I might have been a bit too enthusiastic when I wrote my “Bull Case” straw for Acrow a few weeks ago. At that time shares were trading at $1.05 per share and I thought that was a bargain. Acrow shares have traded as low as 94 cps since reporting. So what happened?

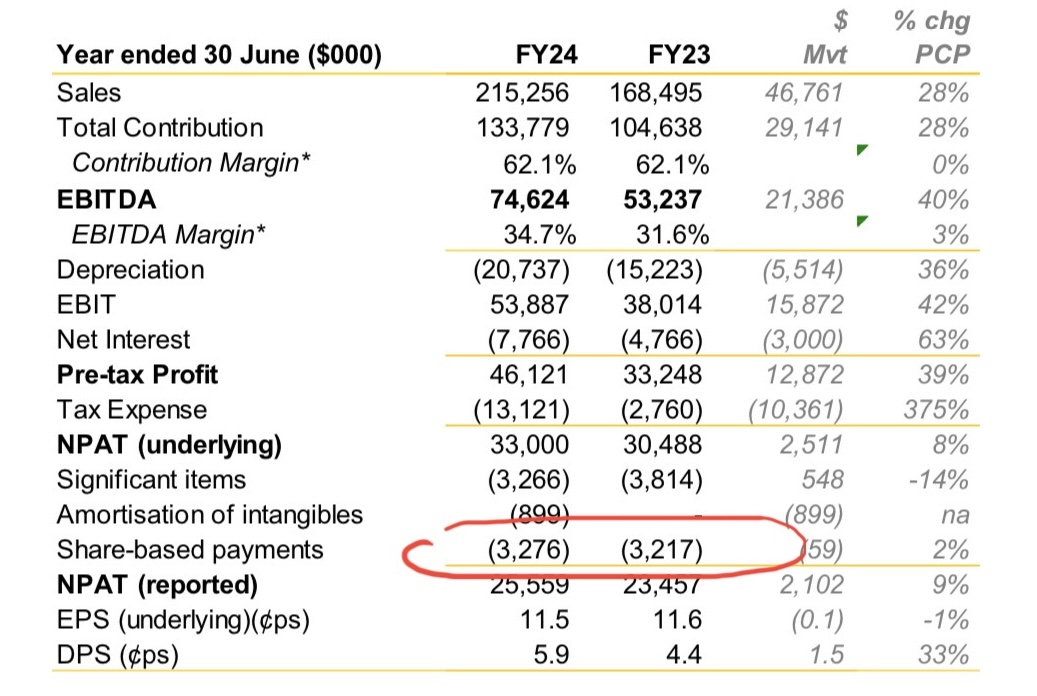

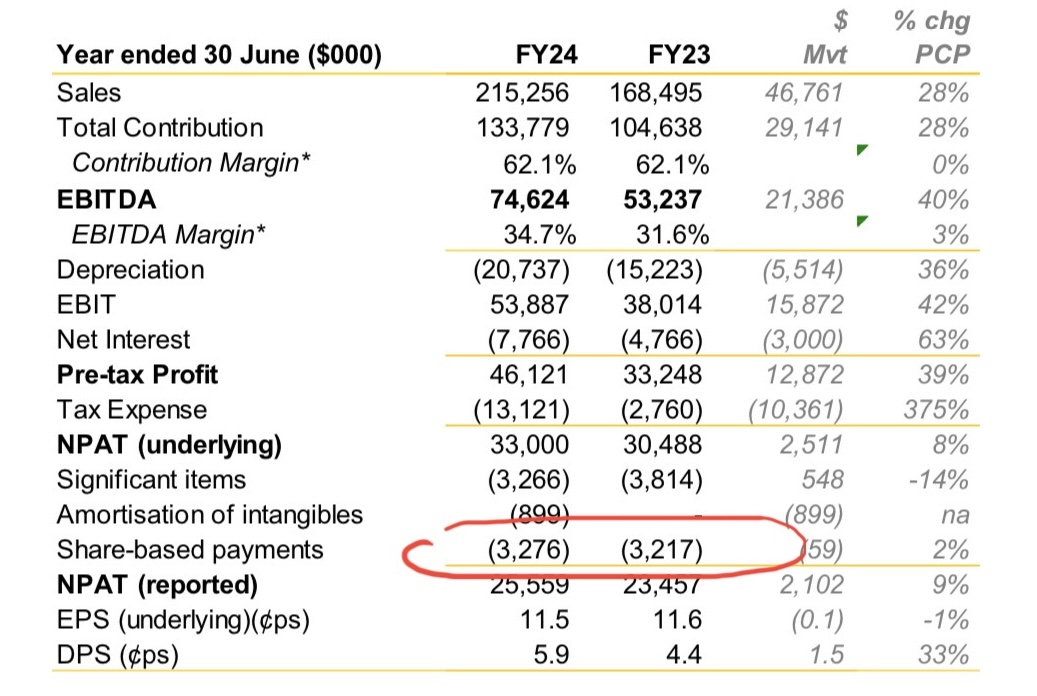

At a glance the key highlights looked OK:

• EBITDA of $74.6m up 40% on PCP

• Pre-tax profit (underlying) of $46.1m up 39% on PCP

• NPAT (underlying) of $33.0m up 8% on PCP, despite effective tax rate of 30% (FY23: 8%)

• EPS (underlying) down 1% on PCP to 11.5 cps, impacted by effective tax rate increase

• Final dividend of 3.0 cents (fully franked), up11% on PCP

• Return on Equity of 27.1% after factoring in higher effective tax rate

• Record new hire contracts secured up 17%, and pipeline up 33%

• MI Scaffold and Benchmark Scaffolding acquisitions expand Industrial Services division and bolsters group recurring revenue

• FY25 forecasting circa 20% revenue growth and double-digit EBITDA growth

However, I don’t think “underlying” NPAT and EPS were a true indication of normalised earnings. To arrive at these figures share based payments of $3.28 million were added back to the “Reported NPAT.” Share based payments are real costs to shareholders, have been on-going, and are not one-offs. Adding these back has boosted underlying NPAT by 13%.

I consider “normalised NPAT” to be $29.7 million, or 10 cps (up from a reported 7 cps for FY23). Normalised ROE comes back to 20% for FY24, not the 27% as stated by Acrow in the Key Highlights.

This year shareholders were diluted through capital raising for acquisitions, DRPs, and share based payments. The share count increased by 35.1m to 301.4m, an increase of 13.2% on the prior year. This was primarily due to the following:

- In November 2023, Acrow acquired MI Scaffolding. The acquisition was partly funded by a $15m capital raise, resulting in the issuance of 18.8m new shares;

- In March 2024, Acrow issued 1.8m new shares to the vendors of Benchmark Scaffolding as part payment for the acquisition;

- Acrow issued a total of 8.1m new shares as part of the dividend reinvestment plans (DRP) in November 2023 and May 2024, including a DRP shortfall underwrite of 6.6m new shares in May 2024, to assist in funding short and mid-term growth opportunities; and

- The balance of approximately 6.4m new shares came from the conversion of performance rights.

Debt increased from $51.3 million to $74.2 million, or net debt on equity of 48.7%. This is higher than I’d like to see it in the current economic climate.

Looking Forward

Management are forecasting 20% revenue growth and double digit EBITDA growth for FY25. Analyst Consensus is for EPS of 11 cps in FY25. This puts ROE at 23% going forward.

Valuation

Using McNiven’s Formula assuming current shareholder equity of 47 cps, forward ROE of 23%, reinvested earnings 34%, fully franked dividends at a 66% pay out ratio, and requiring a 14% annual return I get a valuation of $1.15. That’s a FY25 PE of 10.5 based on analyst consensus.

I still like Acrow and have been adding at around 94 cps before it goes ex-dividend on 30 October. At the current share price Acrow has an 8.9% gross yield which makes it a good dividend stock in the portfolio.

Held IRL (2.9%), SM (4.2%)