Interesting series of articles in the Economist last week. Basically saying there is widespread under-appreciation of the impact of Solar on the energy markets. The main article is a long read so won't re-post here as would clog up feed. The synopsis in point form:

- solar efficiency continues unabated (currently 22-23%). For comparison my panels, installed 6 years ago are 16% and were top notch at the time.

- unit cost of production is falling rapidly

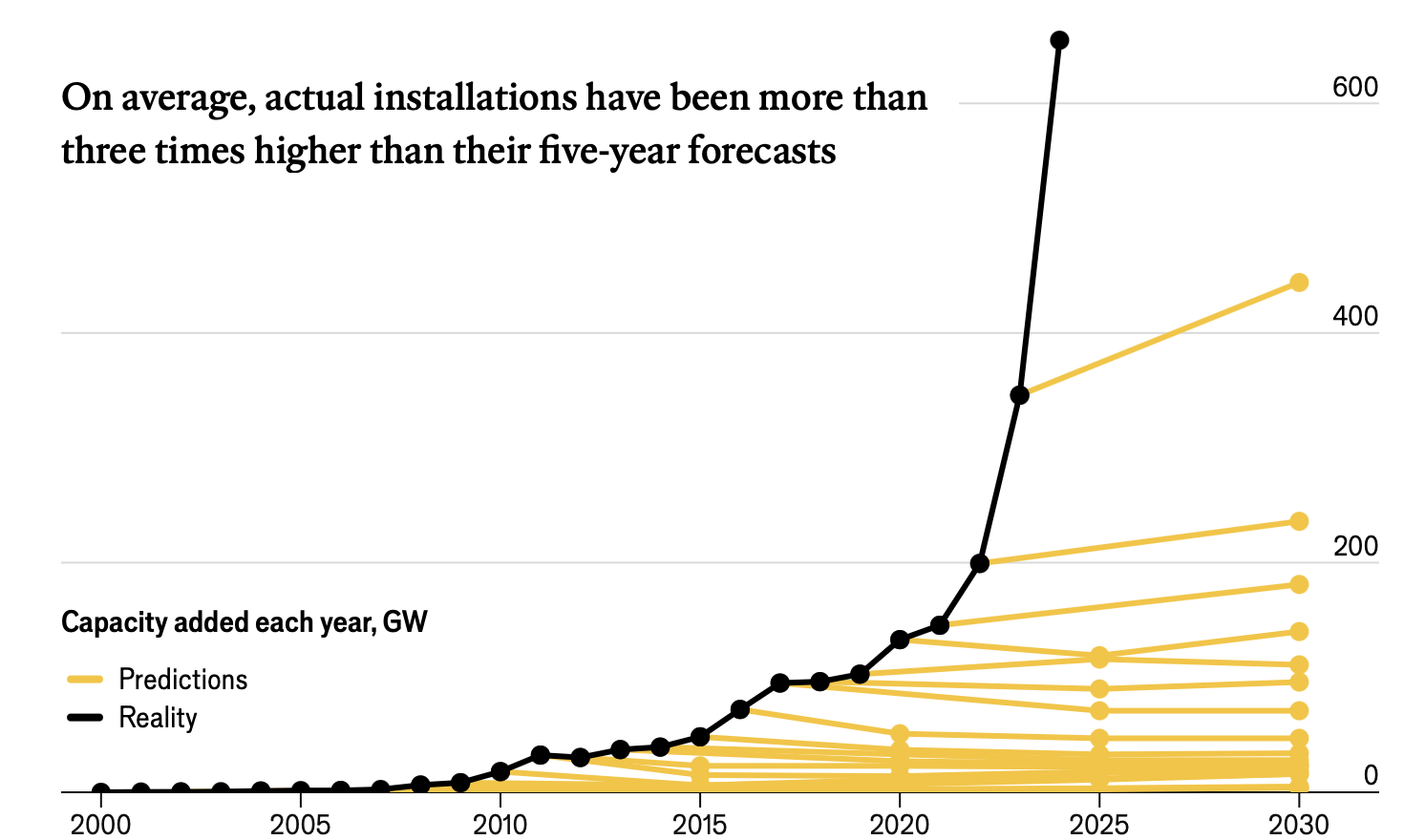

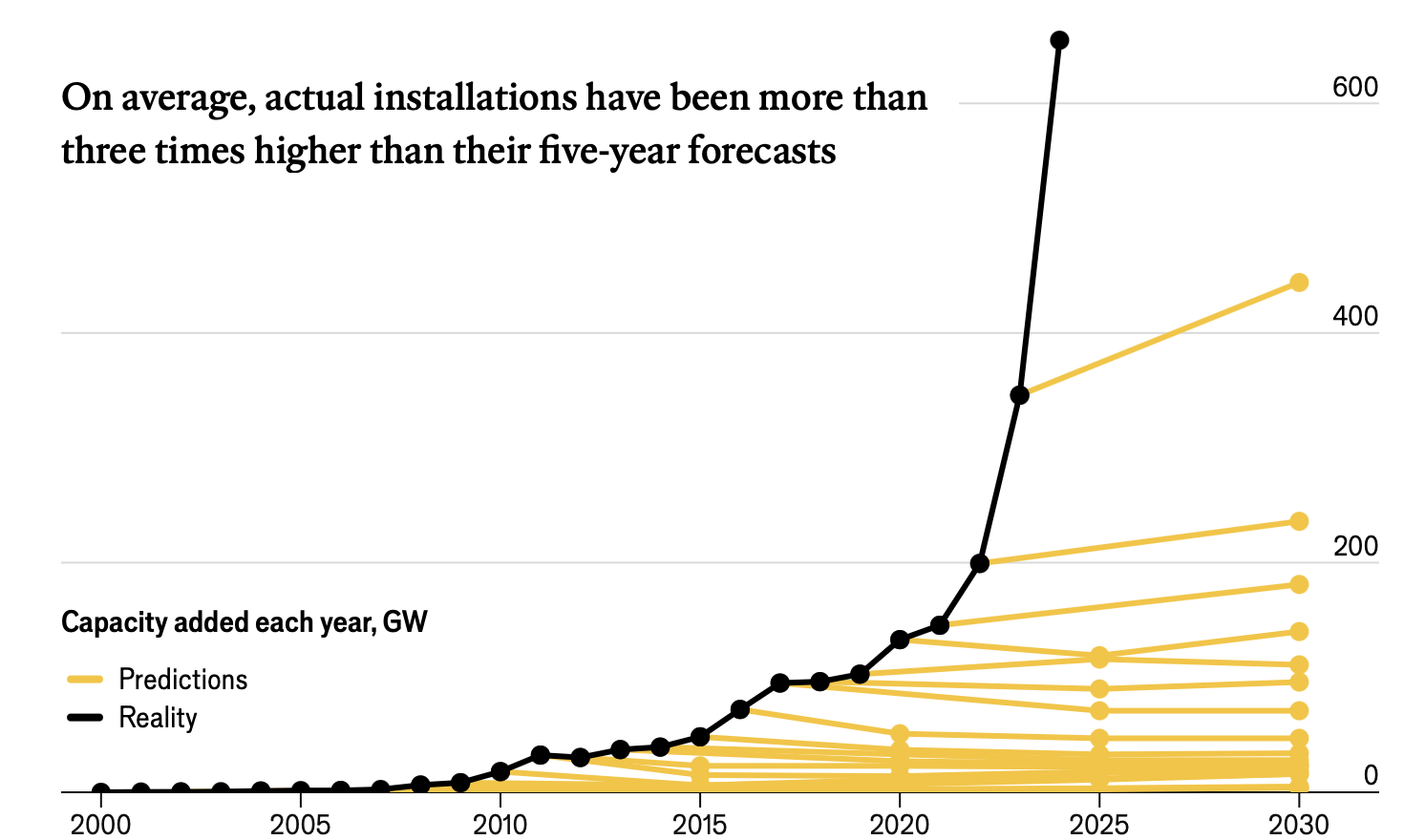

- installed capacity is still going exponential, no flattening into S shaped curve.

- the above combination favours positive feedback loop (the bigger the foundries/plants, the cheaper the unit cost driving greater adoption)

- all predictions of installed capacity have been woeful

- there are no rate limiting inputs to slow this down (other than geopolitics). I was hoping to find some spade selling twist to this thematic, but it doesn't seem like there is one.

- Capex is the main issue and is being provided by the Chinese communist party.

- reasonable assumption that most advanced countries will have free power during the hours of sunlight early next decade. Even gloomy places like Europe, but excluding Britain (too gloomy, not enough land, too many people!)

The impact of that last statement is difficult to predict. Not for data centres, but for whole swathes of society.

couple of choice segments:

William Jevons, a 19th-century economist, pointed out that when energy gets cheaper, people use more of it. When that energy has large uncosted externalities, as fossil fuels do, Jevons’s “rebound effect” can be a source of environmental worry even as it provides economic benefits. If the energy’s only large cost is that of the marginal land in a place with a grid connection—or, if the user is willing to move nearby, without even that—it becomes a lot more benign

From the mid-1970s to the early 2020s cumulative shipments of photovoltaics increased by a factor of a million, which is 20 doublings. At the same time prices dropped by a factor of 500. That is a 27% decrease in costs for each doubling of installed capacity, which means a halving of costs every time installed capacity increases by 360%. If you treat the late 2000s, when subsidies led to the creation of foundries producing polysilicon specifically for solar cells, as an inflection point, the rate is now over 40%.

This performance suggests that solar is not like other energy sources. History shows the same thing. From 1800 to 2020 the amount of energy the world derived from coal increased by roughly a factor of 400. But as Dr Way and his colleagues point out, when adjusted for inflation coal’s cost in terms of its energy content stayed more or less the same. The same is true for the long-term costs of oil and, later, natural gas. Exploiting these fuels drove lots of economic growth; that made the fuels more affordable, their use more valuable and the returns on their production greater. But their costs stayed broadly stable in real terms.

Since the 1960s what analysts call the levelised cost of solar energy—the break-even price a project needs to get paid in order to recoup its financing for a fixed rate of return—has dropped by a factor of more than 1,000, and the trend is continuing

C