Althea Group is a manufacturer, distributor, and now also a direct-to-consumer seller of cannabis-based products. Their flagship product is a cannabis-based drink ( a seltzer, bro) that will soon be sold online and in stores across the US.

Here’s the ASX chart of the company’s historical performance:

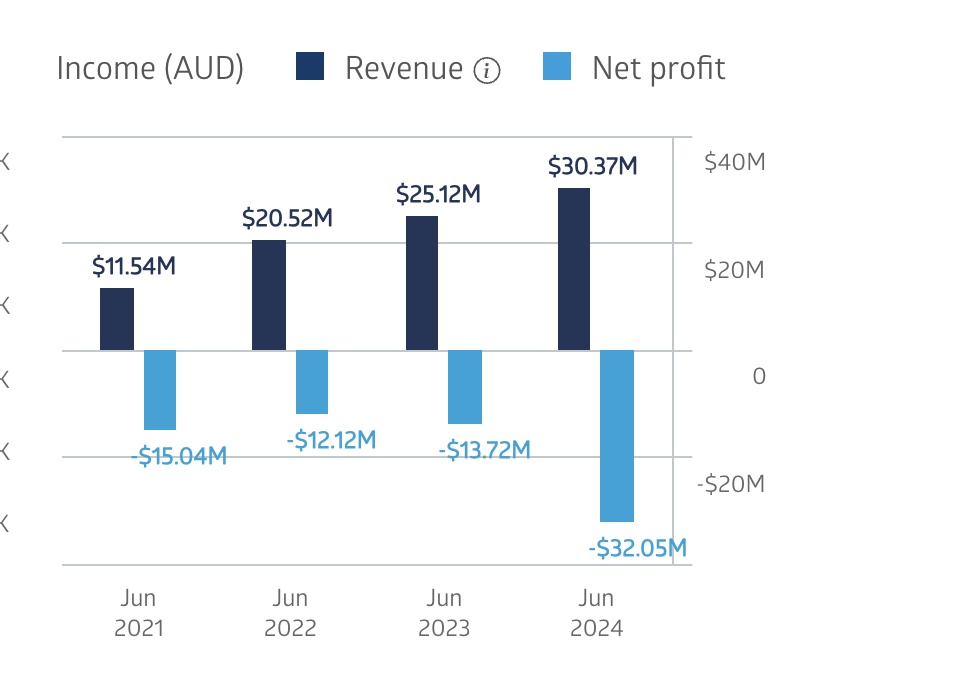

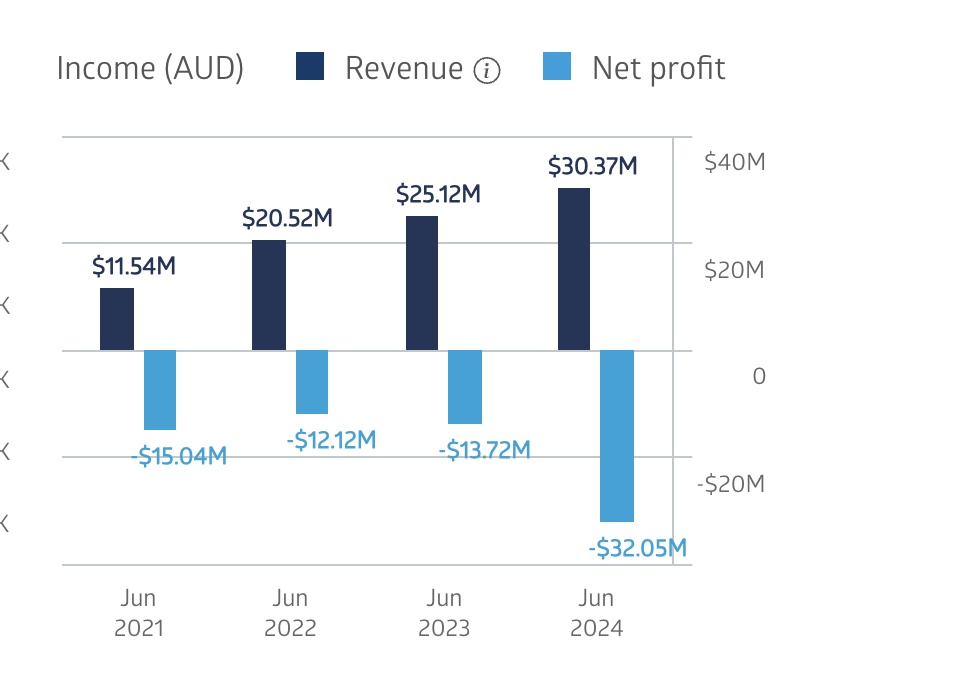

While the losses might seem scary at first glance, the numbers are not as they appear. A significant portion comes from non-cash write-offs. Specifically, a “non-cash impairment of $17.74 million was recorded for Peak Canada.” This adjustment was made to align AGH’s financials with more realistic post-acquisition performance expectations.

Although this impacted FY24 results, it clears the path for improved profitability in FY25 by ensuring the company’s financials more accurately reflect current asset values.

To verify my claims here, we’ve got the company’s 4Cs. This year they’ve burned through $2.7M. They recently completed a capital raise, bringing their current cash balance to around $2.8M. This means there’s a strong possibility they will need to raise additional funds, which I consider the biggest risk to the share price. Despite this, I’m willing to accept that risk given the potential for a large inflection point in the company's US entry.