$M7T reported their 4C today and I attended the investor call.

Their Highlights

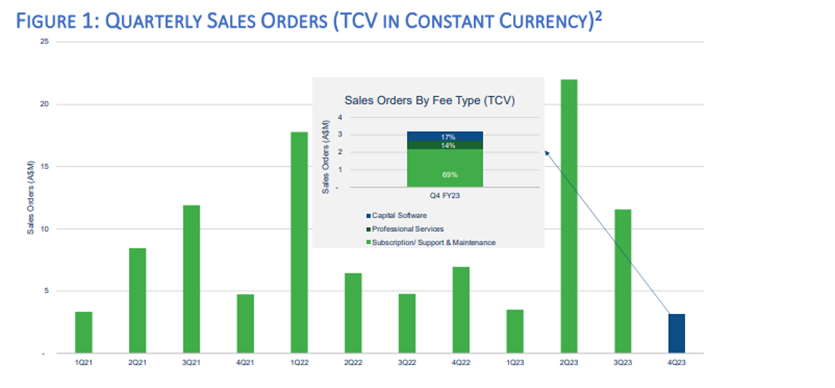

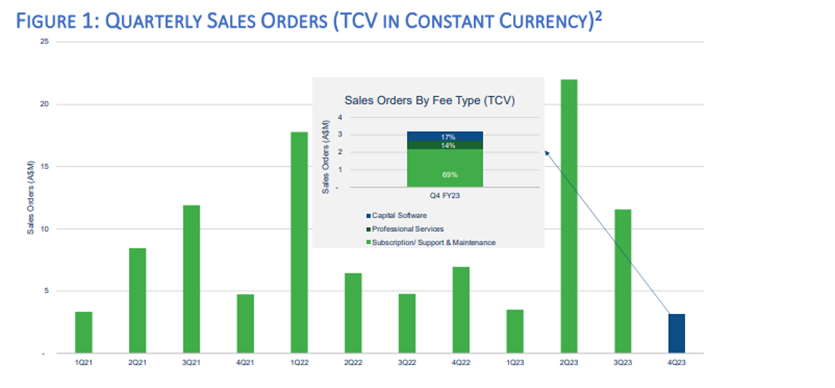

- Q4 FY23 sales orders of A$3.2M (TCV ) bringing FY23 sales orders to A$40.3M, up 21% on FY22 and exceeding FY23 target of A$36M

- Contracted Annual Recurring Revenue (CARR) steady at A$20.6M as of June 2023

- Annual Recurring Revenue (ARR) run rate largely unchanged at A$17.0M as of June 2023

- A$23.4M cash on hand at Friday, 30 June 2023 plus customer’s A$2.5M electronic payment advice bringing cash on hand to A$25.9M at Monday, 3 July 2023; (A$19.4M at 31 Mar 2023)

- Management restructure elevates David Madaffri to COO; confirms Dyan O’Herne as CFO

- Strong start to Q1 FY24 with over A$15.4M TCV of sales orders secured

My Analysis& Observations from the Investor Call

Contracts

Overall, it was a soft Q for $M7T contract wins but quite strong from a CF perspective. Recent SP advance has been due to announcements made following the close of the reporting period of the Phase 1 of the Veterans Health Administration (VHA) contract (A$11.7m) and the Diagnostic Imaging Associates a$3.7m 5-year contract.

The chart below shows the lumpiness of $M7T’s contract wins and, I suspect, this morning’s 11% SP drop at time of writing is a response to that, after the kicker following the recent contract win announcements.

It is at this moment that I reflect just how funny the market is. On their own, the individual wins, or periods of few wins, say nothing about the fundamental value of this business. You have to zoom out and look at the bigger picture. (Ok, so I admit to maybe feeling a little $3DP-exit regret. We are all human. But perhaps that case illustrates the same point.)

Looking forward, this lumpy story will continue, because one month in to 1Q FY24, they’ve already contracted for $15.4m, making 1QFY24 already their second strongest 1Q and 3rd strongest Q ever. And there are still 60 days to close more contracts, with America now back to work after the summer holidays!

Mike stated that several of the contracts had seen volume-based revisions. The example he gave was that a customer who has a contract for 100,000 studies per year and hits 105,000 within the period, has to purchase a licence for a further 15%, to take their contract up to 115,000. In this way, organic growth within existing customers drives $M7T revenues. He noted, however, that not all customers are winning, and some of the recent contract revisions has been from customers experiencing reducing volumes.

Cash Flow

Once more, they came close to achieving cash flow neutral for the year, citing a late receipt against the payment schedule of A$2.5m (received on 3 July) meaning they just missed the goal. (Our good friend Claude Walker had a go at Mike asking if they’d missed opportunities to report this earlier, which Mike batted back saying that the payment was expected on time, and was just a few days late. Storm in a teacup, I think, Claude.)

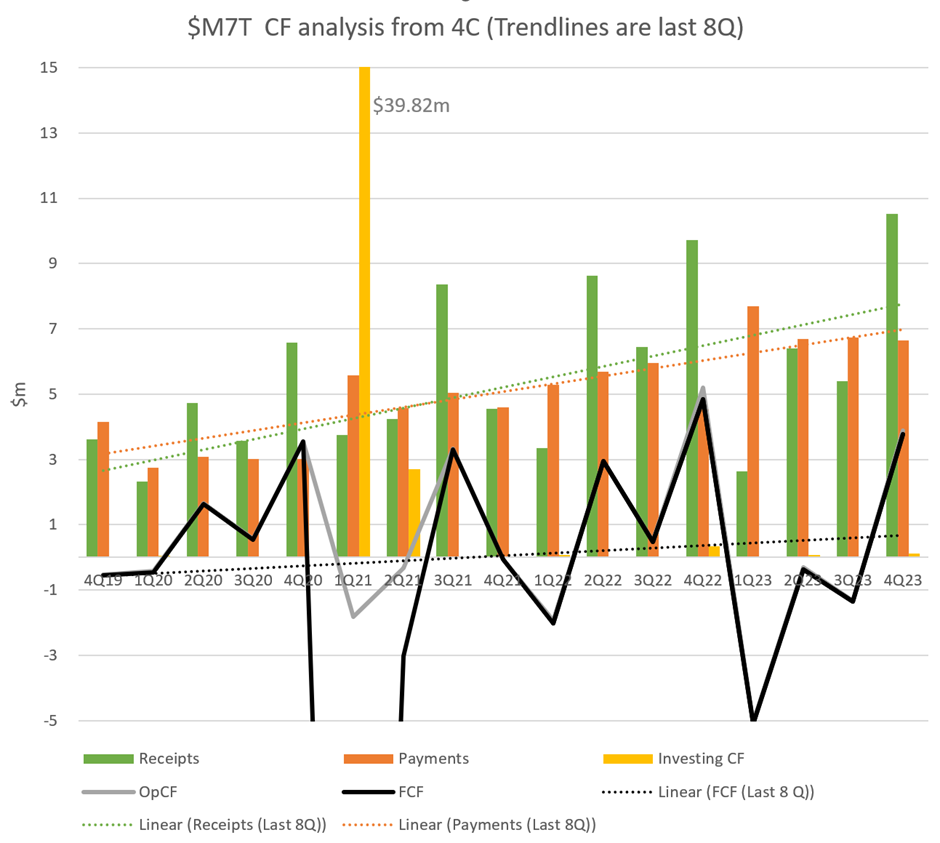

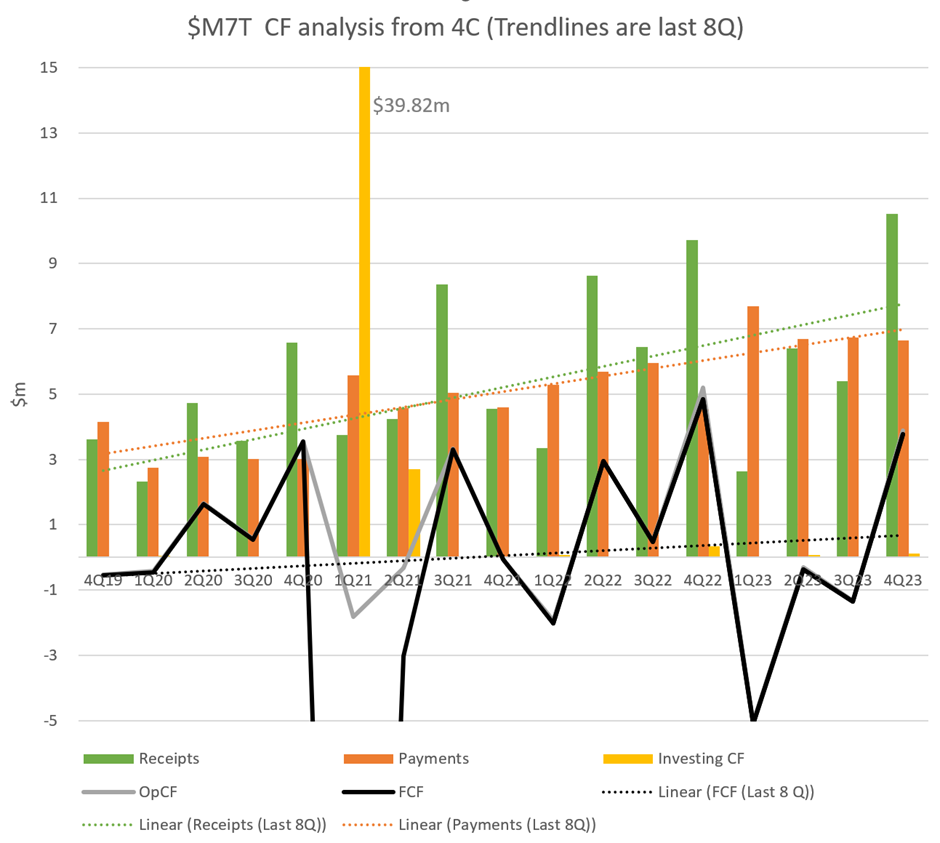

Again, zooming out I plot my usual CF trend analysis, with the trends calculated on the last 8Q.

You can see the favourable trend in OpCF by the clearly different slopes of the Receipts and Payments line. The trend on FCF is also positive, and now in cash generation territory. (Note that the acquisition investments in 2021 are now outside the trend window.)

Outlook

Mike has once again set expectations for FY24 of 20% top line growth. He reported that the sales funnel provides 3X coverage of the target. He also commented that more of the pipeline was for two-product sales, whereas two years ago, the majority was for single products.

There was some discussion about prosects in Asia and Middle East, as these have been discussed previously over the last year with no recent newsflow. Mike confirmed that there were multiple prospects in HK, Singapore and Middle East and that he expected to see more of a contribution here in FY24 than in FY23.

On staffing, costs appear well controlled. Headcount has risen to 96 from 87 a year ago. That’s an increase of 13%, with the top line growing at 20%. In terms of further staff growth, Mike indicated that they are focused on delivering an excellent customer experience and will staff up ahead of demand, to ensure that staff working on deployments have the required product and system knowledge. He said the management are about to meet to finalise FY24 plans. My interpretation is this means that the recent contract wins and, in particular, the transformational VHA contract will require additional staffing.

VHA Contract

The discussion yielded some important insights about the recently announced VHA contract, which has a first phase worth A$11.7m, and a second phase with a potential to increase the TCV to $59.6m, which far exceeds any contract won to date.

- $M7T will integrate products from several providers, covering the prime vendor, IT infrastructure, cloud services and AI analytics. $M7T has undertaken integrations with (at least some of) these vendors before, which lowers execution risk.

- Year 1 will focus on the phase 1 deployment

- Once Phase 1 deployment (and presumably performance) milestones are met, the contract can proceed to Phase 2. This is important, in that Phase 2 does not need to wait until the 3-year term of Phase 1 is completed. Indeed, Mike indicated that Phase 2 could start soon after the successful deployment.

- The VHA NTP program can be opted in to by the many service providers and centres within the VHA. These are autonomous organisations which make their own decisions about PACS procurement. Mike commented that many have legacy PACS that will roll off contract in the coming years, and he believes that with M7T being the exclusive provider to the NTP, then M7T is well-positioned to replace existing PACS at the renewal point. He stated that they were very much focused on doing just that.

- Mike also pointed out that this program could potentially lead to analogous programs in other public health services. He cited the Defense Department and Indian Affairs. Clearly, these would be separate, competitive processes, however if M7T can demonstrate success in the VHA contract, then that would be an important calling card.

Competition

In the Q&A Mike indicated that $M7T (eUnity) and $PME (Visage) were starting to compete for contracts. He explained that Visage started out focused on the radiologists’ work flow, whereas eUnity focused on connecting radiologist and other healthcare professionals outside the walls of the centre with a zero-code solution. Over time, he commented, each has developed the functionality of their product to be able to do more and more of the competitor’s offering.

Market Development

Mike re-iterated a comment made on previous calls that he saw tailwinds in the demand for solution in outpatient (ambulatory) imaging services for which $M7T’s products are advantaged. He cited market research which pointed to this moving from 40:60 (ambulatory:inpatient) to 60:40 (and maybe even 65:35). There are two drivers. First, the staff shortages of radiologists in hospitals is driving more hospitals to have images read externally. The second driver is insurers, as it is cheaper to have radiologist read images outside the hospital.

My Key Take Aways

This quarter was a soft result and, over the last two years, although revenue is growing above the 20% p.a. level (Mike would not be drawn on FY23 Revenue, so we’ll have to wait a few weeks), $M7T has been making slower progress on contract wins within FY23.

This explains today’s negative SP response, bringing the SP back to reality after the euphoria following the two recent contract wins at the start of FY24.

To Mike's credit, he focused the results call on the quarter which was unexciting.He didn't do anything to deflect from that. Inevitably, the Q&A focused much more on the recent contracts and the outlook, which is strong.

I am still on the fence regarding $M7T. For me, the thesis is holding together for three reasons:

· Continuing to grow revenue while managing costs;

· Positive benchmarking with other industry solutions (KLASS customer surveys);

· Periodic news flow on larger contracts (>$2.5m), with VHA a gamechanger.

At a multiple of EV/EBITDA (FY25) of 12x, $M7T is very good value within the sector. The lower multiple is a direct consequence of the more lumpy deal flow and cashflows. Over time, as $M7T grows, this should become less and less of a problem, and earnings quality will improve.

However, as the imaging software space becomes more competitive among the market leaders, it remains an open question whether $M7T can continue to win more of the larger deals. With a strong pipeline of 3x what is needed to grow top line at 20%, FY24 should help answer the question. The VHA deal is, however, a gamechanger. If $M7T can will more of these programmatic deals for large services, then it would certainly deserve a closer look (i.e., a bigger position).

For now, I continue to hold.

Disc: Held in RL (2.0%) and SM