. We continue to maintain a flexible cash position to ensure we can benefit from share price volatility and take advantage of valuation anomalies, while monitoring the heightened geopolitical risk and its impact on investor sentiment in the short term.

Listed investment companies sector

Recently the listed investment company (LIC) and listed investment trust (LIT) sector has experienced a challenging period as investors sought the perceived safe haven of term deposits and cash amid a volatile equity market. The yield on fixed interest and bonds has surpassed the average dividend yield for the Australian equity market for the first time in nearly 12 years, causing share price premiums to net tangible assets (NTA) to contract and discounts to widen.

The LIC and LIT sector has experienced numerous cycles of expansion and contraction since the first listing in 1868 in London.

During 2002 / 2003 the Australian LIC sector experienced significant growth which was followed by a period of consolidation. After the levelling of the playing field with the Future of Financial Advice (FOFA) reforms in 2012 the sector expanded significantly from 51 LICs and LITs in 2013 to a peak of 114 in 2018.

Recently a number of LICs and LITs have resorted to restructuring to open-ended managed funds or active exchange-traded funds (ETFs) with 24 LICs and LITs departing the sector since the peak in 2018. While we expect further consolidation in the coming years with LICs and LITs that have underperformed, or failed to properly engage with shareholders, choosing to or being forced into restructure, the sector will emerge from this period of consolidation stronger with a solid platform for growth.

--- end of excerpt ---

Source: WAX-2023-Annual-General-Meeting-Chairman's-Address.PDF [from pages 1 and 2]

That's a bit of a reality check as well as some positive spin along the lines of, "...this too shall pass..."

There is also some commentary on subsequent pages warning about their franking credit situation - they (WAX) didn't have enough franking credits to fully frank their last dividend - it was only 60% franked. They said:

The Company’s ability to continue paying franked dividends is dependent on the future franked dividends received from investee companies held within the WAM Research investment portfolio, and future tax paid on realised profits generated by the investment portfolio. In FY2024, it is anticipated that the franked dividends received from investee companies in the investment portfolio will generate franking to fully frank approximately 2.0 cents per share in a dividend for shareholders and any additional franking would need to be generated through the payment of tax on profits.

--- end of excerpt ---

2 cps is only 20% of the 10 cps that WAX paid in divs in FY23, so without tax credits for tax paid on trading profits, future WAX divs could be as low as 20% franked. Again, reason for the premium to close because the income stream is worth less to those who can make full use of franking credits like Australian-resident self-funded retirees - or most Australian retired people really - which is WAM Funds' main demographic. In truth, most of us can use and do appreciate franking credits, and we prefer fully franked divs to partially franked or unfranked divs.

And... back to WAM Capital (WAM.asx) and their SP's smaller premium to NAV, or to NTA as LICs like to call it, a premium which is defying logic or is counter-intuitive in my opinion because I believe the WAM Capital dividend is not sustainable and has looked unsustainable for at least 18 months so far, and something has to give, sooner or later. They have stubbornly maintained the same dividend every year since 2018 despite having next to nothing in their profit reserve (PR) - they currently have just 6.5 cps (cents per share) in their WAM PR (as at Nov 30) and that won't even cover the next half yearly dividend (their FY24 interim div for the period ending December 31, 2023, i.e. the end of this month, usually paid in May or June) if it is maintained at 7.75 cps, let alone covering a whole year of dividends (which would be 15.5 cps) - no chance - not without further trading profits.

If and when WAM Capital (WAM) either reduce or suspend their dividends I believe we are likely to see a big market re-rating of WAM - and not a positive one either - and it could spread across to their other LICS as well seeing as WAM Capital is their flagship fund - no longer their largest, but their first/oldest LIC and the one that their longest-term shareholders have generally held the longest and held the most. Their investors are there out of loyalty partly but mostly because they believe they can rely on that dependable fully franked income stream from WAM Capital, which certainly has NOT lived up to their stated aim/goal of "Providing an increasing stream of fully franked dividends to our shareholders", at least not in the past 5 years, but at least it hasn't gone backwards, yet. If they continue to pay 7.75 cps fully franked every six months despite the fund earning less than that after fees, it's going to be interesting to see how they try to justify that seeing as they have repeatedly said that the dividends come from the profit reserves and are limited by the profit reserves (and their respective franking credit balances).

Mind you, despite being the champion of the Aussie LIC sector for a couple of decades, Geoff Wilson is not above the odd U-turn, or mind change. He used to lecture people about always comparing fund returns on an AFTER fee basis, and that any fund manager reporting fund results only on a pre-fee basis was being dishonest with and direspecting their own shareholders, and then a few years ago he quietly switched to providing his own funds' results on a before fee basis instead of after fees. He has also very recently launched an open-ended version of their closed-end WAM Leaders (WLE) LIC, despite preaching for years about the many advantages that closed end funds have over open ended funds.

But WAM Capital desperately needs some trading profits locked in or they won't have the money in their PR to maintain the current dividend. That's the main problem with WAM Capital - lack of performance and an almost empty profit reserve.

Back to those fund snapshots above. WLE has been trading at small to moderate NTA premiums throughout CY2023, and has fluctuated between small NTA premiums and small NTA discounts in prior years, however their premiums have not approached the larger premiums we have seen with WAX and WMI - and formerly WAM as well where premiums in the high twenties and thirties were the norm. I have posted straws or forum posts here on this before - about why somebody would pay a 37% or 38% premium to the underlying value of the portfolio of shares held by a fund - those being about as high as I've seen the premiums get to in the past few years. They're lower than that now for sure.

I certainly wouldn't be buying shares at those premiums to NTA, no matter how good they were, not unless there was a catalyst coming that was almost certainly going to drive the share price even higher. And even then, it's a high risk play, because any false move or sustained underperformance by the manager and the premiums can reduce or even evaporate fairly quickly, or they have done with other LICs such as Cadence Capital (CDM) and Djerriwarrh Investments (DJW) at various points. Both traded at significant premiums in prior years and now both trade at discounts to their respective NTAs.

Back to the snapshot above again - WAA and WAR both trade at significant discounts to their NTA, and WAA fluctuates between discounts and premiums and is currently trading at or very close to NTA - the snapshot above says their SP on 13th December and their before tax NTA on 30th November were both 72 cps. WAM Global (WGB) continues to trade at a persistent discount to NTA as all globally-focussed LICs and LITs here in Australia seem to do. It appears that most Australians prefer to get their overseas market exposure via ETFs, not via managed funds with much higher fee structures and patchy/lumpy results. That said, I think Catriona Burns and her team at WGB have done an excellent job so far, and WGB actually pay a decent (high) fully franked dividend yield for a LIC that only invests in overseas listed companies. Not only have they raised their dividends every year, their dividends have been 100% franked which ain't easy when they are investing in overseas companies that either pay no dividends or low dividends, and there are NO franking credits - that's an Australian thing - so the franking credits that WGB have been able to accumulate have all come from paying tax here in Australia on trading profits from their investments in companies that are listed overseas, which is not an easy thing to maintain, but they have. But I still don't expect them to be trading at an NTA premium any time soon, despite that excellent performance - it's just unlikely because of who they are and what they invest in - the NTA discounts seem to come with the territory with these globally focussed LICs.

Of all eight of Wilson's LICs, I currently like WGB best by a country mile. Probably WLE second. WAX third. WMA fourth. WMI fifth. Not interested in WAA, WAM or WAR.

That said, I'm happy to be completely out of LICs, LITs and all open and closed end funds, indeed all managed funds at this point and also having no exposure to fund managers. It certainly helps me to keep track of exactly what my portfolios are exposed to at any given time. The last LIC I sold out of was SNC (Sandon Capital, a LIC with an activist investment strategy) in October just before they went ex-div (the day before actually), which usually provides good exit points from these things, because they often drop by more than the grossed up value of the dividends when they go ex-div, which I imagine is due to some punters wanting to exit but waiting until they qualify for the div before they jump ship. We wanted to exit SNC at that point because of their exposure to MFG (which they hold in their portfolio) as the MFG share price had just fallen by over 20% at the time and SNC only do monthly NTA updates so we figured it was going to be a negative month for them (it was) - they also hold Fleetwood (FWD) who have been in a strong downtrend since mid-July, falling by over -36% from $2.36/share to around $1.50/share now - Fleetwood also had a bad October contributing further to SNC's NTA decline. I was also personally concerned with SNC's exposure to Nuix (NXL) who Gabriel Radzyminski believes are a deep value play now. He has had mixed results from his activist strategies, some clear wins like when Iluka (ILU) finally capitulated and spun their MAC royalty out into DRR (Deterra Royalties), but lately things have not been going to plan so much, and the SNC share price has been going down along with their NTA. I would now rather read his monthly reports and choose what exposures I want for my own portfolios than allow him to invest a portion of my investable funds in companies I am not entirely comfortable having exposure to. And that's the risk with LICs. They are investing your money for you and your only choice with respect to those investments is to stick with them or to exit.

As you say @TycoonTerry - it's been a positive experience to cut that lot loose over time and to now be totally free of that exposure for the foreseeable future. And have a clearer understanding of exactly what companies and sectors my investment portfolios are exposed to at all times.