Pinned straw:

A friend recently pointed me towards FOS Capital (ASX:FOS) and said it was worth a look. I'd never heard of it before, but having had a quick look it seems to have some merit.

First off, it's tiny -- $13m market cap, and averages about $10k per day in trade value. On that basis alone it's something you need to be very careful with. We've profiled companies like this before (eg Stealth Global), but still, it could be super difficult to fill a position, and even then it may prove to be something of a lobster trap (hard to get out once you get in).

Anyway, although the name makes it sound like a financial services company, FOS designs, manufactures and markets lights and controls, mainly for commercial and industrial customers. (FOS is the Greek word for 'light')

The origins go back to the 70’s when it was first established as a fluorescent lighting manufacturer. It's undergone a long series of acquisitions, and in June 2021 it listed on the ASX after raising $3m at 25c per share. Now it's 27c

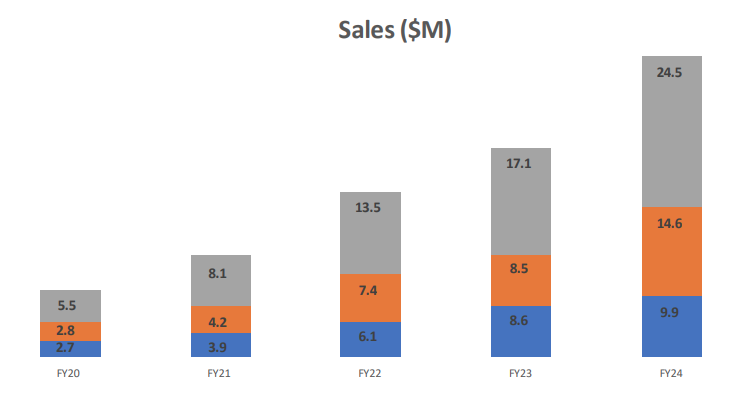

Since then, sales have roughly tripled, and grew at 72% in the second half just ended (24% organic):

Moreover, the business has been profitable for 10 consecutive half-year periods. In the year just ended they did $2.1m in EBITDA and $1.1m in NPAT, a record result.

The PE is like 13x and they also pay 3.7% ff dividend.

And it looks like there's a bit of growth ahead, with a strong order book and growing quotes (up 20% in last 6 months). There's also a recent acquisition (KLIK) which should drive more growth and has some duplicated costs that they think they can strip out (they seem to have some form on this front -- having done 5 acquisition since listing, all while expanding margins).

In fact, they are doing 8.6% in operating margin today, but (reminiscent of Stealth) they think they can improve this and have a 10% medium term target. They have about 5% market share, but aim to get to 15% in the coming years.

The company reckons there's a tailwind in terms of govt. infrastructure spending, and tapping into new markets.

Management own 57% through SKM Investment group.

Anyway -- not without risks. A construction or CAPEX downturn would hurt, there's always acquisition risk and as mentioned it's super illiquid.

There's a bit of debt too -- $1.5m as a business loan and $1.1m in invoice financing, all held against $1.7m in cash. There's almost $5m in brands and goodwill as intangible assets given all the acquisitions. All told, the net asset value is just shy of $10m, or $5m if you strip out the intangibles.

Still, aligned management, history of successful execution, low multiple and reasonable growth outlook make it interesting

To be clear, I do not own any shares, and given the potential risks/perception of a ramp I wont buy without first disclosing here first. I want to speak to the CEO first anyway, and have asked if he'd be keen to do a Strawman interview

Keen for any thoughts from others.

Barium

I have held FOS since its float for a few reasons:

• The Chairman has an excellent record of taking companies into good performance.

• Specialised lighting that requires high quality and bespoke solutions creates a moat around the potential low-cost Asian competitors. Those constructing or renovating quality buildings want good lighting

• The company has been profitable from day 1.

Bear77

Fair enough @Barium - I note that Sandy Beard left CVC in early August 2019, which appeared fortuitous in terms of timing as their share price dove right down from $2.45 to $1.01 over the following 8 months (to 2/4/2020) - so he got out at a good time clearly. They closed at $1.56 today (up 6 cents) but still well below where they were when Sandy was their Chairman. They did provide good dividends when he was there however, and their share price did rise up until he left.

Sandy Beard is still the Chairman of Hancock & Gore (HNG) (and their largest shareholder @ 10.67%) and he's been there since 31/10/2020 when their SP was 30 cps. HNG closed today @ 35 cps and they have paid a total of 5.5 cps in dividends in total over that period of almost 4 years or about 1.5 cps per year (on average) all fully franked, so around a 5%pa dividend yield if you paid 30 cps for them back when he joined them, or around 7%pa (average) grossed up (including the franking credits). Not bad. And around +4.4% p.a. capital growth (30 to 35 cps over almost 4 years). Plenty of companies have provided much worse returns than that.

They are a very illiquid company however, and the share price is super-choppy. But if you can stomach the volatility the returns have been decent.

Commsec says: Hancock & Gore Ltd (HNG) is a diversified investment company with a focus on active management and driving shareholder returns through investing in a broad range of opportunities across Private Equity, ASX Listed Equities, funds management and real property, debt funding and other alternative investments. The company seeks to become a trusted partner of choice that aims to solve their partner's problems, identifying and pursuing opportunities that benefit all parties. The key strategic objective of the company is to deliver long term returns to shareholders, in excess of 15% per annum on invested capital, including dividends and long-term capital growth. This company aims to fulfill this objective through a combination of short-term, medium-term, and long-term investment strategies which will both increase in size and overlap over time with reinvestment of profits.

--- end of description ---

It's that reference to Private Equity that scares me off - too many bad stories and poor outcomes.

Sandy Beard is also the Chairman of AN1: Commsec says: Anagenics Limited (AN1, formerly Cellmid Limited) is a health and beauty-tech business growing through the global distribution and sales of its proprietary and licensed brands of differentiated, clinically validated anti-aging solutions. BLC Cosmetics Pty Ltd is Anagenics' wholly owned subsidiary focused on sales and distribution of Australian and international brands of cosmetic and wellness products. Advangen Pty Ltd is Anagenics' wholly owned subsidiary engaged in the development and sale of proprietary products for hair, skin and body.

--- end of description ---

Don't know if anybody remembers BWX (was placed in liquidation on 10th May this year). That was a private equity float and another beauty and cosmetics company. Other PE floats include Dick Smith Electronics (after PE bought it off Woolworths for a fraction of what WOW had paid founder Dick Smith for it), Baby Bunting (BBN, was over $6/share, now under $2/share), Appen (APX) was another - went to over $30/share, back below $1.50 now, and have been as low as 26 cents in the past year. Dusk Group (DSK) is another company that was spun out of private equity and did well initially and then tanked - DSK peaked at $3.85 in May 2021 and is now trading at less than $1.

Sandy Beard had nothing to do with DSE, BWX, BBN, APX or DSK - these are just cautionary tales about the sort of investor returns (or lack of) that ex-private equity (ex-PE) companies can provide for their shareholders once they become ASX-listed companies. They usually do fine, until PE has fully exited at a nice profit, and then they turn pear-shaped real quick.

Anagesics (AN1), where Sandy Beard is also the current Chairman, closed at $0.008 (eight tenths of one cent) today. Sandy became the Chair of AN1 on 17-Feb-2022 when their share price had already dropped from over 25 cps to 5.2 cps, and they've only gone lower since. The company has had negative earnings and negative ROE for each of the past 10 years. No excellent record there.

For some reason Commsec does not list Mr Beard as either a current or a former director of Centrepoint Alliance (CAF) - but he was apparently appointed a Director in 2020: https://www.industrymoves.com/moves/new-centrepoint-director-comes-from-investing-biotech-background

That January 2020 article says: Financial adviser service provider Centrepoint Alliance has named Alexander (Sandy) Beard to their board of director. A professional investor, Beard brings a diverse set of experiences to Centrepoint. He was the CEO of the ASX-listed CVC Limited, a diversified investment company that invests patient capital in listed and unlisted capital. In addition to his duties with Centrepoint Alliance, Beard is also a director with pharmaceutical company Probiotec Limited, property investor Eildon Capital Ltd, and TasFoods.

--- end of excerpt ---

Probiotec got bought out by an Indonesian company apparently, although it had not been making good returns for its shareholders prior to that takeover accord to this article: https://www.afr.com/street-talk/probiotec-in-play-receives-3-a-share-offer-from-offshore-buyer-20231222-p5et7u [22-Dec-2023]

Sandy Beard left Eildon Capital group (EDC) in January 2020, after apparently being there for 21 years. The company had only been listed on the ASX for 3 years at that point (when Sandy Beard left) and the share price was around the same level as when they first listed (IPO'd), but it's lower now. It looks like they did pay some decent dividends during the period that Sandy was there (after they IPO'd in Feb 2017) and since then also so they must have been profitable.

Sandy Beard left TasFoods (TFL) in October 2020 after 2 years as a NED there. After peaking at 42 cps in 2015, TFL has been in a long downtrend that has taken them all the way to 1.6 cps today (so under 2 cents), and their downtrend was not interupted by Sandy Beard's short tenure on their Board between 2018 and 2020.

So a bit hit and miss - Some companies that he was at have provided some decent returns for retail investors, like CVC, EDC, CAF and HNG, and some, not so much, like TFL and AN1.

You might notice that the ones that have done well are the financial services and investment companies, and the ones that have done poorly are the ones that actually produce (manufacture) products and try to sell them.

If I've missed any @Barium leave a comment please - I'll have a look.

Barium

Thanks Bear.

This is very thorough. I have been following all these companies too, and you have an exhaustive list. There are some others like KIL that were invested in through HNG's High Conviction Fund, which have turned a profit.

As you say, it is a very illiquid company, so only for the brave.

thetjs

Have had FOS on a watchlist since the IPO.

Could never quite get a handle on what the long term growth strategy for them would be.

The acquisitions on the lineal fixtures will get them greater market share. But it’s the share of a market without, in my experience, a huge amount of loyalty.

Looking at their last presentation, particularly the order book and our clients section. The huge uptick in Dec ‘23 and Jan ‘24 look like the award of a few big contracts.

The our clients page would lean towards projects of large volume/size. In lieu of premium products.

So if their growth sits with wining larger projects. What’s that pipeline like in the near and long term.

They may have a slight advantage being an Australian manufacturer in terms of government requirements to use local companies. However those requirements, for the builder, often get achieved at the sub-contractor level with supplier focus more on green ratings and/or First Nations affiliated companies.

The consolidation piece is great. But I think it’ll hit a limit of advantage soon and from there it’s competition with overseas suppliers.

Now with all that said. Watch these guys shoot the lights out and become the next Reece Plumbing.

edgescape

Was on my radar too. Seemed to have popped today.

Looks good value but don't want to have too many contractors in my holdings.

Bear77

Never heard of FOS before. On their management - bit of PE (private equity), a bit of SKS - which tripled in price (under 50 cps to over $1.50 in 3 months earlier this year, but has been falling in August):

Alexander (Sandy) Beard

Chairman and Non-Executive Director

Sandy is a seasoned Company Director, Investor and Investment professional focussed on driving value from small cap ASX listed companies and private equity and early stage investments. He is Chairman and substantial holder in ASX Listed Hancock & Gore Limited, a diversified investment company. Previously was CEO and MD of CVC Limited from 2001 – 2019 where he oversaw investment returns in excess of 15% per annum over that period. He has extensive experience working with investee businesses, both in providing advice and in direct management roles, especially bringing management expertise to early-stage businesses and in turning around financial performance to deliver substantial shareholder returns for sustained periods.

Sandy’s key focus is extracting and overseeing the creation of shareholder value from the companies with which he is involved.

Sandy Beard is currently Executive Chairman of Hancock & Gore Limited (ASX:HNG), Chairman of Anagenics Limited (ASX:AN1) and Director of Centrepoint Alliance (ASX:CAF).

[CAF was doing nothing until they reported last Thursday, then they shot up, AN1's chart looks horrible, CVC's chart looks worse, and HNG looks choppy and a bit nasty too.]

Con Scrinis

Chief Executive Officer and Managing Director

Con has been involved in the electrical and lighting industry for over 35 years. He founded commercial and industrial lighting manufacturer Moonlighting in 1991. Moonlighting employed 150 staff with revenues of +$30M. Moonlighting was sold to Gerard Lighting in 2004.

He then founded and was Managing Director of ASX listed Traffic Technologies which developed the first Australian Standard approved LED traffic light. Traffic Technologies had +$100M in revenues across 3 divisions, Traffic lights, Traffic management and Traffic Signs. Con was a major shareholder and Director of ASX listed SKS Technologies Group Ltd formerly Stokes Ltd which transformed from an appliance parts manufacturer and distributor to a lighting and audio-visual business.

[Love it when the top job is held by a Con]

Michael Koutsakis

Executive Director (Sales & Marketing)

Michael completed his Degree in Electrical and Computing Engineering at Monash University and has been involved in the electrical/lighting industry for over 28 years. Michael has held senior sales & marketing positions Sunlighting/Holophane, Moonlighting, Zumtobel/Bega, and WE-EF lighting.

Michael then joined the ASX listed SKS Technologies Group LTD formerly Stokes Limited as Executive General Manager Lighting in order to further develop and grow the companies lighting division.

[It all sounds Greek to me]

Michael Monsonego

Non-executive Director

After graduating the IDF as field medic in 1999 Michael attended Hadassah College in Jerusalem to study computers engineering. He joined Israeli TV broadcast company TELAD as a software engineer working on digital broadcasting systems. After 2 years he was promoted to lead the software team of TELAD. In 2004 Michael took up a new position as software engineer at Optibase in Israel, leading provider of video over IP solutions. In 2009 he joined Forma lighting in the R&D team responsible for developing LED lighting solutions.

Michael then moved through the ranks and now holds the position of General manger of Forma Lighting HK.

[Ahh, a Weebit of Israeli Tech on the Board]

Source: https://www.foscapital.com.au/about-us

FOS' one-year chart looks good, however they are just back to where they were in April 2022, not sure if the current uptrend is too sustainable. Their financial highlights look good compared to the prior year, however is it growth via aquisition (M&A)? They acquired KLIK Systems, and in the previous year they acquired Hawko so it would be interesting to split that out and see if they are achieving much organic growth or just acquisitive growth - the type that Private Equity groups tend to go for.

I haven't done any real work on this one, so I can't answer my own questions - just suggesting that these are things that should be looked at with a $13m market cap company that does Lighting but has the word "Capital" in their name.

I do note that despite their "bumper" year, their EBITDA margin is only 8.6% - so single digit margin - and this isn't an FMCG company that relies on massive volume of sales, they manufacture and sell lighting solutions.

Another thing - In their presentation for FY23 one year ago, they said (on slide 2) that their operating cashflow was -$0.1M (i.e. negative) and their Order Book was down -46% to $3.3m, so at least some of the metrics they are touting this year are coming off a reasonably low base.

This year they said their NPAT was up +88% to $1.1m however that did NOT include restructuring costs of $600K (in the note at the bottom of the slide), so their NPAT was actually only half a mil, not 1.1 mil, and half a mil is actually lower than last year. FY23 NPAT = $0.58 m vs $0.5 m for FY24 (after the $0.6m of restructuring costs have been deducted from the $1.1m NPAT). So lower NPAT even with the extra acquisition in FY24. And the 2 cents EPS that they've reported in their slide this year is also before the $600K of restructuring costs.

Like I said, I haven't looked under the hood too much with this one, but just looking at their presentation this year vs. last year and knowing that their Chairman is ex-PE and either ran or was on the Board of those other companies is enough for me to pass.

Strawman

Excellent points @Bear77

I've barely dug under the surface myself, but my read was that it's a push for better scale advantages. And with all the acquisitions, you need to squint to have some guess at what 'normalised' earnings could be as they grow. We're yet to see if they can engineer the growth and margins they are signaling, while simultaneously maintaining decent organic performance, but that seems to be the strategy.

It just piqued my interest in the sense that in the early parts of these strategies you can get accelerated profit growth -- at least for a time -- by unlocking genuine synergies and securing larger contracts as you scale up. And you eventually go from a low to high multiple as you get bigger and market liquidity improves. That's assuming it all works out, but ascending the market cap ranks from micro to small (and hopefully beyond!) can be worthwhile if you have a 3-5 year view.

Plenty of companies don't succeed of course, or take waaay longer than you think. At one stage I thought Spectur (SP3) may be a contender (and maybe it still is, i havent looked for a while).

Con has agreed to come chat, so hopefully we can get a clearer read then.