Can't explain it all @neke86_ , but I can give you some jigsaw pieces - see if they fit anywhere.

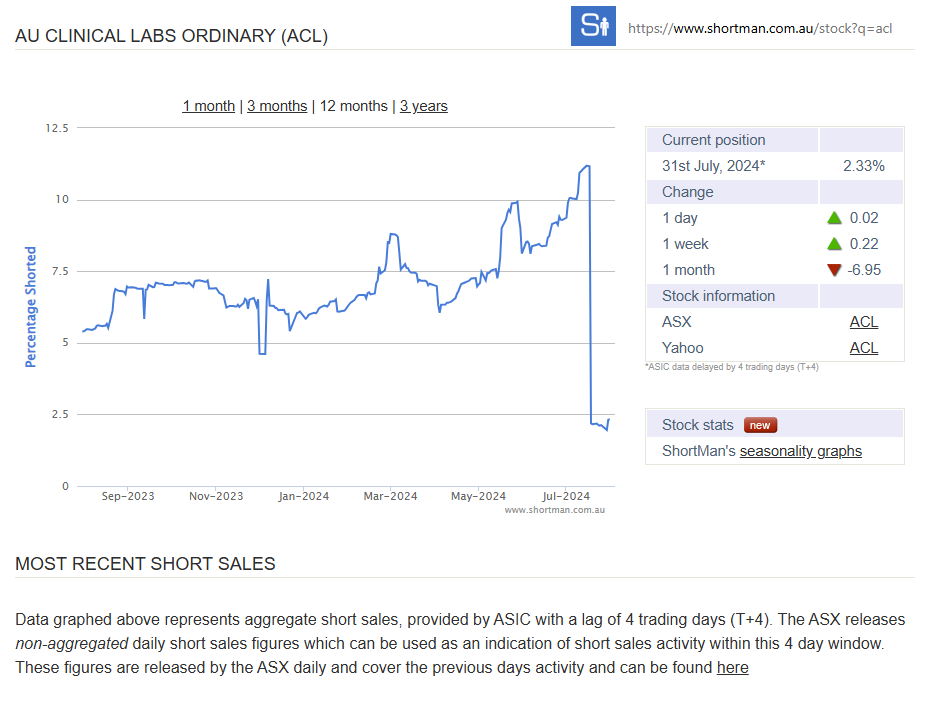

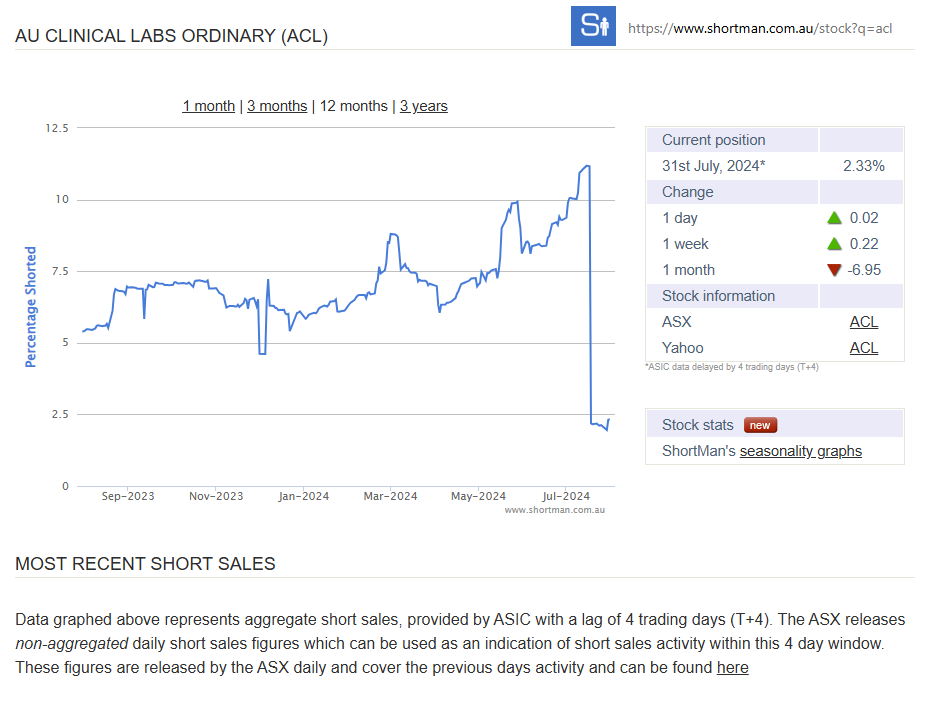

First - there's this: https://www.shortman.com.au/stock?q=acl

Next piece:

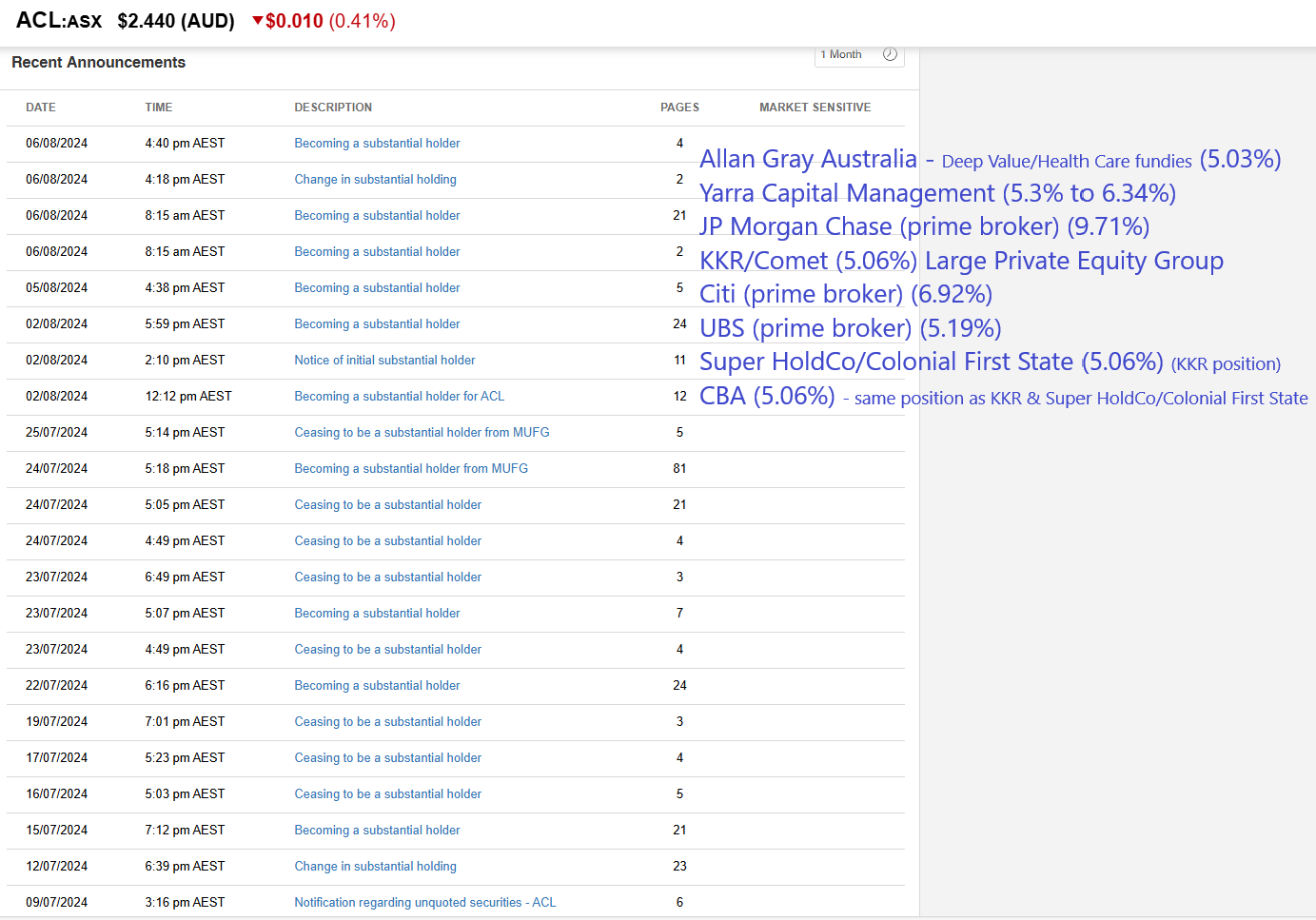

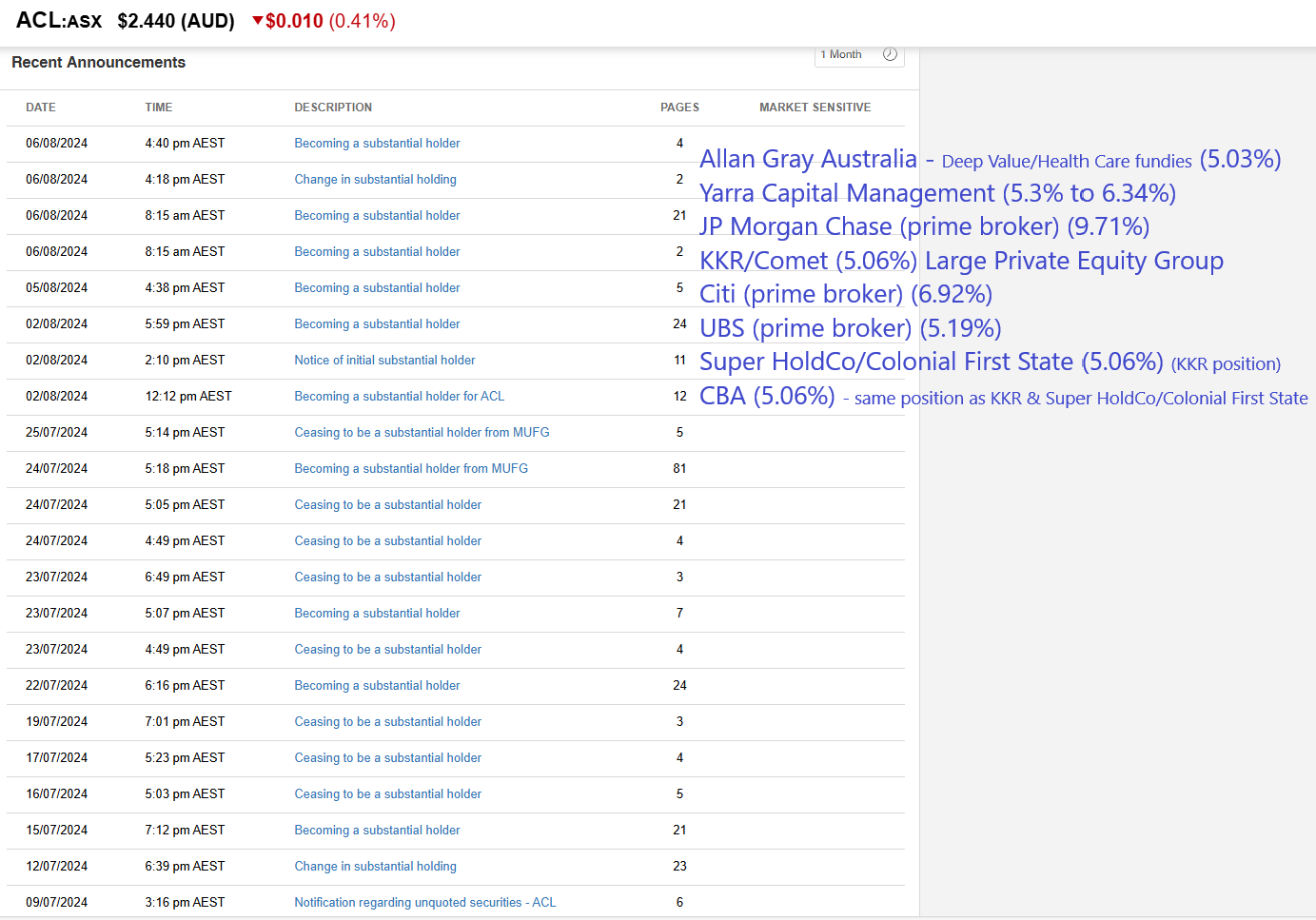

Note that 3 of those notices are for the same position - CBA, KKR/Comet and Superannuation HoldCo/Colonial First State. Similarly if you see notices for First Sentier Investors, they are owned my Mitsubishi UFJ Group, (MUFG), so you'll see mirror notices for those two also quite often, depending on whether the underlying holding is held by the smaller subsidiary or not. In the case of the CBA/KKR/Colonial tie-up, I think that might have to do with this:

https://www.afr.com/street-talk/ethical-partners-to-close-its-doors-massive-blocks-in-acl-noble-oak-20240718-p5juw3 [AFR, July 18th, 2024]

Street Talk

Ethical Partners to close, sells massive big blocks in ACL, NobleOak

Sarah Thompson, Kanika Sood and Emma Rapaport

Jul 18, 2024 – 10.04pm

Funds management house Ethical Partners, co-founded by ex Perpetual deputy head of equities Nathan Parkin six years ago, will close its doors and return nearly $2 billion to investors in a move that spells big changes for the ownership of Australian Clinical Labs and insurer NobleOak.

Street Talk can reveal Ethical Partners was the seller behind a 10 per cent slice of ACL and just under 15 per cent of NobleOak traded by E&P Financial and Barrenjoey respectively on Thursday. Sources said Ethical Partners sold the stock – among other, smaller names – after receiving redemption requests from a handful of institutional clients.

Ethical Partners co-founders Nathan Parkin (left) and Matt Nacard are shutting up shop after six years. [image: Karl Schwerdtfeger]

“We have made the decision to hand all money back to clients. We are in the process of telling clients and we appreciate their support over the past six years … We are proud of the leadership in ESG and careful stewardship of client funds,” Parkin said when contacted by Street Talk.

Parkin was Perpetual’s well-regarded deputy head of equities until 2018, when he branched out to set up his own shop. In six years, the firm came to oversee about $2 billion in funds under management.

Ethical Partners’ decision to close comes as active managers battle a tougher institutional market, where superannuation mergers and in-housing of investment capabilities have dried up long-term investment mandates. Value investors – of which Ethical Partners was one – lost their sheen to growth managers during lower interest rate periods.

--- ends ---

I reckon that fund ("Ethical Partners") selling 10% of ACL in July coincides with a big unwind in the short position and is likely why Allan Gray and Yarra AM have increased their stake - buying blocks of ACL stock from Ethical Partners through those brokers.

The prime brokers (JP Morgan, Citi, UBS) are always trading in and out of companies as demand for stock waxes and wanes, particularly from shorters who use those prime brokers to borrow stock from. A lot of ACL stock would have been returned to those prime brokers as the shorts unwound in July.

Hope that helps a bit.