You want me to read through a Beforepay write up? This is a joke, right? What's with the name, did they lose a bet?

I'll admit, Beforepay is not a company I thought I'd have any interest in owning. The first thing an investor is going to see is the name and think it's is a total rip off from Afterpay. Immediate meme stock alert. The second thing is the high level business model. It's a pay day lender. It's just not one as you know it.

Under their model they will lend you between $50 and $2,000 and you'll pay 5% for the privilege. If you're late there's no additional fee and interest doesn't compound. They'll keep trying to recover the funds but the worst that will happen is you can't make another loan. In fact, their business model has won a series of awards for its ethical nature. You could argue that being in financial services the competition doesn't bat real deep but still…

That doesn't sound right. How can that make money, especially when they're borrowing at 15% to loan to you?

So the first thing you do when you first apply is give them access to your bank account feed and they analyse transactions over the last 2 years to help make a credit decision. You also have to authorise a direct debit to permit repayment of your loan on your pay date(s). The maximum term is two months and the average is about 26 days. All of this combined means their net default rate is well under 2%, and in the most recent quarter was just 0.5%. That's incredibly low for an unsecured product and especially so when you consider they are lending to people who live paycheck to paycheck and can't access/pay for it on BNPL and/or credit card with a grace period.

But they're borrowing at 15% and charging only 5%, and that 5% has to pay for defaults and all their costs of doing business!

They're borrowing at 15% per annum but charging 5% on a 26 day loan. They turn over the book 14 times year, so they're actually getting a 70% return per annum. In fact, just 1/5th of the 5% (i.e. 1%) they charge is absorbed by external lending costs. Plus I don't think that 15% they are being charged will stay that way for long. That was negotiated when they were an unprofitable start-up with an unproven business model. They've now proven themselves and are consistently profitable.

When I say consistently profitable I'm talking about a company that started in 2019 and has grown purely organically from a standing start to generating revenue of $35 million in FY24. They've done that while keeping a tight rein on operating costs. Their marketing spend topped out in FY22 and then has declined year-on-year for the past two years. Despite this revenue more than doubled in the past two years. There's clearly something about the product that peeps like.

Surely this a product you'd use on a last resort basis only. How often does that happen? This doesn't sound very sticky.

I hear you but with respect it's been a long time since you were contemplating trading down from your Step One jocks and foregoing a daily coffee to pay the car repair. I must admit I arched a hairy brow when I read their CAC in the last quarter was $39. When you consider their average advance is $387, it means customers need to use the product twice to break even at a gross level. How long will that take? The answer is not long. They made 494k of advances in the quarter among 251k of users. That means users made an average two advances in the quarter. That tracks with Jamie's assertion that users access the product 7-8 times a year. Their customers come back.

Listen to you refer to the CEO on a first name basis, Mr "I hobnob with the big cheese". So if they're that good they must be expensive.

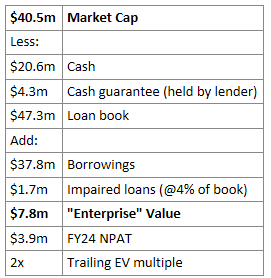

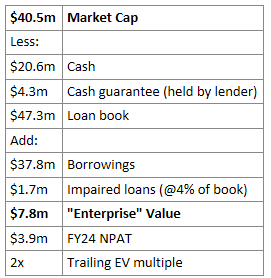

Well you be the judge but they're about 10x trailing NPAT. I can hardly believe I'm using an earnings multiple for a company that is only five years old but there it is. Here's another way of looking at it:

Hang on, you're adjusting EV for the loan book - that's not EV!

That's true but these aren't mortgages. The vast majority of that book will convert to cash in the next two months. Plus I'm adding back a healthy allowance for impairments. If you look really closely you'll see 4% of the loan book isn't exactly $1.7m either but my OCD needed the EV multiple to be a round number and that's how I got there. I'm asking for a little latitude!

A very little latitude, what's the catch?

Well, their primary market are millennials, who live paycheck to paycheck, who can't access alternatives e.g. BNPL or credit cards. It sounds like a bit of a niche market and there are signs they are topping out. Active users in Q1 FY25 was a record 251k, but that's only 7% higher than a year ago. Other loan metrics were similar. Impairment rates were considerably lower, but they can't go below zero.

There's also the whole "Your product is my feature" thing and CBA does have a somewhat similar, and in fact cheaper, offering called Advancepay. A few things though:

- CBA's minimum loan is $300. Beforepay's average loan is $387 and the median is lower. They cross over but not as much as you'd think and I don't think the big players have the appetite/systems to make smaller advances work.

- You need a CBA account. That's probably my least best defence tbh.

- If not paid by the nominated date the overdue amount starts to accrue 14.9% interest and other fees apply. In fact, that's the reason they're offering the product - they don't want you to pay it back.

So if I'm reading this right they have a somewhat tenuous position with a large proportion of a very niche market and you're relying on a dodgy definition of EV to make the maths work?

Tough crowd…

They've announced two growth initiatives to maintain the rage:

- A larger, longer dated personal loan product. They obtained a credit licence in Q1 to support this. Details are limited but it will need to be a different model to the current one. You'd think they'd want to stick with the fixed percentage model that's won them all the awards and a loyal customer base, but 5% is not going to compensate them for the additional risk and lower book turnover. More likely a sliding scale percentage based on duration and value, but known up front.

- Carrington Labs. So essentially this is them selling their IP, being their decisioning (risk) model and their lending platform to other players, with a focus on the U.S. They've consistently talked up these tools big time and the reality is they wrote up around 1,000 per loans per week per employee last quarter and recovered 99.5% of their value - they're doing something right with software! But can they sell it to 3rd parties? I dunno, but it seems like a low-risk way to try for international expansion. If they do manage it they want to use a usage based revenue model.

They continue to track user's bank feeds to constantly update their risk profiles and having a data set like for more than 250k of a particular cohort of people would seem to me to have some value, even on an aggregate basis. I asked Jamie…I mean the CEO…about this and he agrees but it comes down to time and priorities.

You bought it didn't you? I know you did. You're a sucker for a company that surprises you. What is it, guilt?

I bought a small amount IRL last week. I took a bigger swing on my SM portfolio. Look, Q1 is their seasonally best quarter from a defaults perspective and I took a bet the market would miss that. Today's pop on release of their 4C kind of vindicates that. I've got some time now to consider next steps. There are some potential catalysts with the growth initiatives in Q2 and I want to see how that plays out before deciding next steps.

Sucker…