Not sure I see the major banks winning this fight - a bit of an innovators dilemma for them.

Another article today.

Home loans: Banks gear up for bruising battle to reconquer the mortgage market (afr.com)

Banks are pinning their hopes on older, more sophisticated customers who are comfortable digitally negotiating their home loans as they prepare for a bruising battle to claim back territory lost to the mortgage broking industry.

The bankers’ strategy involves them luring new customers who wish to refinance their home loans by offering enticing rates that are below what they could obtain if they used a mortgage broker, or even if they visited a bank branch.

Mortgage brokers have been increasingly successful in a competitive market, as the number of applications falls on higher interest rates. Peter Rae

But it also means banks will have to be much more transparent about their pricing – and how it is adjusted depending on the particular property’s loan-to-valuation ratio – than they’ve been in the past.

Still, by targeting price-sensitive home loan borrowers with a track record of meeting their mortgage repayments, bankers finally have a credible strategy for clawing back some of the market share they’ve ceded to the mortgage brokers.

Of course, it’s likely that even if the banks’ new strategy succeeds, brokers will retain a sizeable market share.

According to a McKinsey & Co report on the mortgage market, published last November, “customers who favour brokers are typically younger and have a lower income than those who start their shopping with banks.”

The report adds that “broker customers are also more likely to be first-time home buyers; in such cases, they work with brokers to bridge a knowledge gap.”

But the banks’ new strategy also involves them attempting to shift the narrative that the mortgage brokers have used to great effect for the past three decades.

In 1995, Aussie Home Loans founder John Symond fronted an iconic advertising campaign that positioned mortgage brokers as the allies of battlers dealing with the predatory banks.

“You work hard for your money, so why give it to the banks?” Symond asked. “With our home loans, more money stays in your pocket. In fact, you’ll save thousands.”

But increasingly Symond’s claim that “we’ll save you” is ringing hollow.

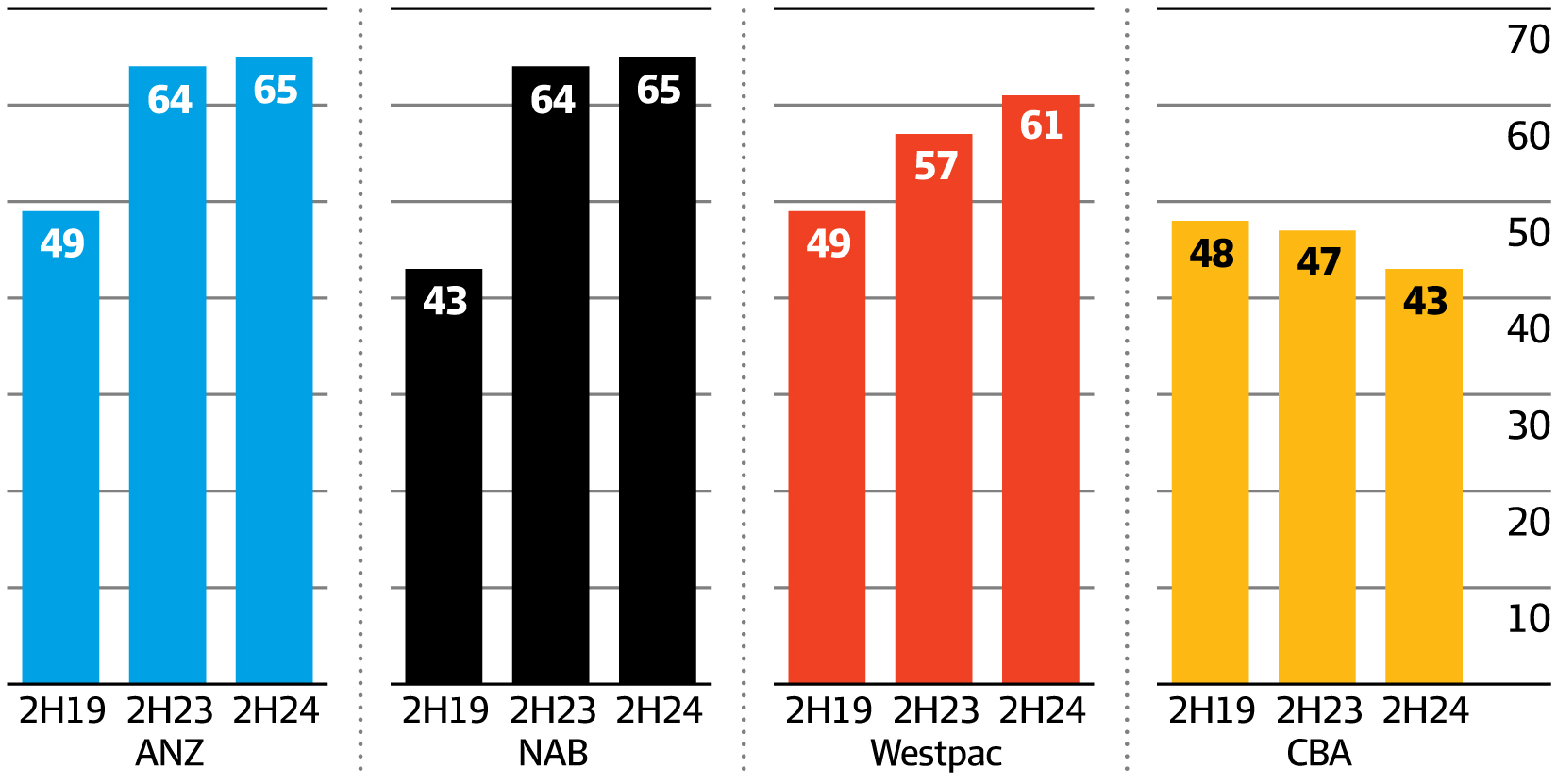

It’s certainly true that the growth in the mortgage broking industry has shrunk the profitability of home lending. In the early 1990s, the country’s big banks enjoyed a net interest margin of 4 per cent on home loans – this has now dropped to below 2 per cent.

The problem is that a large chunk of the surplus profits the banks previously enjoyed on their home loan books is now flowing to the mortgage broking industry.

As house prices have climbed across the country, brokers have enjoyed a huge boost in upfront fees and trail fees. And this means that brokers’ remuneration has jumped even though the effort involved in delivering their service has remained steady.

The increase has been most pronounced in the country’s major cities, such as Sydney and Melbourne.

According to mortgage broking industry sources, the average Sydney mortgage broker earns around $400,000 in upfront fees each year. Based on standard broker commission rates, this suggests that the average Sydney broker is pocketing $670,500 a year when trail commissions are included.

The hefty cost of commissions paid to mortgage brokers means home buyers – those who go through the banks’ branch networks and those who use a broker – are paying more than they should on their mortgages because banks factor the commissions into the pricing of their home loans.

According to the Mortgage & Finance Association of Australia’s Industry Intelligence Service, national average annual broker remuneration totalled $181,199 in the six months to March 2023, but there were major differences between states.

The highest earning brokers were based in Queensland (they earned average annual commissions of $186,446) and NSW and ACT ($186,127). The lowest earning brokers were in Tasmania, where average annual commissions per broker came to $144,511.

It’s important to note that these figures underestimate the earnings of active mortgage brokers, as 22 per cent of brokers were inactive in the six-month period and did not settle any home loans.

According to the MFAA report, the jump in the number of inactive brokers – up from 14 per cent the previous year – “is consistent with the decline in new settlements observed during the period, and the increase in the broker population”.

But critics point out there are other ways in which mortgage brokers fall short in their claim to be the battlers’ friend. Because upfront commissions are much larger than trail commissions, mortgage brokers have an incentive to encourage their clients to sell their existing homes and to upgrade to new and more expensive properties.

But while the broker pockets higher fees from the increased loan size, their clients are saddled with larger mortgages, and higher home loan repayments.

Another conflict of interest arises because some home lenders will occasionally lift the level of upfront and trail commissions paid to mortgage brokers in a bid to win a larger slice of new home loans.

Transparency about commissions

Even though mortgage brokers are subject to a “best interest” duty, it isn’t difficult for them to justify channelling more loans to lenders offering higher commissions by arguing that that bank also has, say, a more lenient credit policy.

One way to mitigate these conflicts of interest would be to require mortgage brokers to also be more transparent about the commissions they’re earning.

But even in New Zealand, where mortgage brokers are required to properly disclose the commissions they’re earning, there are concerns that they could be “unduly influenced” by commissions.

Earlier this year, New Zealand Commerce Commission chairman John Small recommended that the rules around brokers’ disclosure of conflicts of interest should be tightened.

“From the broker’s point of view, they will get different amounts of money from different banks,” Mr Small said. “I’m not sure when you go to a mortgage broker that they would declare that to you.”

Of course, in Australia the political clout of the mortgage broking industry means there’s little likelihood that they’ll be forced to be more transparent about their commissions, or their conflicts of interest.

Both sides of politics have clearly decided that picking a fight with the brokers is simply too dangerous.

The Morrison government, which initially backed the Hayne royal commission’s recommendation for moving to a model where the borrower, rather than the lender, paid the mortgage broker quickly backflipped after the industry mounted an intense lobbying campaign.

Meanwhile, Labor, which initially favoured capping the size of the upfront commission and banning trail commission, quietly decided against stirring up a hornet’s nest by tampering with mortgage broker remuneration.