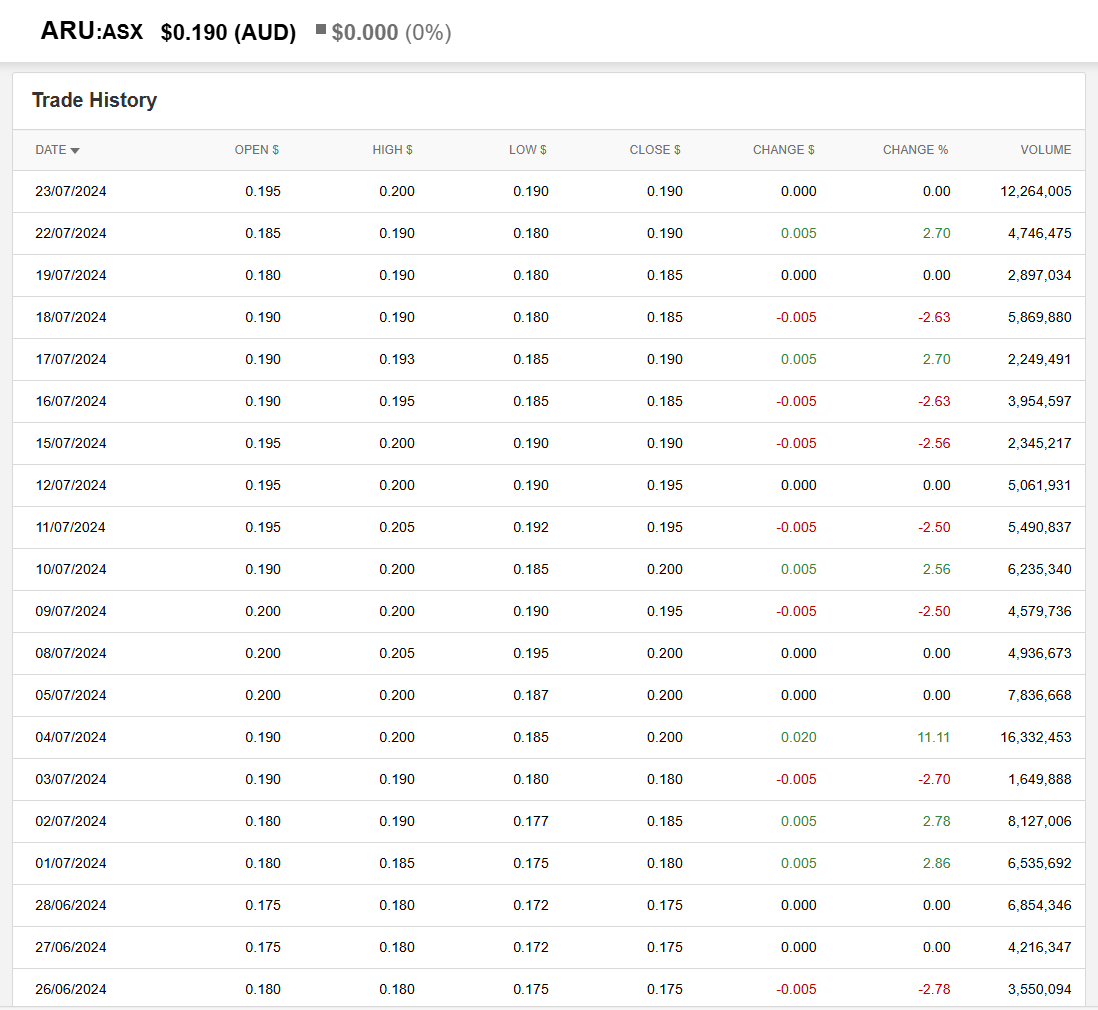

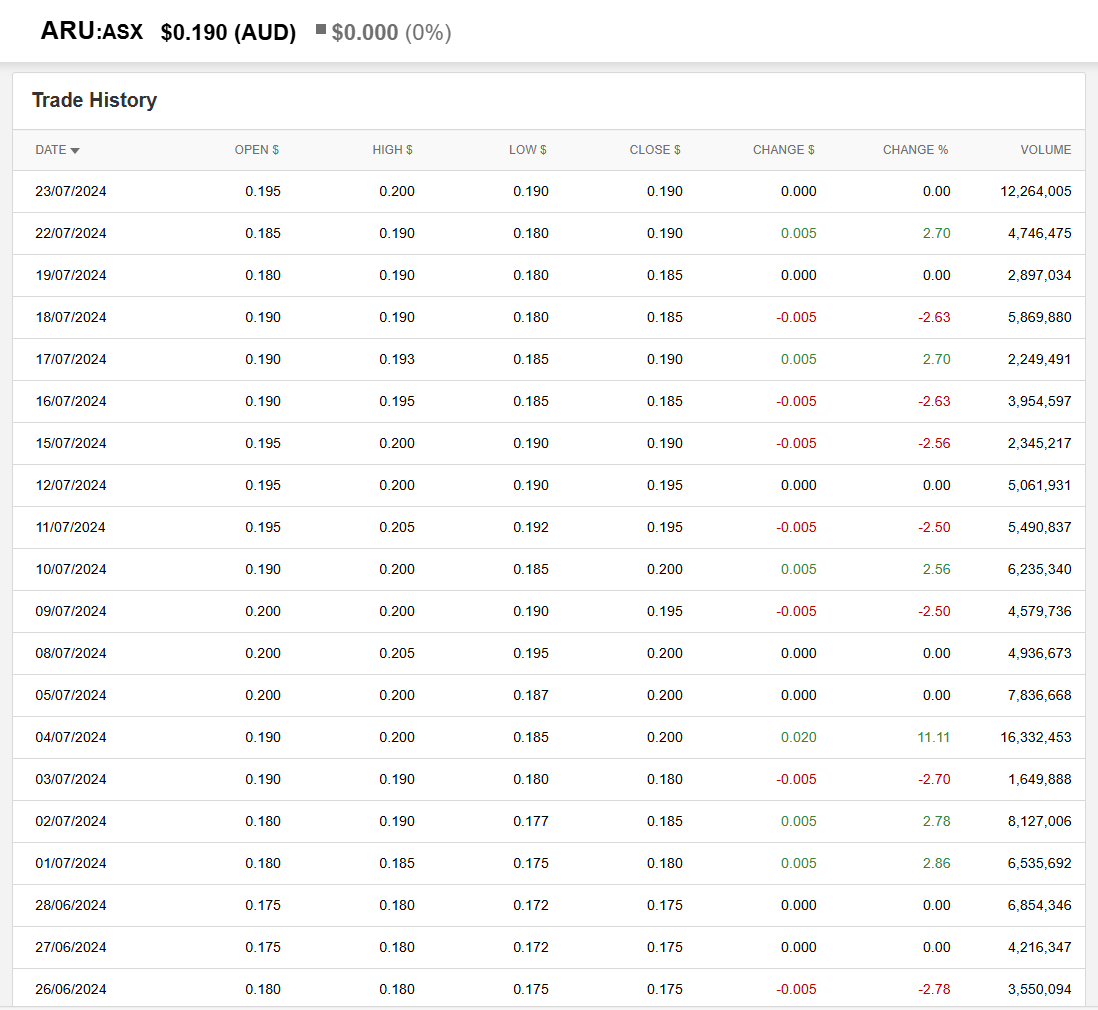

I am unaware of any course of sales data being available freely for prior days @Parko5 . I know you can look at "Trade History" in Commsec, but that only shows you opening prices, closing prices, and the day high and low, plus volume data, as shown below, not course of sales throughout the day.

In terms of your trade last night. The closing price is always determined by the CSPA or Closing Single Price Auction as explained here: https://www.asx.com.au/content/dam/asx/participants/trading-platforms/asx-closing-and-settlement-price-determination.pdf

Excerpt: Under normal market conditions, ASX uses a Closing Single Price Auction (CSPA), to generate a consensus price reflecting the interaction between market supply and demand. Where there are no trades completed in the daily CSPA, the closing price reflects the last trade executed on ASX during the continuous trading window or reported to ASX as an NBBO crossing. Where there were no trades in a security that day, the closing price will be the last traded price recorded on the ASX trading platform.

--- end of excerpt ---

Stocks like ARU generally will have an active CSPA most days, and they work like this:

On a normal day:

- Trading ceases at exactly 4pm, Sydney time.

- Trades can be entered between 4pm and 4:10pm, but are queued for the CSPA, not executed.

- During this period (4 to 4:10pm) the "indicative price" is displayed which suggests where the stock price would close if no further trades were lodged between that point in time and 4:10pm. As further trades are lodged and existing trades are modified or cancelled, the indicative price updates automatically to reflect these changes. This indicative price is, as the name suggests, indicative only, and is there to assist us, i.e. if the indicative price is 19.5 cps, I may not get my open buy trade closed out below that level in the CSPA so if I really want it to be executed I need to be placing at a higher level than the indicative price. This is when you have plenty of liquidity in a stock. If it's a low liquidity stock, then lodging a buy trade above the indicative price might simply move the indicative price up to your buy price, so you need to be aware of the liquidity, i.e. how much volume is there in the buys and sells and at what prices.

- At 4:10pm the system stops accepting new trades, and also won't accept cancellations or modifications of existing orders. For the next minute (4:10 to 4:11) the Closing Single Price Auction takes place, and the price is determined based on volume and prices that overlap and cancel each other out. If there is no overlap in prices, the last traded price is the final price, however where there are buy trades priced higher than sell trades, the system works out the closing price based on the volume and price points of those trades lodged before 4:10pm to determine the closing price - based on supply and demand basically.

- Then from 4.12pm to 5pm, the Adjust phase takes place where brokers may 'tidy up' their orders by cancelling unwanted orders, amending orders, etc. I have found that nothing that I lodge during this time is accepted, so I'm guessing that only brokers have that access. Anything I do in terms of new trades, trade modifications and cancelled trades after 4:10pm is simply queued up to be processed on the morning of the following trading day, where a similar process takes place to determine the opening price of each company after the 7am to 10am (Sydney time) "Pre-Open" market window for lodging, modififying or cancelling trades. Any trades lodged before 7am are queued to be added at 7am, and then from 7am to 10am you can see the orders and the indicative price that the stock would open at if no further trades were added, modified or cancelled.

In terms of manipulation, there is plenty of legal manipulation that takes place, much of it done by automatic trading systems, and one example is lots of small volume trades that are lodged to act like bread crumbs to suggest there is liquidity and interest at certain levels when there really isn't. In a low liquidity stock, you might have a series of small buy trades lodged below the current price at different intervals and so you think there is interest and lodge a sell trade and only a tiny part of that sell trade goes through and then the prices move down. I reckon this sort of behaviour is designed to lead buyers and sellers to "chase" the volume and try to close out the trade. This is really only obvious however with low liquidity companies because companies with heaps of liquidity are not so easily manipulated.

There is also a saying that the smart money buys and sells at the close, or only at the open and the close, and when you look at only trading at the close, that does make some sense because the day's closing price is really the one that matters in terms of the value of your position between then and the following trading day when you are holding a position, so the inference I guess is that the so called smart money is only interested in each day's closing price (just like Strawman.com is) and so decides whether to trade or not only during the pre-CSPA period on each trading day (4pm to 4:10pm) and only acts at this time. This does seem to check out in that there is often high volume transacted in that CSPA, much higher for instance than what was traded in the previous few hours of trade. Not always, but often with a few decent sized companies.

That could also be traders closing out their positions too. I tend not to worry too much about market manipulation. I just accept that it happens and there's nothing I can do about it, so I work within the system as I know it, making the best decisions that I can with what I know. At the end of the day, it's not what happens on a single day that matters, except if you are buying or selling on that day. It's where the share price trajectory is heading over time that really matters.

Further Reading: https://stockhead.com.au/primers/how-the-asxs-pre-open-market-works-and-the-risk-of-placing-an-order-during-this-window/

P.S. I mostly trade through Commsec and I have noticed that sometimes I can see ASX and Chi-X trades that have been lodged but not yet executed, and sometimes they only display ASX trades and NO Chi-X trades - in various screens, so that makes things a little harder to follow sometimes - there are a lot of smaller trades (those breadcrumb trades) lodged using Chi-X I reckon. The total volume and historical data (such as what I have screenshotted and included above) DOES include both ASX and Chi-X trades.