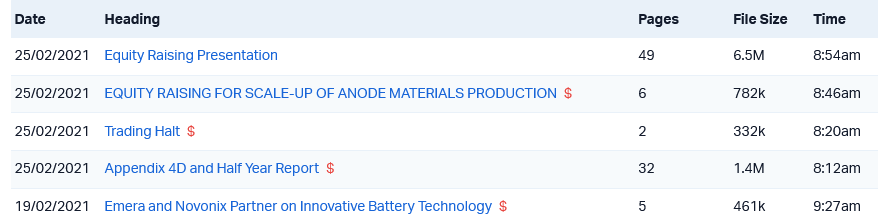

Feb 2021 I think. Around 110m. The world has changed around it with lots of different battery developments (Marketindex)

As always there will divided opinions towards tech or lithium with tech being strongly biased here.

That is if you are a tech company with a good product or service you have pricing control as opposed to Lithium which is governed by market supply and demand, processing, labour etc. And possibly years away from producing

So it then follows AZS is worse value than say a good quality tech stock.

But the counter-argument is I think this Andover discovery is really more about economies of scale which allows some workarounds around pricing and costs. And I have a feeling it's getting harder to find big discoveries that can "compete" with Andover or Kathleen Valley

Herein lies the competitive advantage. Until the next big discovery is made that "obsoletes" Andover which could be years away, even with AI being used to drive discoveries as you still need to get on the ground and drill.

As usual these are my thoughts. I hope others will share as it is too quiet here.

Threw caution to the wind and put in SRL so AZS gets a bit of attention here and nothing more than that.

In my opinion I wouldn't buy at 2.87 as it is a bit too expensive versus the CR price of $2.40.

[held]