Medical imaging software provider $M7T provided an update on their FY24 guidance today.

ASX Announcement

I'm a little slower than usual in my analysis due to having a day job today (finishing soon!), however, $M7T was falling towards the bottom of my conviction lsit, despite great progress in renewals, and today's announcement tipped me over the edge.

Their Summary

My Analysis

I'm not going to summarise the entire release. The release is long and detailed and is clearly aimed at preparing investors for the HY result. Rather, I'll get straight to my analysis.

As those following the business will know, FY24 is a huge year for renewals of key contracts - and management has clearly and correctly focused on those renewals. Several have been accounced previously, and I have commented positively on several because they have expanded some key accounts on renewals - a good sign. And don't forget the new huge Veteran's Health deal signed last year, which can be expected to drive revenue for years to come.

However, those of us who invest in SaaS have become conditioned to the idea of a subscription business being one of perpetual renewal, moderated only by hopefully modest or low churn. However, it is wrong to think of $M7T (or other SaaS businesses) in this way. They are fixed term contracts which must be renewed to sustain a flat revenue base. The growth has to be on top, including expansion of customers buying more of the product because it adds value or the pricing structure allows revenue to grow as customers grow.

On renewals, $M7T has outperformed the expectations they set - by some margin. However, sales orders of $60m - largely renewals - have to be understood in the context of $30m revenue in FY23 and sales contract terms of 3 to 5 years.

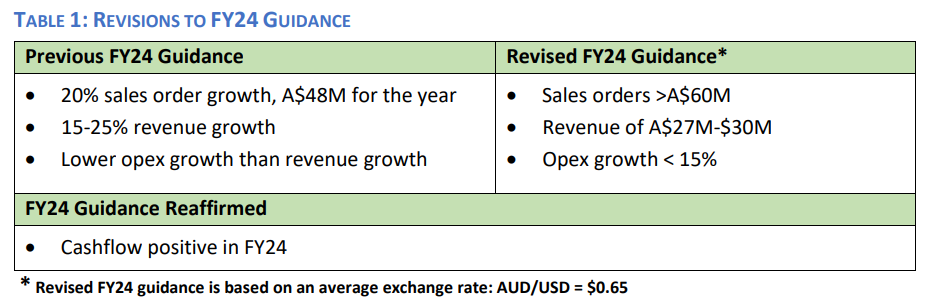

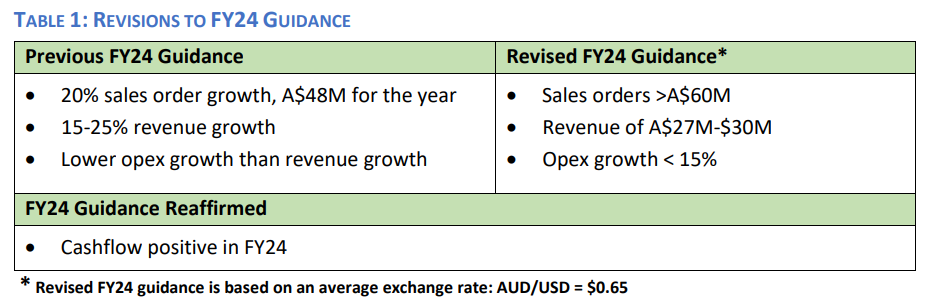

So there is some significant bad news in the release. They had targeted 15-25% revenue growth, which on $30m revenue for FY23 implies an expectation of $34.5-37.5m (Indeed, the market consensus for FY24 revenue is $35.7m; n=5). So to be guiding now to FY24 revenue of $27-30m isn't just a downgrade, its indicating that revenue is expected to decline. Not good.

There is a narrative about FY24 having lower capital sales, with this being positioned as "subscription transition accelerates". I'm not so sure.

There is further bad news on costs. A key part of the premise of moving to positive operating cashflow, is that opex growth would be lower than revenue growth. Today, we learn that opex growth will be <15%. OK, but renvenue isn't expected to grow. What?

There is an effort to point to $8,2m of contracted ARR which is yet to reach the "first productive use" milestone. True, that is material in the context of the gap between FY23 revenue and forecase FY24 revenue. Further, if much of that revenue is activated in H2 FY24, its revenue impact in FY24 will be modest and it will contribute materially to FY25.

But that's the problem with the growth treadmill. My investment thesis is predicated on $M7T maintaining >20% revenue growth with growing operating leverage. So a year of going backwards, makes the challenge for the next year even harder. As you will see from my threads on this firm over the last 1-2 years, I have been on watch on this factor. Today, the double-whammy of lower revenue and higher costs has pushed me over the edge.

Divestment Decision

Today, I lost my remaining conviction in my thesis for $M7T. I sold my entire RL holding (during my lunch break between classes). While I understand the critical importance of supporting the FY24 renewal program, today $M7T have indicated to me that they might not be able to simultaneously renew AND grow.

I'm disappointed to have to have exited this business. There is still a long way to go for imaging operations to transition to the cloud, particularly outside the US. I like Mike Lampron, as he is a matter-of-fact CEO, who isn't unduly promotional and historically sets targets his team can outperform.

This might well be a bad decision. With a solid year of renewals in FY24, FY25 might turn out to be a stellar year in new business growth as new accounts come back into focus. However, I am not convinced.

To be honest, I've had the feeling for a while that $M7T isn't going to meet MY expectations at the more speculative end of my portfolio. I need to see strong, sustained growth and cost control leading to operating leverage.

Overall, this was a minor capital loss, but today I have called time.

Disc: No longer held in RL; Held in SM

For the record, my SM order didn't clear as I set a price limit of $0.73 which the SP has sunk below by close. I'll have to figure this out in due course - but I no longer hold $M7T in RL, which is unique in my SM portfolio. In future, I think I'll not set price limits in SM for trades executed in RL. Today, I had to go back into class, so I didn't know until 5pm that the RL trade had cleared. However, the SM portfolio isn't real money, and I do try to maintain my SM portfolio as a reasonable reflection of the higher risk part of my RL portfolio.