One I'm currently researching on as it has largely escaped the recent market rout and because of the recent talk on "Gas Reservation" during the election

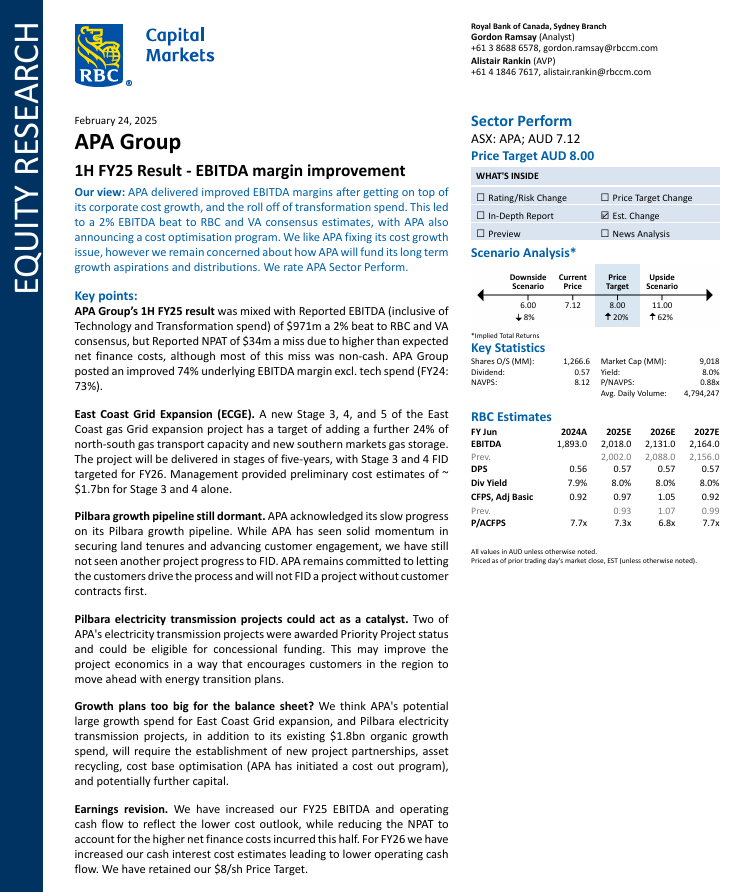

Here's a report extract from RBC. Mainly got gas assets on the East Coast and a couple of small renewable projects in the Pilbara which are not significant to the top line right now.

Maybe someone here with Gas and Energy experience can shed some light on APA and whether this is hidden gem or a "value trap".

My only concern is future gas supply on the east coast (Melb and Syd) which seems to be running out int eh distant future. They will need to tap new supply from "somewhere". Perhaps Queensland or, highly unlikely, the west.