RWC

RWC

FY24 Results + Outlook

Pinned straw:

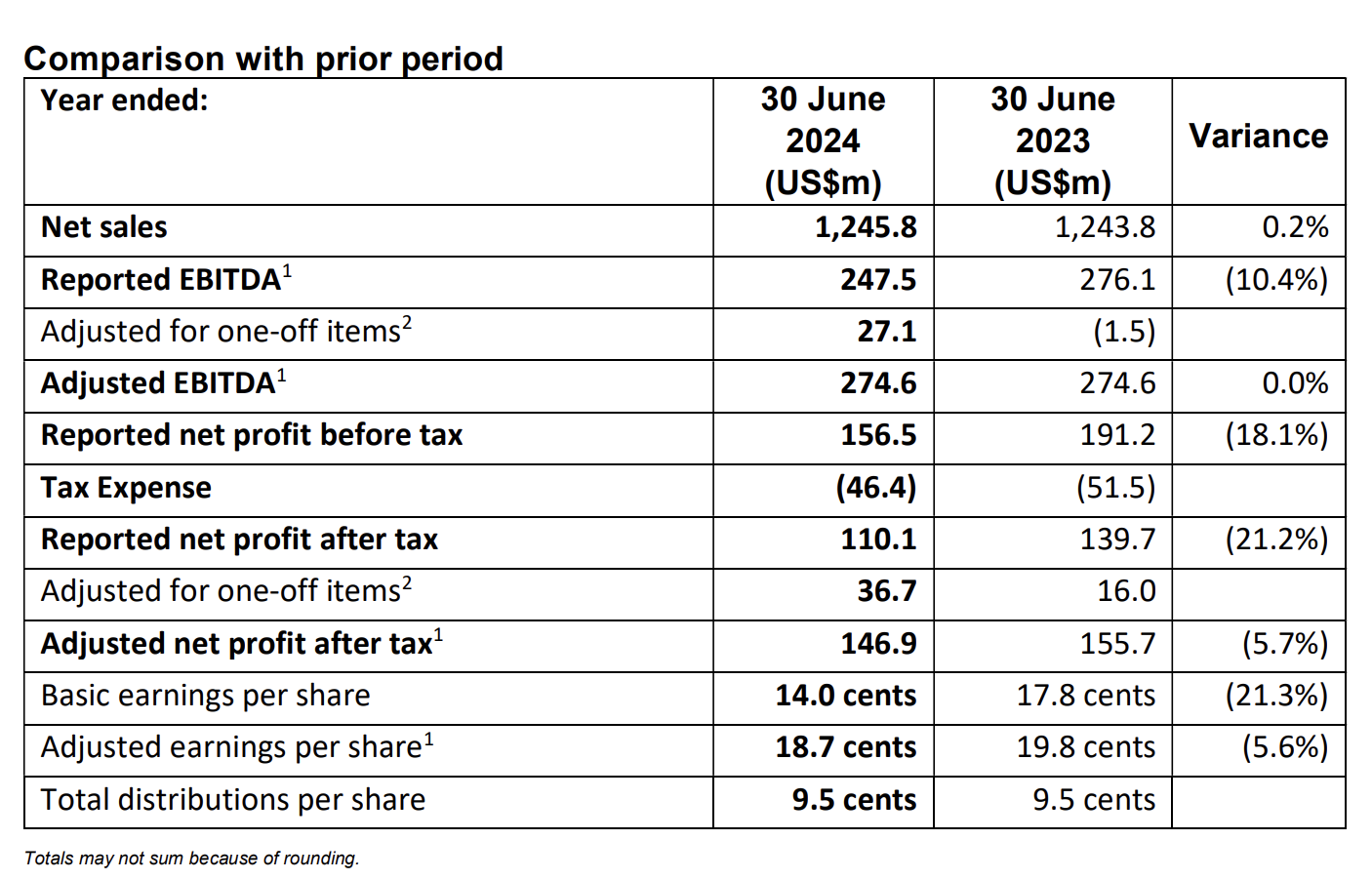

So apparently the results were slightly better than expected

Hence share price is up 10%

Which funnily enough makes the valuation even more STRETCHED

5