Pinned straw:

PSC Insurance enters into Scheme Implementation Deed with Ardonagh

PSC shareholders will receive A$6.19 per PSC share in cash, which represents a 32.7% premium to PSC’s undisturbed three-month VWAP.

Speculation is mounting The Ardonagh Group is closing in on PSC Australia in a deal expected to be worth over $2bn.

The chatter is emerging out of London about a transaction, and sources believe a sale may be agreed upon in about two weeks.

It comes after DataRoom reported last week the $1.9bn Australian-listed PSC struck an agreement with Ardonagh on its insurance underwriting agency in Australia.

PSC exited its agreement with its existing broker, Lloyds-backed Miller Insurance and entered into a deal with Ardonagh instead.

Now, the chatter is there is likely to be more to it, with Ardonagh closing in on the business.

PSC Australia has been working with Goldman Sachs to find a buyer, and speculation earlier emerged Marsh had been running the ruler over the insurance broker.

Arthur J. Gallagher & Co also looked into it but was put off by the price, as was Australian rival Steadfast.

The market has predicted Ardonagh had the most to gain from an acquisition because PSC generated a lot of revenue from London where Ardonagh, a trader, operates.

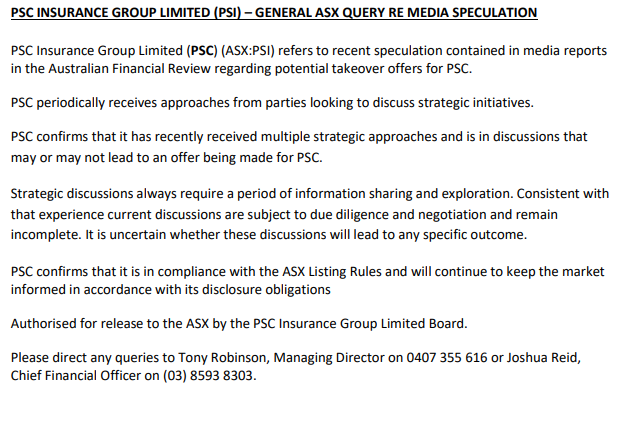

PSC Insurance announced on March 13 it had received multiple strategic approaches and was in discussions which may or may not lead to a takeover offer for the company.

Recent discussions were subject to due diligence and negotiation and remain incomplete, with any potential outcome highly uncertain, the company said.

In February, PSC Insurance upgraded its full year guidance to between $125m and $130m from $122m to $127m previously.

Net profit guidance was $83m to $87m compared to $82m to $86m previously.

The key driver was strong organic growth and several smaller acquisitions during the half.