Being a shareholder of EZZ I am going to list a few things I don't like about the company and results

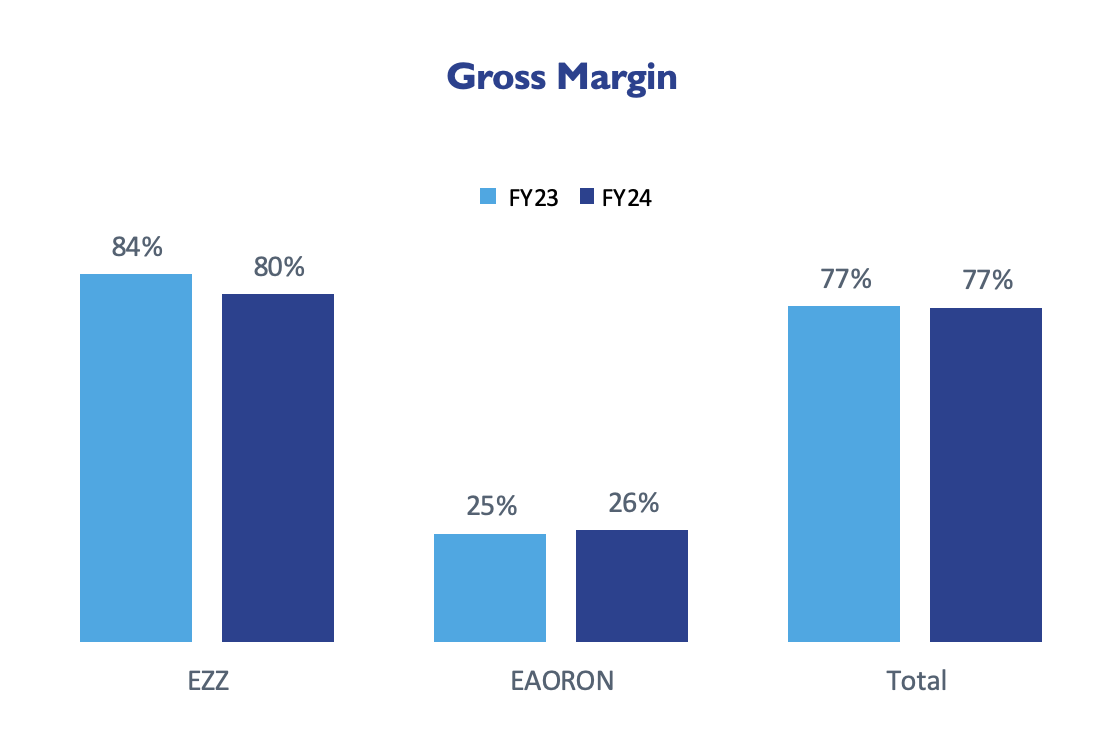

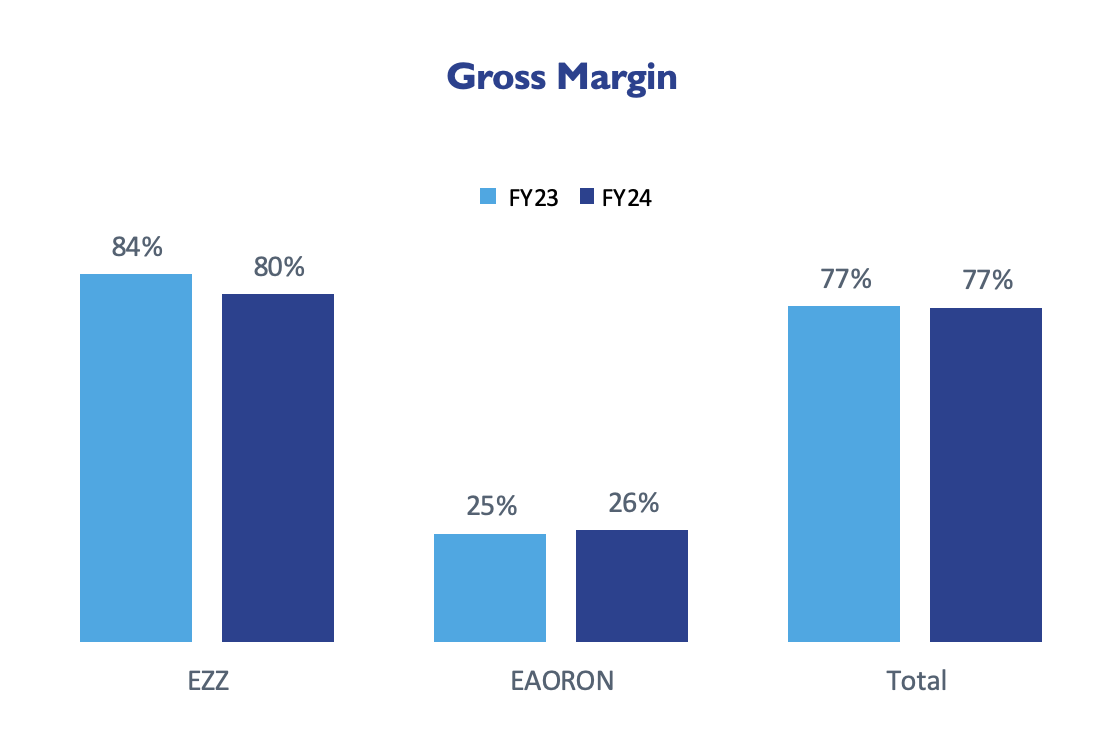

"Gross margin remained above 75% in FY24" - I hate vague statements like this, particularly when they were less vague on all the other information (see financial highlights below. Gross margins might have dropped from 98% to 75.1%. That would be signifcant. On first galnce, seemed to me they are trying to hide something.

Speaking of gross margins. This is a high gross margin company. Is it sustainable? I doubt it. Falling gross margins dropping is one red flag to focus on. Though overall gross margins remained flat for the year, gross margins for the EZZ side of the business dropped from 84% to 80%. Is this a sign? Not necessarily so just yet ...

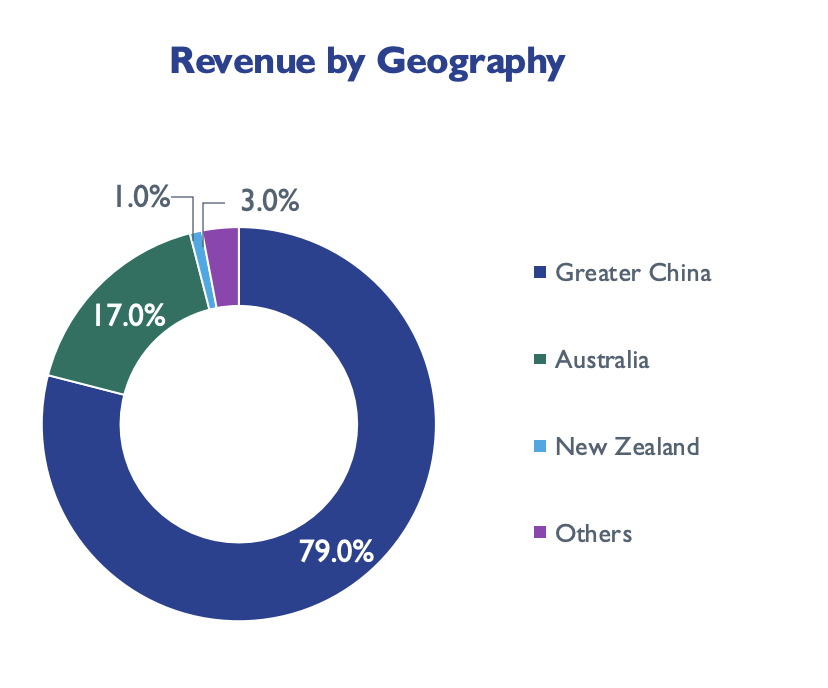

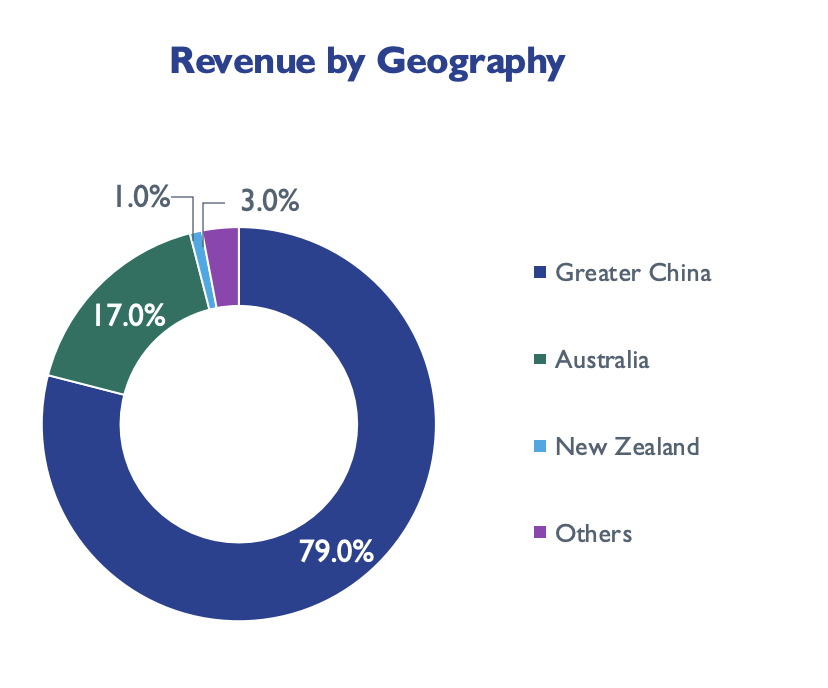

I am not a fan of highly concentrated geographic businesses, particularly when that concentration is in China. They are trying to address this by expanding into USA

I am NOT a fan of their products. This a personal bias/issue against supplements. Not an issue with EZZ's products as per se

In saying all that, share price is 20% so I am maybe a bit too nit-picky