Pinned straw:

It's an interesting one.

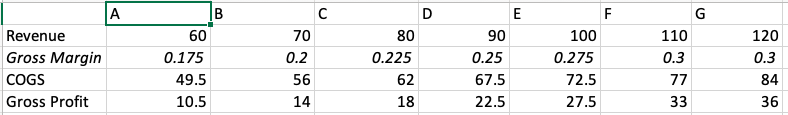

I was also on the recent call and did a similar exercise modelling out the revenues, gross margins, etc. As you say, the company is highly levered to the cycle due to the large amount of fix costs.

My main query on this one is whether the margin of safety is there at the current price. On $80m revenue I have them making a Normalised NPAT of $1.1m (I'm assuming 30% tax, perhaps a bit too conservative in this case) which puts it on a EV/E of 40. EV/E drastically reduces as revenue increases.

At $120m revenue, my normalised NPAT is $9.3m which puts it on an EV/E of 5.2. Can it get there? It's not too far off the last peak. And even then, if it does get there, I can see the market saying EV/E of 5 is fair for a highly cyclical low-margin manufacturer at the top of the cycle.

It's interesting. Just a query whether the price is compelling enough.

Found the following in an old slide pack which highlights what a tough time the company has had. FY22, FY23 and FY24e revenues are $28m, $47m and $81.5m (my estimate).

Love that thesis @UlladullaDave. Especially the insight that the capex is already spent.

I think personally I too often pigeon hole myself into a given style. Yeah, it's good to know what kind of investor you are and where any edge lies (if at all), but it can stop you from exploiting good opportunities.

I guess the important thing with cyclicals is understanding that you also need to be prepared to sell as soon as the valuation gap closes, or there's any sign of the cycle turning (and I guess that's what often stays my hand in these situations -- I'm terrible at both selling and predicting cycles). But if you're attuned to that, there's undoubtedly good profits to be made.

I found a good summary of the book you describe (see here) -- I haven't read it but will definitely add it to my reading list.