Pinned straw:

@nessy i scratch my head why people actually pay any attention to price targets. no one can call a one-year share price, the base rates are abysmal, although it has been a decade or so since i have examined it closely (i dont bother). there are plenty of studies that show that. If you have examined the inputs into price targets by brokers, as i have over many years, being many and varied, conflicted, inconsistent etc etc, you would need much more than a single number for a price target to be useful, like a detailed valuation! thats my rant

@nessy i scratch my head why people actually pay any attention to price targets. no one can call a one-year share price, the base rates are abysmal, although it has been a decade or so since i have examined it closely (i dont bother). there are plenty of studies that show that. If you have examined the inputs into price targets by brokers, as i have over many years, being many and varied, conflicted, inconsistent etc etc, you would need much more than a single number for a price target to be useful, like a detailed valuation! thats my rant

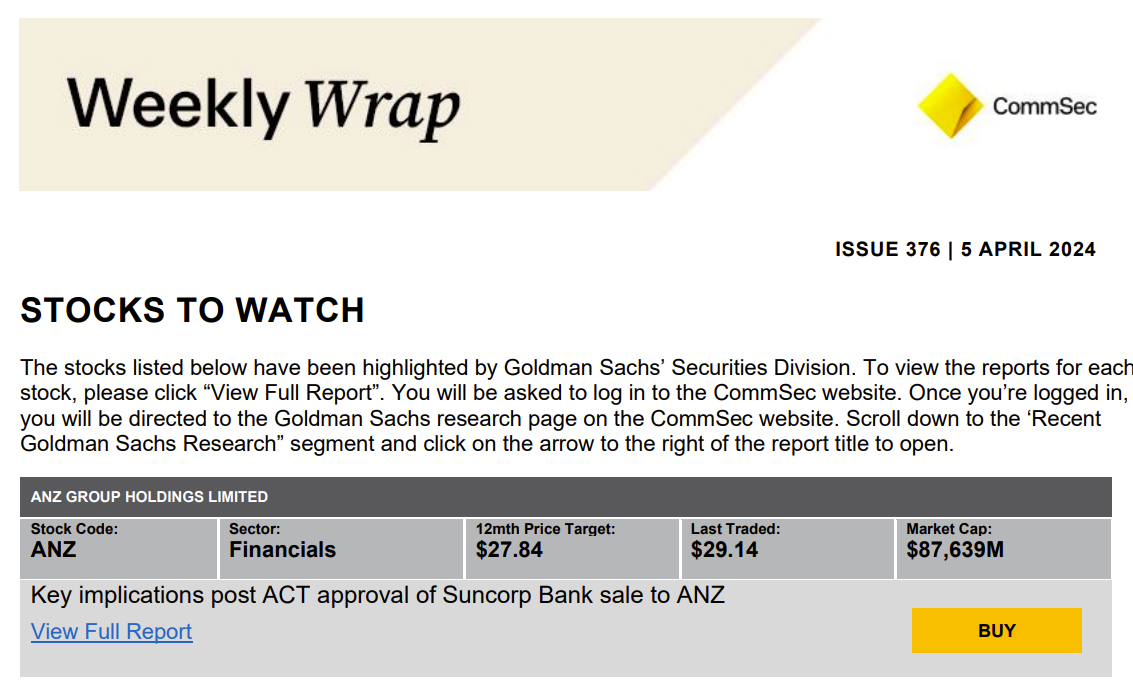

It depends on what return you would be happy with @nessy. You could make about 8% per year without the share price changing (5.6% fully franked, 8% gross yield) providing everything goes well for banks.

I think the banks were worth buying last year when they were trading close to book value and with a ROE of 10%. Then all the brokers were saying Sell!

Now that ANZ is 1.3 times Book Value and you might be lucky to scrape in a 9% return, the brokers are all saying buy?

I did exactly the opposite, I bought when they were saying sell, and now I’ve sold when they are saying buy. All except CBA and some NAB which we’ve held since the GFC and would attract some hefty capital gains tax.