Late yesterday Acrow Formwork released its FY23 results with underlying NPAT at the top of its latest guidance range. Here are the key highlights:

• Record financial results

• NPAT (underlying) up 71% on PCP, EPS (underlying ) up 63% on PCP

• Final dividend of 2.7 cents, fully franked

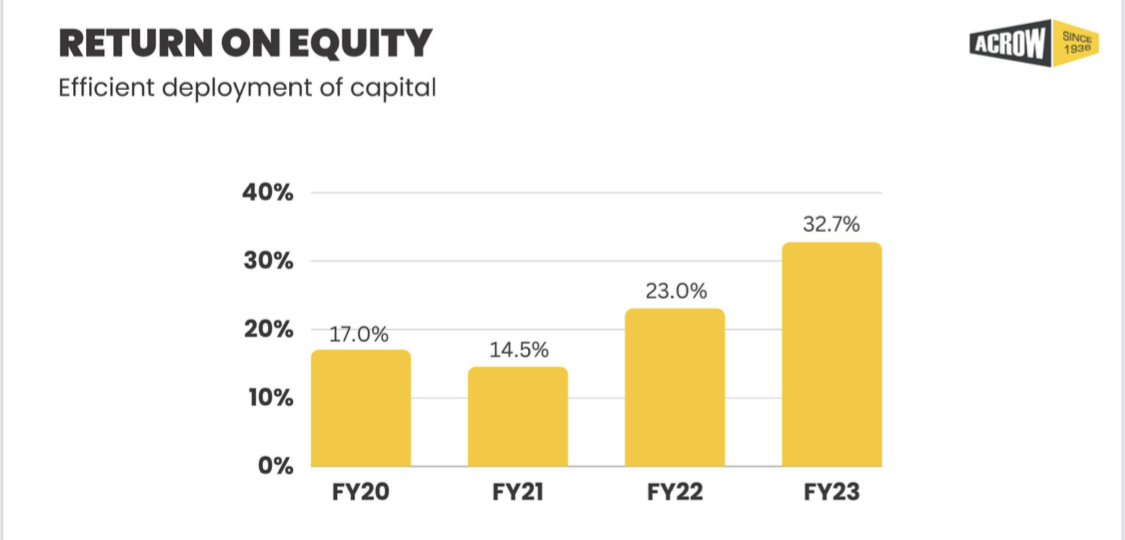

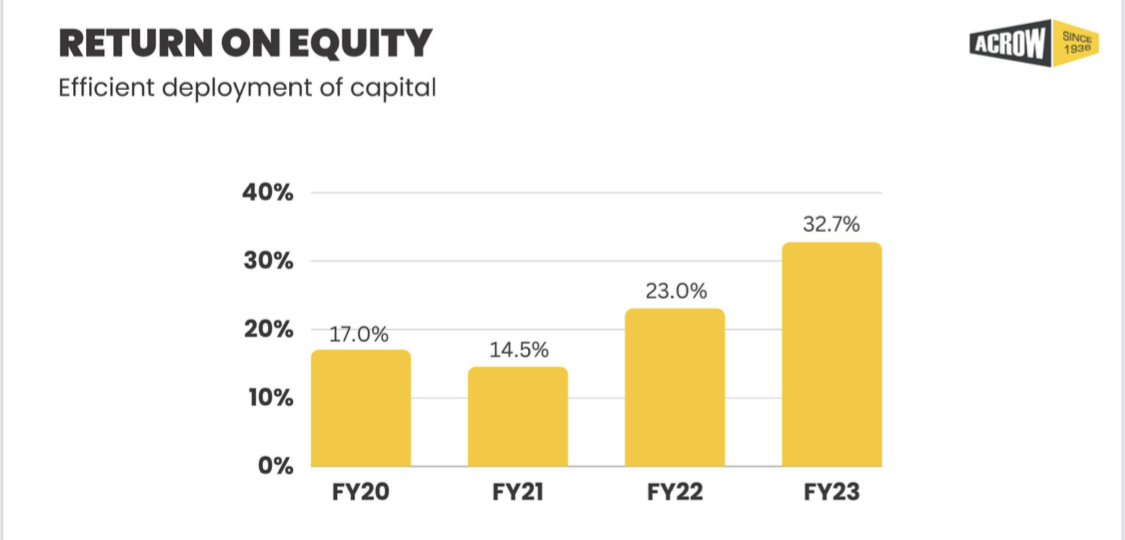

• Return on Equity of 32.7%, up 9.7 ppts

• Record new hire contracts secured up 34%, and pipeline up 70%

• Strategic capital investment across Jumpform, premium screens and panels assets

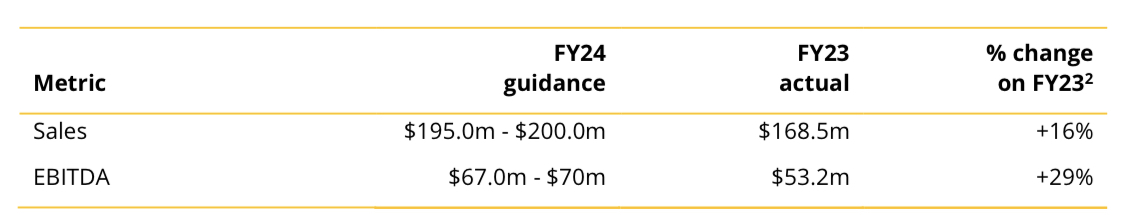

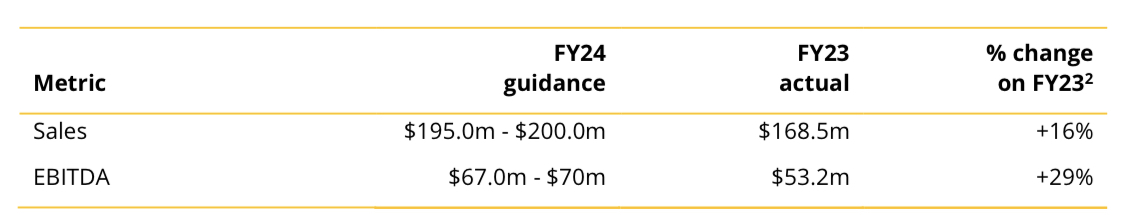

• FY24 guidance for EBITDA growth of 29% on PCP

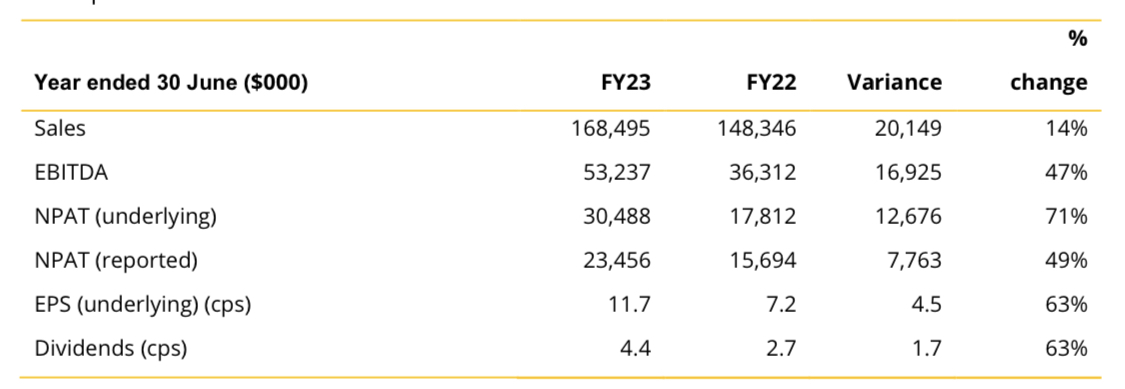

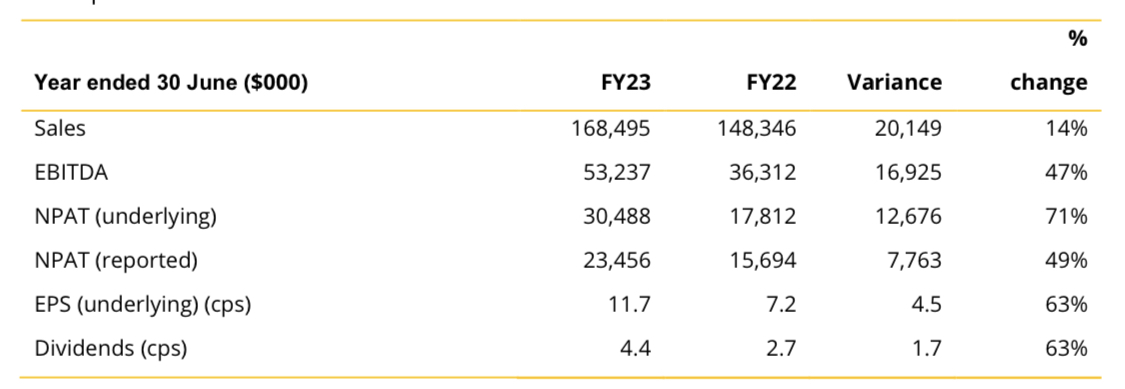

Key financial highlights include:

• Group revenue up 14% on PCP to $168.5m, assisted by a strong trading performance in the formwork division, up 29% on PCP and commercial scaffold division, up 9%. Performance continues to be predominantly organically generated

• Sales contribution of $104.6m, up 29%, with 77% of uplift generated from stronger equipment hire across all divisions. Margin up 7.3 ppts to 62.1%, benefitting from the mix change towards hire revenue as a proportion of total revenue

• Underlying EBITDA of $53.2m, up 47%, accelerating in 2H FY23 due to scale benefits. EBITDA margin of 31.6%, up 7.1ppts

• Underlying NPAT of $30.5m, up 71%

• Underlying Earnings Per Share up 63% to 11.7 cents per share

• Full year dividend per share up 63% to 4.4 cents per share

• Net debt to EBITDA reduced to 1.0 times vs. 1.1 times in PCP. Includes only 2 months of earnings contributions from asset acquisitions reported in May 2023 against directly associated borrowings of $16m

• Return on Equity at a record level of 32.7% up 9.7 ppts

Acrow Formwork reminds me of the 1930’s kids story, “The Little Engine That Could”. For those not familiar, the story is about a little locomotive that put itself in front of a great heavy train when other larger engines refused. As it went on the little engine kept bravely puffing faster and faster, "I think I can, I think I can, I think I can” until it pulled the great heavy train up over the mountain and down the other side!

We’ve held Acrow for over 3 years now and have continued to add more shares along the way as it keeps on surprising us! The management led by CEO Steve Boland keeps putting out stretch targets that it consistently outperforms.

No one tells the success story better than the CEO Steve Boland as he comments proudly on the FY23 results:

“I am thrilled to reflect on our incredible journey over the past five years. Our mission was to become the leading engineered formwork sales and hire equipment solutions provider in Australia, and I'm proud to say that we have achieved that goal.”

“I'm particularly pleased about the remarkable progress we've made in expanding our market presence. Our products, engineering expertise, and national footprint have allowed us to become involved in most major transport infrastructure projects across the country. Additionally, our recent entry into the industrial scaffold market has opened new opportunities for us to replicate our formwork market success in the maintenance shutdown market and general industrial sectors.”

“Our unwavering commitment to efficiently deploying capital has resulted in substantial value creation for our shareholders. The scale benefits we've achieved across the group have driven record profits, margins, operating leverage, and returns. Our return on equity of 32.7% in FY23 is undoubtedly one of the highest returns achieved in the industry, and it reinforces our dedication to maximizing shareholder value as well as the success of our disciplined capital investment program.”

“Our Formwork division had an exceptional year in FY23, marked by several key milestones. We successfully launched the Jumpform business, made strategic acquisitions of premium screens and panel assets along with accompanying contracts, and developed and deployed proprietary formwork products specifically designed for the Australian market. Our first product Powershore 150 was launched into the market during the year, with our second product Acrowdeck due to launch in the first half of this year. Over time we will continue to develop and deploy new Acrow designed products into the market.”

“Market share gains and the deployment of our extensive product portfolio around the country resulted in some notable achievements during the year:

• Queensland and New South Wales delivered strong growth, up 46% and 41%, respectively;

• the screens business reported record revenues and profits; and

• early revenues generated from our new Jumpform business have been very promising.

We secured some pleasing contract wins in the June/July period and generated a robust $26m pipeline within just two months of active marketing.”

“Improvements in hire rates and volumes continued into the second half of the year in the Commercial Scaffold division, largely due to higher funding costs leading customers to opt for hiring equipment instead of purchasing.”

“As previously guided, the Industrial Services division experienced softer conditions in the second half of the year due to fewer maintenance shutdowns scheduled during the period. Nevertheless, I am very confident that FY24 will bring a return to an enhanced program of work for this division.

Outlook

The Acrow Board is pleased to provide FY24 revenue and EBITDA guidance, underpinned by the following:

• record secured hire contract wins of $67.5m (+34% on PCP);

• a current pipeline of $142.3m (+70% on PCP);

• an additional 10-months of EBITDA contributions of approximately $8m, associated with the premium screens and panels acquisitions in April/May 2023; and

• full year contributions from the FY23 capital investment program.

My Takeaway

I’m so pleased we jumped on board “The Little Train That Could” three years ago. With the share price up over 160% it’s one of our better performers. It just keeps chugging away!

I don’t think you can underestimate Steve Boland’s unwavering focus on achieving a minimum return on invested capital of 40%. During FY23 Acrow achieved an annualised return on investment of 58%.

Since 2018, Acrow has increased ROE from 1.7% to 32.7%, now one of the highest in the industry. That’s an incredible achievement.

Valuation

Using McNiven’s Formula and assuming ROE of 30%, FY23 equity of 38.9 cps, reinvested earnings at 62%, franking at 100%, and a required annual return on investment of 15% I get a valuation of $1.35 per share.

At $1.35 per share that’s a PE of 11.5 times FY23 underlying earnings of 11.7cps. I know that’s a long way from the current share price of 90cps (potential upside of 50%), but I think that’s reasonable for a solid little business with excellent management and one of the highest returns on equity in the sector. I’m hoping to add some more shares.

Disc: Held IRL (2.6%), SM (5.2%)