Trumps copper tariffs are now clarified. 50% on US imports of any final products with substantial copper content eg electrical, transformers, electrical wire and so on. No added tariffs on refined but not processed into a good. US refining capacity is very much smaller than they need, so this targets increasing local manufacture of the refined copper into finished goods. They will need time (years) to affect increases in refining capacity.

https://finance.yahoo.com/news/copper-gains-london-trump-tariffs-012624204.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAB8BGrO3Doc1UhBsVvxyn0HuiIVl6kjqpwrqDKtFq1ZzlqHxNCvpYbTVN7KZjsXN9hHwMV3hTEgUsqdfcegvMSnZ8YtFvpyaiV6MhK9tv8eTMOrYsTWS10nlCUH0eGfmvZ77OLxeUN7qvxQHooby8rvZC_ORxW4lDr_rqvPVCnB5

Global trade in copper is volatile as the inrush of copper into the US ahead of the formal tariff announcements increased import values, which have now evaporated to the extent there is talk of re-exporting some of it.

The reaction of trade to remarks from Trump is quite amazing, prior to formal announcement of trade rules by the US. The lemming business at least is alive and well!

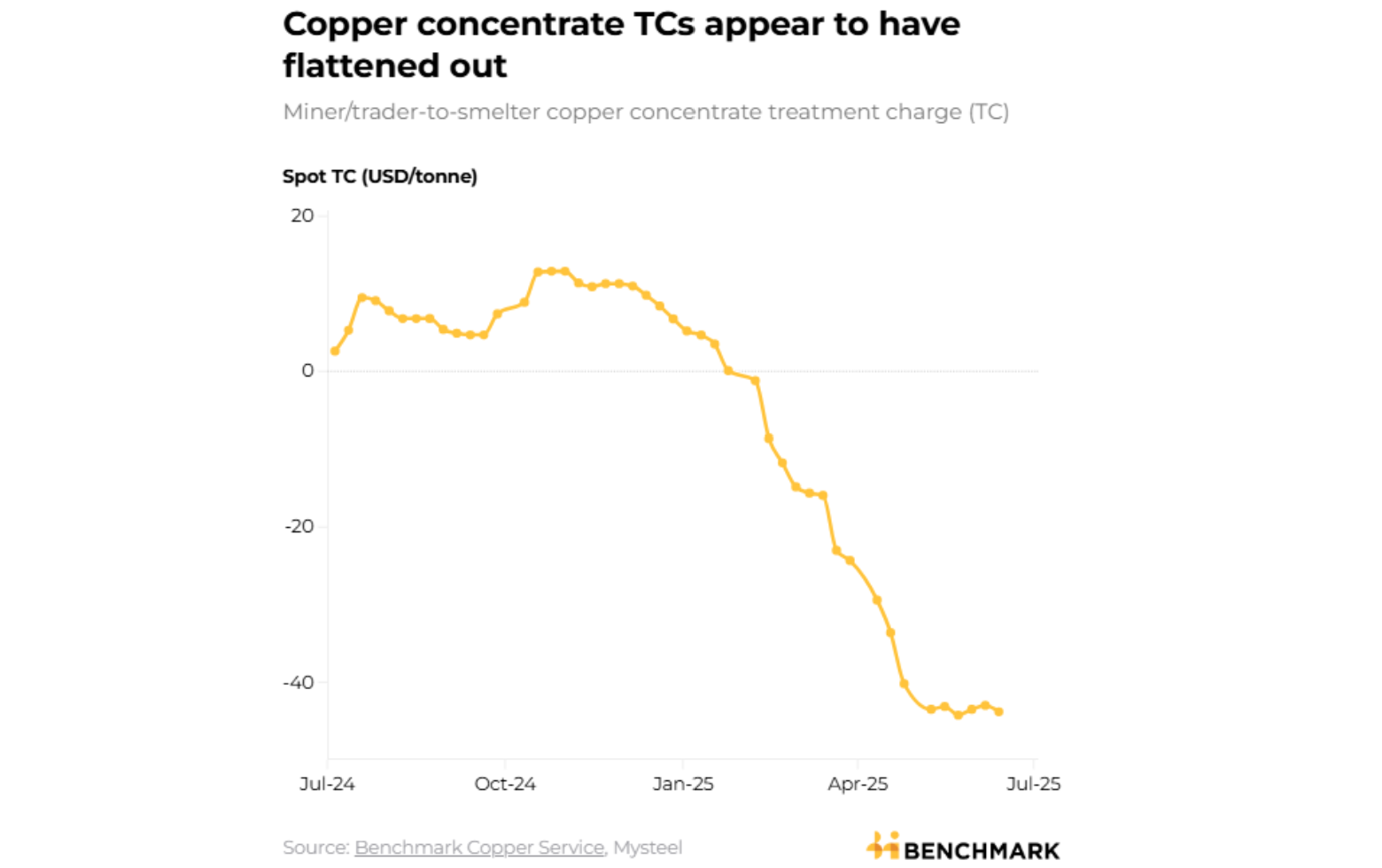

SIx months ago I illuminated the fact that there had been a very big increase in copper smelting of ore heading into China. The impacts continue to flow. Smelters are paying miners to process the ore (rather than the usual charging for the service). Ore imports into China are large, whilst recycled copper imports has flat-lined. The chart below tells the tale.

Smelters do make money from extracting gold and silver, and sulphuric acid prices are rising (a by product of copper smelting), to offset their losses in their main core activity.

This isn't sustainable of course, but the outcome isn't that the Chinese will reduce their smelting capacity. Rather that smelting capacity in other countries is reducing, or going into care and maintenance as they can't compete. Feels like an opportune strategy to reduce competition and position yourself as the dominant processor perhaps? Well, we have seem China do this with other commodities, and then use their pricing power to maintain dominance by lowering costs to make investments in capacity elsewhere uneconomic. The Chinese industry can keep this up for a while most likely.

With new copper mine discoveries becoming less frequent, copper grades reducing, environmental and other barriers extending the approvals process (Trump's reforms in the US may change that locally) and demand still climbing it appears the Chinese patience for business in the longer term strategies will pay off in the copper market too.

Chinese subsidies for solar panels will reduce soon, whilst vehicle copper demand continues to rise, construction is flat but investments in the energy network increase.

There has been a large potential copper discovery in the Southern Andes in South America this year. But operations are a decade and a half, and substantial investment away.

https://www.mining.com/web/column-copper-smelters-are-facing-both-market-and-pricing-crises/

https://www.npr.org/2025/03/16/nx-s1-5327095/copper-rare-earth-minerals-mining-electronics

An interesting overview, but the themes are familiar. The back end of the article talks about the problems developing copper resources within the USA, and the especially tight refining capacity that exists within the USA currently. There are emerging indications now that Trump will move on copper tariffs before any review is finished. Disruption, and tariff impacts serve as propellant for increased copper prices. Bringing on capacity within the USA, especially if they introduce tariffs on copper, will take some years.

The link to the order (below) the Trump administration has generated to look at copper and the current status of the US with regard to import access, local production and refining. It's a continuation of the process of countries looking at the demonstrated opportunity for China to control supply chain and restrict the ability of nations to access materials they need. The scope of the investigation is interesting and demonstrates the seriousness of the US in ensuring supply chains they rely on. Whilst it seems likely it will strengthen the opportunity for the US to ramp up domestic production it takes 15 years or so to get a mine to production, perhaps in current conditions shortened a bit by the removal of environmental and similar barriers to entry under the Trump administration. Still, not something that will happen anytime soon. More likely the US will reinforce supply chain through relationships with companies and friendly allies eg Canada, Australia and to a lesser degree Chile and Peru and similar. This diversifies supply and improves the US risk management environment in the meantime. The refining of raw materials is probably something they can move on more quickly. Interestingly of course it reinforces the hand of these supplier nations in any trade negotiations.

https://www.whitehouse.gov/presidential-actions/2025/02/addressing-the-threat-to-nationalsecurity-from-imports-of-copper/