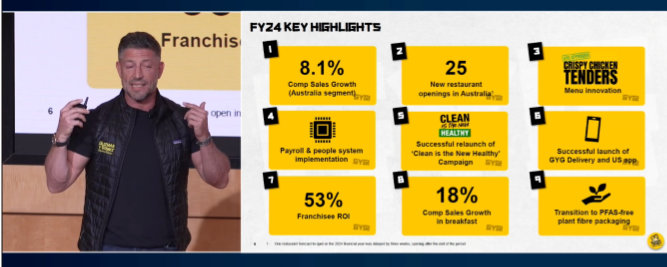

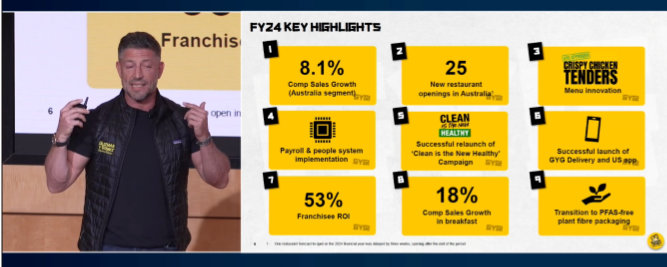

GYG presentation below

noted costly to set-up the shop these days ~$2Mill

25% sell

So looking at how McDonalds coffee market in Australia; Presently McDonalds has 25% of this market, GYG is very interested on taking a share of this.

there is More Presentations listed Below Just Scroll:

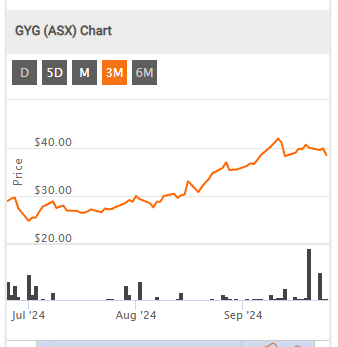

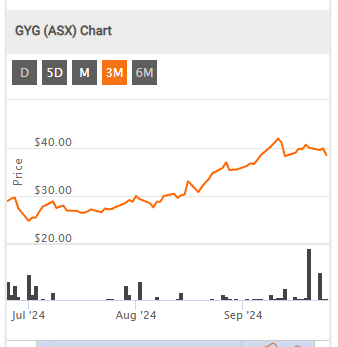

GYG asx Listed for 3months

8:50 am - 9:20 am - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium

Notes

Favourite

8:50 am

Blair Beaton - Group Executive, Listings - ASX

Notes

Favourite

ASX Welcome

8:55 am

Ian Irvine - ASX Conference Moderator

Notes

Favourite

MC Introduction + House Keeping

9:05 am

Grady Wulff - Market Analyst - Bell Financial Group Ltd

Notes

Favourite

Please click here to visit the Bell Financial Group Ltd booth.

9:20 am - 11:00 am - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium

Notes

Favourite

9:20 am

Oleg Vornik - CEO - DroneShield Ltd

Notes

Favourite

Please click here to visit the DroneShield Ltd booth.

9:40 am

Jitu Bhudia - Deputy CFO - Emeco Holdings Ltd, Theresa Mlikota - CFO - Emeco Holdings Ltd

Notes

Favourite

Please click here to visit the Emeco Holdings Ltd booth.

10:00 am

Yoav Amitai - CEO - Elsight Ltd

Notes

Favourite

Please click here to visit the Elsight Ltd booth.

10:20 am

James Agnew - CFO - Aroa Biosurgery Ltd

Notes

Favourite

Please click here to visit the Aroa Biosurgery Ltd booth.

10:40 am

Dr Howie McKibbon - CEO - Botanix Pharmaceuticals Ltd

Notes

Favourite

Please click here to visit the Botanix Ltd booth.

11:00 am - 11:20 am - 25 September 2024

Session - Break

Notes

Favourite

11:20 am - 12:00 pm - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium

Notes

Favourite

11:20 am

Jayne Shaw - Executive Chair - BCAL Diagnostics Ltd

Notes

Favourite

Please click here to visit the BCAL Diagnostics Ltd booth.

11:27 am

Michael Kotsanis - CEO & MD - Acrux Ltd

Notes

Favourite

Please click here to visit the Acrux Ltd booth.

11:34 am

Nan-Maree Schoerie - MD - ECS Botanics Ltd

Notes

Favourite

Please click here to visit the ECS Botanics Holdings Ltd booth.

11:41 am

Dr Luke Reid - CEO - Microba Life Sciences Ltd

Notes

Favourite

Please click here to visit the Microba Life Sciences Ltd booth.

11:48 am

Marc Lichtenstein - CFO - Close the Loop Ltd

Notes

Favourite

Please click here to visit the Close the Loop Ltd booth.

11:55 am

Bill Kyriacou - CFO - Dropsuite Ltd

Notes

Favourite

Please click here to visit the Dropsuite Ltd booth.

12:00 pm - 12:40 pm - 25 September 2024

Session - Break

Notes

Favourite

12:40 pm - 2:20 pm - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium

Notes

Favourite

12:40 pm

Terence Wong - CFO - Generation Development Group Ltd

Notes

Favourite

Please click here to visit the Generation Development Group Ltd booth.

1:00 pm

Blair Turnball - CEO - Tower Ltd

Notes

Favourite

Please click here to visit the Tower Ltd booth.

1:20 pm

Nicholas Smedley - Chairman - Findi Ltd

Notes

Favourite

Please click here to visit the Findi Ltd booth.

1:40 pm

Anthony Wamsteker - CEO - Praemium Ltd

Notes

Favourite

Please click here to visit the Praemium Ltd booth.

2:00 pm

Stephen Kowal - CEO - Atturra Ltd

Notes

Favourite

Please click here to visit the Alturra Ltd booth.

2:20 pm - 2:40 pm - 25 September 2024

Session - Break

Notes

Favourite

2:40 pm - 4:00 pm - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium

Watch Now

Notes

Favourite

2:40 pm

Mark Heine - Co-CEO - EROAD Ltd

Notes

Favourite

Please click here to visit the EROAD Ltd booth.

3:00 pm

Lucas Dow - MD - Sayona Mining Ltd

Notes

Favourite

Please click here to visit the Sayona Mining Ltd booth.

3:20 pm

Vlad Yakubson - CEO & MD - dusk Group Ltd

Notes

Favourite

Please click here to visit the dusk Group Ltd Ltd booth.

3:40 pm

Steven Marks - Founder & Co-CEO - Guzman y Gomez Ltd

Notes

Favourite

Please click here to visit the Guzman Y Gomez Ltd booth.

4:00 pm - 4:10 pm - 25 September 2024

Session - ASX Small and Mid-Cap Conference - ASX Auditorium