Within minites of the DDH1 board announcing the Perenti acquisition agreement (26 June) the DDH1 share price reached a high of 92 cps before beginning to plummet. Four days later (30th June) the share price closed at 82.5 cps, which was even lower than the share price the day before the acquisition announcement.

The share price seemed to defy the views of both the DDH1 and Petenti Boards who suggested the combined business would create value for both DDH and PRN shareholders. DDH1 shares were said to have an implied value of $1.01 (a premium of 17.4%) based on the 5-day VWAP. The valuation was based on a cash payment of 12.38 cps plus 0.7111 shares in PRN for each DDH share held. So the DDH share price is now closely linked to the PRN share price due to the script heavy acquisition.

I did not expect the share price of both businesses to plummet and I have been trying to work out why. I think the reason for the sell down could be due to private equity firm Oaktree selling down borrowed shares in Perenti. While I’m not certain of this, it does look very suspicious. I guess the reason will become apparent.

I’ve learnt an important lesson this year. Be wary of businesses that have been floated by private equity and where they continue to retain a large stake in the business after listing. Private equity is there for a good time, not a long time! They are always waiting for an opportunity to exit and maximise their profits. Once they have made their money they are ready to move on to their next plaything, even though the business might be well undervalued. They have the capacity to create share price momentum in the wrong direction because they are not buyers, they are sellers! Something I have experience with both Best & Less and DDH1 this year.

Oaktree have been chomping at the bit to exit DDH1 since it listed (see AFR article below). I suspect Oaktree have been very supportive of the deal with Perenti as they see it as an opportunity to exit DDH1 and maximise profits in a year when earnings for DDH1 have been impacted by the wet weather and a slow start to 2H FY2023.

Their are a few things that point to Oaktree’s early exit on the DDH1 acquisition agreement:

- Perenti’s call option for 80,178,575 shares in DDH1 currently owned by Oaktree

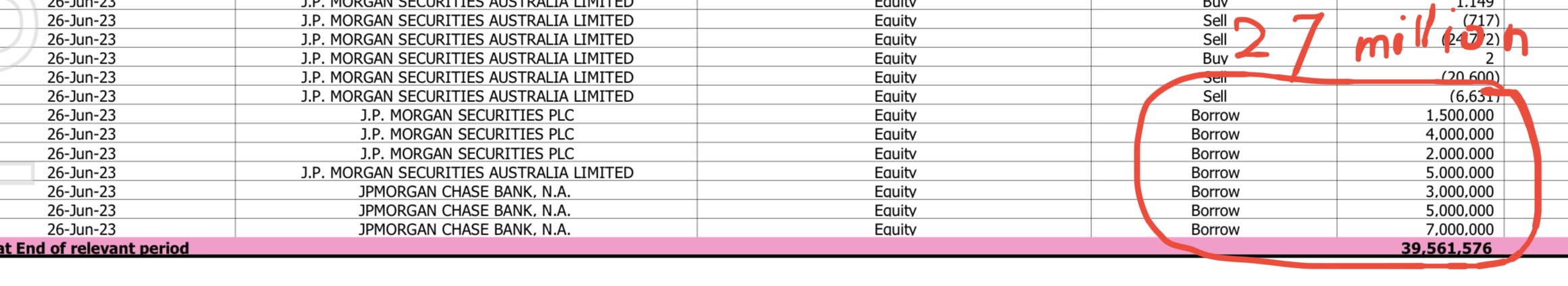

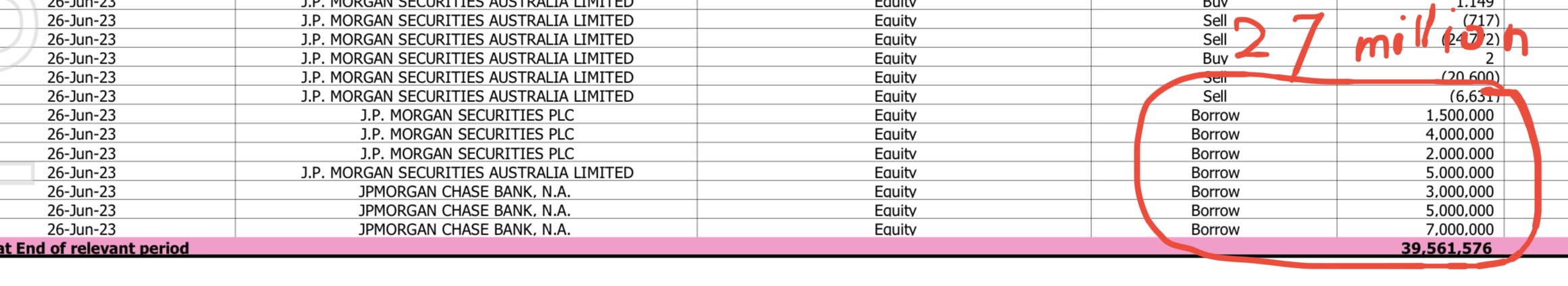

- JPMorgan Chase borrowed 27.5 million shares in PRN on 26 June.

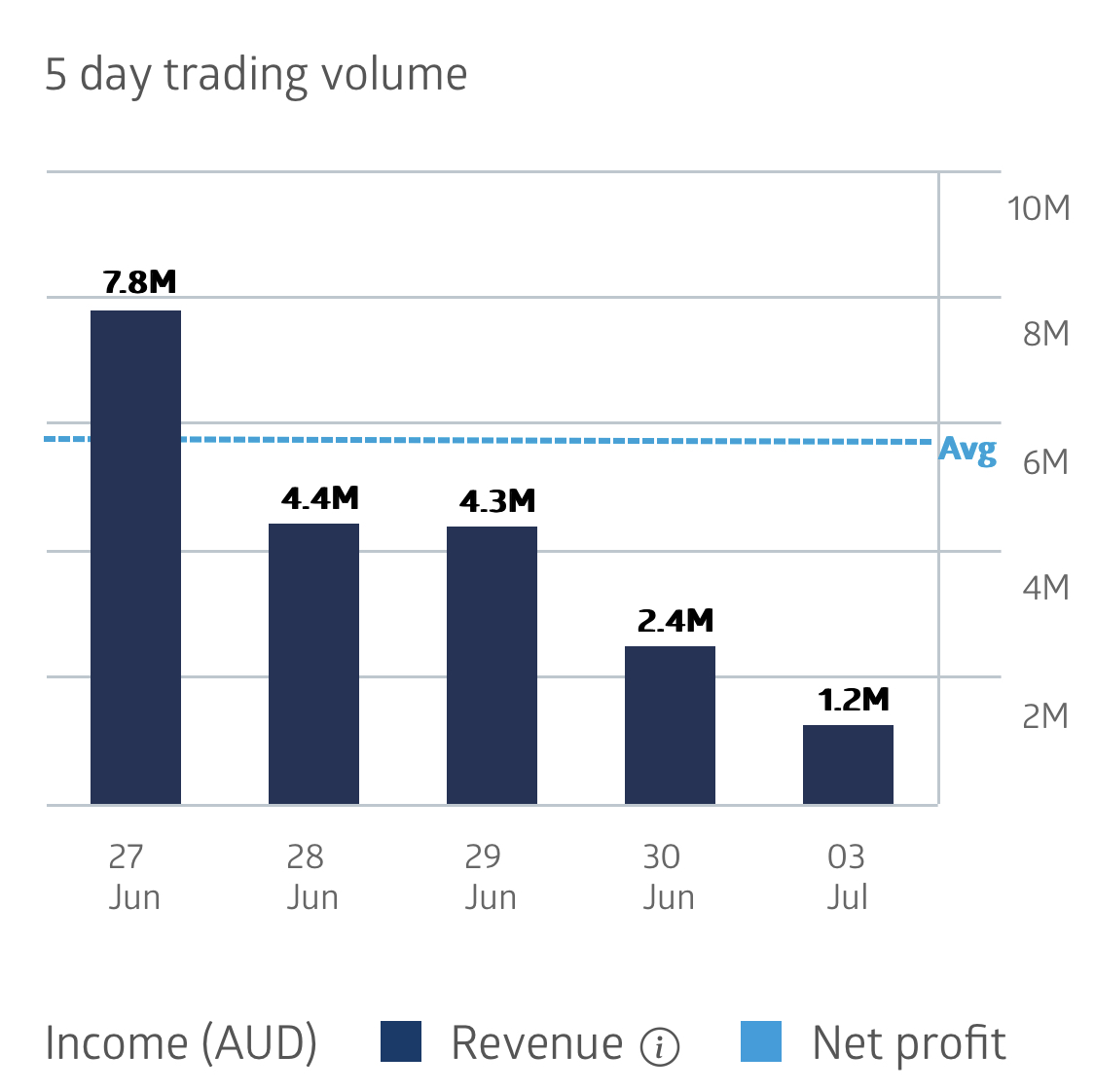

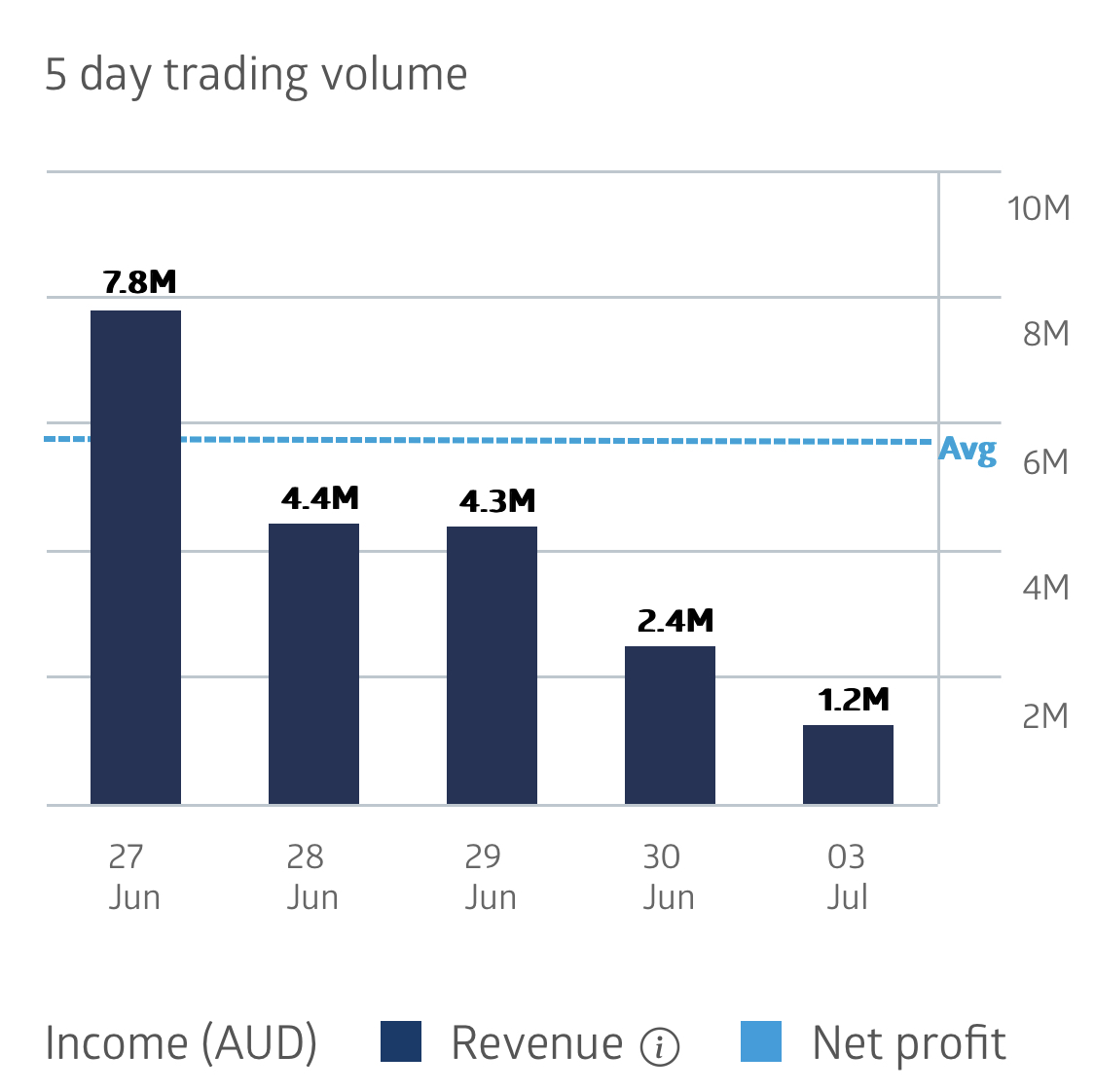

I suspect the 27.5 million PRN shares were borrowed to sell when the PRN share was close to a 12 month high of $1.29 per share. I don’t know if these shares were borrowed for Oaktree, but it looks suspicious given the heavy sell down (19 million) of shares over the four days following the announcement (ASX 5 day trading volume chart below).

The big sell down is also at odds with recent director buying (Timothy Longstaff bought 43,500 shares on-market for $50, 014).

Thankfully the selling has tapered off today and the PRN share price is up 6% at time of writing.

Disc: Held IRL and SM.

Oaktree’s white flag indicative of a life on the ASX

(AFR, 26 June 2023)

Oaktree Capital’s DDH1 joins the growing list of PE playthings to be snapped off the ASX. It shows the bourse is often just a temporary home.

It’s one thing putting a private equity investment together, it’s another finding an exit. And it’s the latter that’s the harder part, particularly with IPO markets either closed or suspicious of new listings.

Oaktree Capital did well investing in West Australian driller DDH1, taking a 50 per cent stake in June 2017 soon after the American firm formally set up in Australia by opening an office in Sydney.

The exit’s been a longer journey but can be consigned to Australian deals history as part IPO/part buyout, an increasingly common exit route for private equity sellers. The ASX boards are often just a temporary home for private equity-backed businesses such as DDH1.

Oaktree’s involvement in DDH1 stretches back six years. DDH1 was the leading provider of directional diamond core drilling services – used to extract core rock samples in gold and base metals – and went looking for a deep-pocketed backer to help it expand into other drilling disciplines.

Oaktree took the bait and invested for a half share in June 2017. It backed the “platform” strategy and DDH1 added Strike Drilling in June 2018 and Ranger Drilling in April 2019. Strike was an air core and reverse circulation driller used by exploration companies mostly in WA, while Ranger was a reverse circulation driller serving the Pilbara iron ore industry. With more rigs and more customers, the combined group was bigger and potentially more valuable than the three businesses operating alone.

By December 2020, DDH1 had 96 drill rigs and made most of its money drilling at producing mines or helping with brownfield expansion in WA. Servicing the gold sector accounted for half of its revenue in 2020.

The exit was planned at about the same time, when DDH1 set course for an IPO. It met with fund managers and eventually raised $150 million to list with a $367.5 million enterprise value in March 2021. The deal didn’t fly out the door, but had a big cast of stockbrokers to drum up buyers.

The IPO was a partial exit for Oaktree. The pre-float investors, which included Oaktree, took a combined $109 million off the table and retained a combined 60 per cent stake. About one-third of that (22 per cent of the company) was in Oaktree’s hands, locked up under voluntary escrow.

But listed life proved to be a bit of a slog. DDH1’s revenue and earnings grew strongly, but its share price did not. The stock listed at $1.10 a share, traded down straight away and has spent most of its time below the $1.10 mark in the two years and three months since.

DDH1 was either too small and too illiquid for fund managers (it is not in the S&P/ASX 300), left behind by the market’s flight to bigger and more liquid stocks, or not diverse enough in its revenue base, depending on who you ask. Investors did not reward it for beating its prospectus forecasts, or its acquisition of Swick Mining Services in early 2022.

DDH1 could also not escape the fact that drilling is a bit of a punt for Australian small-cap fund managers, with fundies trading in and out of the likes of Ausdrill (now Perenti) and Boart Longyear for years as a means to play the mining cycle. They see them as boom and bust stocks that you want to own in the boom times.

The other problem was Oaktree’s retained stake, with institutions a bit put off by the potential for a chunky selldown. That’s life on the ASX boards. Oaktree tried to address those concerns last year, while sell-side analysts continually pointed to DDH1’s big discount to its closest listed peer, Canada’s Major Drilling Group.

While the discount is still big – Major Drilling last traded at 5.2 times forecast EBITDA and 12.4 times earnings per share versus DDH1 at 2.7 times EBITDA and 6.3 times earnings per share – Oaktree and DDH1’s board and founder shareholders have called time on life as a separately listed company. It was the best of a bunch of potential deals studied, DDH1 chief executive Sy van Dyk said on Monday, and a way to fix the aforementioned problems.

Oaktree offered options over its 19.99 per cent stake to Perenti as a form of deal protection, proving it’s keen to see the transaction take place.

The scrip-heavy deal valued MA Moelis-advised DDH1 at a 17.4 per cent premium to the five-day volume weighted average price. Oaktree is expected to own 5.7 per cent of the combined group, while the wider DDH1 shareholder base will own 29 per cent stake of Perenti.

UBS-advised Perenti and DDH1 fronted shareholders and analysts on a call on Monday morning. Their pitch was about synergies and creating the biggest ASX-listed mining services play by market capitalisation and a company that could potentially be included in the all-important S&P/ASX 200. Both companies’ CEOs said the early reaction was positive.

The combined market capitalisation is $1.3 billion, which is astonishingly small for the title of Australia’s biggest listed mining services play, given the size of the mining sector and the miners’ appetite for drillers, mining contractors and the like. NRW Holdings is the No. 1 listed mining services group today with a $1.1 billion market capitalisation.

As for Oaktree, it will no longer have a seat on the mining services group’s board. It is not technically gone, but is clearly on the outer. That Oaktree overhang will become Perenti’s problem.

The situation is just another in a growing list of former PE-backed IPOs sold to a trade or financial buyer within only a few years of listing. Others include Healthscope, Spotless Group, MYOB, Asaleo Care, Cover-More, Pepper, Veda, Virtus Health, Scottish Pacific, APN Outdoor and Vitaco. Others in the pipeline include Silk Laser Clinics and Estia Health, both under offer from potential acquirers.

Each has their own reasons, but at the end of the day it’s all about value.

That list says IPOs may help create exits or partial exits for private equity owners, but the floats themselves do not always set the company up for its long-term future. Often the ASX boards are just a temporary home until stars align for a strategic buyer or a new cashed-up private equity player to try to make its own pot of money.

ENDS.