OK, so this is well beyond the purview of stock picking, but I spent some time this morning hate reading TCORP's financial reports. It came on my radar after reading a recent AFR article that talked about TCORP consolidating some of its funds. It piqued my curiosity, so i dug into it..

But let's back up a bit.

TCorp is "the financial services partner to the NSW public sector" -- or, more plainly, it is the central borrowing and investment management agency for the state of NSW. It was established to manage the state's financial assets and liabilities, providing financial services and solutions to the NSW Government and its public sector entities.

One of its core functions is to raises money for the state government (which in the trailing 12 months spent $7.8b more than it received and now has a $145b in borrowings, or $92.6b in net terms. Debt is expected to hit $190b in the next 3 years) -- so not an enviable task.

Anyway, after sifting through a bunch of annual reports, here are some factoids to get your blood boiling:

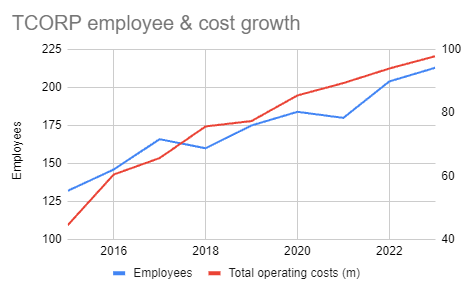

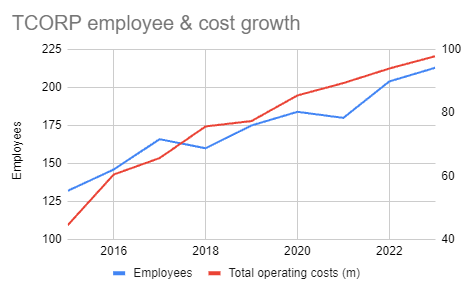

- TCORP employs 213 people, most classed as "professional" (ie beyond admin and support roles, which make up only 16% of the total).

- This is a number that has grown at an annual compound rate of 10.4%pa since 2015

- The total base salary and super expense for these people is $60.5 million, or $285k per employee

- Actually, that average is distorted by the top end somewhat: the CEO and 7 senior executives account for over 10% of the total salary, and collectively get >$5.3m per year, with an average base pay of $663k pa. Not bad work if you can get it! Still even if you exclude the big bosses, the average pay is ~$250k

- OK, let's not be too cynical. Maybe all that extra resourcing is delivering a good return on investment for the people of NSW?

- Well, the NPAT for TCORP has grown at a compound annual growth rate of 2.5% pa since 2015. Net assets have grown at 5.2% (remembering that the vast bulk of assets are in the form of loans to the government)

- You might think with 170 financial professionals, they'd at least do their own stock picking, right? No, they give the money to external fund managers (People like Blackrock and KKR...). From what i can tell, all they do is determine asset allocations.

- Across all their funds, they have achieved a weighted average return since inception of ~6.3% (ha!!). Frankly, they could pay me $200k per year and i'd put it all into an index fund. It'd save them >$90m a year in costs and they'd get a much better return. You're welcome.

- Luckily for TCORP, they tend to outperform their benchmarks (but not always). Could be something to do with the fact that the hurdle rates are laughable --

Anyway, i had to stop at this point. What a total joke and flagrant waste of tax payer money.