Pinned straw:

FWIW Gaurav Sodhi has posted an updated report on MIN on Intelligent Investor today and has a Buy under $65 (Sell above $120)

In short he's quite glowing on the stock

Key Points:

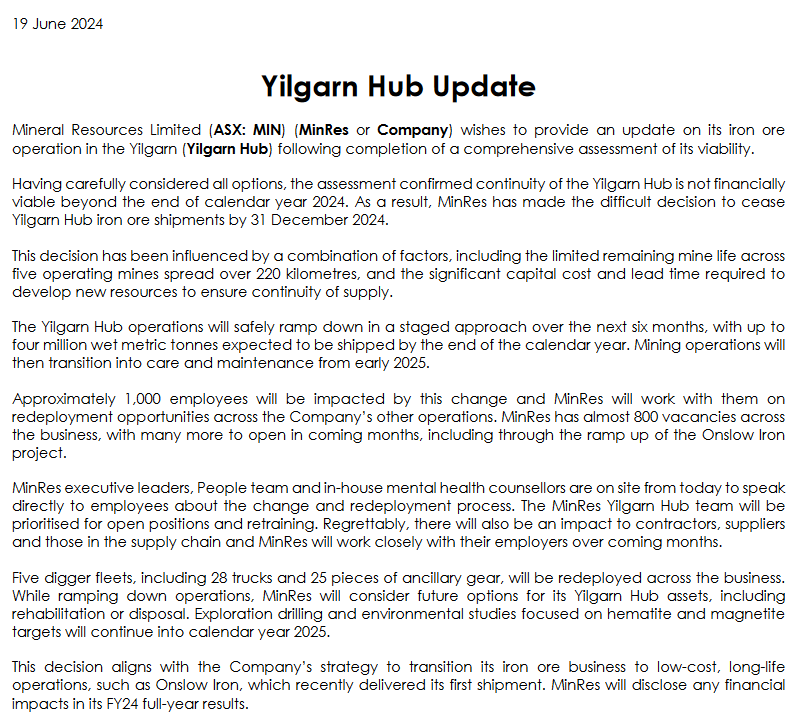

- Iron ore prices falling

- Lithium prices falling even more

- Balance sheet carries debt

but ...

"Nothing makes a more determined long-term investor than a fall in the price of a stock you own. Finding patience when prices fall might be a cliché, but it's the right call in this case.

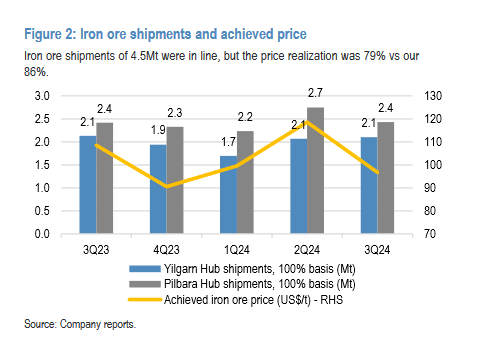

If we look out three, four or five years, MinRes will be a larger, more profitable business following the investments made now, in difficult times.

Iron ore volumes and margins will expand even as prices fall; lithium margins are admittedly at risk of lower prices but will be offset by higher volumes and rise with prices. Mining services earnings continue to grow and gas assets present an uncounted option. MinRes will be more profitable over time. We just have to be patient. BUY."

DISC: Held in RL & SM

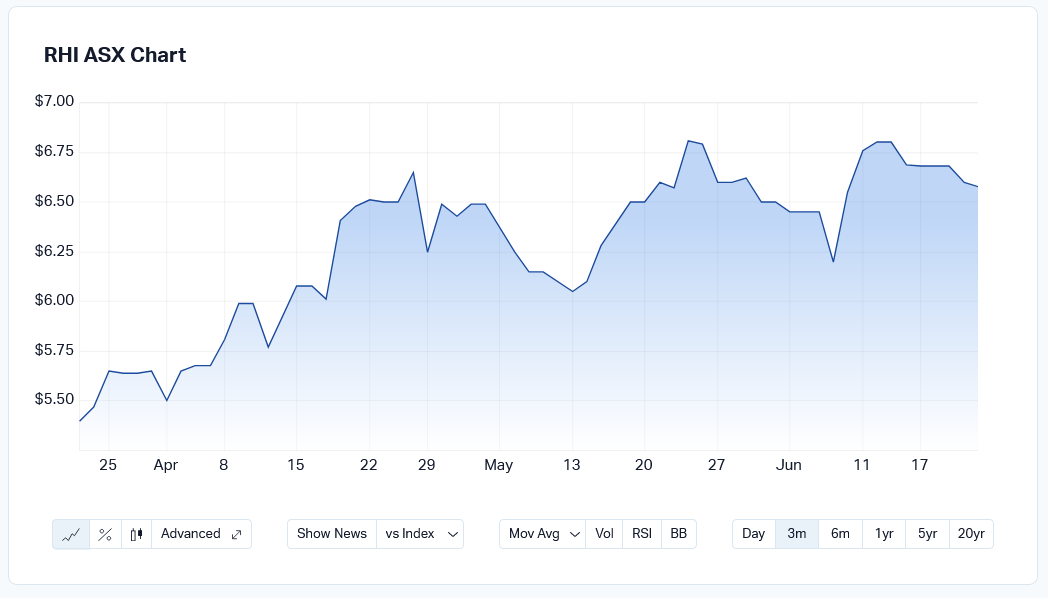

This may not be the bottom (indeed, the shares look vulnerable technically), but I couldn't resist initiating a position here at the lows. Still room to add if the market obliges with better prices over the coming months.