Just having a look at contract expiry, and I think I understand what is happening here...

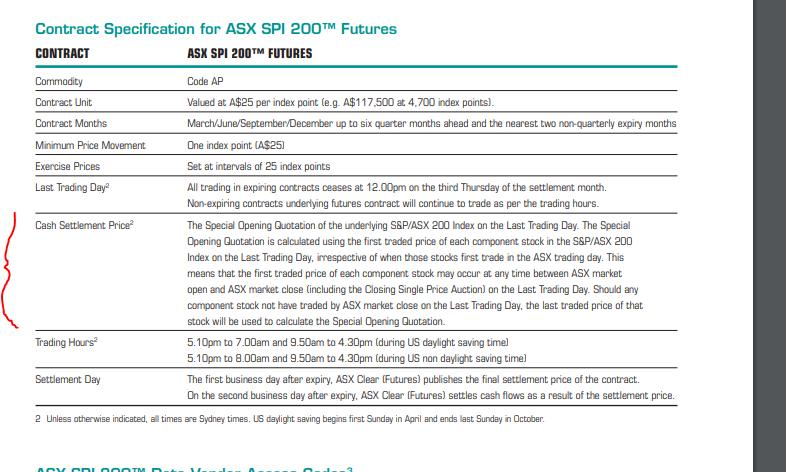

OK, so the ASX uses the open price as the cash settlement price. This method of settlement has a fair bit of scope for manipulation. So, if I'm long March futures and short June futures my goal is to maximise the expiry day opening price of the index. I can do this by buying big on a few large components of the index. Let's say I can get a 20bps movement in the index, so I make 20bps on my March long, but my June short position won't move anywhere near as much – maybe it falls 5bps. So I've netted 15bps. Once the opening price is known the contract is effectively expired and I need to immediately close my June short because I am now naked short the SPI.

If you are arbing this then you'd probably be closing out contracts as the opening auction takes place.

So that's my best guess, but like I said, I've never traded ASX futures.