I think Chris Kohler nailed it with his recent post

https://www.facebook.com/share/r/1CiWDrSzwZ/?mibextid=wwXIfr

Something interesting I've come across looking at some property stats recently.

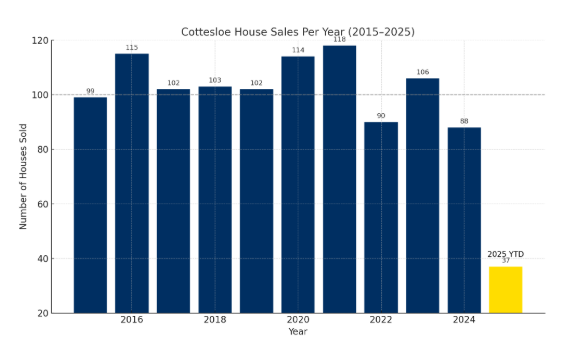

Annual house sales in Cottesloe over the last 10 years, annual Long Term Average is 100 and change. Currently, year to date is 37.

Tight tight tight

Cottesloe often is one of the suburbs which leads the pack up and down and is the canary in the mine for many movements.

In the absence of any world changing black swan events, the media are going to be having a field day in the coming months about growth...

Another monthly contribution in an industry I work in. Hopefully some analysis from my side assists someone with their decisions...

Contributing to the conversation with what I can!

After what’s felt like a stop-start few months, the Perth property market is finally getting a bit of clear air. The school holidays are done, public holidays are out of the way, and the Federal election is behind us. With those distractions easing off, we’re seeing momentum return to the market, and the general sentiment right now is pretty simple: just get on with it.

This week’s 0.25% rate cut from the RBA, the second in this current easing cycle, is a welcome sign. While it won’t have an immediate, dramatic impact on borrowing power, it signals that inflation is softening and the economy’s cooling just enough to give the RBA confidence to ease the pressure. For property investors, that’s key, because confidence and clarity are the fuel for decision-making.

In practical terms, we’re already seeing increased activity, especially around well-priced, well-presented homes. Perth continues to offer a compelling value proposition compared to the eastern states, and with rental vacancy rates still sitting incredibly low, yields remain strong. That combination of affordability and return continues to draw interest from both local and interstate investors.

From the conversations I’ve been having with clients, the shift in sentiment is clear. We’ve moved from a “wait and see” mindset to a “let’s make it happen” one. Buyers and sellers are becoming more realistic and more decisive.

The truth is, while the market isn’t running hot like it was a couple of years ago, it’s steady, active, and full of opportunity. There’s less panic, less noise, and more room for strategic moves.

My Musings

For what it's worth, I thought I would share my opinions and expectations on property. I like to think I am a little more a tuned to the market being a Real Estate Agent in the Western Suburbs of Perth (sorry). This is a longer post and I like putting my opinions down on paper and referring back in months to come.

The reported stats and media commentary is often delayed well behind what is actually happening out there and I feel the market, in Perth at lease, currently has a bit of a crouching tiger hidden dragon going on.

Current status quo:

- Low levels of available property

- Reduced velocity of sales with people holding for longer. Owners aren't able to sell, because they have no where to buy. This grinds the whole machine to a halt.

- Lack of building and completions - As Alan Kohler so eloquently put in his Sunday finance segment on the ABC. Link here:https://www.youtube.com/watch?v=l4xUwtLTawk

Next few months:

April is a write off. School holidays, Easter and Anzac Day all align this year and no sane property seller would commence a marketing campaign in that time. The key is to advertise a property when you can get the most eye balls on it, not when everyone is away down south or taking a well earned breather over public holidays. Anecdotally speaking from my experience of years and years in the industry, these school holidays are typically the time where the market transitions from the Summer Selling Season to the Winter Hibernation. Much of our market goes away to the northern hemisphere from here on, and many people switch off from property.

Following the holidays in April, we lead into a Federal Election. Whilst neither party is really doing anything remarkable this time which will move the dial (in particular with property), Buyers and Sellers and property owners all delay their decisions and will defer to a sitting on their hands approach. Enter @Strawman's rant on Black Friday Sales behavior here!!!

June/July/August are dead months where unless people have a really important and immediate need to sell, I very rarely recommend they do in these months.

I would describe this market we're in now as a Death, Divorce and Taxes market. These are forced sales where owners are either dead, forced to sell from separation or are financially squeezed so hard that they must.

Property Investors have no reason to sell in this market.

- Interest rates are trending down which is positive for value growth - a.k.a.decreased debt servicing

- Rents are continuing to climb - a.k.a. dividend growth.

- Unemployment is still very tight - everyone that wants a job has one. - a.k.a. capacity to service debt

- Migration is still cranking along - a.k.a. growing demand

- Building approvals are well below equilibrium - a.k.a. undersupply

- Building costs are sky rocketing and more and more builders are going under - a.k.a inflation

I am nowhere near game enough to put a figure out there for growth in the market, but am incredibly bullish on property values in Perth, and in particular the blue chip suburbs. In the last 12 months we've seen a slow down at the top end and a massive spike in growth in the entry level properties. It's been a real bottom up push in values which I put down to affordability both in terms of rental demand being very high and investors preferring smaller 'bite sized' properties as opposed to more eggs in the one basket. The top end of the market has been squeezed and plateaued from Cost of Living pressures with banks not being so liberal and open with their lending. Speaking with mortgage brokers and going through the process myself recently, the banks are placing such incredibly high and tight lending standards on how they will give out money, there is a lot of people wanting to spend money as soon as these get eased. Take for example, the tax cuts which came into effect July 1 2024, the banks all increased their serviceability requirements greater than the tax cuts and sighted 'inflation and cost of living' as their rationale. As soon as lending and serviceability requirements come down then there's going to be a huge influx of additional buyers in the market with the capacity to purchase at higher levels competing for the same supply.

With interest rates trending down, we should see some more action here. Another top end problem is there have been very few business sales and liquidity events. Back in 2006/7, and again in 2012-14 we saw a fair few deals being done in the corporate space with M&A etc. Guess what everyone does with their enormous windfall profits? Goes and buys premium property!

On the coal face in my daily work, I am dealing with incredibly frustrated buyers and sellers who are licking their lips. Buyers are squeezing themselves to the absolute maximum they can.

Having said all of this, anything could happen in the world which could shake up some of the above points and completely shift the market sentiment and dynamics overnight. But at the end of the day, as we found out during the pandemic, housing is an essential item and everyone needs a roof over their heads. People will prioritise paying their rent over other bills, they'll prioritise the mortgage over other bills and when there's uncertainty in the world and other asset classes, investors focus on tangible and safe-harbour assets which also conveniently pay a weekly dividend.

Rant over - Cheers